Our Q3 2024 Letter & Look Ahead (Part I)

October 22, 2024

We’d laugh if it wasn’t so serious, the absurdity of it all. The disconnect between what we see out the window, and what others see on their spreadsheets. Distill those assumptions into a program, feed the computer, and let it rip. Let it rip indeed. Let the machines trade the paper market. One that whips the physical around so quickly that whiplash is the least of our concerns. Still we all rubberneck, fixated on the selloffs. What’s happening, everyone’s wondering? What’s causing the sell off? Something fundamental? There must be a fundamental reason.

What if there isn’t? What if price action forces us to search for a narrative? What if, momentum begets momentum, and in algorithmic trading, selling begets selling. It may be as simple as that, and when >30 paper barrels are traded for every barrel actually used, there’s little the physical market can do . . . in the short term. It’s something we’ve seen consistently in this sector, one where the price action can drastically diverge from the fundamentals. In times past, low inventories, rising geopolitical tensions, a solid US economy, and a stimulating Chinese one would augur higher prices, but the soothsayers dismiss those factors this time. Instead their crystal balls show vivid images of an impending stock build, thereby handing free reins to the computers to short oil to historic levels. They may even show a Trump victory, which harkens back to the days of “drill baby drill” and the Saudi quid pro quos. The ensuing volatility makes the sector even more uninvestable (as if that’s possible) as money managers can’t tolerate the swings. With no one to stop it, the lower we go.

In contrast, as the year has progressed, we’re increasingly convicted that our core thesis is coming true. The world has underinvested in energy. Unsurprisingly, US shale growth is slowing and non-OPEC+ supply (i.e., everyone else) came in at a fraction of the projected levels. So the leverage swings back to the Middle East and OPEC+ itself. Like a true conspiracist, however, we’re left to repeat “it’s only a matter of time” before everyone sees it . . . as we mutter to ourselves in a dark corner.

Could this very well be a value trap as some have claimed? A financial mirage? Ironically, perhaps even the same sticky tar-like substance that’s trapped and suffocated prehistoric mammoth and marsupial investors alike. We’re fully cognizant that we’re trading precious assets (time/opportunity cost) for an uncertain one (rising energy prices). Not a fair trade many will say. Possible, but what if this value trap has a catch? What if the very thing you shun, the very commodity that you freely short today, increases in value the more you drive it into the ground? Complacency abounds and despite the price action you see, we sure are burning a lot of it. Make it though? Not so much. Oil prices have averaged $82/barrel for nearly 2 years, and non-OPEC+ supply growth was anemic this year. What do you think will happen if oil prices stay at the $70/barrel level we see today?

As we bid everything else in the world to the moon, we’re left to wonder about the very thing that powers it. We are entitled to nothing and certainly not cheap energy. In the financial market, we are historically short oil, in a world where demand climbs inexorably higher. Low oil prices today portend higher prices tomorrow, it always has. It’s why we continue trudging on this path, the one less traveled, all the while muttering . . . it’s only a matter of time.

Perception vs. Reality

As we embarked on the third quarter, the summer season when energy demand increases and inventory draws begin in earnest, things appeared relatively steady and as expected. Conditions, however, “deteriorated.”

