Our Q3 2024 Letter & Look Ahead (Part II)

October 22, 2024

Start Unpacking the Bazooka

It’s time for the central government to step in. Make no mistake, they’ve been doing so, but the monetary stimulus announced (i.e., interest rate cuts, reducing bank leverage ratios, providing local government funding, etc.) have been ineffective. Cutting rates and easing lending requirements help, but they’re hardly a panacea solution when the main issue is too much debt (local governments and businesses) and sluggish demand. It’s hard to lend when people don’t want to borrow. Weak private demand means government officials are “pushing on a string.” So we’ve all been waiting. Waiting for fiscal stimulus, and waiting for Beijing to do what the US did during COVID, rain money down on the people and caffeinate demand. Big government spending to solve big money problems.

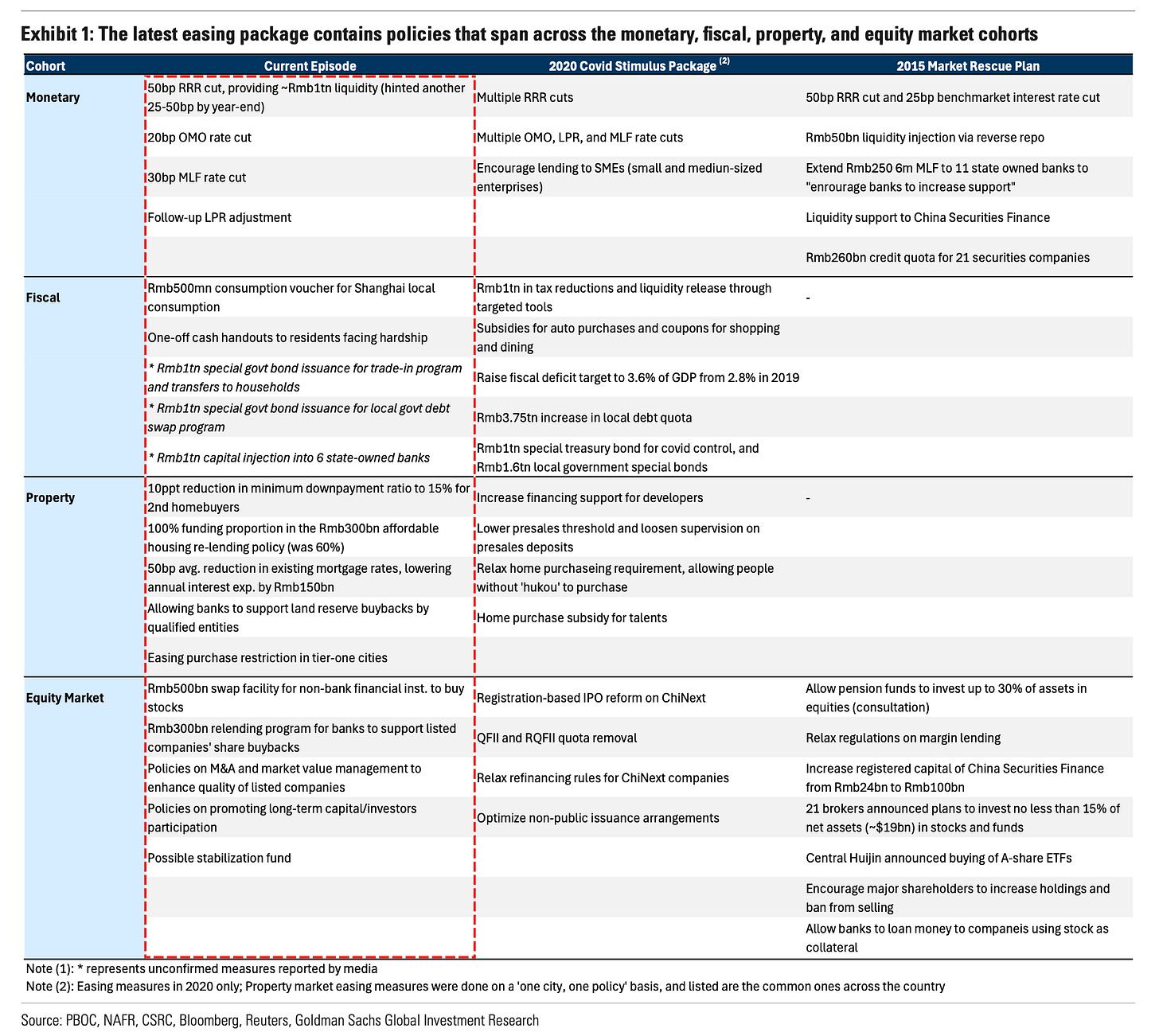

Bring the bazooka they did (maybe). In the past few weeks, the central government has announced, or leaked to the press a bevy of programs designed to cut mortgage expenses, spur local government deleveraging, and bolster consumption. Goldman Sachs summarizes the announcements and their relative size as follows:

