Our Q2 2025 Letter & Look Ahead

July 25, 2025

Everyone’s playing poker these days. Each shark, real or otherwise, pondering their hand and sizing up their opponents. Call it the Art of the Deal, call it leveraging, bullying, blind bluffing, or buffoonery, everyone’s playing the hand they were dealt.

It’s a trade war, and every player’s out for themselves. It’s the game the US is choosing for its global trading partners. US or China, us or them? Vietnam, Indonesia, Taiwan, etc., you decide, choose wisely. Don’t even think about transshipping Chinese goods into your country, and rebadging them for export to the US. Enforced strong enough, it could all work. The decoupling between US and China that is, but we don’t think it will. Already, the US is backtracking on its stance with China. Softening this and that, delaying the implementation of this or that, to get temporary relief. Breaking-up is hard to do. Everyone knows this, which is why the stronger players have held out. Japan, South Korea, India, the EU, we haven’t heard much from them of late. Where are those deals? Where’s the capitulation? The only things we’ve seen are trade frameworks, which make for great press conferences, but lack substance. Truthfully, it’s probably enough for the market, which is betting on the US to quietly capitulate on its positions. The TACO trade (i.e., Trump Always Chickens Out) is alive and well, and the market’s counting on it as stock valuations and speculation runs high. Heck, China and the US have agreed to slow bet the hand, and are already making cooing noises for a trade summit. For the time being, goods are flowing again, though at higher tariffs. A 15% rate seems to be the baseline, but any rate higher than zero translates to friction, and friction for businesses translates to higher costs and lower profits. Inevitably this will get passed onto customers in the form of higher prices, a regressive tax, under the guise of geopolitical posturing.

So what pray tell will they do with the revenues? Fund tax cuts, Big and Beautiful ones. Well more accurately, make permanent the ones that came before. Is it a tax cut if we’re simply keeping the lower tax rates already in place? Depends on which political party you ask, but raising tariffs (i.e., regressive tax) to lower taxes on high-earners (i.e., progressive taxes) sure seems contrary for a political movement built on pluralism. It would all be fine if we weren’t overspending already. The real issue is no one is willing, able, or frankly wants to rein in our fiscal profligacy. It’s why our deficits are blowing out. DOGE’s failure to find meaningful spending cuts means our government is already running fairly lean, and year-to-date, we are spending more than 2024 . . . $40T deficit, here we come.

There is one way out, a fire escape if you will. It’s called growth, and it’s about to run hot. It’s the only thing that makes any of the above remotely acceptable, or politically viable. As we turn to 2026 and mid-term elections, Republicans are making a big bet that it will come together. Lower taxes, less regulations, a secure border, weakened geopolitical threats, and eventually lower interest rates, will unleash economic growth. That’s the ask for our indebted nation. The market’s already pricing in that growth, betting and speculating that it will continue. It’s betting that the US has the winning hand, or at least a hand it can make. A flush draw on the turn to win. Isn’t that only a 18% chance to make a flush on the turn? Never tell me the odds. This is US strong, US-centric growth, and if y’all don’t get American exceptionalism, then you can git going. Besides, pot odds for trillions of dollars of growth. Will it work?

Yeah . . . we think so.

All-in.

Oil Demand & Oil Supplies

Let’s zoom out a bit. Tucked into this Liberation Day quarter was also another Middle East crisis. During the quarter, Israel attacked Iran. The success of Israel’s initial air campaign provided an opening for the US to satiate its FOMO, as it sent B-2s to drop bunker busters on Iran’s Fordow nuclear enrichment site. Iran then retaliated with a dozen ballistic missiles launched at US bases in the region, but like before, pre-warned the US so the attack became a fireworks show. Everyone’s happy right? Well, post-strike bomb damage assessments showed that US and Israel strikes failed to destroy Iran’s enriched uranium, and Fordow likely remains operational. Any optimism that Iran will willingly trade their right to develop a nuclear weapon for lifting economic sanctions should be dispelled once Israel attacked. The very survival of that regime now depends on it.