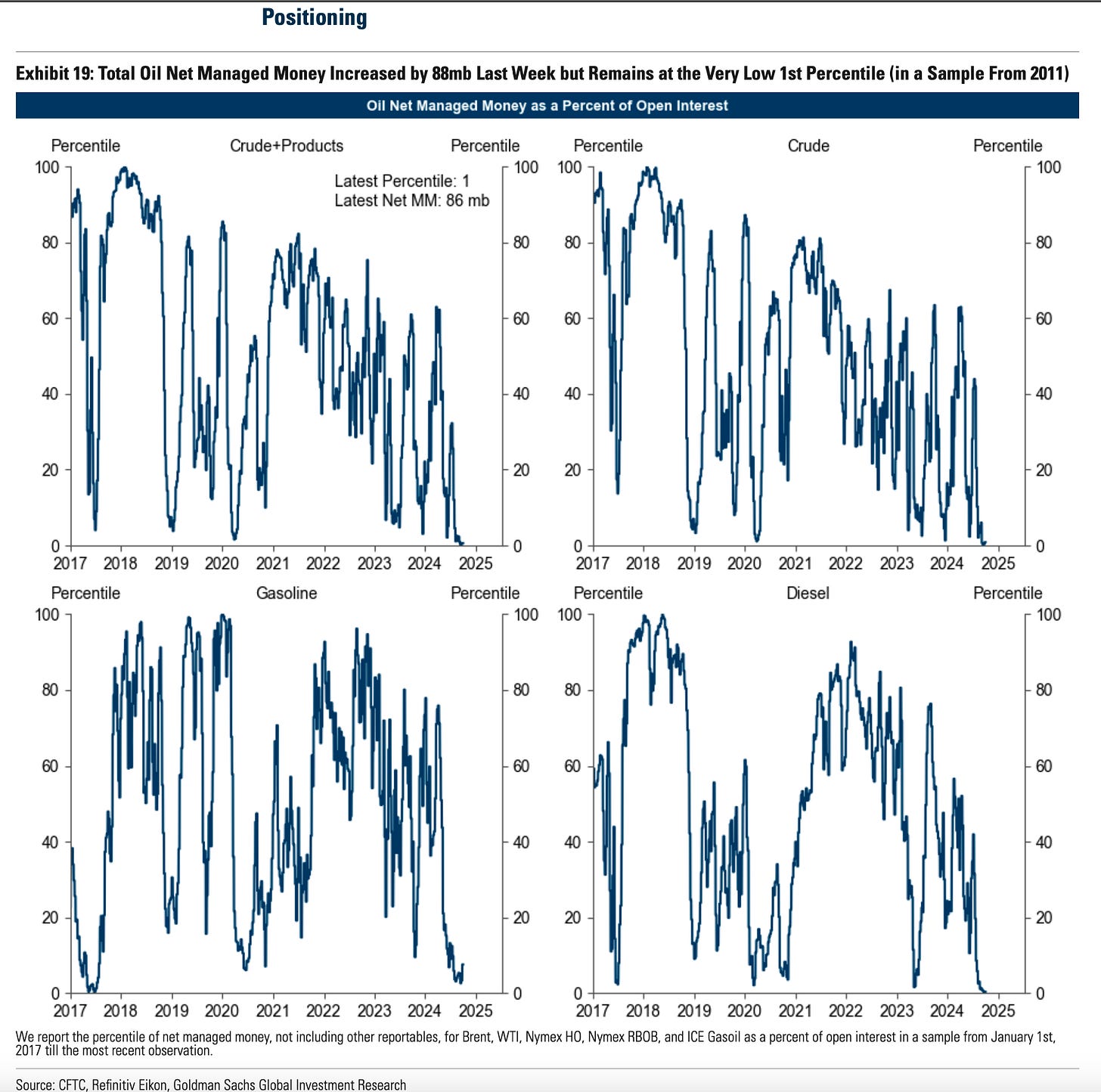

By quarter-end sentiment cratered to the point where they reached historical lows. Yes, you read that right, historic lows. Forget fundamentals, speculative positioning (i.e., the side bets on oil that trade +30 paper barrels to the single barrel that’s actually refined into petroleum products) have reached unseen levels.

It’s never historically been lower. Sentiment didn’t just deteriorate, negative sentiment cratered to levels below COVID . . . when the world stopped moving. It’s not just crude oil, but products as well.

Analysts attribute the decline to a bevy of reasons: China’s weakness, oversupply of non-OPEC+ barrels, threat of OPEC+ unity, global demand slowdown, and/or 2025 recession risks, we think most of the factors above are merely a market searching for answers. Sometimes, the price drives the narrative.

In contrast, do you know what else hasn’t been lower? Inventories.

More pointedly, inventories are also sitting at some of the lowest levels since the market’s started tracking them via satellites on/offshore. No matter the market claims, it’s the age old debate between perception and reality. Despite declining inventories, the market is pricing in future builds. The expectation for 2025 is weak demand coupled with high supplies. How the latter is possible when oil prices are weak makes little sense, but that’s the argument. The logic train runs like this, weak demand stemming from China’s economic malaise combined with fraying OPEC+ discipline and non-OPEC+ supply growth means inventories will balloon in 2025. The compelling narrative has allowed the paper market to take positioning to extremes. Once begun, the snowball careened downhill, and energy sentiment/prices collapsed by mid-quarter.

