Peloton's Push for Growth

October 20, 2025

In the past 1.5 years that we’ve followed this company, we’ve seen a flurry of changes. A wholesale revamp of the company’s operations, a laser focus on profitability/FCF, a new management team led by Apple alumnus Peter Stern, and a complete strategic overhaul of its approach to the fitness market.

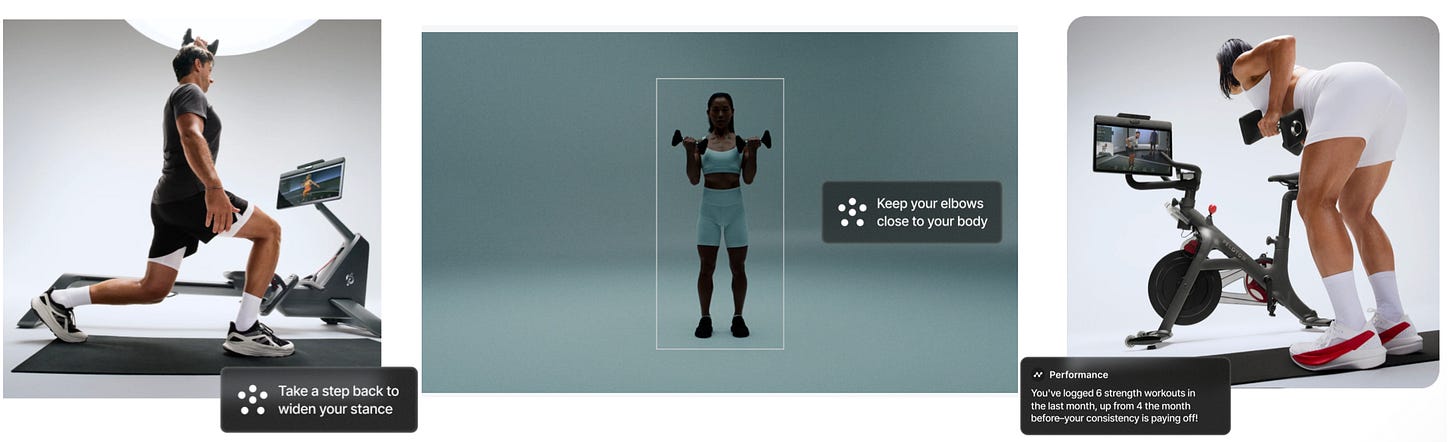

As we head into FY 2026, PTON announced for the first time in its history a revamp of its product line. The company’s new connected fitness devices now come with AI assisted workouts, enhanced audio, a swiveling screen, upgraded processors, improved WiFi and Bluetooth for connectivity and a built-in movement tracking camera that can provide form feedback and rep tracking. Best part of all? They’re pretty in silver.

