Palantir's Air Pocket

February 11, 2026

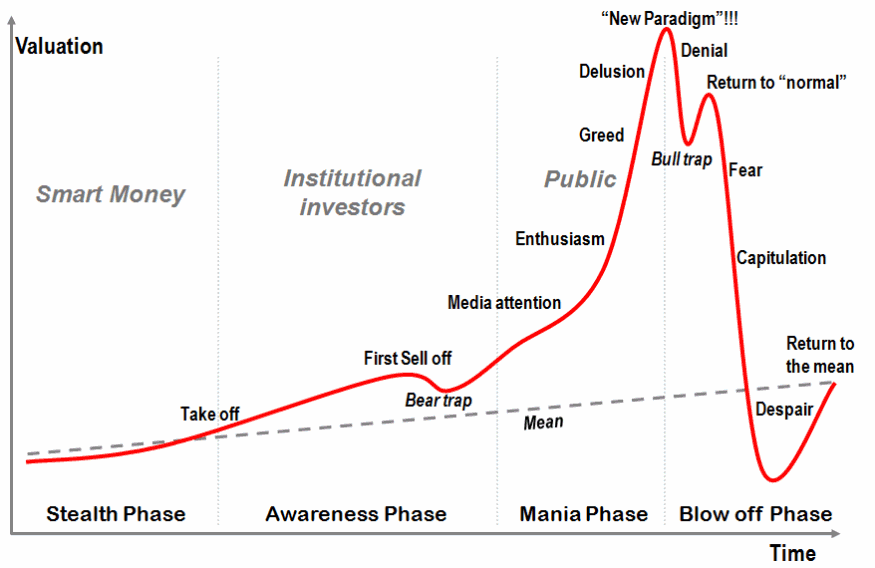

There’s a chart . . .

It’s something I have saved on the desktop. Nothing obnoxious, it’s unobtrusive, but it’s there.

I’ve had it for awhile now.

I’ve seen it repeated, many, many times, and in many places.

Sometimes on the things I own, sometimes not. Fortunately, not so many.

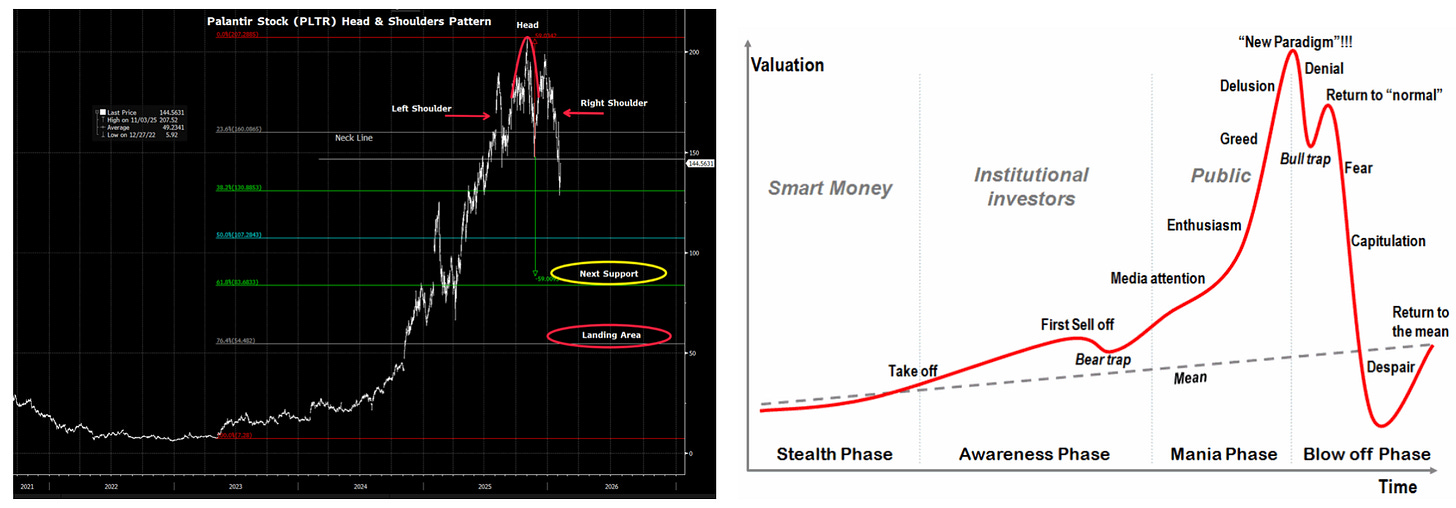

The chart doesn’t always repeat, but in Mark Twain’s parlance, history sure does rhyme.

