Our Q4 2025 Letter & Look Ahead: Oil, OXY & PTON

January 26, 2026

There’s a disconnect. A disconnect between what we think should happen vs. what’s happening. What are companies are doing and how their stock prices are reacting. We’re in a moment in time when prodigious spend on the backs of lofty promises are shepherding monumental share price gains. It’s a log jam at the top as each company, each management team, clambers and climbs furiously to outrace one another. Mountaineers all of them, everyone chasing the promise of fame and fortune as prices rip and stock options rise. It’s generational wealth being transferred up and down the tech stack: microchips, semiconductors, memory, everyone grasping for the AI imprimatur so they can elevate into rarified air. Anyone else that’s trapped below the peak, unable to advance, wither. Sapped of strength, most of the stocks not at the summit (or waiting to summit?) are left to their own devices. Exposed to the market’s frigid indifference and unforgiving elements, most cling to life in the death zone.

The economy’s growing, but mostly because of AI. Inflation is low, but prices are high. The consumers’ strong, but it’s largely the upper class. Contradictory notions whirl through our analysis as we wait patiently and some painfully. Have we erred, or is it oxygen deprivation? Could be both. This year we did in thinking OPEC+ would continue managing the markets instead of materially raising production to take market share. Geopolitical pressure or abandoning a failed strategy, whatever the reason, they chose a price war. So let’s all run this capital intensive and depleting sector below its cost of capital and find out what happens shall we? The resulting higher inventories, lower prices, and shale’s treadmill effects will certainly blunt supply growth, while global demand keeps rising. This’ll be fine.

It’s frustrating when reality falls short of expectations . . . for now. That’s what the younglings call “cope.” Perhaps, but it’s also the young ones that are the most ardent advocates in a bubble. This one appears to be a trap, a slow springing one. A confluence of compelling narratives buttressed by easy money. Add in a dash of real innovation, and the ingredients are there to lure a new generation of investors to believe that these are easy paths to riches, and the journey’s worth any price paid today. Never mind that the sector is replete with related party transactions and recursive investments made under the guise of developing the ecosystem. Never mind that the ecosystem becomes increasingly fragile when a customer’s ability to buy your products depends on your ability to finance them.

Capital is oxygen, and you can only recirculate it so much before the market needs a fresh tank. When valuations vault to extremes, who’s left to provide that? Investors will need more from their companies to attract the next group that’ll provide their exit liquidity. Grow revenues 50% year-over-year? The market will demand 60%. Grow 60, it will want 70. The mountain is unforgiving. So long as the weather stays fair and your narrative intact, the greater fool will come along to deliver fresh oxygen so you can climb higher. Hypoxia’s still a threat though. Each step will become increasingly perilous, and each movement uncertain. At dizzying altitudes, some climbers may begin to untether from the mountain as even their bravado fails to impress the quarterly judges. That’s when your oxygen’s cut-off.

No, we’re probably wrong. Everything will be fine.

No . . . this is a trap.

