OXY Gets a Chemical Bath as the Market Douses the Messenger

October 4, 2025

Okay let’s just say it.

We don’t love this deal.

We don’t hate it either.

It’s just an expensive way to deleverage, but it does make some sense.

Well it would make sense if they explained it properly. Yet the messaging was great, and the reaction? Just as bad.

That 7% sell off my friends is what we call a kerfuffle. So what caused it? A sale of asset by this company. So what did Occidental Petroleum (“OXY”) sell?

OXYChem.

What did it receive?

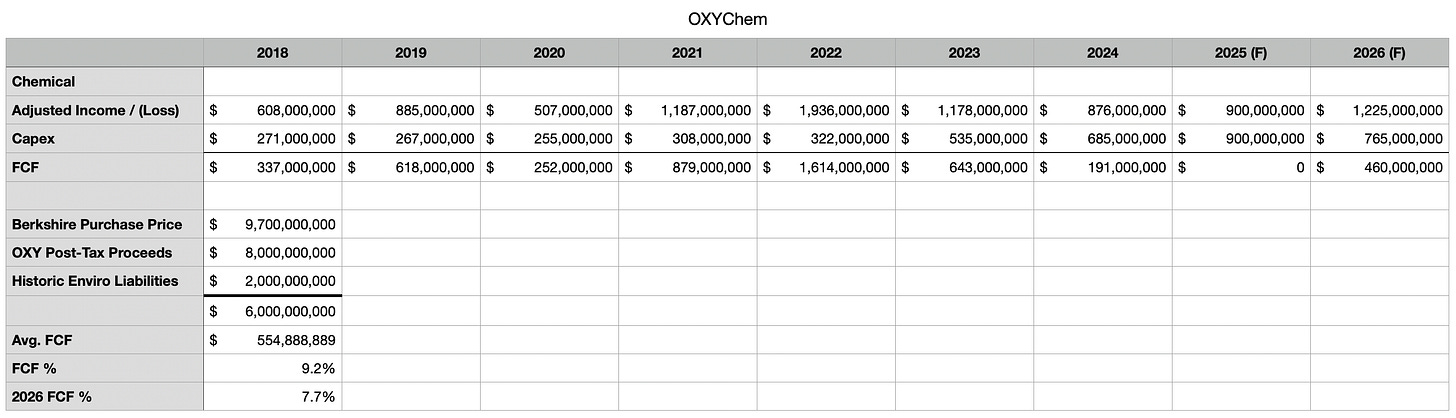

$9.7B in cash, or really $8B after the government takes a tax bite. Is that a good tradeoff? Let’s see. We’ll just line up what we think was the free cash flow (“FCF”) coming from this business line. We’ll use the “adjusted income” that OXY likes to use in their Form 8K press releases and subtract capital expenditures (“capex”) for those years.

Ah okay. So on average this business line generates about $550M in FCF. Now obviously 2025 is a down year for basic chemicals. After you tack on higher capex spend for the Battleground plant expansion, FCF this year was going to be anemic.

The capex spend though was supposed to fall by next year as the expansion finishes up, and then the higher throughput adds about $325M of EBITDA to OXYChem. Mind you, that’s 2026 . . . which is basically around the corner. So if we assume 2025 figures, bump up the net income by $325M and reduce capex by $135M we see that FCF should come in around $460M (if trough cycle pricing is still bad) higher, which is slightly below historical average, but only slightly so. If you assume a better pricing environment, then it’s significantly north of that number. Maybe $500M to $1B.

Okay so that’s what you sold. What did you get? Well $9.7B from Berkshire. Really $8B since the government always wants to take its cut. What’s a bit boggling, but unsurprising is that Berkshire also forced OXYChem to retain the environmental liabilities, which total ~$2B. So at the end of the day, OXY likely walks away with $6B. Divide the $460M of 2026 FCF, and we’re looking at a 7.7% FCF to sales price figure. If you don’t assume trough chemical pricing, well then this was a VERY expensive deal as we take historical averages of $550M FCF + $325M Battleground EBITDA uplift and you get near $900M, which is somewhere if the math is right, in the low-teens of FCF to sales, higher if you factor in the environmental liabilities.