That’s not surprising though because human nature isn’t surprising. We get bulled-up, we get excited, and we get greedy. Then the euphoria rips, and the grifters grift. The institutions legitimize it and the investors harp it. The media focuses on it and retail gets swept up in it.

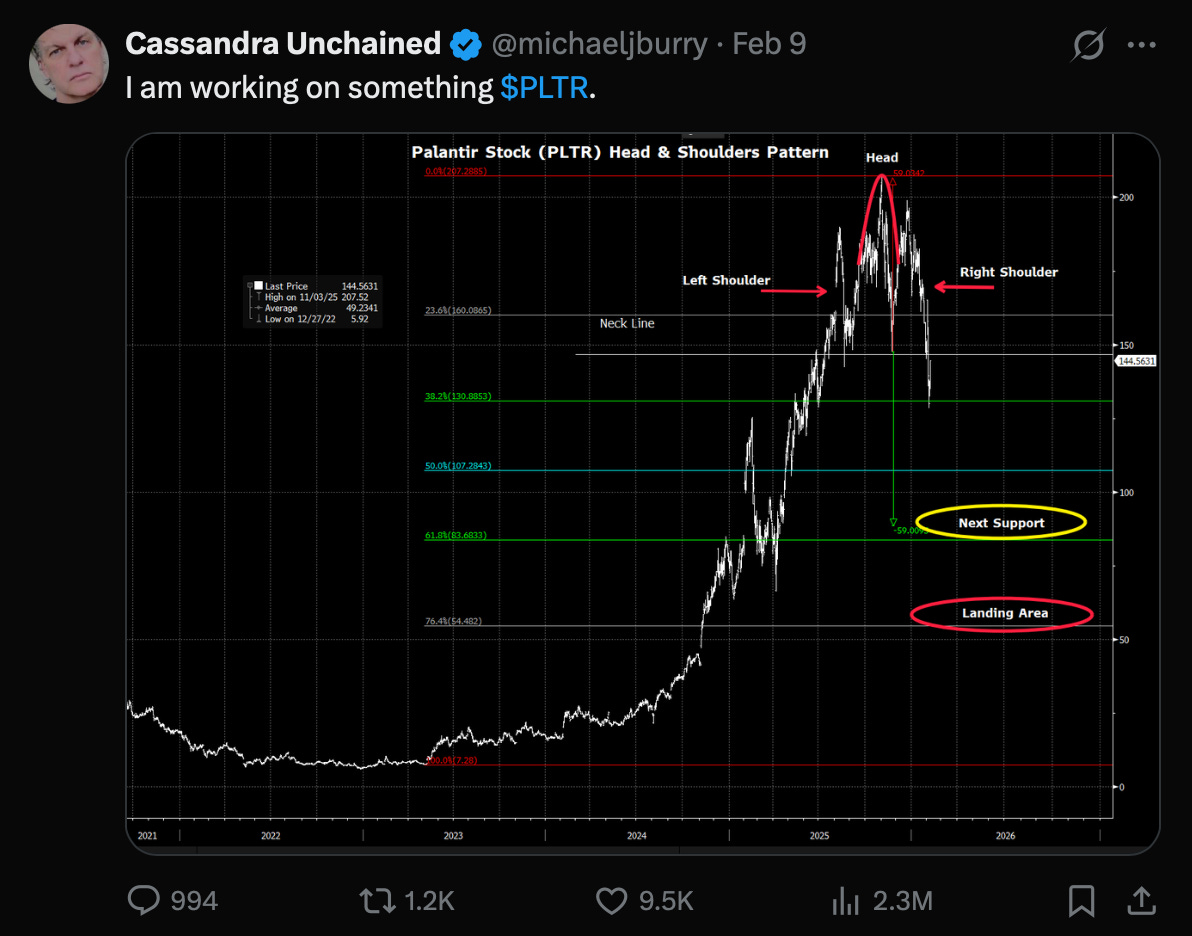

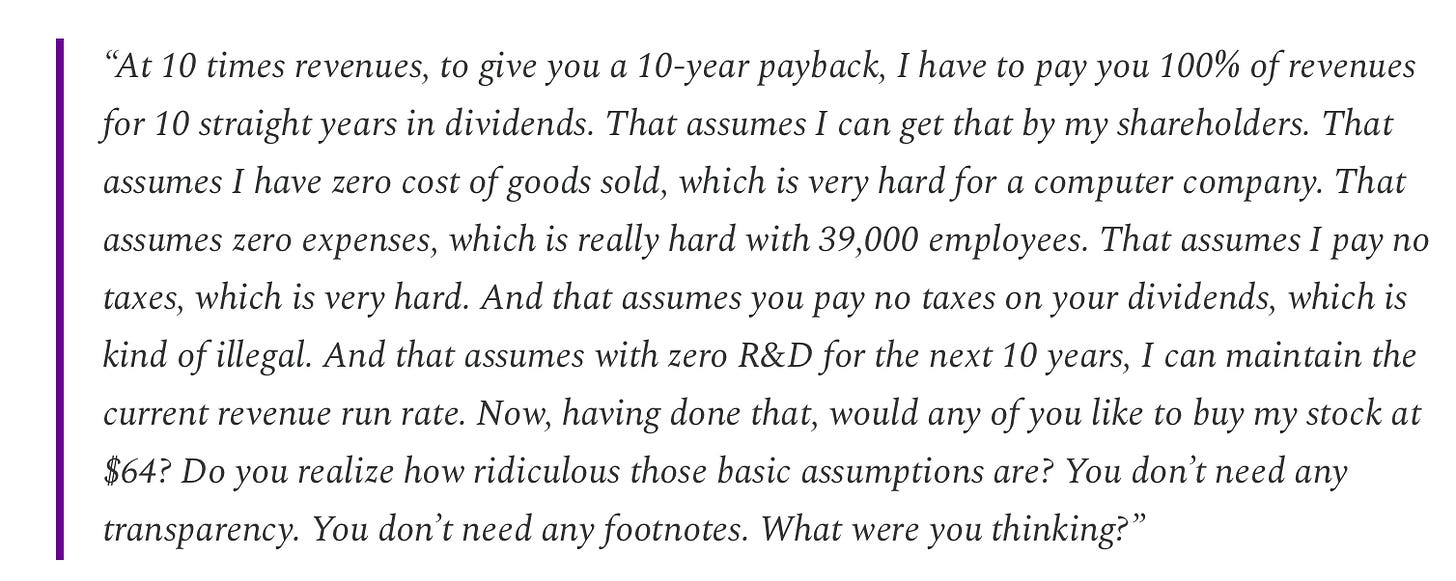

Then . . . and only then, is when it tips, and when it tips, is when we all get nervous. Michael Burry it seems, senses some nervousness (his chart below for Palantir).

For some, nervousness lends itself to bravado. “I want IT to crash, so I can buy more!”

. . . no you won’t.