Oil Demand & Oil Supplies

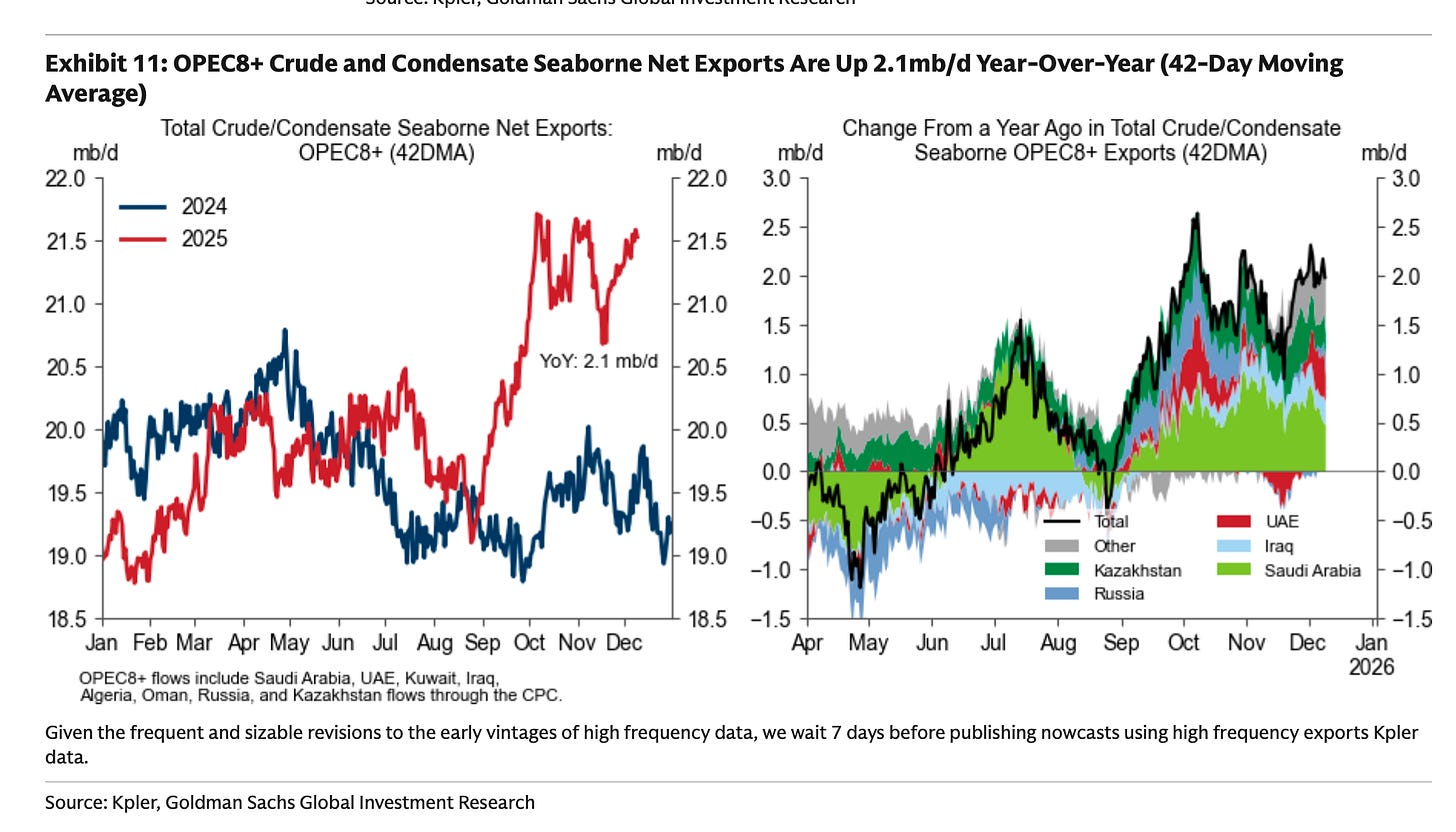

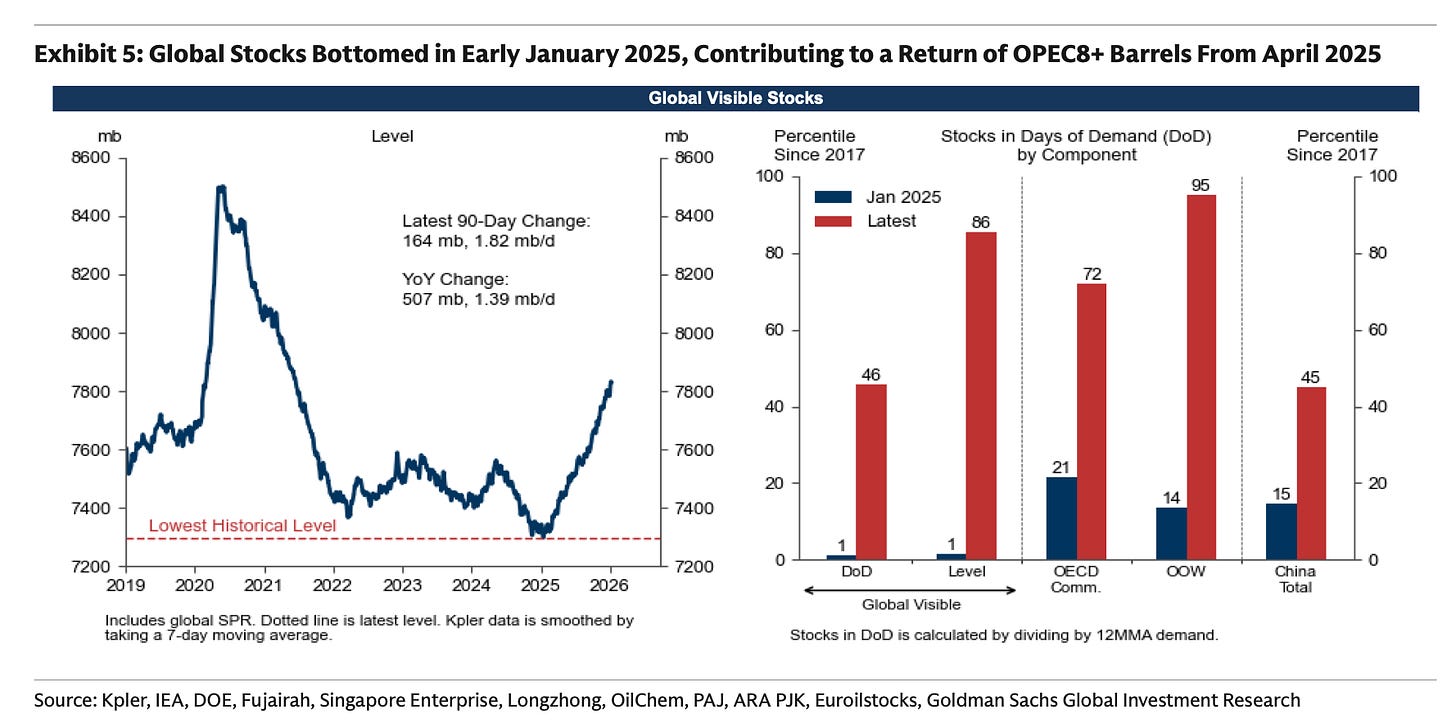

As we’d written last quarter, oil inventories began building materially in Q4 as OPEC+ lifted its quotas, removing some of the last vestiges of artificial constraint on their members. What started this summer has continued into the fall, and oil inventories have moved upwards counter seasonally. No longer “managing the market,” OPEC+ members have abandoned restraint and pressed forward with production increases. So far, the inventory increases and higher oil-on-water largely mirror the increased exports from the OPEC+ members.

With their shackles thrown clear, producers gunned exports. Oil-on-water increased as sanctioned barrels met with higher exports. First oil-on-water and later oil-on-land.

The producers, save Saudi Arabia, the UAE and Kuwait, are effectively maxed out today. What spare capacity is left remains in the hands of these three producers in the Middle East, and we surmise that totals ~1.5M bpd. Still the deluge from the OPEC+ members is real, and much of it is transiting to land storage. Once they arrive, land figures will show the increase. It’s why oil prices have declined 18% this year. This is a price war, and it’s everyone for themselves.