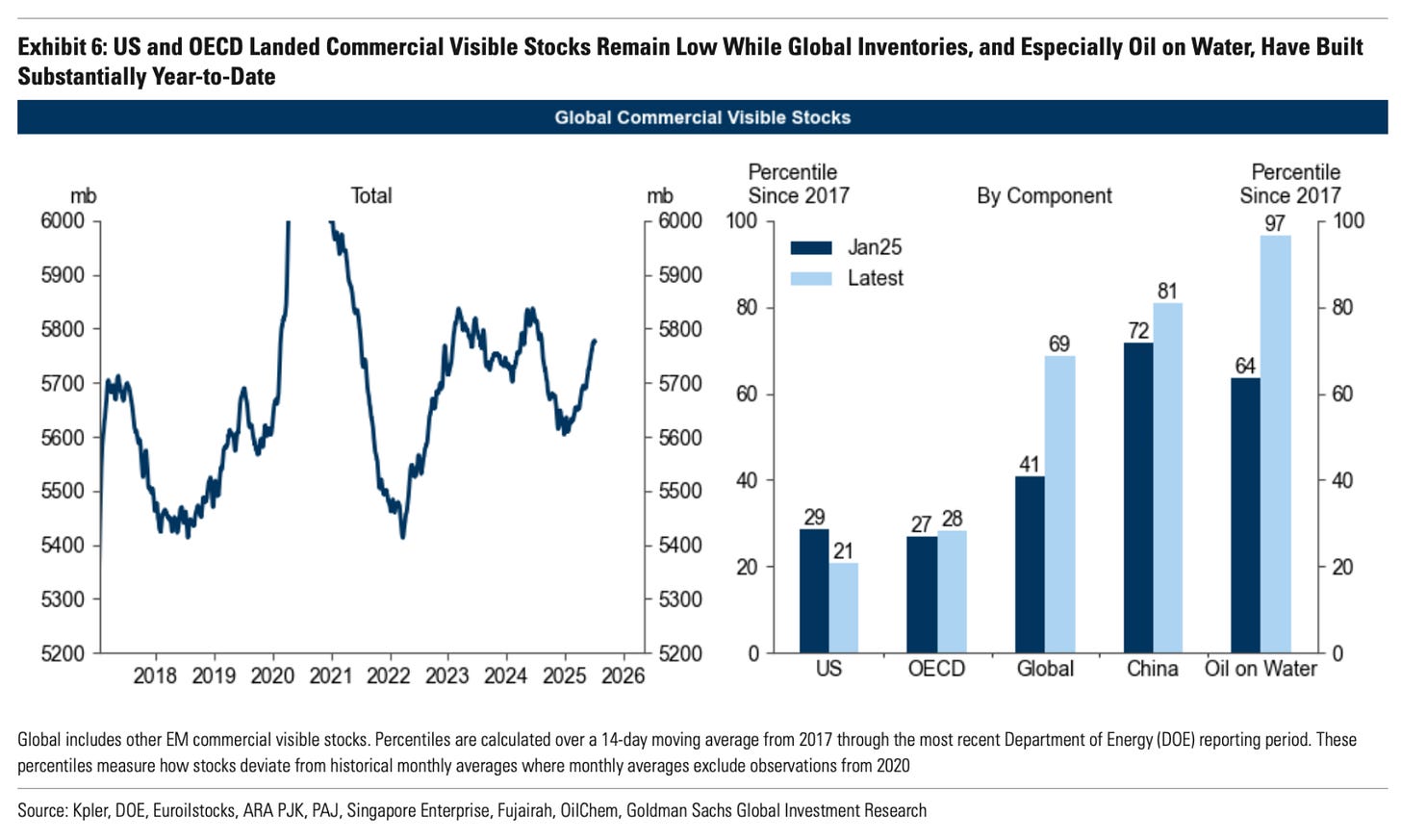

Oil prices, however, round tripped the Middle East crisis, starting and ending where it began. It was as if nothing ever happened. All eyes reverted back to global trade and fundamentals, and in Q2, the numbers were horrendous. Oil inventories have built by ~220M barrels in H1 2025.

The 5 year average is ~80M, which leaves a delta of 140M barrels, and the majority of this increase was in China as the government filled its strategic petroleum reserve (“SPR”) and refiners slowed their pace amid the trade uncertainty. As US tariff policy came into play, global trade took a pause, especially coming from China. The astronomical (or comical) 145% tariffs placed on Chinese good was essentially an embargo. Thus, transportation halted, product stocks built, and crude demand fell as refiners retreated.

