OPEC+ to the World. Let Them Eat Cake.

July 7, 2021

As the OPEC+ drama unfolded last week, we tweeted out our thoughts on the issues and walked through some of our analysis. In this missive let’s walk through it in some greater details.

OPEC+ . . . Let Them Eat Cake

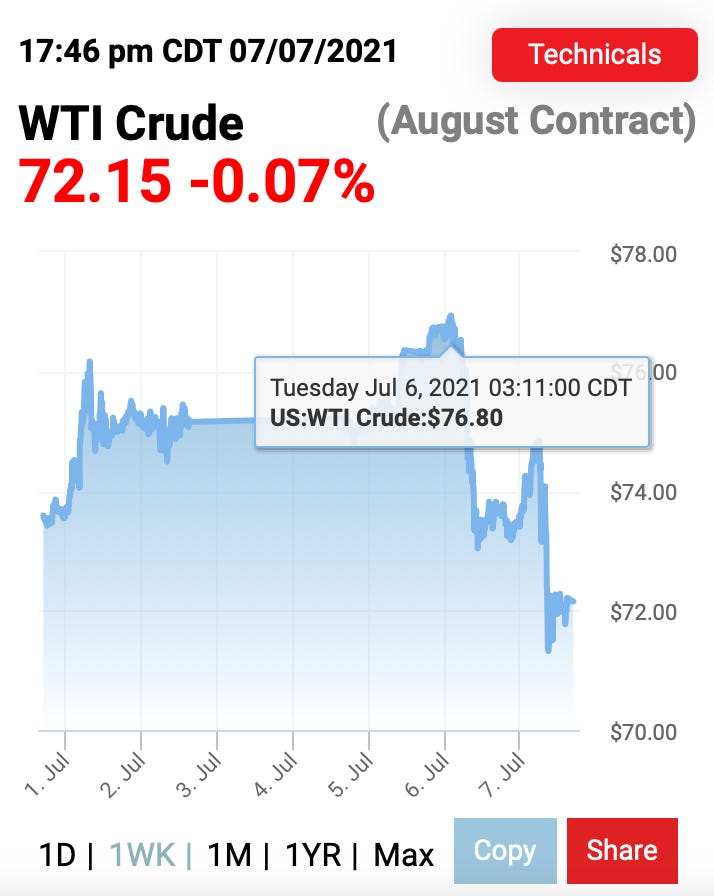

As background, OPEC+ held its monthly meeting last week, ostensibly to discuss raising production as global oil demand has steadily increased as vaccinations have accelerated throughout the world. As people venture out globally, large summer draws from inventory have begun occurring, and oil prices have climbed steadily higher and become increasingly backwardated. Prior to the meeting, WTI almost touched $77/barrel, though it has fallen back to $72/barrel in the days since.

Entering the meeting, members in OPEC+ have been collectively cutting 5.7M barrels from the reference/baseline levels they agreed upon in early 2020. These reference levels were derived from each member’s October 2018 production levels. Although they’re somewhat dated, these figures were also significantly above where OPEC members were producing in early 2020 even before the group agreed to them. Nonetheless, adopting a high ceiling gave everyone the opportunity to produce more (i.e., raised the overall ceiling), and make the 2020 cuts seemingly much larger, which helps bolster market sentiment as the pandemic raged.

As we’ve recovered, OPEC+ has been slowly releasing barrels onto the market. Lately, Russia has been making the rounds seeking a resolution to increase production. Inflation, upcoming parliamentary elections, and the strength of the ruble were all factors for Russia’s push to increase output. The Saudis, the other dominant player within OPEC+, was naturally hesitant. After starting the price war to tame OPEC+ members last year, the hard won inventory draws have largely been carried on the backs of Saudi’s unilateral supply cuts. The Kingdom now prefers to have the global market “pull barrels” as demand climbs, instead of having the Saudis proactively “pushing barrels” into the market. Prince ABS has also said that the Saudi’s want short sellers “ouching like hell” and bring specs “to their knees.” As for the consumers? It’s the Marie Antoinette of oil strategies, let the market run tight and hungry . . . let them eat cake.