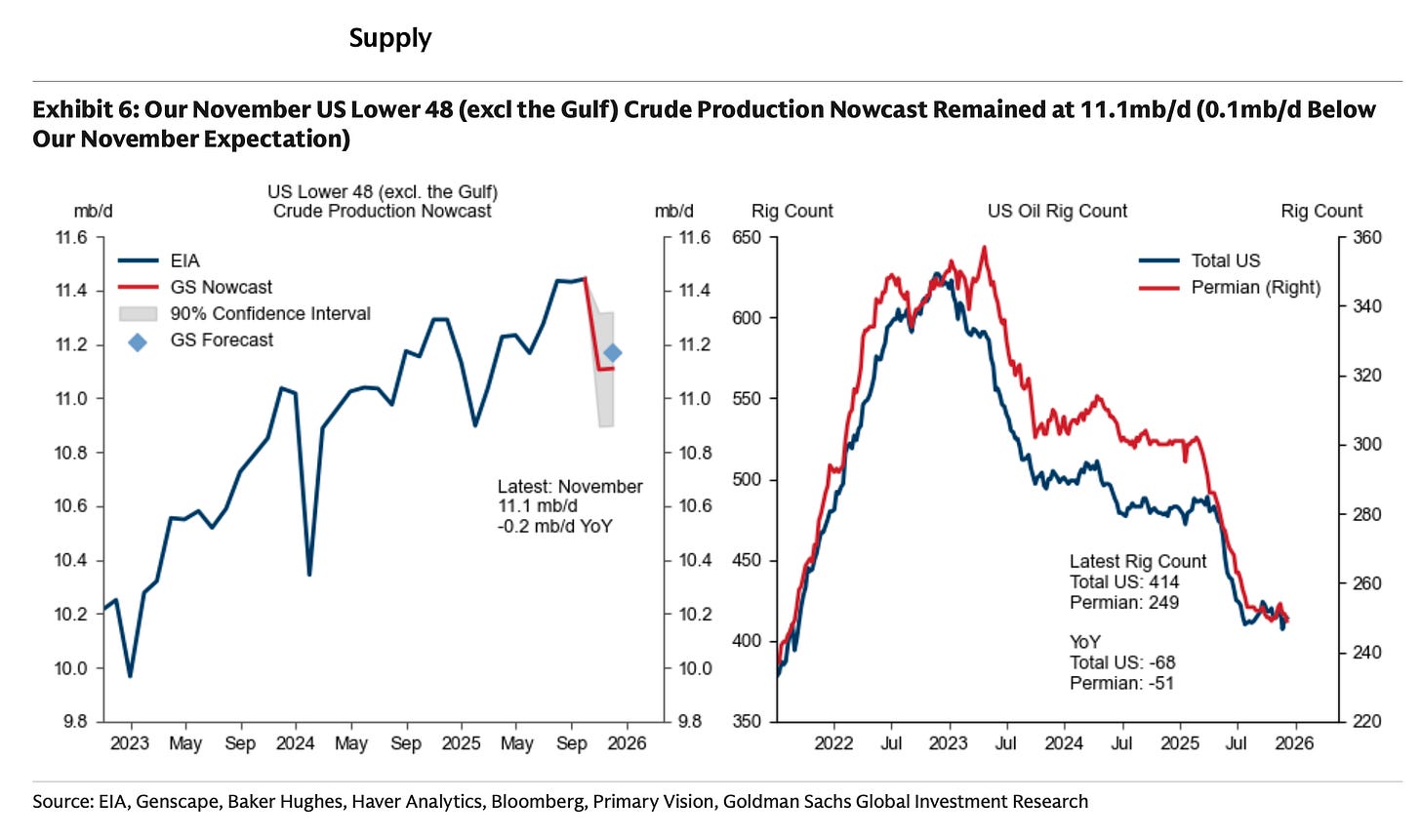

Interestingly the increase has been less than forecasted by analysts. It’s not much of a consolation when the build is “only” 2M bpd vs. the expected 4M bpd, but it does suggests that the bearishness is vastly overdone. Current builds (QTD with January)? 0.7M bpd. What is clear is that low prices have killed US shale growth, which has provided nearly all of the non-OPEC supply growth in the past decade.

This also explains why despite the price war, oil prices have stayed in backwardation, which is indicative of higher near-term demand. So despite initially building at a pace second only to COVID, prices have not collapsed. The velocity of the build is now slowing. So is the glut real? Yes. Though much smaller than expected. What happens next? What happens after low prices induce higher demand and lower supply in the near future? Again say the phrase . . . run a capital intensive and depleting sector below its cost of capital, and let’s find out.