Nervousness lends to seek answers “What do you see in the charts? Where’s it headed?”

. . . I don’t know, but maybe down?

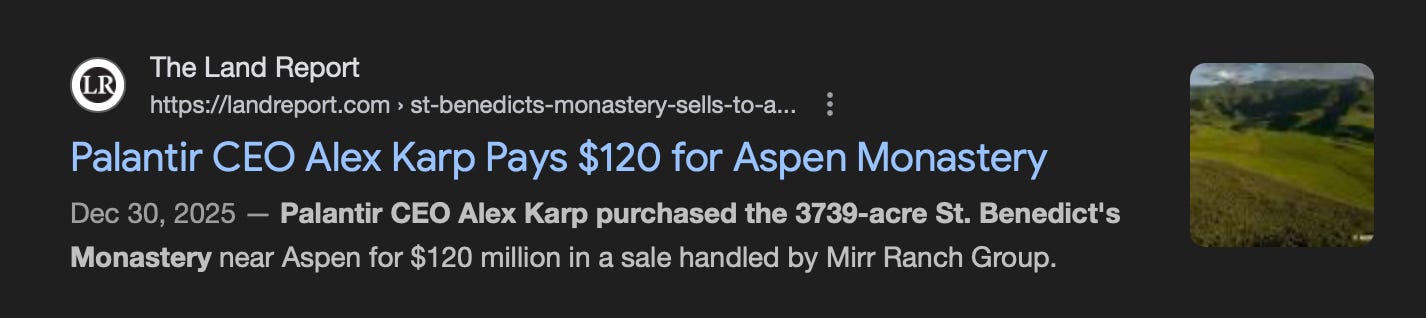

Nervousness leads to questions “Why isn’t the management team defending the price?”

. . . they were busy selling.

. . . and buying things that surely speaks to the revolutionary nature of what they’re doing . . .

It doesn’t matter though.

We don’t understand it. All the US government contracts, all the software platforms, Gotham, Foundry, AIP, and Apollo. Awesome game-changing, face ripping, sweet-mother-of-GOD dashboards and tools that allow companies to manage their supply chains, detect financial fraud, and hunt terrorists . . . simultaneously.

