Our Q1 2025 Letter & Look Ahead

April 21, 2025

April 2nd, Liberation Day. What a day. In an instant, the US abandoned an era of rules-based global free trade system, one that has endured for decades. Whatever you may think about Trump’s reciprocal tariffs, namely how they were calculated, enacted, modified, reduced and rolled-back, it is most certainly a profound shift. Despite inequities, on the whole, global free trade has ushered in significant prosperity for all its participants, including the US. China’s inclusion in the World Trade Organization, however, has come at a cost, and the electorate backing Trump have been keeping the receipts. It’s time to pay. Instead of the status quo, we now embark on a period of greater uncertainty, one decidedly more arbitrary, capricious, unpredictable, and ultimately protectionist. Under this new rubric, global trade will rearrange itself. The US will attempt to cleave willing participants and those dependent on the US market from China, and force countries to choose sides. US or them.

This is COVID . . . 2.0.

Man-made and unleashed on an unsuspecting world. Sure there were tariff preludes with Mexico and Canada, but not at these levels, nor to the extent of how ill-conceived and ill-prepared the administration has been to handle the consequences of its actions. While the ultimate goals may make sense, execution matters. The incompetence displayed in the early days of this exercise is at best troubling, and at worst frightening. Consequently, we’ve lost confidence, and as that dives so does commerce. Corporations and consumers will turn cautious. Long-term investments will stall as executives fret about over-committing, lest a midnight tweet turns your carefully made investments into stranded assets. Businesses can thrive in different political environments, but not unstable ones. The years of lean manufacturing and efficient supply chains means we have little inventory stashed away. 145% tariffs on Chinese goods isn’t a tax, it’s a border wall. So when we decouple so quickly from China, where does Walmart, Target, Costco, and Amazon source their goods? How do businesses plan, and how do they make capital investments when macro factors are so volatile? They don’t, so we’ll live day-to-day.

Even if you can find alternative suppliers, the higher cost for doing so can’t be passed along immediately to consumers who’re already complaining about egg prices. So you freeze in place, you freeze all capex spending (i.e., long-term investments) and you start slashing operating expenses (current spending) to protect your rapidly eroding profit margins. New hiring stops shortly, and workers who leave aren’t replaced. Jobs begin to disappear, and as job insecurity climbs, consumer confidence falls. Consumer spending accounts for 2/3rds of this economy, and while as a group they aren’t over-indebted, wallets will inevitably tighten as the economy slows. Even if the tariffs are reset at a lower level via trade agreements, many will be skittish in the foreseeable future. When the rule of law, or the promise of a stable and orderly environment is compromised, credibility will need to be rebuilt by steadier hands. We run on consumer confidence and the animal spirit, and those things are bolstered by confidence in the competence of those at the helm. We expect steadier hands will takeover here from inept ones. Perhaps Secretary Bessent, will take on a larger role in navigating the course. One can hope, and one needs to because this is a minefield with many unseen risks. Unintended consequences rue the day. Again, we’ll have to figure it out as we go.

This is COVID . . . 2.0.

Liberation Day

To understand the impetus of Liberation Day, we need to step-back and understand the administration’s goals. While there’s a broader geopolitical goal of isolating China, there are also some financial and monetary targets to be aware of. So what’s the plan financially? Well take a deep breath, here goes . . . shrink the federal government, raise tariffs, heighten trade barriers to “level the playing field,” restore US manufacturing, weaken the US dollar to encourage exports, reduce interest rates, deregulate the economy, and shift the tax burden for how we fund the US government.

Simple.

So let’s talk tax. Simply put, tariffs raise taxes. Admittedly, we actually need to raise taxes. We need to because this country, with its fiscal profligacy, is on a dangerous path. At the federal level, we spend ~$7.1T annually, but we only take in about ~$5.2T in taxes, so we currently run a deficit of ~$1.9T a year at a point in time where total debt has surpassed ~$36T already. The ~$36T of debt already exceeds our GDP, which stands at ~$29T. Historically, when debt to GDP rises above 125% bad things tend to happen. We’re talking about end of empires/nations type of things like massive currency devaluation, hyperinflation, and war. The US is at 122%.