It’s probably optimistic though. In fact, in a follow-up Reuters interview yesterday Vicki Hollub, OXY CEO stated this:

“OxyChem had been expected to generate an incremental $350 million in free cash flow year-over-year from 2027, but eliminating the interest expense on some debt will save the company exactly the same amount, Hollub said.”

So for Buffett, he buys a business that in the trough of a cyclical environment generates more than the Treasuries he had originally parked $9.7B of his nearly $350B in, and in a more favorable basic chemicals environment, does significantly better.

OXY on the other hand doesn’t think caustic, PVC, etc. prices will bounce that dramatically and took the sure bet of deleveraging instead. Saving $350M of interest a year, and bolstering cash by $1.5B. Look, $9.7B isn’t exactly a terrible price, it actually feels about right at a time when it’s a down cycle for chemicals right now. Dow Chemical stock is down 41% YTD, and even LyondellBassell is down 34% YTD. So it’s a tough market out there for these companies, and we all know Buffett/Berkshire never pay top dollar.

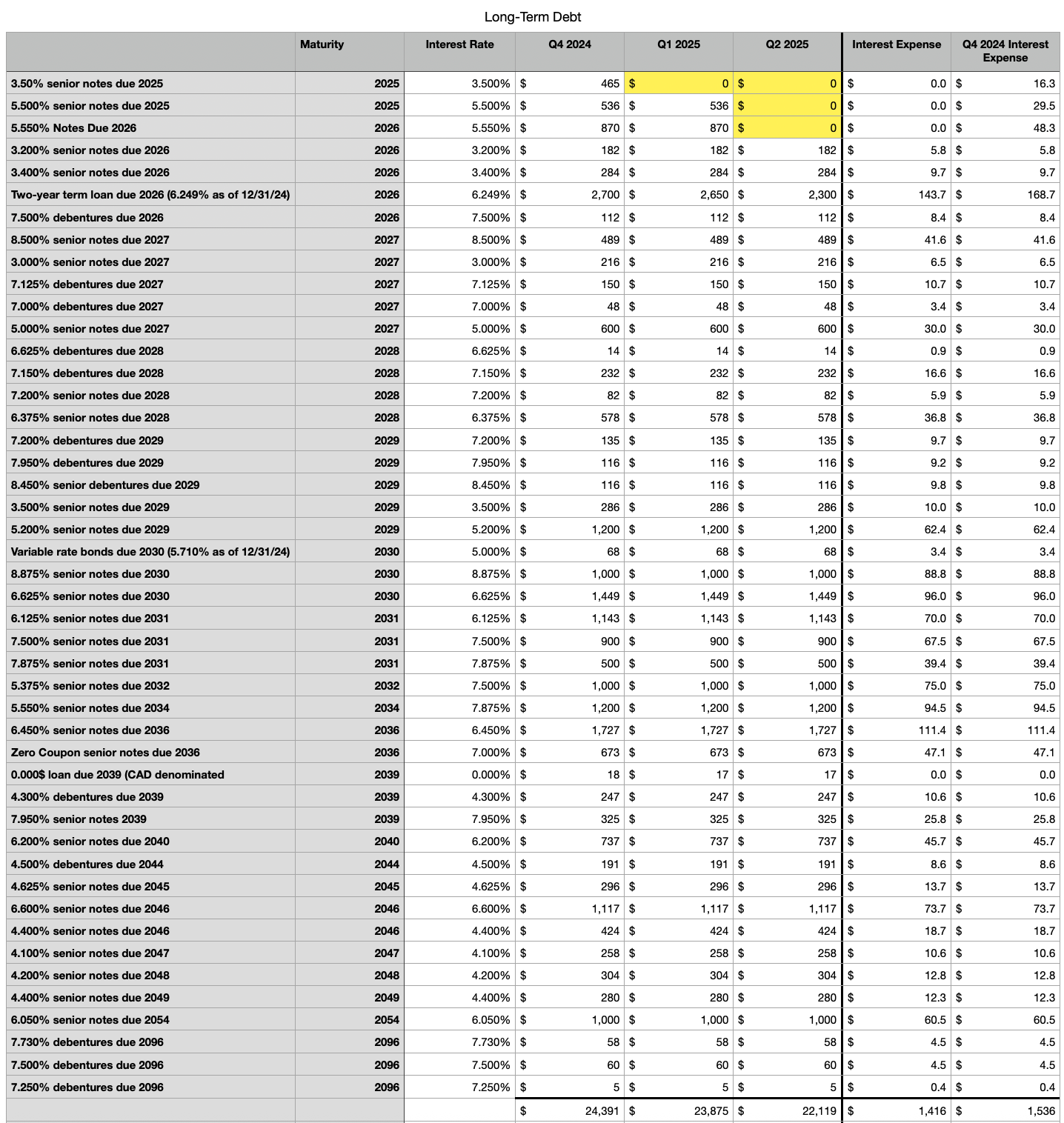

So what gives? OXY, seems to think this was necessary. Why? Because of its debt load. Standing at about $24B after Q2 2025, with $2B in cash, we’re looking at net debt of around $21B. Long-term debt is certainly hefty, and with the current oil price and pace of paybacks, OXY had years of debt repayments ahead before it could even start to return capital to shareholders. I mean, just look at this list of maturities . . .

So now, in one fell swoop, we’re able to reduce that by 1/3. OXY anticipates using $6.5B of proceeds to pay down debt, bringing total net debt below $15B, which will allow it to begin shareholder returns (increasing the dividend and repurchasing stock). $1.5B of cash will be parked on the balance sheet, likely starting a savings plan to retire those pesky Berkshire 8% preferred shares in 2029, or fund those environmental liabilities left by OXYChem. Either way, cash is still cash.

