OXY's Sensibility Makes Little Sense

November 14, 2025

As we walk through OXY’s Q3 results, it appears on first glance to be another “great quarter guys,” operationally that is, but it leaves us wondering . . . why do all your efforts rarely translate to shareholder returns?

Let’s walk through it.

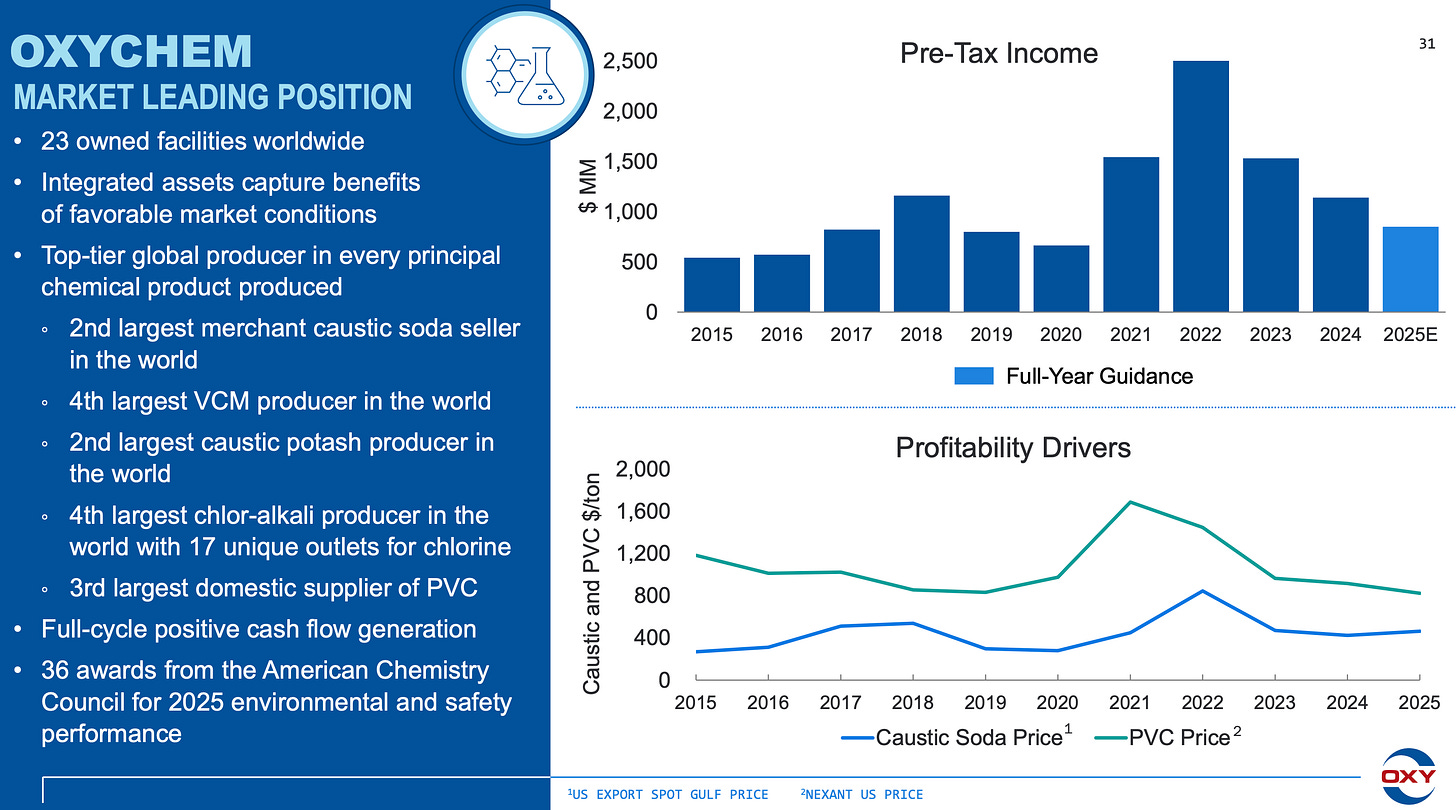

The Dust Begins to Settle Post-OXYChem Sale

Okay obviously the big news last quarter was the OXYChem sale for $9.7B, $8B net of cash. $1.5B of that cash will go straight to the balance sheet, call it a downpayment for the 2029 payoff of the $8.5B of preferred shares ($9B if you include the 5% premium). That leaves you with $6.5B, which will be used to retire $4B in near term maturities (likely what’s highlighted in blue).

