Our Q3 2023 Letter & Look Ahead

October 13, 2023

Visions. Arguably, that’s what distinguishes the successful leaders from mediocrity. Those that have it are initially written off. Crazy, delusional, mad. Political correctness would classify it as a mental health issue. Fail, and at best it’s “I told you sos,” muttered quietly in small circles, and at worst it’s screamed loudly by revolutionaries calling for the curtain to fall on your reign and an axe on your neck. Heavy is the head that wears the crown, especially in the basket.

Lest you forget, this is an existential issue. Visions don’t always come in the form of burning bushes or near groves of trees. They can form when you study demographic data long enough. Focus on some charts and you immediately see inspiration. The Saudi kingdom includes 32M souls, slightly more than Texas, but only 19M of which are Saudi nationals, and of these, only about 5M are in the workforce. 70% of that, yes 70%, are employed by the public sector. Over the past 10 years, the public sector accounted for nearly 90% of the total increase in Saudi income growth. Translation? The government is the job market, and household wealth is driven by the government’s salaries and benefits.

Saudi Arabia’s social compact with is citizenry was based on a government-led economic system. Great public sector jobs in exchange for minimal social rights and government support; social spending disguised as public sector employment. Unsurprisingly, the past decades of increasing oil prices have only encouraged the continuation of this program, as all parties were satisfied. Unfortunately, government-led growth so skewed the country’s economic system that the vast majority of employable Saudi nationals now work for the government resulting in an anemic private sector.

The situation is increasingly untenable as almost 2/3rds of the country’s population is younger than 30. By 2030, the number of Saudis 15 years and older will increase by 6M. Said another way, the demographic bulge means the workforce will double in the coming years. If so, where will the jobs come from? Given the low productivity of civil servants and the budget constraints, the public sector alone can’t be counted on to employ this group. Imagine a Saudi Arabia where millions of young, unemployed, economically challenged, and disenfranchised men and women come into their own. Poverty and the lack of opportunity can quickly lead to anger and discontent. In such a caldron, it’s easy to conclude, rocks will fly and tires will burn.

Ultimately, Vision 2030 and the development of NEOM (i.e., the redevelopment of northwest Saudi Arabia) as a new economic/tech/media hub, isn’t a want, it’s a need at this late stage. Fulfilling that need will require massive capital investments, and if the Saudi’s initial foray into LIVE golf, which they parlayed into a stake in the PGA, and signing top tier soccer stars into the Saudi Pro League are any indication, they are truly committed to the project. Such commitment means the Saudis will need to push for much higher oil prices for far longer to fund the endeavors. The West’s willingness to restrict energy production and weaken our energy security means we’ve handed the Saudis and their OPEC+ allies the leverage to set energy prices. It’s an ability they will gladly exercise. Ironically, we’ll fund the very governments we have trouble stomaching, but hold our noses as we hand over the cash. So Saudi’s modernization? Prince Mohammed bin Salman’s (“MbS”) grand Vision 2030?

Yeah . . . you’ll pay for it.

Prime Cut

The physical disciplines the financial. It’s a well known rule, albeit only loosely followed by the market as prices can dislocate from inventory levels. This quarter? It started tyng again as the draws began hitting. Undoubtedly, it’s the Saudis who’re bringing the paddle.