So hence the plan. Raise tax revenues, pitch it as “tariffs paid for by foreign exporters,” and shift our tax base. The fact that many of the goals above are opposing matters not, what’s important is that the administration is hellbent on trying because in their view, something needs to change. After two years of stock market gains (24% in 2023 and 23% in 2024), there’s some cushion to endure the pain and take the needed “medicine” (in Trump’s own words) to cure the ails that . . . well, ails us.

Tariffs, no matter how you look at them, are a consumption tax, and many countries have them. Travel to Europe and Asia and you’ll find a bevy of countries with GST, VAT, etc. Tariffs function pretty much the same, and the consumer eventually bears them as they’re passed along. Most OECD countries derive a larger part of their fiscal revenue from such taxes.

Nearly double the US, and in turn, they receive a smaller percentage of revenue from direct taxes (individual and corporate). For an arguably well run country like Singapore, consumption taxes account for ~20%, so a third higher. Unfortunately, while the tariffs do raise tax revenue, Republicans plan to use the proceeds to extend and fund new corporate and individual tax cuts, effectively shifting the tax burden from corporations and individuals to . . . let’s be honest . . . consumers. According to the non-partisan TaxFoundation, extending the 2017 TCJA (Trump tax cuts), will cost $3.8T over 10 years. Moreover, if Congress passes the litany of Trump’s proposed tax cuts (i.e., no tax on tips, overtime pay, social security, reduce corporate rate to 15% for domestic production, etc.) add another $1.5T. So $5.3T over 10 years = $530B a year, when the deficit is at $1.9T a year.

So how can you square that circle? Well theoretically a 10% tariff on all US imports (i.e., $4T of goods/services) would raise $400B. Couple that with DOGE cuts of $150B a year and “maybe” the $450B start to balance things out. It may, but it doesn’t reduce the deficit spending if we’re swapping one for the other. Still one could argue that the 2017 tax cuts are already in place, and extending them are merely a “status quo” and not necessarily added spending (i.e., our deficit of $1.9T today already includes the tax cuts, so extending them doesn’t exacerbate the deficit). If you buy this line of reasoning, fair enough, in which case the added revenue from tariffs are simply that, more federal revenue, and bring deficit spending down.

Let’s talk about DOGE for a second. Secretary Bessent has articulated a plan to rein in government spending to 18% of GDP, a figure that’s fairly close to the fiscally responsible Singaporeans. For a $30T GDP, that would equate to about $5.4T, which means shaving nearly $1.6T from the federal budget. Current plans include laying off 25-33% of the federal workforce (i.e., 500K to 800K of 2.5M workers). The average federal worker makes about $105K. Even if you round it higher to $150K (for benefits, etc.), we’re looking at savings between $75B to $120B. Interestingly, Elon Musk said in a cabinet meeting on April 10th that savings from “waste and fraud” would total $150B by FY26, surprisingly close to the headcount reduction figures. $150B though is a fraction of the $1T in savings originally touted by DOGE, and as many suspected, there’s just not that much waste and fraud to cut. Can more savings be found if Congress has the courage to cut entitlements? Absolutely, but even that has consequences. The US again has a $30T GDP, and for every $300B in entitlement cuts, it will reduce GDP by 1%. You can slash and burn, but there will be broader economic consequences.

So cut federal spending while tacking on a trade war, and you can see why market makers are calling for a recession. If DOGE does find major savings, and the government holds spending flat as inflation and nominal GDP grows, the administration can achieve their 18% target. The devil’s in the details, and after seeing DOGE’s roughshod approach, we unfortunately have little confidence in their ability to complete the task. Honestly, it may all be smoke in mirrors as current fiscal spend is running ahead of 2024.

