OPEC+'s Cromulent Cut

December 2, 2023

I’m amused.

Well constantly amused by the market.

I’ve a deep respect for the market, as any practitioner must have, but also a healthy dose of skepticism.

As an energy investor (our current investment thesis), we experience some insane bouts of volatility. Often the selloffs are driven by the paper market, over 30x the size of the physical one. Sometimes you don’t see the tsunami wave of buying/selling until it’s done, then many analysts will come back the shore and backfill an explanation in hindsight. As veterans of the space, we often acknowledge, but ignore the selling, knowing it’s algos, macros, and/or generalists flowing in/out of the space. Often what seems meaningful is really meaningless in the grand scheme, and when the selling comes in droves without any fundamental reasons, we simply know . . . this too shall pass.

So after seeing days of red in the oil market, what’re we actually seeing? Well there’s no one clear answer, and that’s what’s fueling the consternation. Geopolitical premium has recently evaporated as the Israel/Hamas conflict looks to be self-contained, concurrent GDP readings have indicated a slower economy that weakens demand, and supplies have stayed surprisingly resilient. In case you were wondering, here’s GDPNow . . .

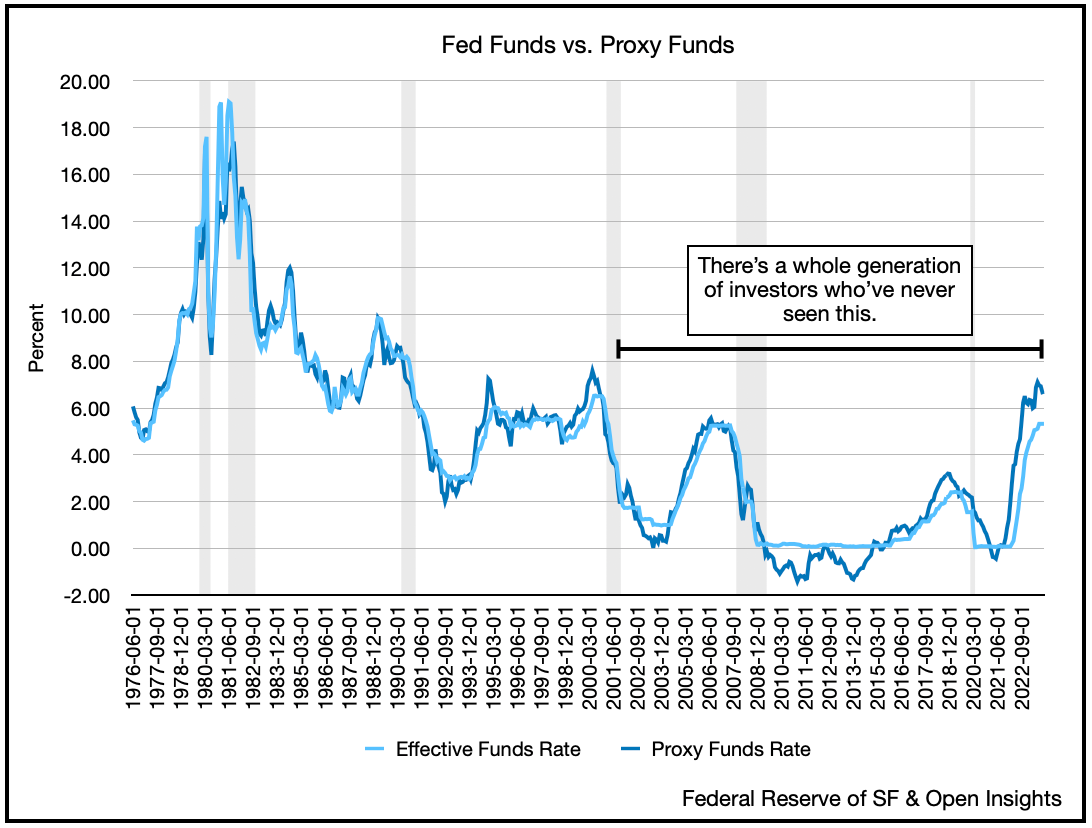

Although consumer spending hasn’t fallen off the table, demand overall has started to slow, no thanks in part to the Fed’s tightening of financial conditions.

That constriction, however, is battling the upcoming holidays, and as people gear-up for the celebrations, we believe they’ll reengage. Just look at our Thanksgiving travel spike and we can see that travel demand broke all time records. We doubt Christmas will be any different (not to mention Chinese New Year).

Yet, that’s not what prices are telling us. Anticipation of a 2024 global slowdown is depressing sentiment, and oil prices have effectively round-tripped back to the moribund summer months.

So here we are, stuck in a rut with little to no discernible catalyst. Although inventories haven’t drawn, they also haven’t increased materially. Things are pretty flat right now.