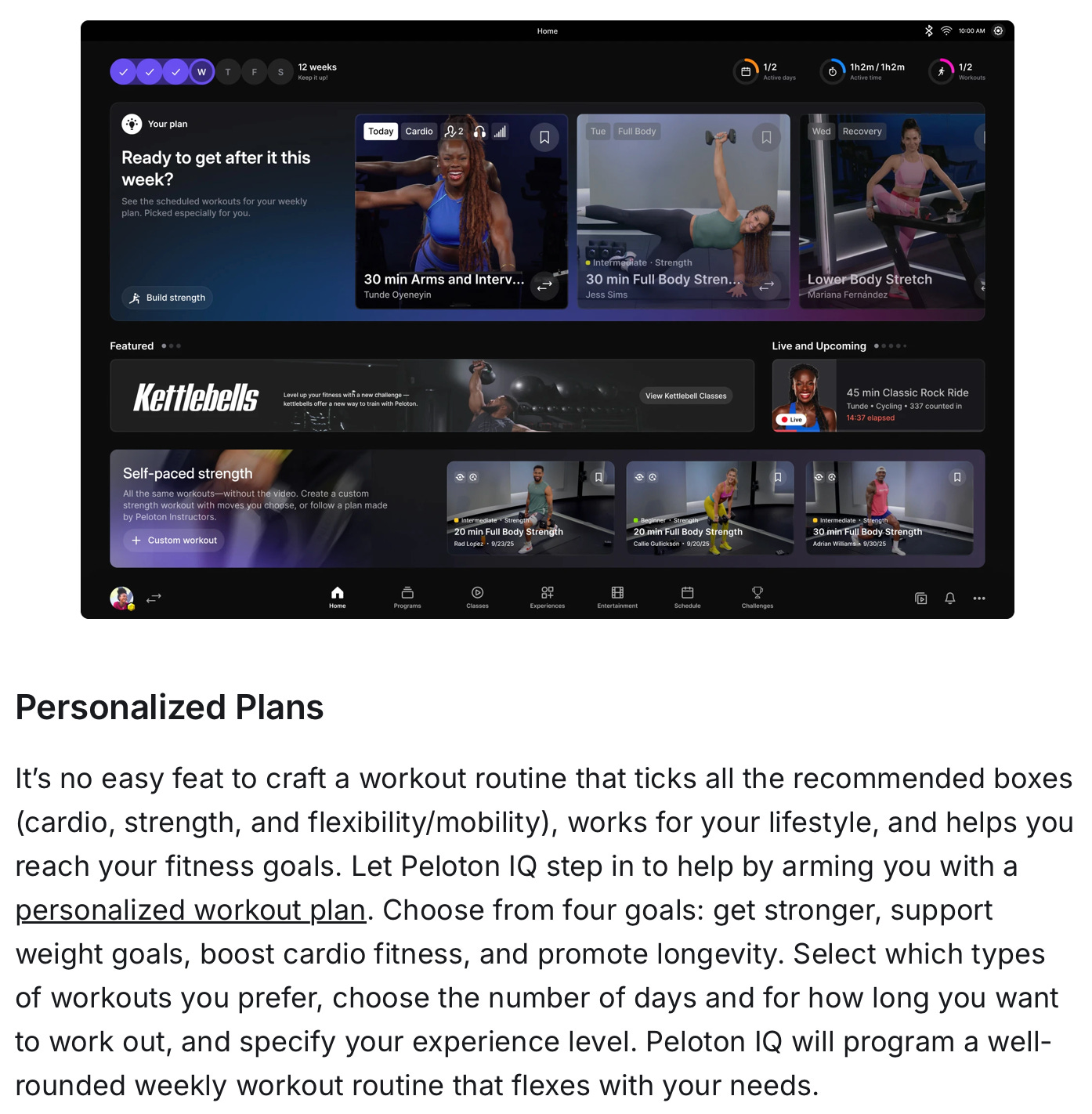

The new product lines are collectively called the Peloton Cross Training Series, and encourages users to incorporate different workout activities into their fitness routines (e.g., combining cardio with strength training, yoga, meditation, or pilates). The company is also leveraging AI to personalize the workouts. The newly branded AI assistance “Peloton IQ” can offer recommendations using the data you provide to create a personal health plan.

We’re not entirely sure how useful this offering will be, but it does show progressive thinking, and if anything it’s a good marketing tactic. More importantly, AI can help the company translate/dub workouts into different languages, reducing the cost to expand PTON’s content to new markets.

The company has also revamped its go-to market strategy. PTON has partnered with more third-party retailers, started its own used equipment website (Peloton Repowered), and redesigned its retail footprint. Gone are the costly and large format retail stores. Instead, PTON’s experimenting with mall kiosks one tenth the size.

The kiosks should generate the same amount of foot traffic and revenue, but have significantly more flexible lease commitments. The company plans to have 10 micro-stores open by the end of 2025, and fully shuttered all retail stores by 2026. Additionally, the company’s refocusing its Precor brand to target commercial businesses and third party gyms, and has introduced Peloton Pro Series, a line of products that cater to gyms, hospitality, multi-family residential, corporate, education and hotel in-room fitness.