Bubble, Bubble, Here Comes Bond Trouble

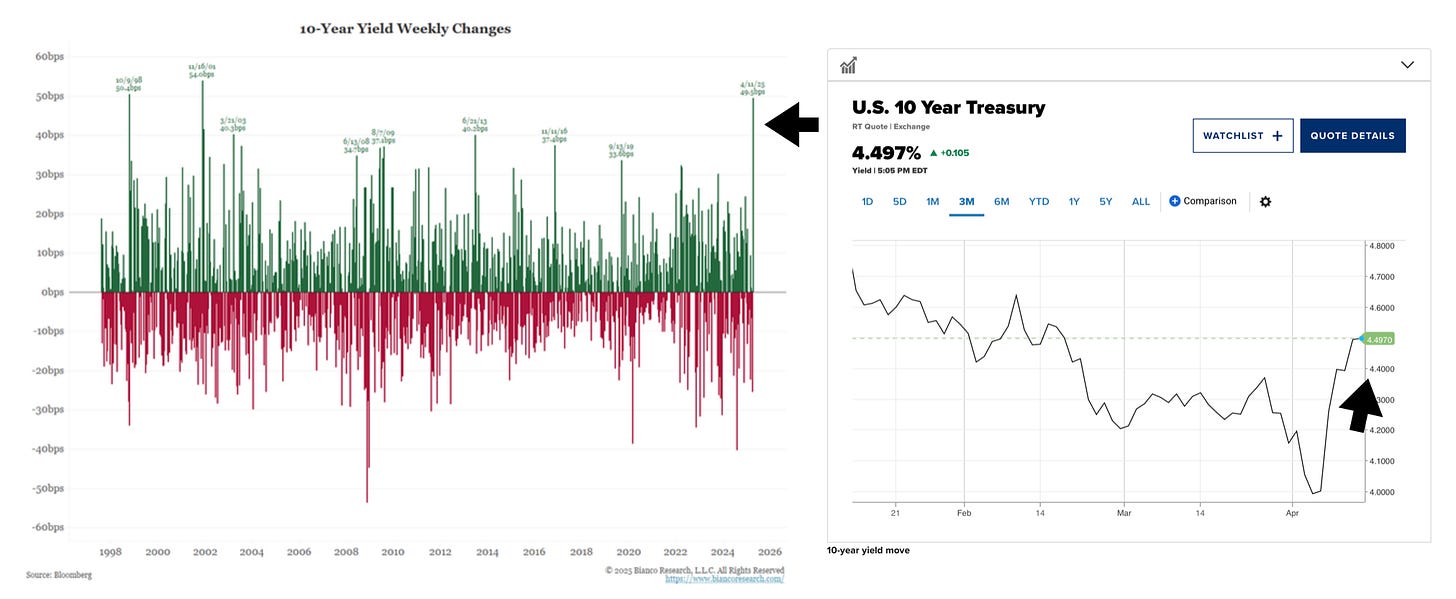

Couple runaway fiscal spending, seemingly ineffectual DOGE cuts, looming tax cuts, and a global trade war, you’re right to expect risk assets like equities to sell-off and safety assets like gold and the bond market to rally. While gold has performed dutifully, bonds bucked the trend last week, and that’s when things got scary. Decreasing tax revenues, a devaluing US dollar, and a slowdown in global trade aren’t conducive to investors holding US debt. Moreover, a falling US dollars exacerbates the losses for foreign investors holding that debt. As the tariff threats and turmoil ratcheted higher, computerized trading algorithms and human portfolio managers sold US bonds in droves. Foreign owners also sold, and the rate on the 10 Year Treasury began climbing unexpectedly.

Not unlike the UK, when Prime Minister Liz Truss was ignominiously ushered out of office after a mere 49 days because her economic proposals induced a bond panic, we nearly saw the same fright here. $1T of Treasuries are traded each day and when the 10 Year Treasury, on which auto, mortgages and consumer credit card loans are priced off of, jump 50 basis points (i.e., 0.50%) in a few days, it has the potential to snowball and destabilize the US economy. Like any debt junky, if the rates at which the US, a debtor nation, borrows at suddenly shoots higher, the lending market can suddenly seize and crash as everyone stops lending to reassess the risks. Think Global Financial Crisis 2.0. Consequently, Trump’s 90 day tariff reprieve suddenly makes sense. As James Carville, Bill Clinton’s chief strategist once said

“I used to think that if there was reincarnation, I wanted to come back as the President or the Pope, or as a .400 baseball hitter. But now I would want to come back as the bond market. You can intimidate everybody.”

Still the shock resonates. Commodities are already sniffing out a recession. Prices have declined, and the odds of a recession are a coin flip. As global confidence cowers in the corner, oil, copper, etc. prices have retreated, and gold prices are surging as investors seek safety. The US won’t see helicopter money this go-around, but China? Almost certainly, as the world’s largest manufacturer needs to sell their goods to someone in the interim. We expect the domestic market to step-up, all funded by the Chinese government. In the coming quarters, the global economy will slow here, and global demand for commodities will fall. When capex and long-lead planning freezes, so does the consumption of long-lead goods.