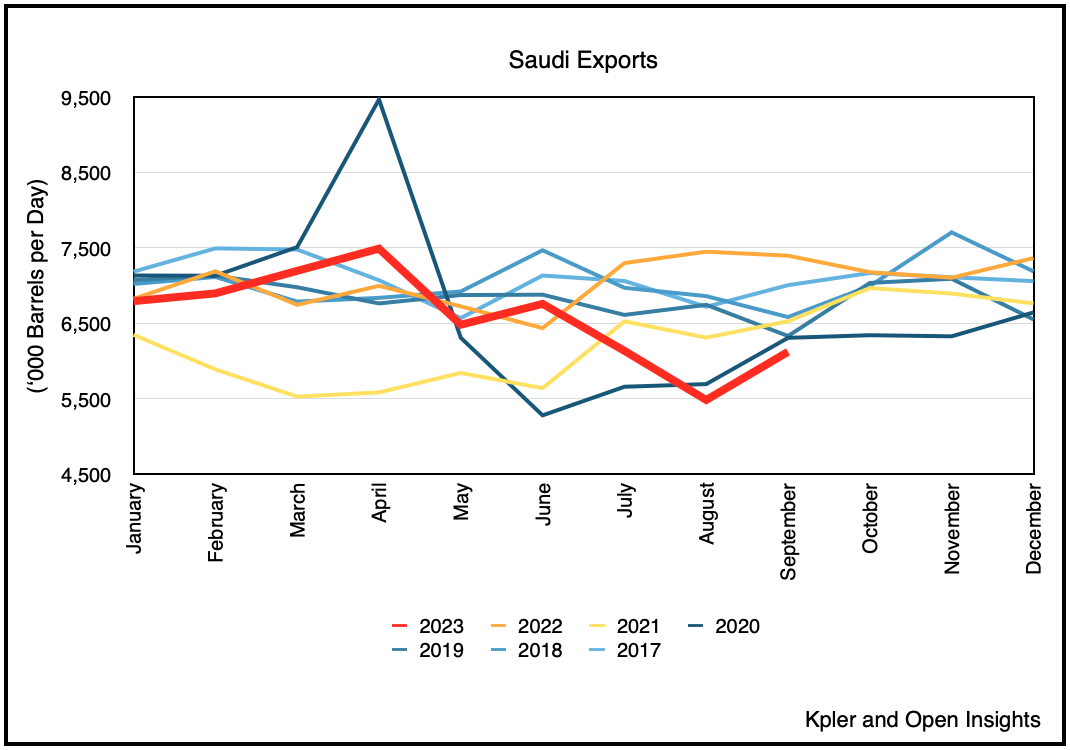

A big one at that as they’ve reduced exports to multi-year lows for the summer, and have announced an extension of the export cuts into year-end. In conjunction, the Saudis have also raised the Official Selling Prices for the US, Europe and Asia, to discourage refiners from nominating (buying) barrels.

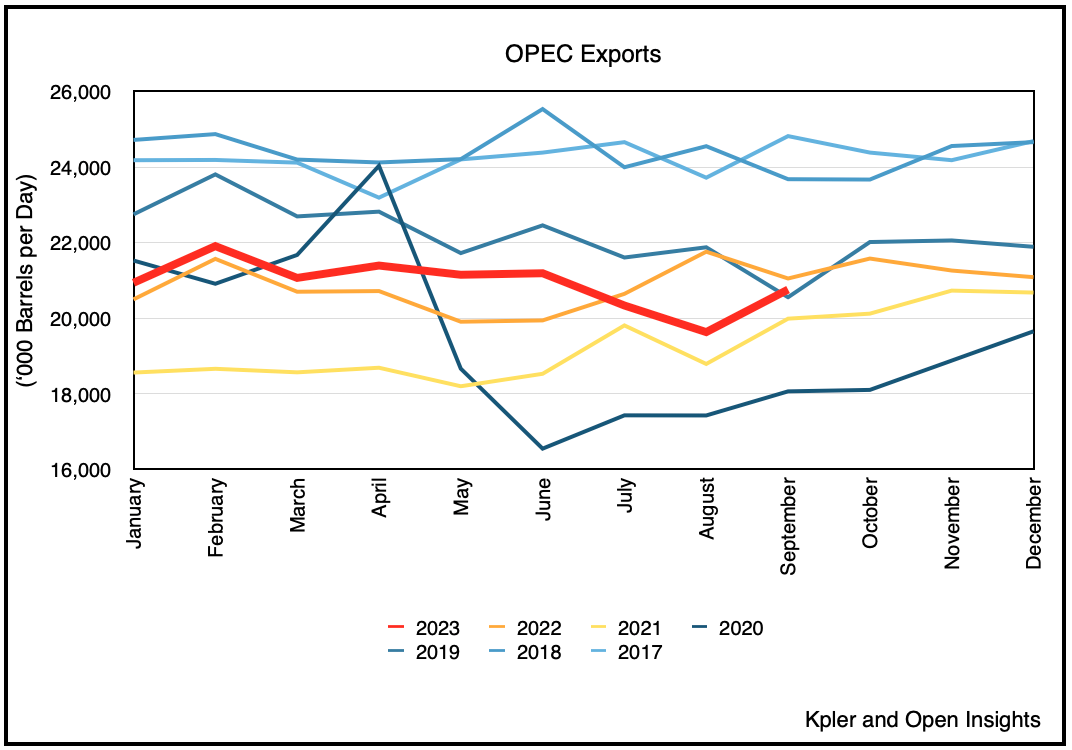

These actions in totality have slowed oil exports out of Saudi Arabia, driving them to multi-year lows. In turn, Saudi’s heavy lifting has also dropped overall OPEC exports.