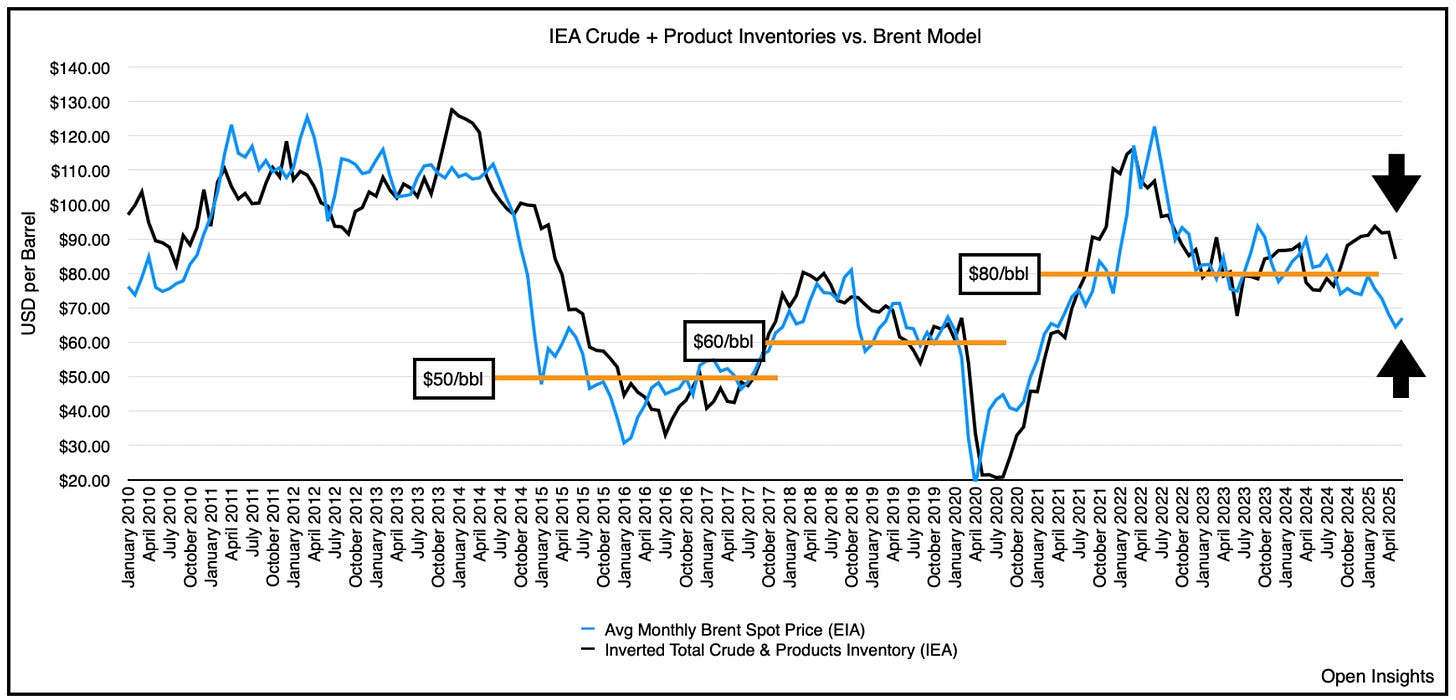

In OECD countries, inventory builds were much more muted. Slightly higher, but below what we seasonally build. This leaves our historic price indicator lagging.

To close the gap, inventories would need to increase in OECD countries by 100M barrels (nearly 1M barrels a day), or oil prices by $18/barrel.

Supplies

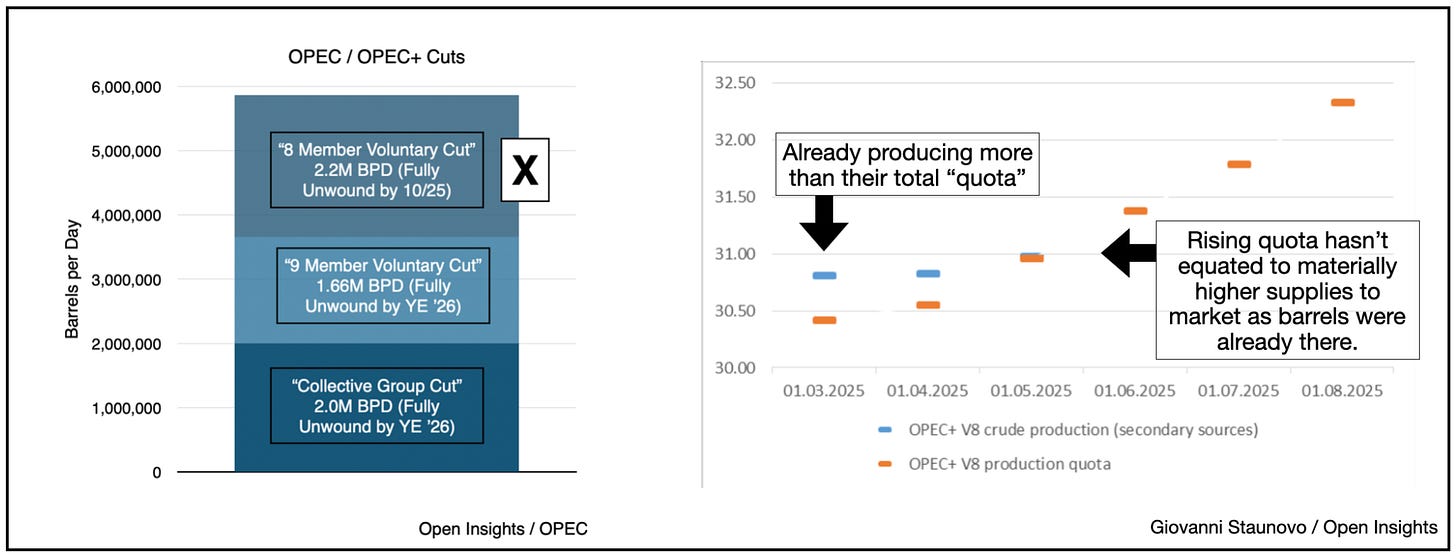

A material price increase won’t happen as analysts expect a deluge of supplies coming online in H2 2025. First, the unwinding of the first tranche of voluntary cuts by 8 members of OPEC+. This sub-group began unwinding 2.2M bpd of cuts in April, and should be finished by their September meeting. So 2.2M bpd of oil hitting the market. Removing the cuts will remove spare capacity, but hammer inventories and prices if production exceeds the market’s ability to absorb supplies. Maybe not, because we’ve long believed that most of the OPEC+ production cuts were fictitious (i.e., as members set, then “cut,” from artificially high production levels, or simply cheat and flout the quotas). Fortunately, most of the barrels are already on the market due to cheating), so some of this is optics.