For us, oil demand will assuredly decline, just like COVID, but not at anywhere near the severity of COVID when the world stopped. Instead, we think we’ll see a few quarters of a mild recession as global trade reorganizes itself while trade deals are finalized. Secretary Bessent knows there needs to be quick wins. The stock and more importantly the bond market needs to see those wins. It can forgive indiscretions, but it won’t forgive mortal sins. The equity market certainly thinks the final tariffs that apply will be a fraction of the ones currently listed. If it didn’t, it’d be down another 20% easily as nearly all corporate profits would be wiped out. Destabilizing the global economy, and not giving investors hope that it can be patched and quilted, won’t do. Secretary Bessent will begin some fast and furious negotiations with the willing countries. So in the next 90 days, we expect our Asian partners (i.e., Japan, South Korea, Vietnam, India, etc.) to conclude new agreements. Given how much the US purchases from Japan, South Korea, etc., expect the capitulation on tariffs and trade barriers to come swiftly. Watch India closely as well, they could be the real new winners here. In the land of self-interest, a world where lower trade barriers and 10% trade tariffs on US exports could be the new equilibrium. We doubt any trading partners will get a “most favored nation” status and garner 0%. The price for admission to be able to sell to US consumers is likely 10% going forward. Don’t worry though, eventually this consumption tax will be passed along to consumers. As with any consumption tax, it’s regressive because the poor will bear the greater burden of the tax disproportionately. Thank you for your service.

Europe as well? Possible. Likely with the UK first. If a Canadian and Mexico détente can be found, then the US will have stabilized the situation as those countries collectively represent most of the top 20 of US trading partners. What of China? Likely not China. That’s an ego trip. The US wants a deal, but both sides need to climb down from their inflammatory rhetoric that plays to their domestic audiences. Even so, there’s significant trade gaps and issues that need to be addressed, and we think China can stimulate longer than Trump can hold out. He will try though as he regrets the trade agreement concluded during his first term, as China never fulfilled its commitments, but our base case is that this won’t resolve itself anytime soon. So we expect temporary targeted reprieves.

Oil Demand & Oil Supplies

For the oil market, energy demand will fall in the next 90 days as the private sector retrenches. Energy Aspects has estimated that oil demand falls by 1.1M bpd. Liberation Day torched oil prices as recession expectations increased dramatically, and demand projections withered. Oil prices touched $57/barrel a few days afterwards and bounced slightly, but in the low-60s means US production will stagnate and fall. Don’t believe that? Here’s an unfiltered view from oil industry executives courtesy of the Dallas Fed Survey before Liberation Day tanked oil prices.

Those in the Trump administration clamoring for $50/barrel oil have finally gotten it via the trade war, but be careful what you wish for. Inflation since COVID means $70/barrel is the equivalent of $50/barrel. If so, how much lower is today’s $60/barrel? $40s? Likely. “Drill baby drill” is impossible under these conditions. Interestingly, before Liberation Day, oil prices at $70/barrel was already underpriced as we approached summer. Inventory levels pegged “fair value” closer to ~$85-90/barrel, and the higher summer demand season should have been the catalyst to nudge oil higher. Look at the disconnect today.

After Liberation Day, the gap between inventories and prices blew out. IEA data lags so this is comparing end-of-February inventory levels to the current oil price, but this much is clear, oil inventories in OECD countries would need to build by ~200M barrels to justify the prices we’re seeing today. Viewed another way, the market is effectively saying that demand will fall by nearly 1M bpd for 6 months in short order, but supplies won’t.

At $60/barrel, we estimate US production will decline by 500K bpd by year end, which contrasts with analysts’ expectations of 300-500K of crude production growth. Larger US producers will initially wait before cutting capex. If prices persist, they will delay capex spending until H2 2025, which means decline rates will accelerate in the coming months. Frac spreads and rigs declined in the first few weeks after Liberation Day and implied oil production is trending lower, confirming (at least initially) our expectations. Why is this material? US production growth in the past decade (2014-2024) has accounted for ~90% of global supply growth. Once that goes, so too will supply growth.