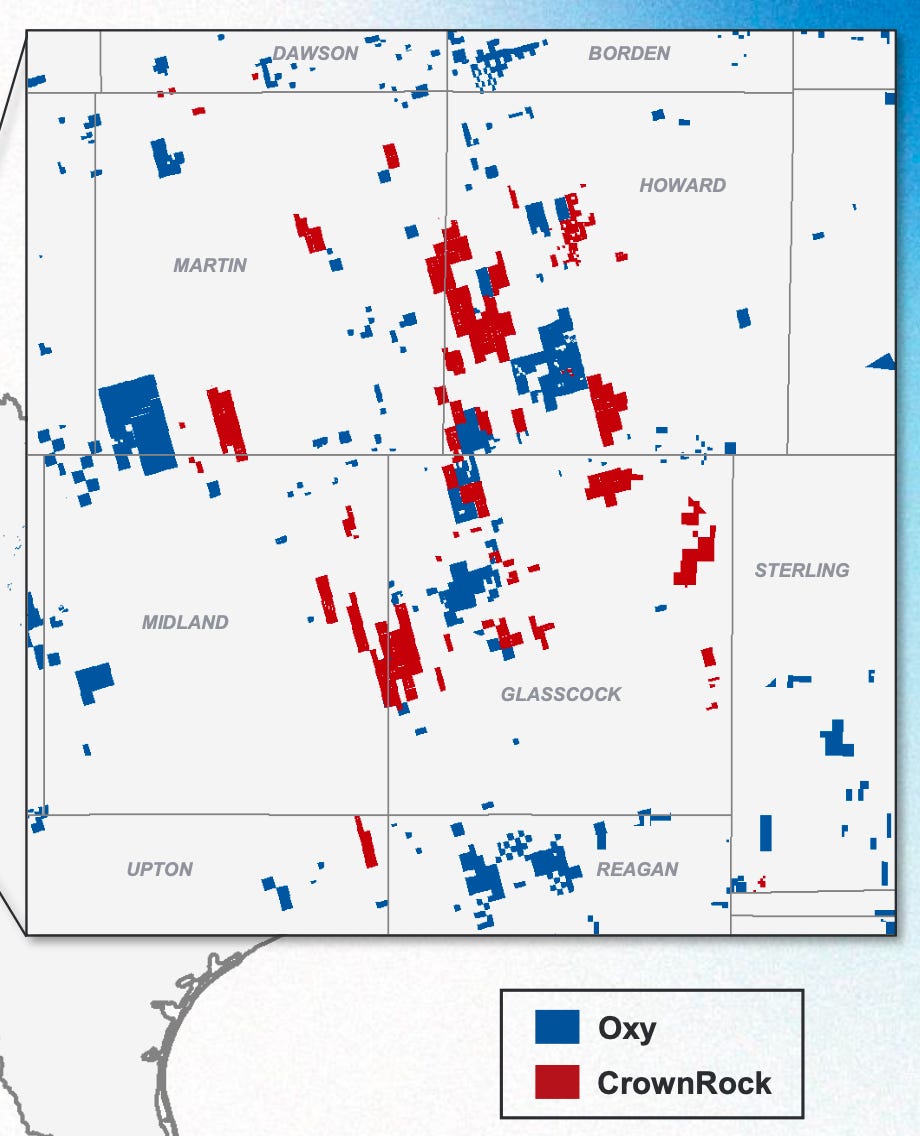

More broadly though, if we stepped back a bit, OXY essentially swapped OXYChem and a host of assets (operated/nonoperated/interests/rights) for CrownRock (“CR”).

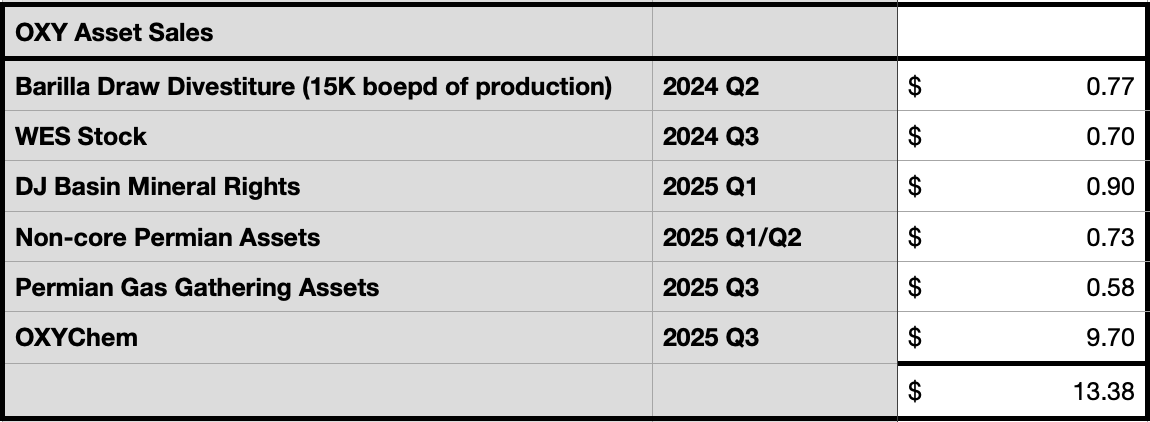

Again OXY acquired CR for $12.4B in Q2 2024, and here’s the list of assets OXY has sold in the 1.5 year since:

$13.4B in asset sales . . . well less $1B of taxes for OXYChem . . . so $12.4B purchase funded by $12.4B in sales.

So was it worth it? You effectively swap OXYChem and other non-core assets for critical mass in the Midland Basin. As a reminder, at $70/WTI, CR with its 170K boepd production generates about $1B in FCF.

So $1B of FCF / $12.4B = 8% FCF return . . . pretty close to OXYChem’s projected return (though in a down cycle). WES stock pays a 9% dividend, so that’s a push, and Barilla Draw’s production probably gives a similar return. So in totality on a FCF basis, we’re near a push, if not slightly below.