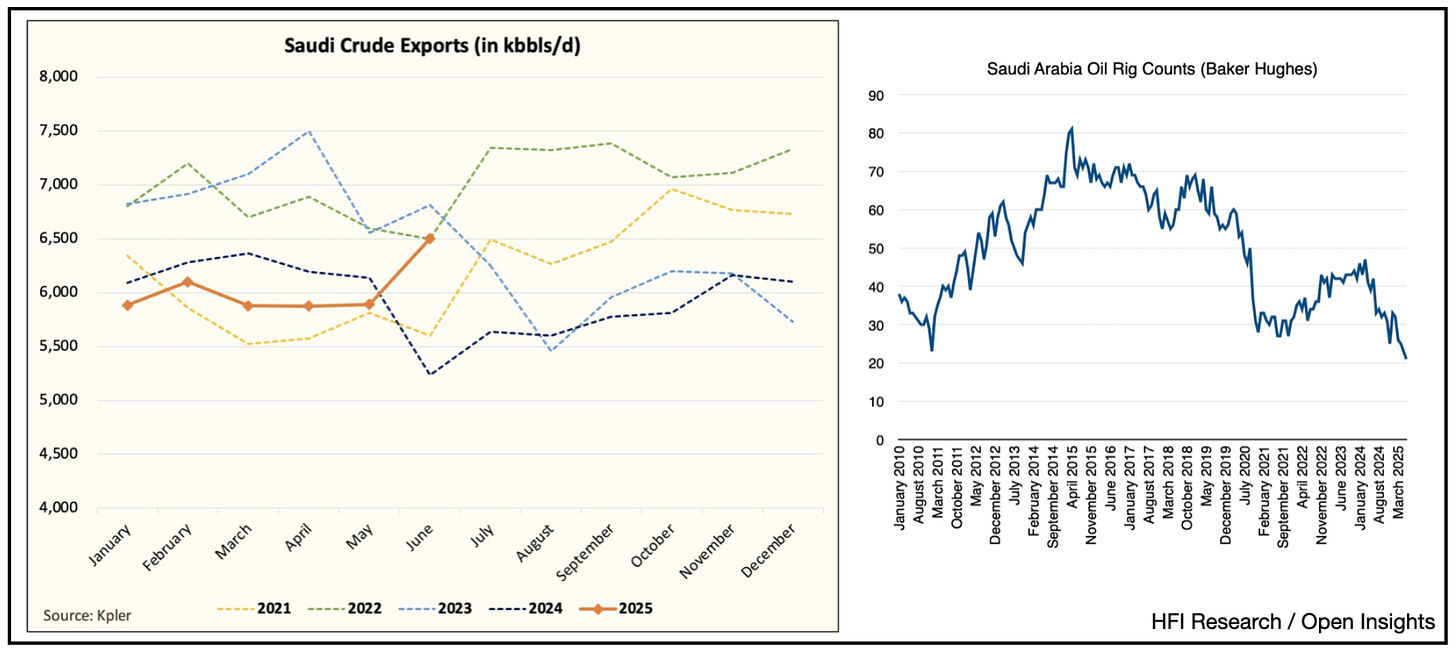

We’ll see what the Saudis decide because they contributed most of the original production cuts. If the Saudis return their full allotment of barrels, and produce flat out, inventories will rise. If they carefully manage the return of barrels, or pause, then the inventory increase will be tolerable. So far, Saudis are exporting more onto the market (HFI Research chart), so there’s that . . . but rig counts makes us wonder if they’re really keen on drilling more.

We’ll be surprised (and wrong) if Saudis and those with real spare capacity bring them fully online to overstuff the market. What we can say with certainty is that the remaining two cuts (i.e., the bottom tiers that equate to 3.66M bpd of spare capacity (i.e., 1.66M + 2M bpd)) is vastly overstated. We suspect that when those cuts are unwound, OPEC production won’t be materially higher than they are today. Certainly more barrels will flow from Saudi Arabia, Kuwait and the UAE, but we’re doubtful others will unless oil prices increase dramatically, which is why we’re sanguine despite the claims the market will be extremely oversupplied in 2026. OPEC is beginning the process of lifting the veil, and that should reveal the reality below.

The second reason why analysts have projected higher inventories in H2 is the pending start-up of long-term oil projects in Guyana and Brazil that are scheduled to come online before year-end. These projects should add anywhere between 300-400K bpd, and would push inventories higher unless demand also increases to offset. In the immediate quarters, they will bump-up supplies, but it eventually fades as the new projects often offset the country’s decline rates. Here’s a chart that illustrates our point.