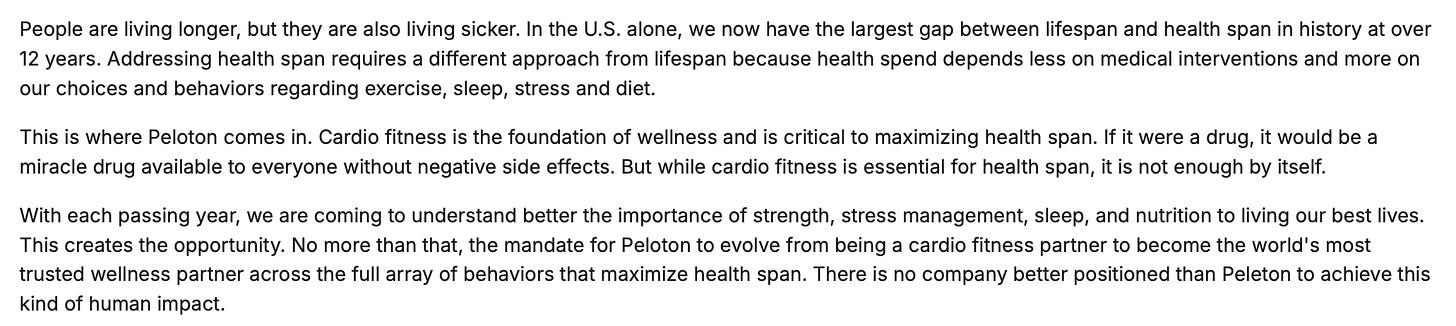

From a marketing/corporate messaging standpoint, Stern has shifted the company’s strategy from focusing on fitness to the broader category of health and wellness (i.e., focus on “health-span” and not just life-span). It’s an effort to reach a greater audience and access a larger addressable market. Here’s Stern’s comments in a recent quarterly call:

Health, recovery, menopause, mental health, injury prevention, yoga, pilates, meditation, come one, come all. This should further enhance how “sticky” the PTON ecosystem is as cancellation rates are still LOWER THAN Netflix . . . and nobody cancels Netflix.