Admittedly, flat isn’t good enough when you expected 1M bpd draws for the quarter.

The reasons for that miss likely comes from a combination of lower demand and higher supplies. It appears that demand has weakened in the past few months. In addition, increased supplies from the US, Russia, Iraq, and Brazil have come onto the market just as seasonality refinery maintenance began. Still maybe some of this is timing, exports from Russia were higher, but have now flattened out. Just look at OPEC+ exports . . . again flat.

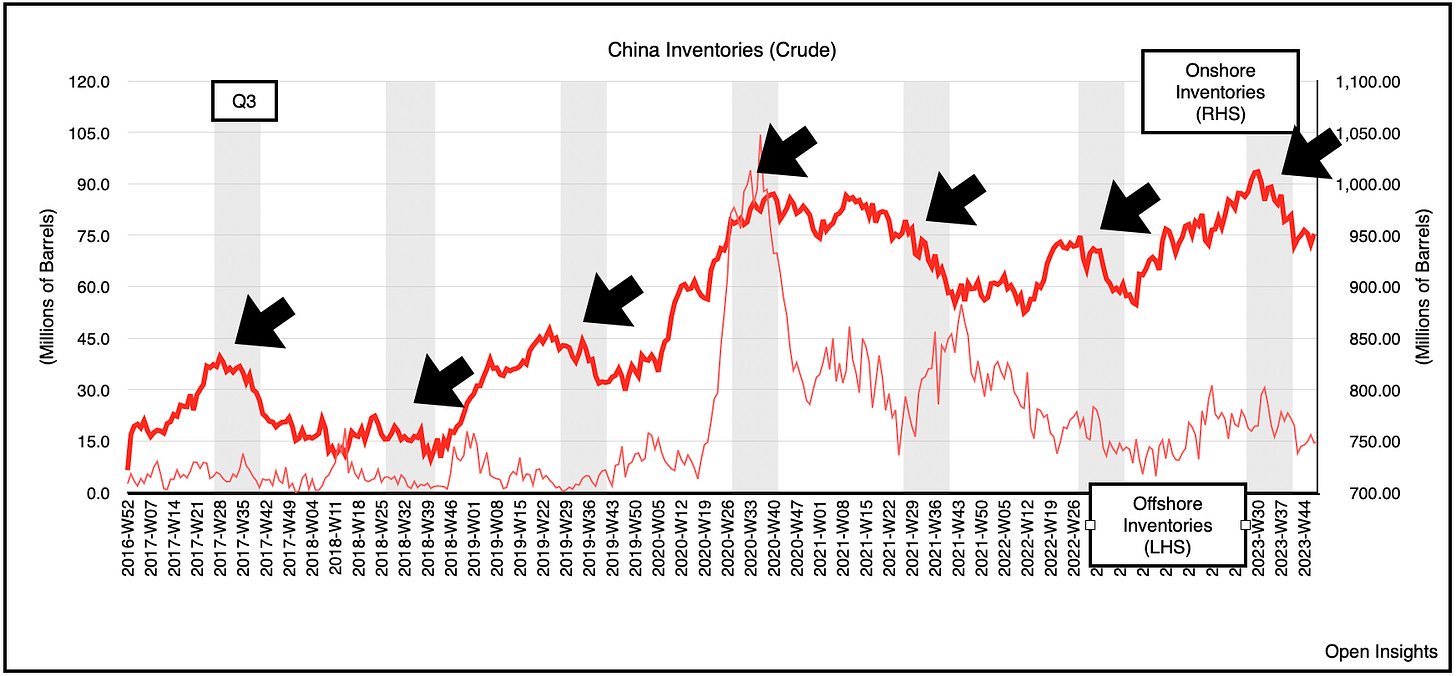

Adding to commercial supplies too was China, which destocked (like they normally do) as we ended Q3.

The market rightfully asked though . . . if we’re not drawing during the “higher-demand” holiday season, how will it look in Q1 2024 during the lower demand winter months? Answer not great.

Look further into the entirely of 2024, then you see why many are starting to get worried. If we look at IEA’s numbers for next year, we can see that the increase in demand is projected to be one of the lowest in awhile. The IEA anticipates oil demand to grow by only 0.93M bpd, well short of the +2.06M bpd and +2.37M bpd we notched in the “COVID recovery” years of 2022 and 2023, respectively. A slowing economy certainly puts a damper on the numbers. This shouldn’t be surprising though because when the IEA began projecting 2024 demand in June of this year, they had projected demand to grow by 0.8M bpd, so they’ve in fact nudged the numbers higher since the summer.

Supplies though are projected to grow by 1.2M bpd. Half from the US and half from everywhere else (excluding OPEC). Again, flip the report back to June and we see they projected about +1.1M bpd increase in supplies. So not much of a change.