Such an endeavor cannot possibly be valued because we simply can’t comprehend the types of services their consultant (nay . . . “Forward Deployed Engineers” (“FDE”)) provide. Got it?

No sir, these FDEs are embedded with clients and mission driven to engineer solutions to tailor Palantir’s proprietary platform to the client’s unique data-set.

Isn’t that what most consultants do?

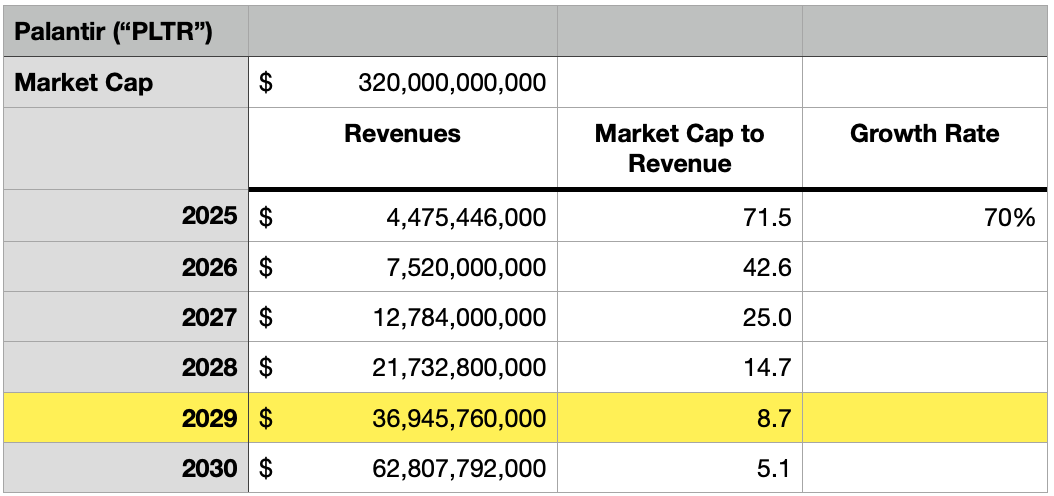

Fine. Maybe we don’t get it. Maybe FDEs and their crack sales teams are AI ninjas that provide so much value that they can simply turn over random rocks to find billions of additional revenue each year.

Heck, let’s growth them at an even faster rate than today. How’s 70% to your liking? More than the 60+ they’ve been doing. Let’s be more aggressive because we simply don’t know. 70% every year for the next 5 years. How’s that look?

By the end of 2029, we’re looking at $37B in revenue! Quite honestly, amazing . . . but even if the stock doesn’t increase from the $135/share today, it’s still nearly 10x revenue. Again we go back to Scott McNealy’s quote reminiscing about the 10x revenue multiple investors were willing to pay for SunMicrosystem’s stock at the height of the internet bubble in 2000.

People today? Hold my beer.

. . . 72 TIMES REVENUE. Oh wait but that’s trailing 12 months. What of 2026?

Fine, 43 TIMES REVENUE.

Feel better?

Or do you feel nervous? Because again, take a look at this chart.

THIS. DOESN’T. INSPIRE. CONFIDENCE.

There’s an air pocket there. An air pocket in which the oxygen’s dwindling, and the fear is increasing. In all likelihood, fear will become extreme, and in time fear will turn to capitulation.

“It’s already fallen so much . . . I might as well keep it.”

When momentum shifts, then the cascade really begins as traders press it lower. Longer-term investors will hold though. They always do because of anchoring bias. Well actually every psychological bias kicks in, creating a toxic stew of stupor. So most won’t sell, most will hold. HODL they say.

Eventually this may all turn into despair and dismay. There’s few natural buyers in the wasteland. Very few who’d step-in to catch a falling knife. Perhaps a bit lower, some compounder bros will deem it worthy enough to take a look, but that chart will make any position small. A starter position if any. If their buying fails to arrest the landing, then lower we go. All the way to the floor, where the carrions of the investing world dwell. The grave dancers, the roaches . . . the value investor. Still, that time has yet to come. That’s further down the road and much further to the right of these charts.

Maybe this’ll come to pass, maybe it won’t. We own puts on the stock and are short common shares, so we’re certainly talking our book. We’re probably wrong, but just look at that chart. How’s the bravado feeling? It’s certainly a bargain today than it was yesterday . . . at 43x Revenue.

Yeah we’re nervous too.

“I want IT to crash, so I can buy more!”

You just might get your wish.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you. (Disclosure: Note we own June ‘27 Puts with a strike price of $95 and other instruments short PLTR shares).