Compromise . . . or Not

Still, to placate Russia and not overheat the oil market, OPEC+ agreed on a Saudi plan to increase output by 400K bpd per month from August to December, thereby raising production by 2M bpd by year end. The Saudis also proposed extending the OPEC+ agreement from March 31, 2022 to the end of 2022, which would allow the group to cautiously and fully unwind the entire “2020 cuts” of 5.7M bpd by the year-end 2022.

UAE, however, threw a spanner in the works last week. As one of the few producers who has real spare capacity, the UAE pressed to raise their reference levels from 3.168M bpd to 3.841M bpd (+670K bpd higher) (i.e., changing its reference level from what it produced in October 2018 to its April 2020 output). If the Saudi proposal was adopted, UAE would be hamstrung by its the lower 2018 reference level for another 9 months in 2022, further delaying when it could harvest the fruits of its investments.

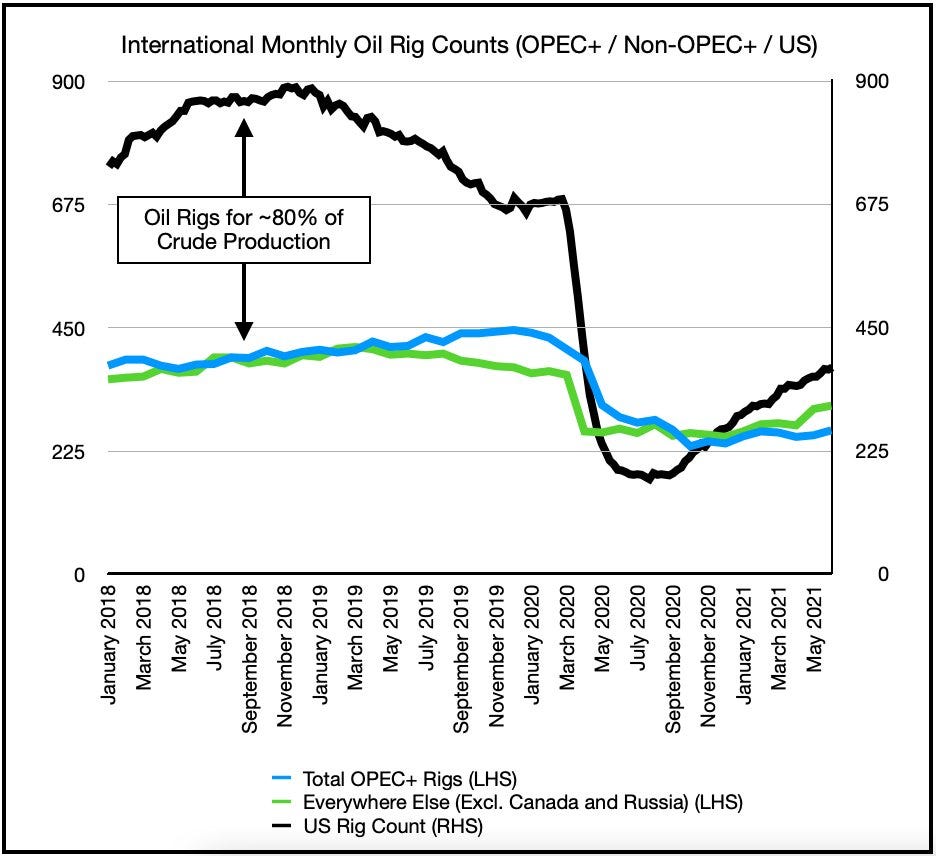

Yet lifting UAE’s reference level would mean every member would want to raise their reference levels. Whether any of them outside of the UAE can actually raise output and produce more barrels is doubtful as many already have trouble producing what they’re actually allowed to produce today. Moreover, OPEC+ is collectively drilling with approximately 1/3rd less rigs in the past year . . . that’s right, 1/3rd less drilling rigs. So there’s a big gap between perception and reality. Nonetheless, allow UAE to increase, means others will want to as well.