Net those two numbers together, 0.9M bpd of demand increase, but +1.2M bpd of higher non-OPEC+ supplies equals . . . 0.3M bpd of oversupply.

That’s the solve.

So here comes OPEC+ and their virtual meeting. Should we or should we not “embiggen” those cut? Frankly, we didn’t think they need to, but they’re trying. OPEC+ attempted to balance the equation by increasing its voluntary cuts to nearly 2M bpd. Seven OPEC+ countries announced additional cuts in 2024 Q1 and altogether the reduction totaled 896K bpd. All of it in one quarter, but if you spread that type of cut over a year, we’re close to zero-ing out the projected oversupply. Those numbers are all a bit iffy because if you use IEA’s numbers and assume that the Saudis will continue their voluntary cuts into the YE, you’ll then get a ~600K bpd deficit.

Moreover in all instances, the numbers above assume robust supply growth, and an increase of only 0.9M bpd in global demand, a level that’s well short of the 1.5M bpd YOY growth we’ve averaged since the Great Financial Crisis. To put an even finer point on that, compare that to the 2.37M bpd YOY growth we experienced as financial conditions tighten this year while the Chinese economy experienced significant slow down.

Going into 2024, there’s a few potential tailwinds. What’s to come and what’s likely to revert. On the first, we’ll see a US/UK presidential election, the Federal Reserve beginning to cut interest rates, and the Chinese authorities getting serious about stimulating their economy and stabilizing/subsidizing their property market.

We simply think demand will be better than most analysts anticipate, and certainly better than the 0.9M bpd IEA estimates. Beyond the fact that travel patterns are already climbing back towards the 2019 norms, and the powerful economic tailwind easing interest rates will have on economic activity, we’re still getting back to historical oil consumption trend line.

On the second, like most things post-COVID, that gap above will further close as behavior reverts, China recovers, workers return to the office because of increased productivity, auto and industrial manufacturing ramp higher, travel recovers, etc. We write that, however, knowing that very few have any confidence those things will happen. In fact, many are predicting a dramatic slowdown, and hence oil’s been taken to the woodshed.

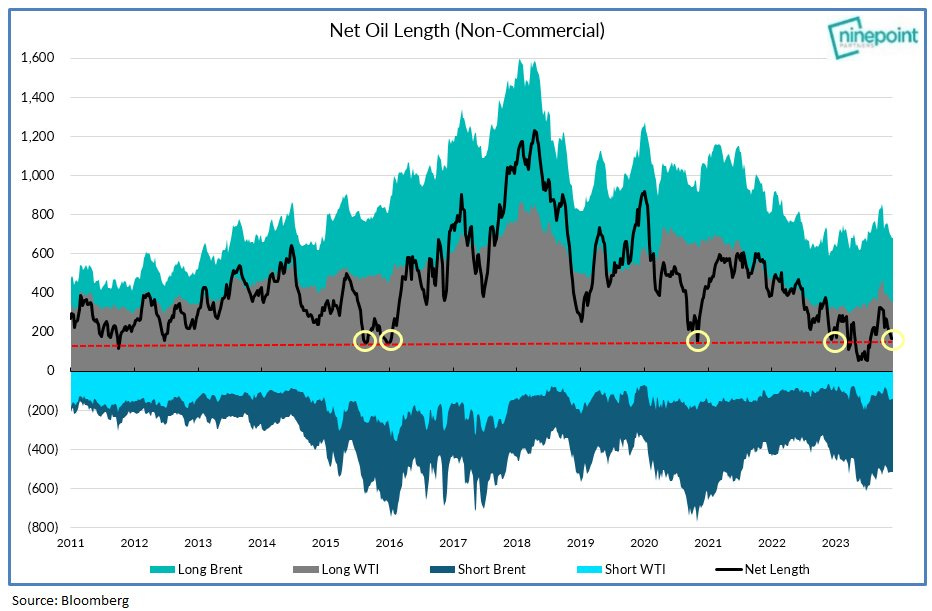

What gives us heart in all this sell-off is that financial flows are near their historic lows while oil prices are still hovering in the high-$70s/low-$80s. Fundamentally we aren’t nearly as weak as the conviction displayed in the paper market.

Everyone’s so bearish at this stage, so much so that we wonder if the cart’s been placed before the horse. Not that it matters, we’ll need to see how the market develops. We go where demand goes, but we believe demand will again mirror 2022 and 2023 and surprise to the upside. With oil “languishing” in the high $70s/low $80s, and managed money washed out, that’s the bet we’ll take.

In the meantime, let’s just keep watching this comedy evolve, one that’s years in the making.

Please hit the “like” button above if you enjoyed reading the article, thank you.