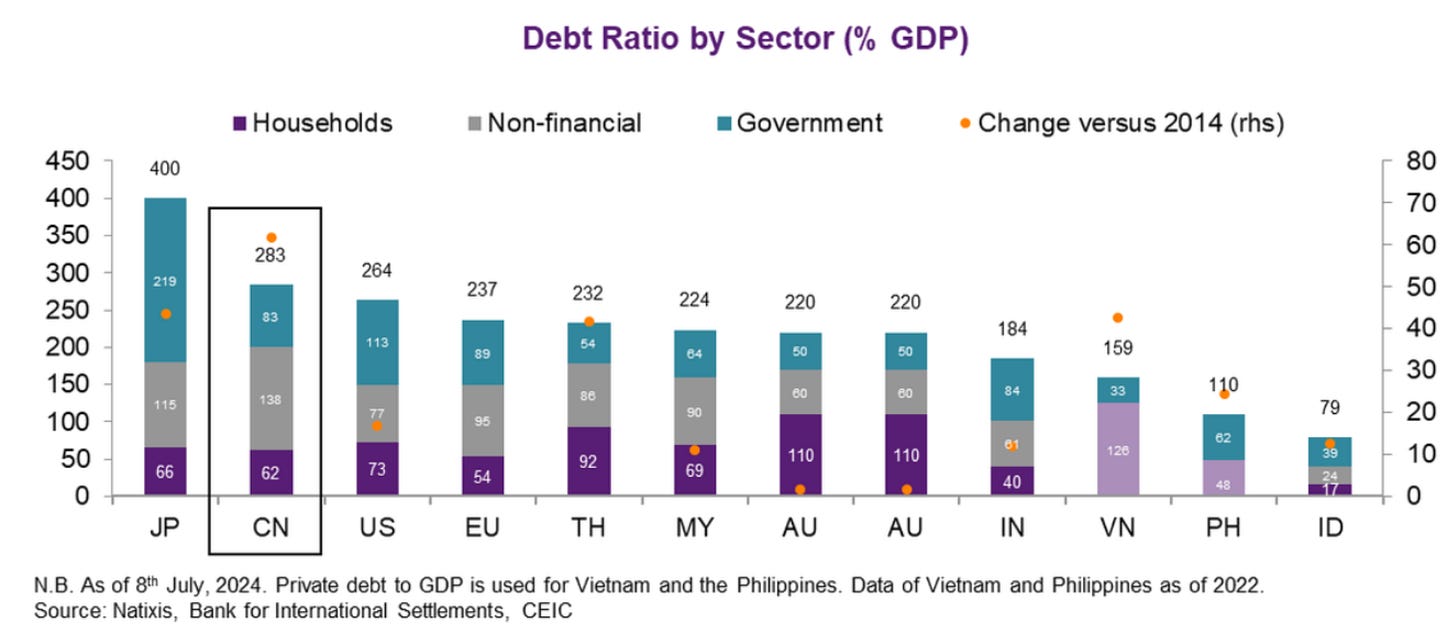

It’s a trifecta, supporting the property and stock market, and the consumer. The central government can certainly afford it. Much of the countries debt resides at the local and business levels.

Some programs are in the form of “cash for clunkers” types of equipment replacement programs (which of course helps your local manufacturing base), but other proposed programs will include direct payments. Reuters reported that one plan was to hand out RMB1T to families with 2 or more children. For context, remember when the US handed out 3 stimulus checks during COVID (i.e., $1,200, $900, and $1,400)? A RMB1T fiscal stimulus Reuters reported would be roughly comparable for larger families. So just that one subsidy should have a material impact.