Reduced exports (read: supplies) translates to falling inventories and that’s what’s happening as crude inventories declined. Notice this chart by Eric Nuttall at Ninepoint.

Today, we’re at multi-year lows with crude inventories less than 4.5B barrels. This is occurring even as macro-uncertainties swirl around the market, and despite the world absorbing nearly 900K bpd of increased production from Venezuela, Iran, and Libya over the past year.

Saudi cuts offset by increased supplies . . . net/net? We’re still negative. So two ships crossing in the night. Well, one ship really, since the Saudi’s are keeping their oil tankers at home.

Couple the above with slowing US production growth, then the pendulum of leverage swings firmly back to OPEC+’s camp. We don’t seem to care though, at least here in the US. US producers have balked at increasing production to take advantage of higher oil prices. What we have is what we have, and producers and their management teams are more than willing to just sit back and return the free cash flow to shareholders. As US production growth slows further in the coming months (declining rig counts have typically led to a production decline in 8-12 months), whether supplies will be sufficient to meet higher global demand will be largely dictated by OPEC+.

Said another way, since spare capacity rests with OPEC+, and Saudi Arabia in particular, these oil producers will hold sway over the energy market for the foreseeable future. Will the Saudi’s “trade away” some of this leverage for political gain? Maybe, if the US/Western inducements are strong enough (never underestimate what a President can/will do during an election season to lower oil prices). Just based on their own self-imposed quotas, OPEC+ has plenty of spare capacity.

Likely not the full 4.5M bpd represented in the chart, but if you take OPEC+’s production in Q3 2022 as a “peak” (since they produced well below their own self-imposed quota (when they had every incentive to produce at the limit, but was unable to)), then we have at least 3M bpd of spare capacity.

Still, doing so, releasing extra barrels back into the market, will mean lower oil prices. Lower prices translates into less capital, and less money for Saudi’s Vision 2030 program, and with 2030 only a 5-6 years away, each day that passes means another group of Saudi children get older and enter the stunted job market. A job market that’s ill-equipped to accommodate that many workers in Saudi Arabia. So it’s a race against the clock. Frankly, it was already a race when they announced the initiative a few years ago, but apparently it was digital since no one heard the ticking. Well it’s finally getting some attention.

At the other extreme, we can also say that the Saudis won’t let the train runaway because doing so means cratering the global economy with uncontrolled oil prices. If global demand collapses, a recovery may take years, years the Saudis don’t have. Thus, at a certain price, we assume that the Saudis will reintroduce supplies (along with OPEC+’s cooperation), turning supply cuts into supply increases, and lowering its spare capacity. So perhaps the way forward is rangebound, a Saudi put that prevents oil prices from falling below $90/barrel, and a Saudi call if prices rise above $110/barrel. Necessity dictates the path forward, and Goldilocks, err Prince MbS, needs his porridge not too hot . . . nor too cold.

Admittedly, all of the above is predicated on whether the self-declared central bankers of oil can actually control the oil market. Non-OECD countries (i.e., emerging markets) account for the majority of growth in energy consumption, and as a weak China begins to stimulate the economy, can surprisingly robust demand take another step higher? The reality is that demand has held-up even as the economy has sputtered. As Goldman Sachs recently wrote

“The outlook for China remains lacklustre and was exacerbated by a flare-up of the cash crunch that has engulfed the country’s property developers . . . . Concerns were amplified by resilient US economic data that sent sovereign bond yields to their highest since 2008, as investors worried the Federal Reserve’s restrictive stance may remain in place for longer. As a consequence, the global growth outlook remains subdued, with analyst consensus of worldwide GDP growth well below trend for 2023 and 2024, at 2.7% and 2.6%, respectively. In this regard, China is the main wild card, as its economic troubles heighten the risk of global contagion among developing nations. Any abrupt weakening of China’s industrial activity and oil demand is likely to spill over globally, making for a more challenging climate for emerging markets in Asia, Africa and Latin America.