It’s Not Me . . . Blame Him

Now having UAE clamor for a baseline increase isn’t necessarily a bad thing because if OPEC+ can’t agree, then the cartel defaults to the current agreement (i.e., continuing to cut 5.7M bpd from the market), which is something the Saudi’s wanted to begin with given the uncertainty stemming from the COVID Delta variant. It could mean, however, that there won’t be any output increases forthcoming in the next 5 months, which would unnecessarily over tighten the market, particularly when spare capacity exists. Blatant apathy would lead to some geopolitical consequences, and we can see from even the current impasse that the US is already “monitoring the situation” closely and holding conversations with the offending parties.

For the Saudis, the UAE’s insistence is another barb in an increasingly prickly relationship. The Yemen war has complicated the relationship between the two formerly close allies, and derailing the Saudi compromise during the OPEC meeting certainly challenges their leadership. This is likely why the Saudi’s sent an immediate “tit for tat” message after the meeting.

Interestingly, the Saudi’s are also in a situation where they can “have their cake and eat it too.” Let the UAE play the bad guy, we never wanted to increase production to begin with. In fact, it was the Russians who broached the topic, while we’ve been calling for caution.

In turn, the UAE are also happy to oblige. If OPEC fails to agree, the market just gets tighter. You’ll want our barrels eventually (whether formally with higher reference levels) or informally, but either way you’re on notice that they’re coming. Still, both countries are playing the “heads we win, tails we don’t lose so much”.

Collusion? Does it Matter?

Perhaps both may even be colluding and this is all a game of Kabuki theater. It’s certainly not a price war as evidenced by the Saudi’s increasing OSPs.

If it was anything but, the Saudis would have lowered oil prices significantly to capture market share and financially pressure the UAE to fall in line.

For us, whether there’s collusion or not, matters not. We continue to believe that geopolitical pressure (and Russia’s insistence) for OPEC+ increasing output will eventually lead the group to compromise; perhaps raise output until April 2022, and leave the controversial extension for future meetings. The extremes (no production increase = geopolitical “heat”) and increasing production + extension to EOY 2022 (UAE non-starter) will fall by the wayside.

Our base case is that an agreement will be made. If we reach 5 year avg. inventory in August (~100-150M bbls away), denying 180M barrels (400K increase per month for 5 months) thereafter isn't geopolitically feasible. OPEC+ can’t withhold 180M barrels from a hungry market over the next 5 months without the US, China, or India taking actions that could be more politically damaging in the long-run.

In the end, we believe the UAE will get its higher baselines eventually, when the overall situation is much clearer. By EOY, we’ll know for certain where inventories, demand recovery and the Iranian nuclear deal stands.

What we’ll also know is who’s really been swimming naked on spare capacity. If by YE 2021 Goldman Sachs is right that demand will inflect by 5M bpd, we’ll need the 5.7M bpd of spare capacity. You either can or can’t deliver that. If you can’t even reach your allotted share of production under the existing cuts, how will you ever increase production to meet higher reference levels? Those who can (i.e., UAE, Kuwait, Saudis) will, those who can’t? Lose market share.

Suffice it to say UAE can, and can right now, and it’s putting everyone on notice today. The truth to all of this is, we’ll need barrels and we’ll need it soon. The truth is we can’t have 100% of pre-COVID demand return by year-end, but only 70% of global rig count to fill our appetite. Those two numbers don’t square in any way. Despite oil’s recent sell-off, which we think is related to the reversal of the reflationary trade, we continue to forecast oil prices to be above $80/barrel (WTI) in H2 2021. Again what you saw in metals/agriculture will now be repeated in energy as we transition from "buying things" to "doing things.” The OPEC+ issue we’re seeing today? Well that’s akin to members quibbling over who gets to pick-up the sprinkling of shiny pennies falling from the sky . . . just as it’s about to pour. If they’ll all need more buckets.