This will cost a few hundred million extra because of the make-whole provisions within the bonds, but at least $1.3B can be retired at par (as it’ll be used to payoff the 2026 Term Loan).

Thereafter, there’s little to no debt left between now and 2029.

Once complete, the $6.5B in total debt repayment will yield ~$350M in interest expense savings. The remaining $1.5B of cash on hand likely generates ~$50M in interest income, so add the two together, you’re around $400M of interest savings/income.

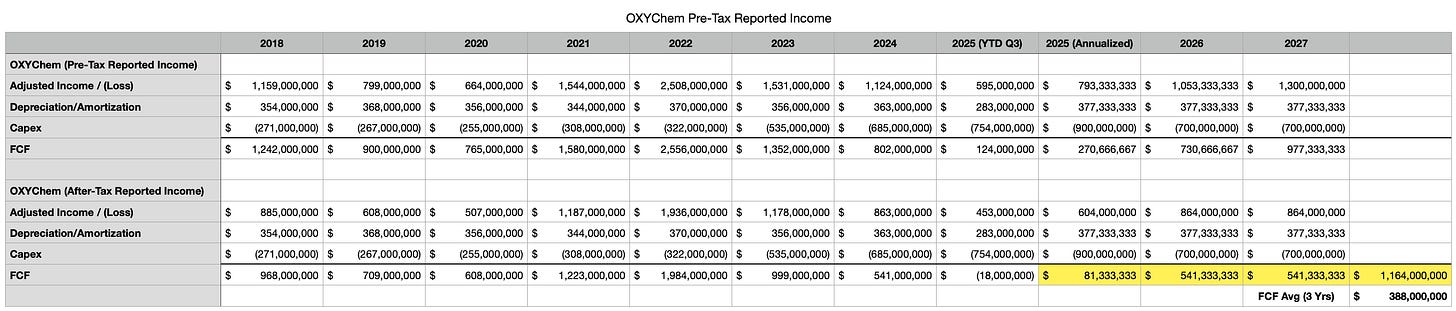

That’s less than what OXYChem brings in on a FCF basis, historically, or even on projected basis. In contrast though, Vicki Hollub has stated that it’s a push, and in turn de-leveraging the balance sheet will allow the company to enhance its capital allocation.

Okay that doesn’t quite make sense to us when we look at the figures. Even using historical numbers, adding back depreciation and amortization and subtracting capex, we get to a slightly different numbers. Perhaps if we use after-tax numbers then. That would make sense, and sure enough it does.

It’s a bit of a fib though since 2025 has increased capital spend because of the Battleground expansion, and if you’re assuming post-tax income, you probably should also assume that the interest savings you’re getting with the debt pay down is post-tax (i.e., it’s lower because you no longer get a tax deduction for the interest expense).

Overall, we think there’s a spread here in lost FCF from the OXYChem sale, and 3-5% feels about right, and the fact that the stock fell 7% after the deal was announced makes sense as the market likely adjusted for the greater market volatility once you remove the ballast of OXYChem from FCF generation.

2026 Capex

Okay, that’s largely water under the bridge. So let’s level set. You sell your major subsidiary, capex should correspondingly decrease next year right? Right. Initial guidance for 2026 capex guidance pencils out to the following ($6.3B to $6.7B).

Here’s the company’s commentary in the Q3 call:

So at the high-end we’re looking at $500M in capex reduction ($7.2B this year to $6.7B in 2026), which makes sense, but again this is largely stemming from OXYChem’s sale (and eliminating the OXYChem maintenance and growth capex spend of $700M and $900M, respectively).

Said another way, the $200M - $400M of additional capex spend is . . . well extra. This amount is being reinvested in the Permian, which will help increase OXY’s production by ~2% next year. It’s not too egregious. To be honest, we’re a bit agnostic on that as it’s not a game changer, and helps with the development of the asset base.

Capital Allocation Policy

For OXY, what needs to be a game changer though is their capital allocation policy. The company’s shares have trailed the broader sector for the past two years thanks in large part to the CrownRock transaction. Post-Anadarko and now post-CrownRock, long-term shareholders have been patient with the company as the ill-timed acquisitions have created a company with great rock/great assets, but a terrible return.

For all the reasons we’ve said in prior articles, some of this was outside of OXY’s control. Whether it’s COVID (post-Anadarko sale), or the timing (when CrownRock wanted to sell), sometimes you don’t have full control over the circumstances of when you’ll pull the trigger, and what happens after a deal. Having said that, if Vicki and company are really done with acquisitions (as she’s shared):

. . . then the rest is up to them.