Portfolio Update

Occidental Petroleum (“OXY”)

Oil’s malaise in the past quarter took the wind out of OXY’s sails. As oil prices sank, OXY’s stock retreated 13% in Q4. Given we own the warrants, those declined more at 20%. At low-$60/barrel, most oil companies in the US are generating around 8-12% free cash flow (“FCF”), not particularly compelling as investments, but not financially dire for the sector. Into the $50s, that’s when FCF starts to disappear. OXY is no different, so at today’s prices, the company treads water. This doesn’t mean that the company hasn’t been furiously churning beneath the surface. After selling a steady business in OXYChem, OXY has decided to go “all-in” on oil production in the Permian. The transaction closed on January 2nd, so after the quarter ended. Following the Q3 conference call last year (and after announcing the transaction), the company provided scant details about its plans for capital returns following the sale. The market didn’t love the obscurity, and OXY will likely provide clarity in the next call now that the transaction has closed. Still the stock was left adrift with no supportive narrative as oil prices weakened in the quarter.

Despite oil’s decline, we’re expecting OXY to still generate ~$0.5B in free cash flow (“FCF”) for the quarter, and slightly over $3.5B for the year, for a company with a $42B market cap. We’ve come a long way from the days where a sub-$60/barrel oil price would’ve proven disastrous. De-levered and re-stocked, this company’s in a different place today with a much healthier balance sheet. Having said that the equity needs to move higher and soon. Either the company will self-cannibalize, and buy back a material portion of its 1B shares outstanding, or a suitor will come along and decide that the synergies involved are too compelling. By becoming a pure play producer and shedding OXYChem, OXY’s remaining businesses are easier to integrate, which makes the company a more attractive target. It’s not dissimilar to what happened with MEG Energy. Eventually MEG Energy sold above $30/share, a price last seen when oil prices reached $90-100/barrel in 2022 because the synergy savings realized from the transaction accreted to the buyer.

We think the share price today makes little sense. Someone eventually will decide to bid if OXY’s shares keep languishing. With synergy savings likely over $1B for a company of this size (i.e., slashing G&A, rationalizing redundant functions, and leveraging scale), the higher FCF is more than sufficient to cover the interest burden on the debt needed to fund the deal.

Energy companies are so discounted in the market today that consolidation is a much more affordable and less risky way to grow production than exploration and drilling. An acquisition not only increases the acquirer’s FCF, but also reduces risks. It’s cheaper and safer to buy than to build it yourself. Inevitably, a buyer will simply look at the expected cash uplift and extensive reserves, and back into the most accretive financing to accomplish the task. The path forward here isn’t just oil prices, it’s further consolidation in the patch. Either oil prices move higher, or we’ll see another round of M&A as shale producers become larger and larger.

Peloton (“PTON”) Update

The coming 6 months are critical for this company. That’s the gist of this investment. After introducing a set of new cross training equipment (i.e., bikes, treads, and row), the company’s embarked on a strategy shift from a pure fitness equipment/subscription platform to a “health span” platform, one designed to give its customers a healthier and longer life. PTON’s new strategy tackles cardio, strength, mindfulness, yoga, mental health, nutrition, etc., and is an attempt to leverage its popular instructors and platform to broaden the reach of its audience. One example is the emphasis on weight training to offset muscle loss for those who are using GLP-1s and for women who are in menopause. From a high-level perspective, the shift is important. The wellness space is a $7 trillion market, whereas the home exercise bike and treadmill market clocks in at a combined $6 billion. Yes, trillion vs. billion. Here’s an excerpt from Peter Stern’s annual letter . . .

These are all noteworthy shifts, but investors will wait until the company can demonstrate that it can steady its core business before getting excited about the new ventures. So for the time being, the company remains largely dependent on equipment sales and subscriber counts. It’s still the razor blade/razor strategy of yesteryear, and where subscriber counts go, so too will the financial and stock performance of the company until the new initiatives hit.