China’s oil demand has so far remained remarkably unaffected by its economic downturn. For the third time this year, its demand set another all-time monthly record – reaching 16.7 mb/d in July.”

Much of the increase though is likely just a reversion to the mean. Global demand after-all is closely correlated with GDP growth, and though there are dips, OECDs consume what they consume, and emerging markets continue to grow. Nearly 8B on this planet, and we’ve written before that 2.8B of them in China and India sure want what we have. The fact that demand is“growing” faster than people anticipate isn’t surprising for us. In fact, we can make the argument that we’re really not growing that much, but continuing on our path of recovery.

As you can see here, there’s still more to go. Mind you, that gap for 2024 is assuming IEA is correct that demand will come in at +1M bpd vs. 2023. What if it’s more? What if it’s stronger? Heck, it’s been stronger in 2021, 2022, 2023 vs. what the IEA had anticipated at the beginning of those years. We think the gap will eventually be filled. We think it will surprise people because what they consider “strong and surprising growth” is actually just a reversion to the mean.

In sum, we have a situation where self-interest on one side (Saudi’s need for higher oil prices) coupled with our insouciance or outright disdain for energy investments is colliding with the reality that people are moving, traveling, and working again. Is it so difficult to believe that people want to recapture their economic prosperity and perhaps even extend it, and that desire drives energy consumption?

Not to us. So mind that gap.

Geopolitical Risk

After tapping out the summary above a week ago, we’ve since witnessed the horrific attacks on Israel by Hamas militants in the Gaza Strip. Prior to the attacks on Saturday, the Wall Street Journal had reported that Saudi Arabia and Israel were progressing towards a normalization of relations with US backing. Ostensibly, Saudi Arabia’s recognition of Israel would come with US defense commitments, and in reciprocation, the Saudis would introduce additional supplies to the market early next year. Undoubtedly, news of this historic agreement had already leaked into the market, promoting a $10/barrel decline in oil prices two days after our quarter ended. Then Israel was attacked, and that has reshuffled the landscape of possibilities, and nudged oil prices higher.

Almost immediately, the Saudi-Israel agreement will become a low priority item as Israel mobilizes for war and the Saudis throw their support behind the Palestinians. In the coming days, we anticipate Israel will invade Gaza, leveling the city as it searches for hostages and insurgents. Given the shocking violence inflicted by the Hamas militants, Israel’s response will be unrestrained. The key question at this point is whether Hezbollah will also join the fight from Southern Lebanon and/or the West Bank. Israel’s keen to avoid a two front conflict that would divide and tax its forces, but once the Gaza invasion begins, the odds of Hezbollah’s involvement increases. The broader question, however, is at what point will Israel’s wrath extend to the puppet master . . . Iran.

Following Hamas’ vicious attack on Saturday, the Wall Street Journal reported the following . . .

“Iranian security officials helped plan Hamas’s Saturday surprise attack on Israel and gave the green light for the assault at a meeting in Beirut last Monday, according to senior members of Hamas and Hezbollah, another Iran-backed militant group.”

Sadly, we’ve little doubt that the kinetic conflict isolated to the Gaza Strip will stay there. The current two day battle has already killed nearly 1,000 Israelis and untold number of innocents in Gaza, and the anger and outrage over the terrorist attack will provoke a much broader Israeli response. To say that this is their 9/11 isn’t hyperbole, it’s reality. So even as the US and Israel downplay Iran’s involvement today, there’s little reason to believe that this mask won’t be lowered in time. There may not be a direct confrontation, but can we eliminate the possibility that Israel will retaliate? No.

So Gaza today . . . Iran tomorrow.

For energy, Iran’s a key supplier, exporting nearly 2M bpd onto the market, an amount that’s steadily increased since Russia’s invasion of Ukraine last summer. As we noted previously, the West had quietly relaxed the enforcement of Iranian sanctions to avoid spiking oil prices. Iran has taken full advantage, draining floating storage and nearly doubling oil exports in a year (chart from HFI Research).