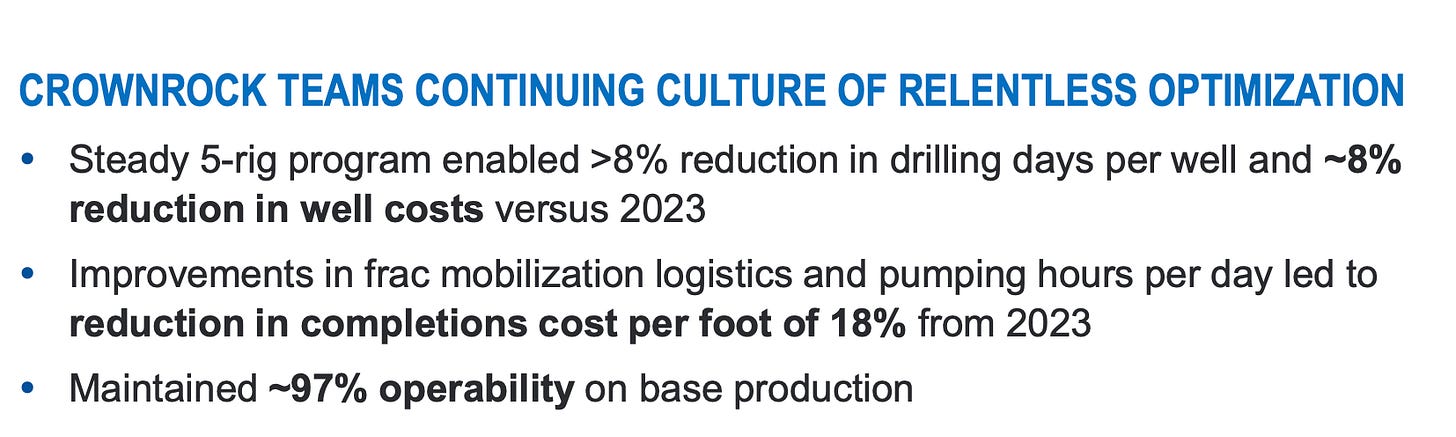

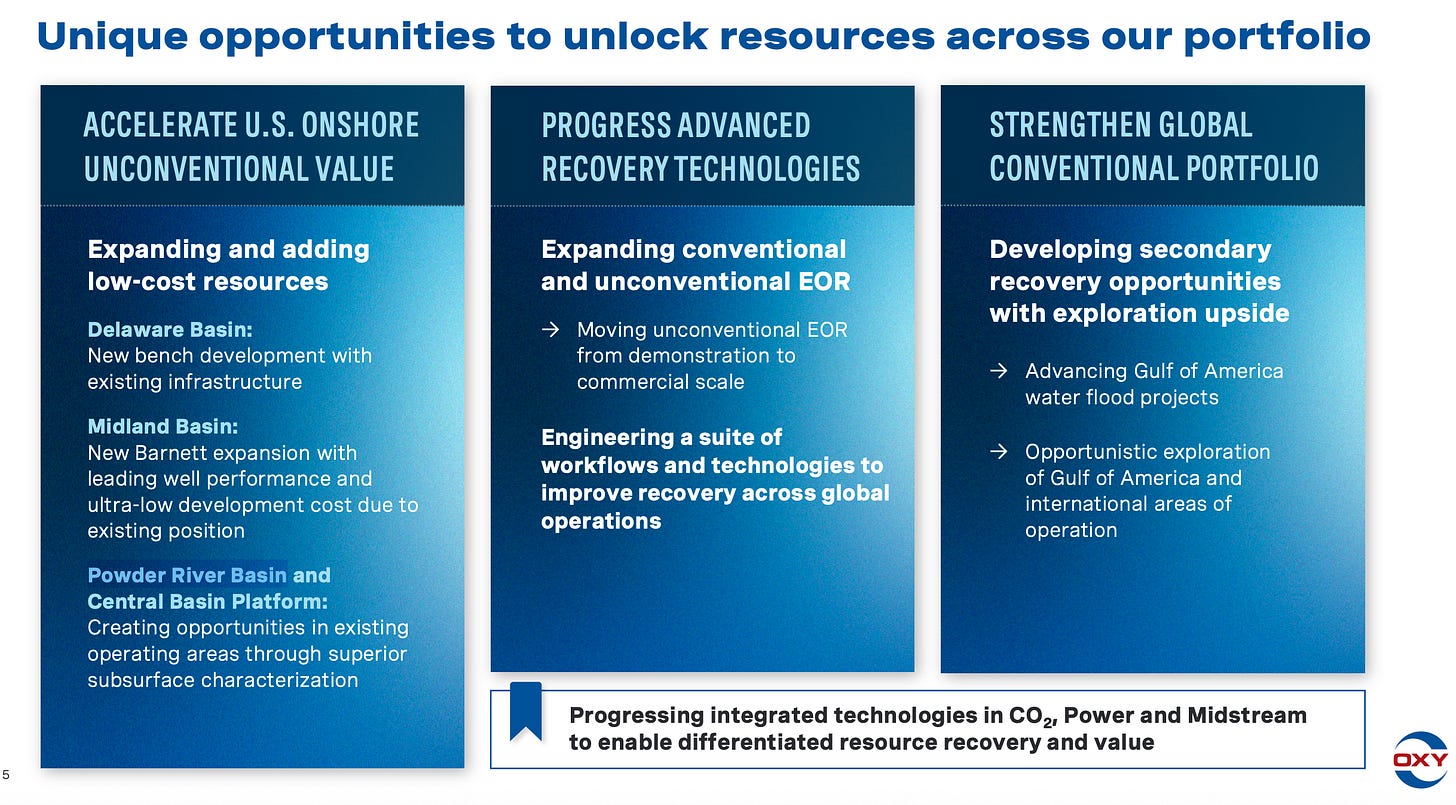

Yet, remember . . . OXY’s projections for CR were “NO SYNERGIES.” We know that’s not the case as the CR team has continued to harvest efficiencies since 2023 (the last full year CR was an independent entity). (Per OXY Investor Presentation in 2025 Q1)

Really though, OXY has to do a better job at messaging the changes. Immediately after announcing the divestiture, the company put out a “Divestment Update Slide,” but given the negative market reaction it withdrew those slides and released an updated “Strategic Transactions Update.” Imminently sensible when your original explanation of a $9.7B sale/deleveraging event leads to your company’s value FALLING by $3.5B.

Still OXY has a lot more explaining to do in the upcoming quarter call (first week of November).

For us, at worst, all of this was a push (trading OXYChem + stuff for CR). Well it was swapping a chemical business that was still subject to the vagaries of the commodity cycle with more volatile oil and gas assets, but ones that are complementary to OXY’s existing acreages. If we take into account the synergy cost savings, and the potential for finding more resources (i.e., increasing proved reserves), the returns swing quickly in favor of CR.

Moreover, if we consider that years after horizontal drilling has already depleted Tier 1 acreages in the Midland fields, having a critical mass of new acreages that allow for enhanced oil recovery (“EOR”) becomes invaluable.

It’s probably why Hollub alluded to it in her CNBC interview. Employing EOR techniques will be the next step in the Midland (and eventually Permian to follow), and the CR acquisition will accelerate the process.

So expect more discussion/details about this in their next investor update (the quarterly report likely occurs in the first week of November).