Since the October launch of new AI powered products, the financial press has published stories like this:

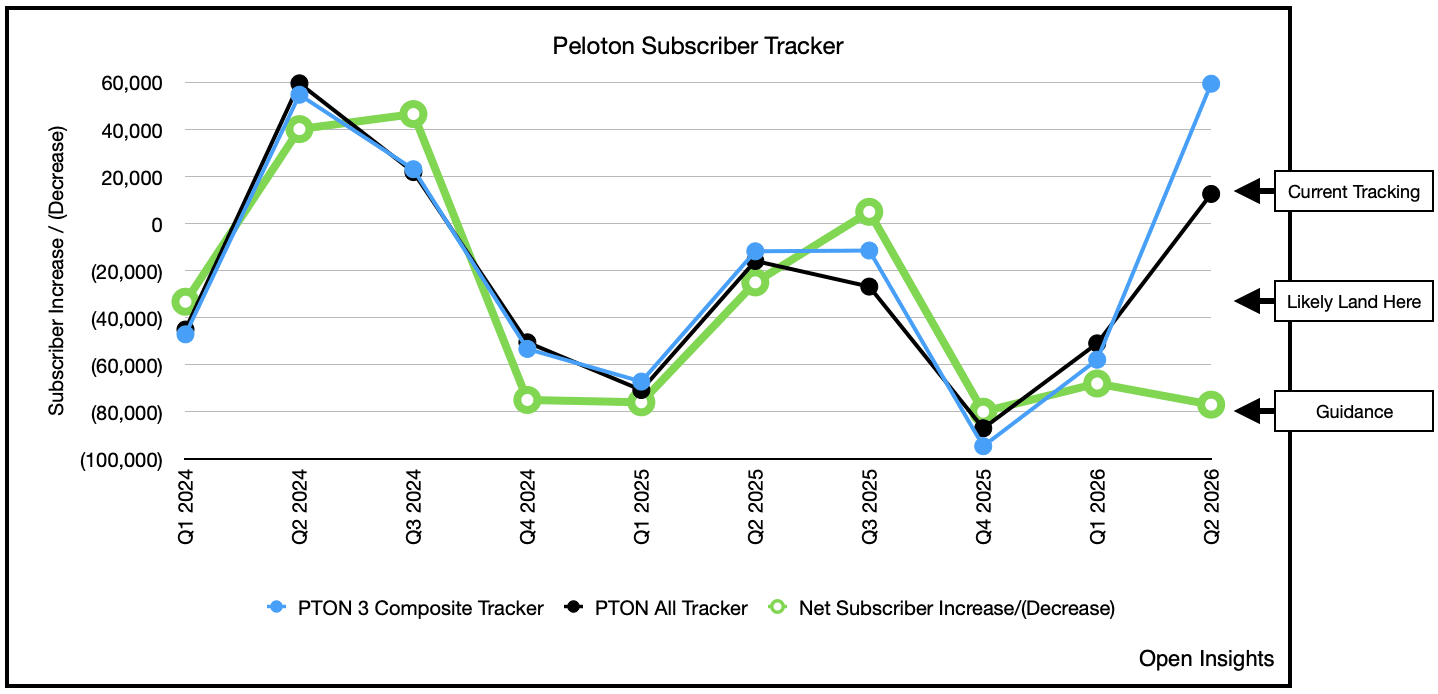

The holiday season through the first weeks of January (New Year’s resolutions) is when a majority of equipment are sold, and based on our tracking the demand was robust last quarter.

As background, holiday sales (Black Friday / Xmas) fall into PTON’s fiscal Q2 period. New Year sales will fall into the Q3 period. While Q2 sales may be good, the subscriber counts will be slightly off this time because PTON recently increased its subscription price. Prior price increases led to a subscriber loss of ~60K, but even if we factor that in, the overall results should still beat guidance.