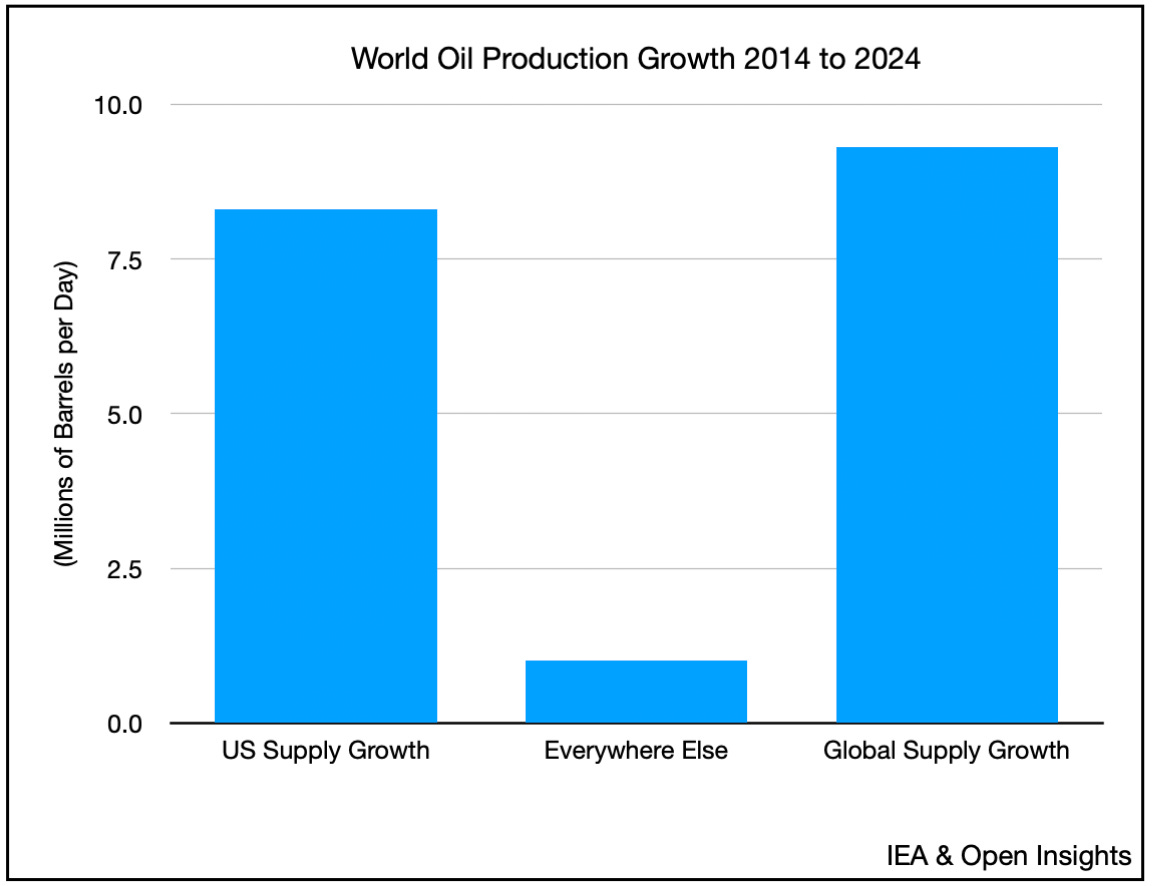

Everywhere else really doesn’t matter. What you find in nearly every country are aging oil fields and increasing decline rates. New projects may bump up supplies in the short-term, but their impacts inevitably fade. What does matter? US supply growth. In the past 10 years, US supply growth has accounted for nearly all of the supply growth in the world, and even before the recent tariff turmoil, US shale was on the precipice of declining. Geological factors, dwindling tier 1 inventory, higher operating/capital costs due to inflation and tariffs, and shareholder demands, have curtailed growth, but Liberation Day slammed the breaks and pushed producers over the cliff.