As this conflagration widens, what’s the likelihood tensions calm quickly? Slim, particularly once Israel’s land offensive begins and eventually bogs down in urban warfare. Furthermore, what happens to the 2M inhabitants in the Gaza strip who lack water, power, food and medicine. This will quickly turn into a humanitarian crisis. Will Egypt grant refugees safe passage? Can they? 2.3M angry Palestinians pouring into Egypt, a poor country already grappling with its own inflationary and security issues, isn’t a prospect Egypt wants to entertain. No wonder they’ve closed their borders, trapping the Palestinians. So ripple that through, will their suffering in the coming days incite additional attacks? Fuel additional anger? More pointedly, will the Western world care given the atrocities committed by Hamas? If the US’ response to 9/11 was the full scale invasion of Afghanistan, etc., what’s the likelihood, or even the appetite to call on Israel to stop at Gaza? Again, there will be reprisals for the puppet master, Iran.

Even if Israel doesn’t attack Iran directly (or openly), the Western world will begin to receive greater pressure to tighten its sanctions. Certainly the political optics for the Biden administration are far from flattering. After unfreezing $6B of frozen Iranian funds in South Korea in exchange for the release of five US hostages and relaxing oil sanctions, we find out that Iran has been quietly preparing proxies for a major destabilizing attack on a key ally in the Middle East.

Supplies may not be at risk today, but certainly the risk premium placed on energy needs to climb. All the while the Saudis and OPEC+ maintain their plans for further tightening. This is still the early days of this evolving conflict, and we won’t delve into hyperbole or overemphasize the potential disruption to oil supplies as the market is currently sufficiently, if not slightly, undersupplied. In the end though, the risk is not zero.

Parting Thoughts

This is going to get tougher. It’s inevitable as the market turns from “everything’s pretty good” to “maybe it’s still good, but less so” to “hmm that doesn’t look good at all.” It’s a transition between phases that can leave investors breathless and afraid. This is going to get tougher because we will begin to deal with the real repercussions of what we did during COVID, and what we’ve done since as the fiscal spend runs away here. Pay no mind to the politics, what matters here are the economics, and the reality is what happens to things when we effectively borrow (read: print) $8 Trillion and release it into the wild?

So what we’re left with is trillions more in the global economy, and heavily indebted and politically weak governments that will be forced to keep printing and borrowing to try and inflate their debt away. We’ve written before that this is the only way forward, and we’re starting to see that vicious cycle play out. It’s why everything’s gotten more expensive, but not getting “cheaper” even as they tell you year-over-year inflation has already declined. Inflation may be “transitory,” but it still feels more like an intermission than a finale.

We believe higher wages will drive higher inflation in the years to come. In turn, higher inflation will require higher rates to offset. Once out of the bottle, the inflation genie’s hard to corral unless you want to hammer the economy. Given the upcoming elections in the US and UK, there will be little appetite for that. Even if we leave aside the short-term considerations, trillions of debt need to be refinanced on a rolling basis. Never before has so much debt needed to be continuously financed and refinanced, and the market will have to be incentivized/induced to lend the government money. So far, that asking price has only gone up. What were near zero rates for even the longest-term of the loans are anything but today, as investors’ inflation expectations and need for higher returns ratchet-up. We can literally see these concerns reprice the curve in real-time.

Whether the government’s borrowing for 1 month or 30 years matters little. Today, the government needs to pay-more to get more. In turn, government rates ripple through to all debt, tightening liquidity, increasing gravity, and potentially dragging asset prices lower. Given our internal political turmoil (look no further than the GOP itself and it’s inability to elect a Speaker), and the arguably weak Democrats, there’s little confidence that our political system can right the ship in short order. Overlay a more volatile and uncertain world, and the risks of “something” physically and/or financially blowing-up, you can see why we wrote . . . it’s getting tougher. So expect volatility and expect the plot twists.

We’re in the thick of it, but we think we’re holding the right assets for this environment. Whether it’s through careful consideration, or a process of elimination, we own what we own . . . sometimes there’s few other choices.

Me: Bubba, listen to me . . . I’m the parent.

Mason: Haha, no you’re not, you’re the“parent parent” . . .

Me: Wait, what? Who’s the “parent” parent then?

Addy / Mason: MOMMY!

Me: Haha, what am I then?

Addy: The babysitter of last choice.

As always, thank you for reading.

Please hit the “like” button above if you enjoyed reading the article, thank you.