PTON ended Q1 with around 2.73M subscribers, and we think it’ll end Q2 with ~ 2.69M, which would mean sales of new bikes did fairly well. As evidenced by aggressive New Year’s pricing, the company’s heavily pushing its Peloton Bike+ Cross Training bikes.

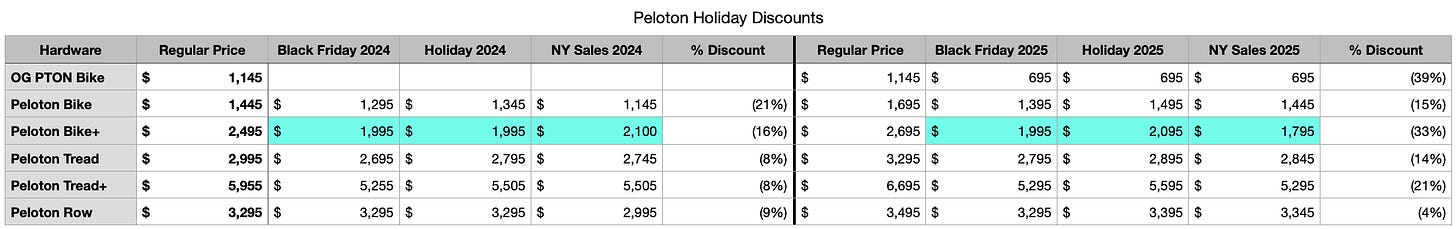

The above may seem like aggressive discounting, but recall that PTON raised equipment prices ~13% across the board in October. That was only a few months ago, and if we look at the subsequent pricing of the company’s products during Black Friday, Holiday Sales and the New Year, we can see the discounts are roughly the same, if not slightly less on some products vs. the “old” prices.

For the 2026 New Year Sales, it’s certainly upped the ante as the company aggressively priced the Bike+. The promotion likely encouraged customers who’d otherwise buy a regular Bike to upgrade to the feature-laden Bike+ (with a movement tracking camera, fan and larger screen) for a few hundred dollars more. By our estimates consumers were trending in that direction as the mix shift has seen a higher proportion of Bike+ purchases after the latest updates (from a 75/25 split previously to a 65/35 split today between Bike/Bike+ sales). The extra cost to produce a Cross Training Bike+ vs. a Bike is negligible, so like Apple’s ability to incentivize customers to pay a few hundred dollars more for memory, on balance this should have induced shoppers to upgrade from the base version. Bike+ subscribers should also be “stickier” because cancellation rates for subscribers who take two or more modalities are materially lower, and the Bike+ features are geared towards non-bike floor exercises.

Financially, the picture’s also improving. Last quarter we wrote:

“In totality, what we have today is a $3B market cap company with ~$460M in net debt. That’s fairly cheap for a company that boasts 2.8M subscribers and dominates the connected fitness space. PTON has recently guided FY2026 to be $2.5B in revenue, $425M in Adjusted EBITDA, and $200M in FCF. We think that’s light, as 2025 revenue came in higher at $2.5B, Adjusted EBITDA at $403M, and FCF at $328M. If you’re increasing prices by nearly 15-20% across the board (pro-rated for FY2026 as it takes effect in Q2), how’s it possible that all your metrics will be lower? We sense there’s “conservatism” in the numbers.

Since then, PTON has raised 2026 guidance. The company kept revenue unchanged at $2.45B, but bumped Adjusted EBITDA from $425M to $450M and FCF from $200M to $250M. We still think that’s light. For 2026, we have Adjusted EBITDA of $500M and FCF around $350M, for a company with a $2.4B market cap today. We think the stock should move higher once PTON demonstrates its equipment is selling well again, and the shares would need to double to match the multiples of its closest competitor.