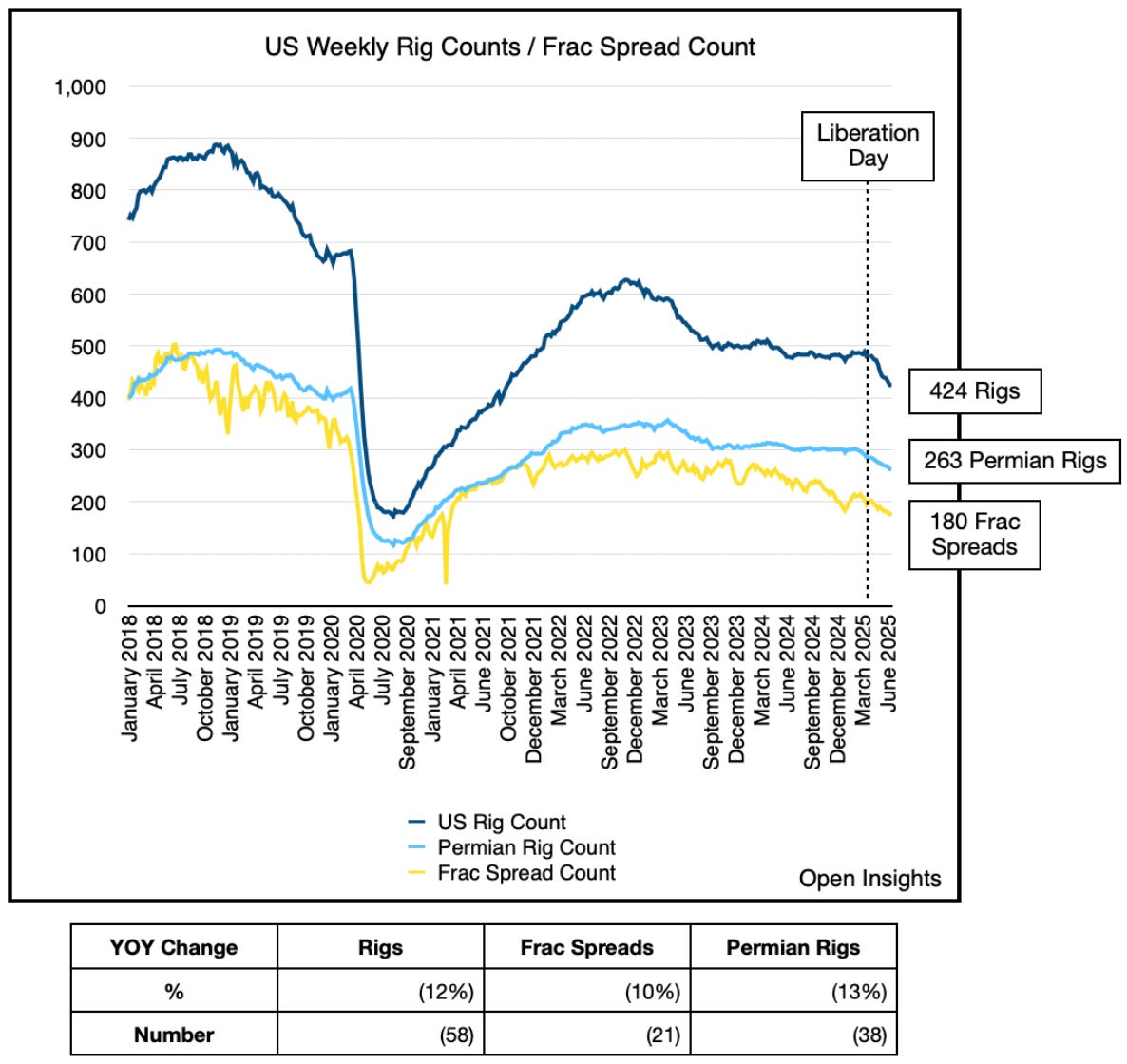

Rigs, frac spreads and crews are all down year-over-year, falling >10% this quarter. Simple math tells you that if shale is 9-10M bpd, and you have a 30-40% annual decline rate, then you’ll need to replace about 3-4M bpd every year. US production grew slightly last year and we averaged 490 shale rigs with 305 in the Permian. Since Liberation Day, we’re at 424 and 263, respectively. So yes, we expect US production to fall here in the coming months, and end the year 300K bpd lower vs. the 400K bpd growth for 2025 (consensus expectations). Once down, it’ll be difficult to recover given the steep decline rates and fewer premium drilling locations than before.

Portfolio Update

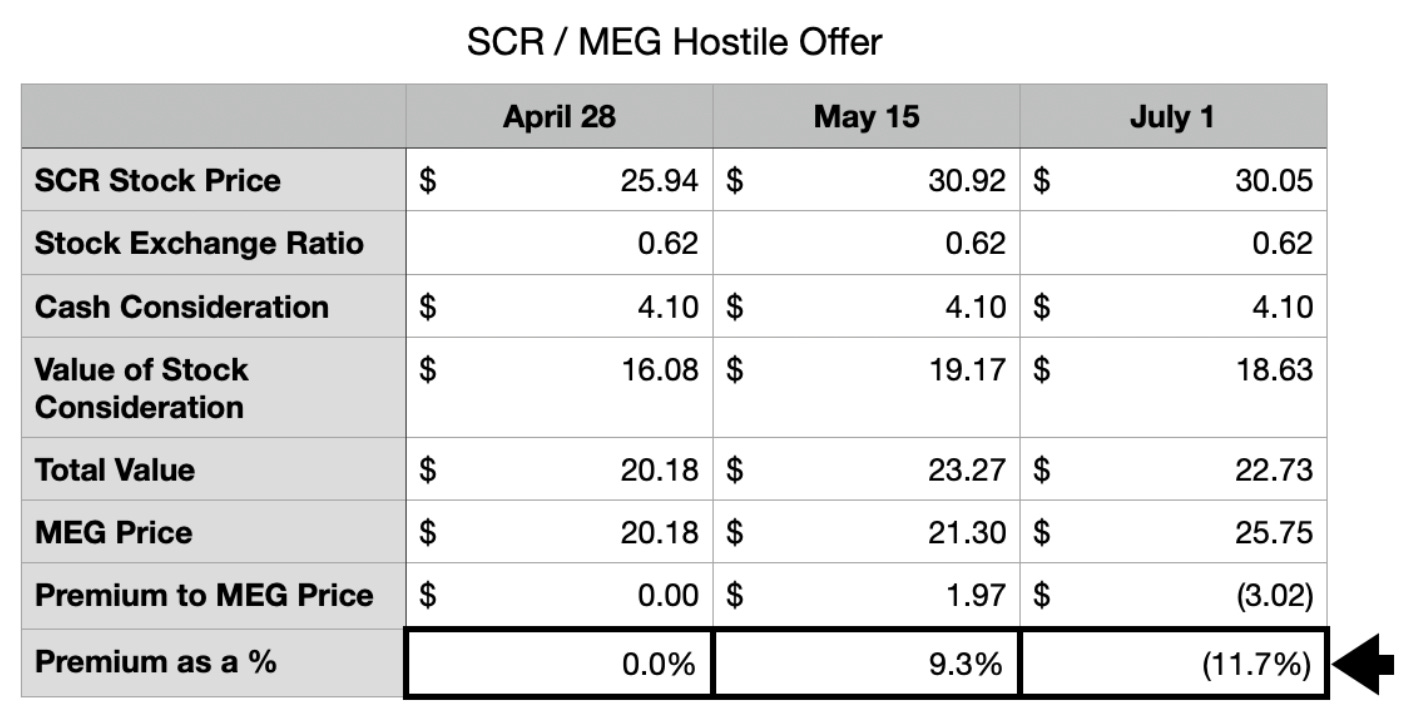

Let’s turn to a few of our portfolio holdings for a bit. On May 15, Strathcona Resources (“SCR”), a Canadian oil and gas producer, commenced a hostile takeover for MEG Energy (“MEG”), our fund’s largest position. Separate from the transaction (though part of its overall plan), SCR announced the day before a major divestiture of its natural gas assets, the proceeds of which will be used to repay all of its debt. Post-sale, SCR became a pure-play oil sands company with steam-oil assisted gravity drainage (“SAGD”) operations in Cold Lake and Lloydminster. The future strategy was well received by the market as SCR shares rose to a near 52-week high at $30.92/share. The next day, SCR announced the bid for MEG, using the inflated SCR shares as partial consideration. At the time, MEG shares traded at $21.30/share, down 10% from the start of the year and mirroring the decline in oil prices.