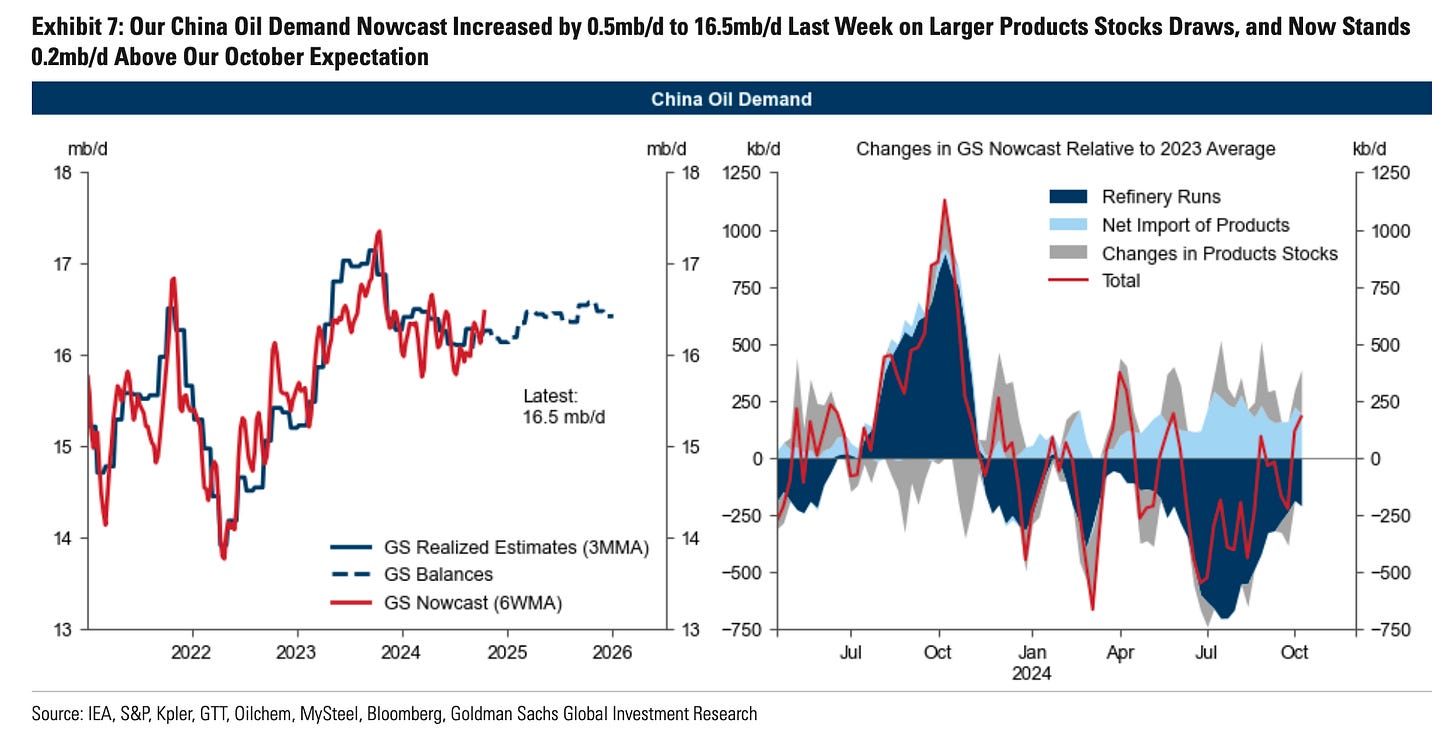

The government has yet to formally announce the program and additional details of fiscal stimuli, but we think it’s coming. It’d be unusual for the government to lead the plans in detail to the press (Reuters and Bloomberg), and then shy away. The Chinese stock market has certainly reacted, and it waits now for confirmation. Whether it’s this year or early next, we think China will eventually fiscally stimulate. Fiscal stimuli also has a much higher multiplier effect (i.e., up to 3x) so expect the benefit to ripple. We view China as beginning to bottom (or close to it). At worst the programs announced thus far can contain the contagion risk, reducing the odds of a financial crisis, and anything above that means a recovering economy and higher oil demand.

What we need here is for China’s economy and property market to stabilize. Once it does, oil demand will climb higher. We’ll be watching the Chinese bond market, if we see long-term bond issuances, then more fiscal stimulus are likely on their way. While China’s recovery has been delayed, don’t bet against it forever. Lift the stock market, stabilize the property market, and infuse the consumer with cash, collectively that should be positive for the wealth effect and reverse the tide. Inevitably, as the economy recovers, so will oil demand.

Parting Thoughts

We’re at historically low financial positioning for the oil market as sentiment is in the trough. In contrast, we have the lowest amount of inventories currently in the system since satellites started tracking them. Geopolitical risk is high, but none of that is currently priced in. Looking ahead, analysts expect a surge in supplies, yet in a backdrop of where oil prices are weak. Couple that with low demand, but while China is stimulating? To say that much of the above is contradictor is to be polite. Truthfully, none of it makes any sense.

The physical will discipline the financial. It’s already doing so because again . . . historically low financial positioning and oil prices are still hovering at $70/barrel. Change comes quickly folks, and we’re fairly certain prices will improve and things will get sweeter even if we can’t have everything now.

Me: Sorry, we’re you waiting long?

Mason: No.

Me: Did you have a good day?

Mason: Yeah, did you?

Me: Eh, frustrating. Trying to write a quarterly letter to the limited partners. Energy sentiment is terrible, but fundamentally data looks okay. Now I’m just waiting on Israel’s response to Iran.

Mason: . . . WHHAATTT???

Me: Haha . . . too much?

Mason: . . . the teacher gave me some candy.

Me: Can I have it?

Mason: No.

Me: Good talk.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

I guess we find out Monday!

thanks for these two pieces.