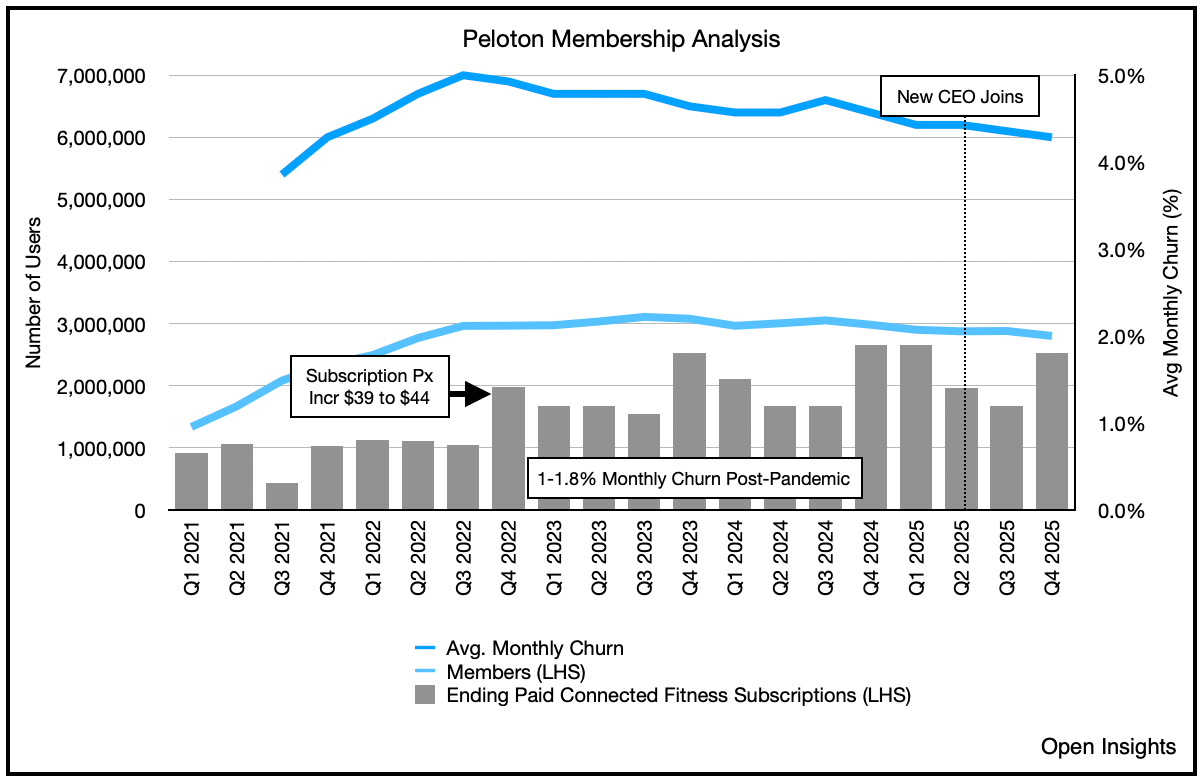

In the recent quarters, we’ve seen little deterioration of these membership metrics, and would expect subscribers to maintain their loyalty. More pointedly, the already anemic cancellation rates fall by half if subscribers take two or more modalities (e.g., bike + strength, or jog + yoga). It’s partly why the company’s emphasizing cross training with its new product line. PTON’s new Strength+ app should also reinforce this aspect of the business. So despite the company’s slow bleed of subscribers in the past few years, we’d expect the new offerings will help stem the tide, slow subscriber cancellations, and bring in new customers.