At the very least, why is OXY not buying back the 29.56M shares it issued to CrownRock at $59.38/share on August 1, 2024? With the stock at $42/share, it would effectively save $514M on the transaction. Moreover, $1.2B in stock repurchase would only equate to the FCF of 1 quarter, and an easy lift for OXY. The company’s shares are languishing at current levels, and with a 10% FCF to market cap and a newly delevered balance sheet, OXY should be aggressively buying back shares.

Sure, “Opportunistic Multi-year Share Repurchase Program” is listed as the next batter up at #3 in OXY’s latest slides, but we failed to hear anything definitive in the most recent quarterly call. #2, Immediate Debt Repayment, will come in Q4/Q1 2026 once OXY closes its transaction with OXYChem, so given the muted explanation in the Q3 call, we anticipate a board approved share repurchase announcement in the next conference call.

Mind you, Step #3 is between #2 (debt-pay down) and #4 (Berkshire preferred equity redemption. Timing wise, we have about 3.5 years to see what can be done (2026 to August 29 = ~14 quarters). If we assume today’s oil prices across that timeline, OXY should generate about $14B in FCF over 14 quarters (i.e., $4-$4.5B in FCF per year = $1B a quarter * 14 quarters).

Retiring the preferred equity will cost ~$9B (including a 5% premium), which leaves $5B in buybacks, or $1.42B a year. We think it’ll be slightly more, likely about $2B of buybacks a year, or half of the FCF at today’s oil prices. That’s likely the baseline, which shrinks share count by 15-20% over that period.

Bump WTI by $10 from $60/barrel to $70/barrel, and you’re looking at an extra $2.7B in FCF annually * 3.5 years, and we’ll have another $9-10B in FCF during that time. $15B basically retires 40% of OXY shares in the next 3.5 years, which should be enough to double the stock during that time.

Frankly that may not be enough. Mind you it’s Vicki Hollub who has said that’s the company’s goal, but 5 years is simply too long, and if oil prices cooperate, we’d expect OXY’s share price to rerate higher as projected FCF vaults, wasting an opportunity to enhance per share value by shrinking the share count today.

There’s a scenario where if OXY is correct, and its enhanced oil recovery (“EOR”) efforts do yield a 100% uplift in its onshore unconventional resources, nearly doubling proved reserves in the Permian, then OXY’s stock is even more woefully undervalued.

We can envision a scenario where if OXY does continuously enhance its reserves, an integrated producer looking to bolster its reserves would explore taking OXY out given its depressed stock price. Sure, Berkshire’s 1/3 interest may be a hurdle to overcome, but deals can be made.

Lastly, the company was fairly quiet about the Low Carbon Ventures (“LCV”) business, and in particular, the Stratos start-up. The first Direct Air Capture facility was supposed to come online in Q4 and begin capturing carbon for storage, but that appears to be delayed by one quarter. We also think the market’s weakened for green energy projects as the Trump administration pivots away from climate change, and prior efforts of the Biden administration. Nonetheless, the Stratos facility will help prove out the concept, and that should go a long way to developing the market for the next DAC facility.

Overall, another good quarter from OXY, but the lack of clarity on capital allocation coupled with the low-share price means they have their work cut out for them.

This management team needs to start delivering not just operationally, but capital-wise. What should have been a conference call where OXY came out to state that they will unequivocally self-cannibalize given their extraordinary value turned into a mealy-mouthed discussion about conducting “value calculations,” and weighing buybacks against debt repayments, and reinvesting in the business.

Sensible, but that makes no sense. The overall quantum of debt has been wrangled down below their target of $15B, and oil prices are touching the $60/barrel range, so what’re we actually talking about here? It’s time for the company to clearly and aggressively repurchase its shares, and return capital to shareholders, otherwise all that was done . . . was done for naught.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

The math you laid out on those 29.56M shares issued at $59.38 is compeling. Buying those back at $42 would be an instant $514M gain for shareholders. With 10% FCF yield and a delevered balance sheet, there's realy no excuse for OXY to be this passive on buybacks. The market is basically beging them to shrink the share count aggresively while the stock is this cheap.

Thanks for your write up.

Absolutely agree that Hollub should understand shareholders' sensitivities, and have been more direct in speaking about capital returns.

Just speculation--do you suppose the current commodity pricing weakness put her into cautious mode and that, should pricing recover past $70++, that Hollub/management will aggressively buy back shares?