2025

Fundamentally, oil prices are below where inventories and time spreads would translate. If positioning wasn’t so skewed, Brent prices should be in the mid-$80 range. So how can sentiment be worse than COVID? Analysts point to the 2025 outlook. As the International Energy Agency (“IEA”) runs its supply/demand model for the upcoming year, it’s anticipating ~1.3M bpd in 2025.

Take the average of the 2025 estimates above (left), and the agencies forecast inventories to vault by 250M barrels next year. Call us skeptical because we did the same thing last year when projecting 2024 (take a look at the right chart). Same time last year, the IEA forecasted that we’d globally build 500K bpd in 2024 (i.e., 140M barrels). Yet, here we sit, crude “in the system” are down by 140M barrels YTD.

What’s more likely to happen is supply growth disappointments (US growth slows and non-OPEC supply growth falls short of expectations). The US continues to show production growth has already stalled. Look how flat that is, and the chart aligns perfectly to the flat number of oil drilling rigs.

We’ll run through 2025 supply/demand numbers in greater detail in our next letter, but suffice it to say despite the draws, there are no incentives for producers, individually or collectively, to force barrels onto the market next year. The largest producers in the US have adopted low growth strategies, and if production didn’t grow much when prices were at $80/barrel, it’s doubly so at $70. OPEC+ also likely won’t add barrels unless necessary. It will unwind the voluntary cuts at its discretion, and likely adjust/reallocate amongst themselves. In totality we expect muted and measured increases from the Saudi led group as they’ll wait to see market demand “pull” their barrels before releasing them.

Ultimately, demand will play a key role in where this goes next year, and we think it can surprise to the upside if China finally breaks out of its recession.

China, China, China

Yes, the words China and “recession” usually don’t belong in the same sentence, but whatever the government wants to call it, China’s facing stiff economic headwinds. Though government figures still show overall GDP growth, we’re a bit leery when you consider alternative measures.

The main cause of the slowdown? The real estate implosion. China’s slogging through a deleveraging hangover as housing construction and sales slow while prices search for a bottom.

The property market is the largest economic sector for China accounting for almost a quarter of GDP (~2x the US). Once hurt, upstream and downstream sectors were impacted. Most Chinese savers invest their excess capital in real property so when the market fell, a severe negative wealth effect rippled through the economy. As the private sector retrenched and local governments deleveraged, the consumer quickly sheltered under a cloak of frugality.

The economy never really had a chance to recover post-COVID as the lock-downs went on too long. Much of this year’s “meh” global oil demand can be attributed to China’s struggling economy. We had anticipated a decent recovery, but that’s proven impossible as the property market pins consumer sentiment to the unfinished floor. Until September, officials have largely been in containment mode, not letting real estate prices collapse, but also failing to improve the economic situation. Surviving property developers are receiving enough capital to finish and deliver their stock, but the existing inventory of homes remain significant.

Per Goldman Sachs’ estimates, excess inventory could be as high as 7.7 trillion RMB, or nearly $1.1T USD. So similar to our post-2008 GFC experiences, reducing that backlog is necessary before prices can stabilize. It’s why China’s recent easing has been focused on second homebuyers, relaxing downpayment restrictions, reducing interest rates, and increasing funding for local governments to buy up unsold property for social housing. As for the broader economy, what are the Chinese focusing on? Well basically two things . . . send stuff overseas and stimulate at home.

Export the Problem

Slack domestic demand translates to a glut of manufacturing capacity, which means idle and unemployed workers. Since they need to keep labor employed, what do you do? Maintain a weak currency, subsidize manufacturing, and juice exports by shipping cheap products overseas. Here’s China’s exports (via the Brookings Institute). Note these are dollar amounts and volume is higher.

Your export surplus, however, is someone elses trade deficit, and it crushes your customers’ higher cost domestic production. Inevitably, China’s policy is creating a backlash as trade barriers/protectionism rise.

Importing countries need to protect their own industrial bases, and those bases often vote as a bloc. One can only imagine just how effective China’s export practices will work if President Trump is reelected.

Even ramping up cheap exports isn’t a holistic solution, subsidized manufacturing has led to overcapacity, which depresses margins, wages, and in turn, consumer sentiment. Frankly, you’re lucky if you can keep your job. So Beijing knows, continuously exporting its excess manufacturing capacity has limits, and the only way forward is to boost domestic demand.