SCR’s offer currently stands at 0.62 shares of SCR shares + $4.10 of cash for each share of MEG. At the unaffected price (i.e., the price before announcement) SCR is offering a total consideration of $23.72/share, a 9.3% premium. Prior to the public offer, SCR had quietly approached MEG on April 28 after acquiring 23.4M shares of MEG, or ~9.2% of MEG on the open market.

If we calculate the value of the offer back on April 28, we can see that SCR effectively offered no premium for MEG’s shares, an offer that the MEG board quickly and correctly rejected.

Given the recent increase in SCR shares, the company is pitching the bid as one with a 9.3% premium. Opportunistic given oil prices and oil companies had fallen post-Liberation Day? Most definitely. So how has the market reacted? Today MEG shares are trading higher than SCR’s offer, ending the quarter at ~$25.73/share. It’s doing so because the market believes that once MEG was put “in play,” a higher offer from either SCR or another acquirer will emerge. Other suitors may include some of the largest oil and gas producers in Canada, Cenovus, Suncor, CNQ, etc. MEG has undertaken a strategic review process, and we think the advisors will shop it around to see what’s out there.

As MEG conducts its evaluation, we’re left to ponder what we think would be an appropriate premium for MEG shares. Oil sands have historically sold with a 20-40% premium, and in MEG’s case it has actually received just such an offer from Husky Energy in late-2018 with a 44% premium. Obviously that offer was rejected, but MEG’s situation today would warrant a similar premium. The company is lightly levered with only $815M in debt and a Christina Lake SAGD operation that is considered best-in-class, with a reserve life of ~50 years. The thesis on the company is fairly simple. If the company uses free cash flow (“FCF”) to buyback stock, it will likely retire half of its shares in 5 years, and the stock will double. That’s it. Yet, we’ve never thought that the company, with its single jewel of an asset would remain independent. This is what we wrote in our Q4 letter last year.

Instead, because of Liberation Day and the resulting swoon in oil prices, MEG’s shares declined along with other E&P producers, which proved to be too tempting for the opportunistic SCR. So would we be happy owning SCR shares? Sure. For the right price.

SCR is an amalgamation of assets collected from other producer’s dustbin. Formed in 2017, the company is the creation of the Waterous Energy Fund (“WEF”) , the eponymous investment firm founded by Adam Waterous. Adam Waterous previously served as the Global Head of Investment Banking and Head of Energy and Power at Scotiabank. With his considerable knowledge, WEF has systematically rolled-up unwanted assets in the space and turned SCR into one of the largest oil and gas producers in Canada.

SCR has recently announced a sale of its Montney operations for $2.84B, using the proceeds to repay all of its debt. Going forward, SCR has transformed into a pure play oil sands producer so combining MEG with SCR makes sense. Both companies are of similar sizes, though SCR generates lower cash flow despite producing nearly 20% more barrels and having the expenses of a management team that sits “off the books” (i.e., Adam Waterous and sons, who are the executives of SCR, are paid by the investment firm and not SCR). SCR is an aggregator though, and if the firm acquires MEG, it can focus on Athabasca, a $3B oil sands producer. Once that acquisition occurs, the space will largely be concentrated in the hands of 4 producers. In turn, SCR’s package of nearly 50 years of oil inventory will likely entice a larger acquirer (e.g., Exxon, Chevron, etc.) who will once again search for reserves after shale starts depleting. That’s the long-term plan, so the question becomes, do we want to be part of this endeavor?

Again for the right price.

So what would it take? Our best guess is around $28-30/share for MEG, which would be a 40% increase from the unaffected MEG share price prior to the announced acquisition. Again the offer as it currently stands is 0.62 shares of SCR + $4.10 cash for each share of MEG, or $23.27/share (on 5/15).

Today, SCR has a market cap close to MEG (~$6B). Yet, because they’re comparable in size, SCR can’t offer any more SCR shares if it increased its bid; doing so would dilute existing SCR shareholders, and in turn WEF, enough so that WEF will end up owning <50% of the company and lose control. WEF has already subscribed to an additional 21.4M, or ~$662M at $30.92/share in SCR to boost its stake to preserve control under the current takeout proposal.

So that leaves cash as the only consideration in the offer that can be raised. Where will SCR find the cash? Borrow. What’s intriguing is if you dive into SCR’s most recent 2025 Q1 filing. The company stated the following:

“On April 25, 2025, the availability under the Revolving Credit Facility was increased to $3.0 billion. The agreement governing the Credit Facilities (the “Credit Agreement”) includes an accordion feature which permits the Company to increase the available Credit Facilities by up to an additional $250.0 million, subject to the satisfaction of certain conditions.”

Why would SCR, having sold assets and becoming debt free, increase its credit facility to $3B? We think it gives them the flexibility to pay more in cash. At $4.10/share, SCR will need to borrow ~$960M of cash, but a $3.25B facility means the company has the wherewithal to pay up to $14/share in cash. Couple that with the 0.62 shares of SCR worth ~$19/share means SCR has the ability to pay up to $33/share. That’s unlikely though as it would stretch the premium we’d put on MEG today given oil prices, and max out the corporate credit card.