Price Increases

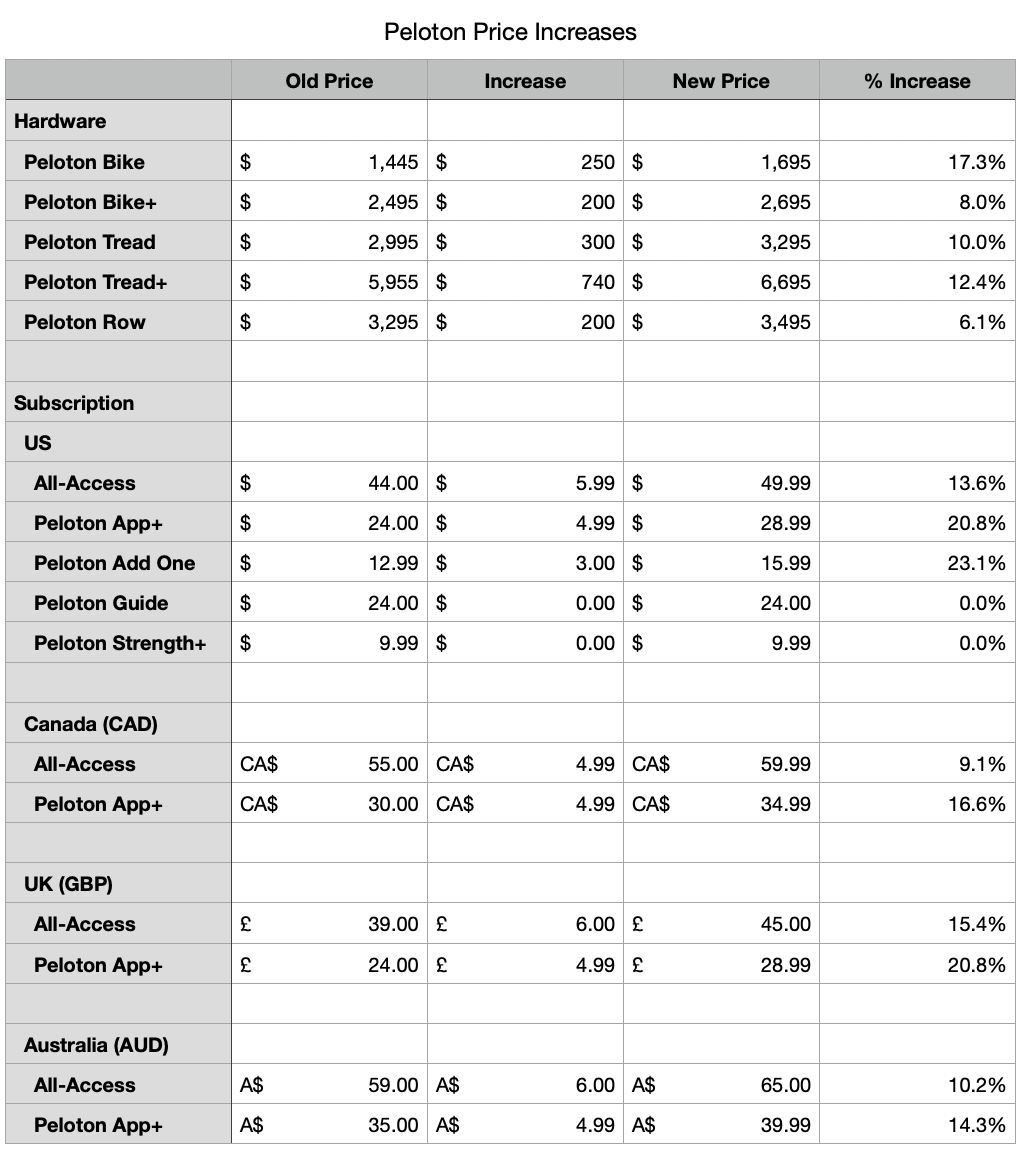

In conjunction with introducing new products, the company also raised all of its prices by ~15-20%.

After the increase, hardware prices better reflect the true costs of manufacturing, and the subscription prices better captures the value enhancements PTON’s rolled out in the past few years. Even at the highest tier of subscription, All-Access Membership, the classes are a relative bargain to in-person instructor led classes. The new $49.99/month All-Access Membership should result in $160M of additional EBITDA over an entire year (even factoring in modest subscriber cancellations). Cancellations will almost certainly increase, but previous price increases in 2022 tell us that the impacts normalize after a few quarters. The price increases coincide with new product launches for the holidays, so cancellations this time around may be lower.

In totality, what we have today is a $3B market cap company with ~$460M in net debt. That’s fairly cheap for a company that boasts 2.8M subscribers and dominates the connected fitness space. PTON has recently guided FY2026 to be $2.5B in revenue, $425M in Adjusted EBITDA, and $200M in FCF. We think that’s light, as 2025 revenue came in higher at $2.5B, Adjusted EBITDA at $403M, and FCF at $328M. If you’re increasing prices by nearly 15-20% across the board (pro-rated for FY2026 as it takes effect in Q2), how’s it possible that all your metrics will be lower? We sense there’s “conservatism” in the numbers.

In addition, PTON announced that it will slash operating expenses by another $100M (after having concluded a $200M restructuring in FY’25), which should provide even more of a cushion to “beat and raise.” FCF also seems light at $200M as we surmise it should be closer to 2025 even with inventory and tariff headwinds. If so, this means, the company’s net debt will largely be extinguished by fiscal year end. It’s likely PTON will continue to operate with some leverage, but the interest expense should fall from the usurious 11% to something more manageable. If PTON ran with half its leverage today, interest savings alone will boost FCF by $60M, nearly 20%. Slap a 10x multiple on it, and it’ll boost the stock price by 20% alone.

There’s definitely headwinds though. We get that. A weakening economy, high price point, depressed consumer sentiment, tariffs, and the need for inventory restocking. FCF will be impacted by a few of these factors (namely the last two), but the reduction in operating expenses means the two should push. PTON’s stock based compensation is also egregious, and the company recently revamped its stock compensation plan to tame it, so we’ll see if that brings it closer in line with peers.

As PTON shifts from a fitness focus to health and wellness, the interest for PTON’s products should grow. Couple that change with international expansion and renewed focus on corporate accounts, we think there’s opportunities to reignite growth. To replicate this business would take billions, and the stickiness of its clientele puts this company in rarified air. If Peter Stern and team can demonstrate a modicum of growth, watch out, the value of this company can soar.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Any users can verify that product ship rates have meaningfully improved and many are good. The class ratings in particular are very useful