As the company begins to refinance its debt and buyback shares, Wall Street’s hype machine can help change the narrative. Based on recent reports, the company plans to refinance its existing debt in May. By then, the company will have ~$300M of net debt (i.e., $1.3B in total debt less ~$1.0B of cash). The company’s de-levered balance sheet should garner a B to BB credit rating, which translates to a 6-7% interest rate on new corporate bonds, a far cry from today’s 10-11%. The resulting 4% lower rate equates to ~$40M of annual interest expense savings on $1B of debt. Apply a 10x multiple and that’s $400M of market cap value . . . on a $2.4B company.

Refinancing the debt also allows the company to lift restrictions on capital allocation. The current debt covenants severely restrict the company’s ability to conduct M&A, or implement share buybacks. Thus, removing these terms will give it greater freedom in generating shareholder value. Overall, the company’s executing and the new products are selling. The enormous subscriber base serves as a solid foundation for Peter Stern’s strategy to tackle wellness, health span, and mental health. We plan on increasing our position ahead of the quarter’s announcement, and believe there’s a long runway here.

Parting Thoughts

We have a barbell portfolio as we write this. We’re invested in companies that are in deeply unfavored industries, or ones with terrible sentiment, but also short companies that we think are priced not for perfection . . . but nirvana. The market loves these stocks. They’re “sexy” and can’t help but be loved on and doted over because they’re growing so fast. AI, predictions markets, gambling. Every chart is up and to the right in terms of growth metrics. The narrative is simple, limitless potential, unlimited growth. In contrast our investments pale in comparison, they’re stodgy and forsaken. We get it. No one talks to old people when babies show up at parties.

Yeah, to heck with the babies. We’re short an AI one that’s currently trading at over 65x 2026 projected revenue. 65x REVENUE. At the height of the Internet Bubble in 2000, Sun Microsystems traded at over 10x revenue. Years later in an interview, the CEO of Sun Microsystems, Scott McNally said this . . .

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

As you’d expect, we get this question often. How can we not participate in one of the greatest advances in human history? What are we thinking? Our response isn’t that we’re not participating, we just wonder whether that needs to be today. Like the internet, AI will eventually be ubiquitous. What passes for AI today though is far below that. While the infrastructure for the AI revolution is being developed today, the technology isn’t there yet, which means there’s likely a bust following the capex boom when reality falls short. Google, Amazon, Meta, they all rose following the Internet Crash, and we’ll wait to participate in that. The market knows this, but it doesn’t care. What it cares about is growth, hype, and the velocity of capital today. It doesn’t matter if it really works . . . it works well enough. Amidst this euphoria, we look at the opportunity costs, but really wonder about the costs of the opportunity.

65x REVENUE though, ponder it for a second. The company is projected to grow revenue by nearly 40% this year. Great, 50x revenue then by year end. Tack another 40% for the following year, and we’re still talking about 35x. To get to 10x revenue, the company needs to maintain this growth trajectory for 6 years straight, selling billions of dollars of services until 2032, and only then would the multiple fall to 10x revenue (assuming the stock doesn’t push higher), the level of absurdity McNally spoke of during the height of the Internet Bubble. We’re the ones paying now as AI and easy money sucks the oxygen from the market, but what if the bill eventually comes due for those who own these things? What are we thinking indeed. Maybe we are wrong, but we don’t think so. Maybe it’s just an another opportunity to learn.

Me: That’s sure a lot of As on your report card there.

Mason: uh . . . yeah? (wisely sensing nonsense is about to start)

Me: You know there are other grades right?

Mason: Like the ones you got?

Me: Well if mistakes are opportunities to learn, doesn’t that mean I learned a lot more than you?

Mason: What IS you talking about???

Me: hahaha, you should listen to me more because I was so much better educated.

Mason: This explains a lot . . .

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

let me guess....PLTR

Really solid breakdown on the AI valuation disconnect. The 65x revenue comparison to Sun Microsystems at 10x during peak dotcom actually undersells it since we're not even at "peak" yet. Been tracking capex numbers in semis for work and that recursive financing loop is showing cracks. The oil thesis is interesting too, shale discipline forced by low prices might finaly create the suppyl response everyone's been waiting for.