The expansion of the credit facility, however, does strongly suggest that SCR can and will raise the cash portion of its offer. If we look at SCR’s historical deals, the firm’s flexed the credit facility and borrowed around 75% of it, which would mean drawing ~$2.4B, or the equivalent of raising the cash portion of the purchase price to $10/share, which would equal a $29/share buyout. Remember though, SCR’s total borrowing will likely be less as we’ve yet to factor in the $662M of cash SCR received from issuing new shares to SCR and the existing cash on its balance sheet, but you get the point. We do think a higher proposal is in the offing.

As it currently stands, the premium is too small, but intentionally so as SCR anticipates other suitors to jump into the fray (e.g., Cenovus, Suncor, etc.). Whether one does or not, shareholders will reject the current offer. Adam Waterous, knows that, but there’s little point in bidding against yourself. For now, we’ll let the process play out, and we will not be tendering the fund’s shares before the September 15 deadline.

Occidental Petroleum (“OXY”) Update

As the Big, Beautiful Bill (i.e., President Trump’s tax bill) wound its way through Congress, we were bracing for large reductions to President Biden’s Inflation Reduction Act (“IRA”) and its bevy of green energy initiatives, one of which was the tax credits related to carbon, capture, use and sequestration (“CCUS”). Since the Trump administration took office, the Department of Energy has canceled many grants for the development of CCUS projects, and we surmised that the tax credits could be axed to generate revenue to fund other tax cuts. We held out hope though that since many of the CCUS hubs were located in red states (e.g., Texas) Republicans would rally to preserve the credits.

To our surprise, they did just that. To our astonishment, Republicans actually raised the Sec. 45Q tax credit from $130/metric ton to $180/metric ton if carbon dioxide from direct air capture plants (“DAC”) are used for enhanced oil recovery (“EOR”). Before, the higher credit was only available if DAC operators captured and sequestered the gas, but under the BBB, captured CO2 that’s used for oil production will be eligible for the higher $180/metric ton credit.

In EOR, oil producers inject liquids or gases into older oil fields to increase reservoir pressures. Doing so enhances oil recovery and lifts the amount of oil and gas ultimately recoverable from the field from 6-12% to 16-22%, a near doubling of the EUR.

The injection wells will later be sealed, trapping the CO2 deep underground. By providing tax parity for how the carbon is used (i.e., sequester vs. used in EOR), the market’s now free to determine the best use case for the CO2 captured. For OXY, EOR will become critical for the next phase of oil/gas development as the Permian basin matures, and CO2 will be a critical ingredient to lower the operating costs. This was a key ask by OXY’s CEO Vicki Hollub and she’s had many conversations with the President and Congress about the need to use DAC for EOR purposes. Fortunately, the intensive lobbying has paid off, and the Sec. 45Q credits were not only preserved, but enhanced.

We expect to hear OXY announce the start of its first DAC facility, Stratos, in the coming months, and as it begins operations, the ongoing process improvement will do much to de-risk the venture and solidify the economics and viability of this nascent market. Selling carbon removal credits, producing sustainable aviation fuel and net-zero fuels, enabling EOR, and creating large scale carbon management programs will give OXY many synergistic advantages, and an imprimatur to operate freely. We’re looking forward to seeing the advantages unfold soon.

Parting Thoughts

As we ended last quarter, we wrote the following:

Sure enough, inventory builds did occur in the first half of the year, partly seasonal, but mainly because of the sudden shock of the trade war. Inventories increased, largely in China, where the slowdown first appeared and SPR stocking became prioritized. In OECD countries, they’ve nudged only slightly higher (and below seasonal norms).

Globally we’ll consume ~104M barrels of crude in 2025, every day. We built over 140M barrels in H1, but is that surprising when we initiate a trade war via tariffs? We don’t think so. A drag of 1-2% on global GDP means demand can easily fall by 1-2M bpd for a few months. Given the uncertainty for how long the Liberation Day shock would last, oil prices needed to fall to shut supplies. Like COVID though, it’s a whipsaw. The casualty this time is US production, and as rigs fall, so will production. As we go into H2, analysts project that reducing OPEC+ voluntary cuts, trade winds, and higher non-OPEC supplies will result in lower demand and higher supplies . . . inventories will build . . . bigly.

We’re not so sure. US production will slow, and we believe global production will decline. Time spreads and strong refinery margins are telling a different story than the one that analysts are projecting. If oil supplies are well in excess of future demand, we should already be seeing the futures curve steepen massively, as the excess inventory in Q4 drops prices, but we’ve yet to see that in pricing.

In fact, we think the opposite might happen. Demand may actually come in higher than analysts project as the full force of what the administration is trying to do takes shape. As trade tensions subside, and activity will pick up. Stated simply, the guys in Washington? They’re going to juice it.

They will run this economic machine red hot in the coming quarters. They will redline it, they will cajole it, and they will bluff and bluster as much as they can . . . to get what they can. As my son recently reminded me, it’s important to know what you know, and we know this, you can’t have a hot economy without burning energy.

Mason: I know 5 words in Spanish.

Matt: Oh yeah?

Mason: Yeah.

Matt: Which ones?

Mason: Uno . . . dos . . . tres . . . cinco . . . hola

Matt: hahaha, uno, dos, tres, cinco?? What happened to 4??

Mason: I said I know 5 words . . .

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Thanks for sharing. I found the commentary on SCR/MEG interesting. Have you attempted to value the pro forma company to figure out what the consideration is actually worth?