Non-US production is also at risk, but it’s too early to determine how quickly production responds there. Brazil (200K bpd), Canada (100K bpd), Norway (125K bpd), and Argentina (100K bpd) are expected to contribute an additional 500K bpd, and given those long-lead projects have been in development for years, they should come online as expected. For everyone else? TBD.

As for OPEC+, it’s poorly timed announcement (i.e., a few days before Liberation Day) to reintroduce barrels taken off the market also contributed to oil’s meltdown. Currently, OPEC and OPEC+ have three cuts in place (i.e., an 8 member cut of 2.2M bpd, 9 member cut of 1.7M bpd, and a collective cut of 2M bpd), and it’s the unwinding of the first that has caused consternation among market watchers. In truth, the partial unwinding was announced to discipline certain cheaters of the quota system (i.e., Kazakhstan and Iraq who were materially overproducing their quotas and skirting the cuts).

While those countries have recommitted to compensate for their overproduction, it remains to be seen whether this actually occurs. If so, the increased barrels are mitigated, if not, they’re additive. OPEC’s aggressive actions though have called into question the group’s resolve and unity at a precarious time of macro uncertainty, but we think that’s overblown. OPEC will likely reintroduce barrels judiciously, particularly when oil prices are in the 60s, and we think it’ll pause when needed. We’d be surprised if OPEC reintroduced barrels in an unrestrained manner given the softening demand picture, but admittedly it is a risk. More likely, once global demand sorts itself out, OPEC will further unwind the cuts, which reduces the spare capacity overhang. The OPEC+ spare capacity overhang is significant, so we still need OPEC+ cohesion to glide prices higher. All of this in the face of a slowing economy justifies conservatism, so time will tell.

Parting Thoughts

It’d be inaccurate to say that we’re 100% bullish on the energy space in the coming months, far from it. You can’t be given the swirling uncertainties. The demand hit will come faster than the supply decline. Producers will try to wait out this turbulent period before cutting into the muscle of production, instead opting to delay and defer projects and the capital involved before cancelling them. Yet as the economy slows, it’ll turn into a footrace between sliding demand and supplies.

Overall, it’s much too early to determine with any reasonable precision what demand will be like in the coming months. We do know that as containerships stop sailing, then port deliveries will slow. Once containers fail to land at ports, long-haul, intermodal, and rail road traffic will decline, and with it transportation fuels (i.e., diesel and gas). Refinery margins should reflect that, and we’re watching it closely. Again . . . this is COVID.

Unlike COVID, a vaccine actually exists . . . one based on the whims of a single person. He just wants a better price. A very big, very wonderful, beautiful price before sharing it. What that figure is exactly resides only in the head of the President, and we’re not entirely sure he knows what that is. A lame duck President who’s motivated to right the wrongs he’s perceived to have suffered, one who’s shilling his own crypto currency and affiliated companies, and revamping a tax code that will presumably benefit his own holdings during and after his term ends. We already know though that it’s all fun and games until the bond market disciplines. You can rock the boat, or flip the table, but when investors balk at your debt offerings, the nonsense stops.

What else can act as guardrails? 2026. In 2026 we’ll have Congressional mid-term elections. Republicans know that and if the economic uncertainty paralyzes the country and we dive into an average recession (i.e., lasting 10 months), we’re well into 2026 before things clear. Good luck with the electorate if a self-inflicted economic malaise turns severe or persists into 2026. If that happens, expect another 2018 blue-wave sweep, when voters took out their displeasure on the ballots and mauled Republicans in the House and state legislatures.

What deals this administration can conclude in the coming weeks and its actions will dictate the direction of where markets go. Given its track record thus far of disrupting the status quo with little regard to consequences means we’ll stay wary. We’ll maintain cash on the sidelines, and may initiate short positions to hedge our holdings if we see darker clouds on the horizon. Best be nimble, and to keep in mind a joke that my young son delights in telling and retelling . . . and retelling.

Me: Mason, can you use the word “dandelion” in a sentence?

Mason: The cheetah is faster . . . dandelion.

Delightful laughter ensues. Let’s all hope this administration gives people something to smile about.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Nice writeup. Too bad the US admin antagonized most of its allies so i think it will be tougher than you think for them to present tangible trade deals. But tbh who really knows, orange man can flip flop faster than the scotty can bring the enterprise to lightspeed...