Deleveraging the balance sheet also means unlocking shareholder returns, which means retiring nearly 8-10% of shares outstanding a year, so OXY will likely announce a new share repurchase program. We forecast OXY will generate $4-5B of FCF in a mid-$60s WTI environment, and that should lead to a retirement of 8-10% of its shares outstanding each year. We also anticipate that OXY will increase its dividend to solidify its investor base, but that can come after more shares are retired.

Messaging will matter greatly in the coming months to reestablish trust, but on the whole, this kerfuffle will pass. Was it an expensive deal? Was the cost of capital “costly” to finance the CR acquisition after OXY’s joint venture partner in the Midland (Ecopetrol) backed out from helping to buy half of CR? Yes, but we surmise only because OXY hasn’t quantified specifically the benefits of CR post-acquisition. Qualitatively yes, but dollars-and-cents? Not quite.

There’s synergies there, and we can kind of see them, but the market’s not giving them any benefit of the doubt.

So time to clarify those doubts OXY, or the market will keep assuming Berkshire gave them a real chemical bath.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

'More broadly though, if we stepped back a bit, OXY essentially swapped OXYChem and a host of assets (operated/nonoperated/interests/rights) for CrownRock (“CR”)'

Bingo! I thought I was the only one seeing this.

Last thing we want is 'messaging' trying to boost the SP before allocating FCF to buy back shares will hurt the real owners... They have told us what we need to know.

am still unsure whether this play was to ultimately help BH's stake in oxy.

the acq seems to be missing criteria warren normally deems mandatory.

may not know unless BH re-packages and sends it off, also unusual.