Peloton's Q2: For Want of a Nail . . .

February 6, 2026

Well that was delightful wasn’t it? Peloton’s Q2. We sure swung and missed there. What a disaster as the market instantly corrected our misguided notions that the quarter was actually going to be decent.

What it was instead was “blah,” and “blah” doesn’t cut it when your subscriber base is shrinking and there’s fears around the durability of your business.

That’s the market right now though, and you play the hand you’re dealt. Anything short of glorious results will get scorched, and the market certainly torched the stock sending it promptly careening 30% lower on this one. Understandable, but as we look at the underlying results, we’re wondering . . . overreact much?

Small misses can lead to disaster though. Everyone knows that, heck there’s a proverb.

For want of a nail . . . the kingdom was lost.

What’s the nail you ask? It’s basically this . . . $30M of revenue, for a company with $2.5B in total revenue. So written another way $0.03B.

Yeah, slightly more than 1%. The reason is because this is about optics and expectations. The issue is PTON has declining subscriber enrollment, and though it is profitable, the Street wants to see top-line growth. If you can’t get subscriber growth right now, at least get revenue growth since you just increased prices in October.

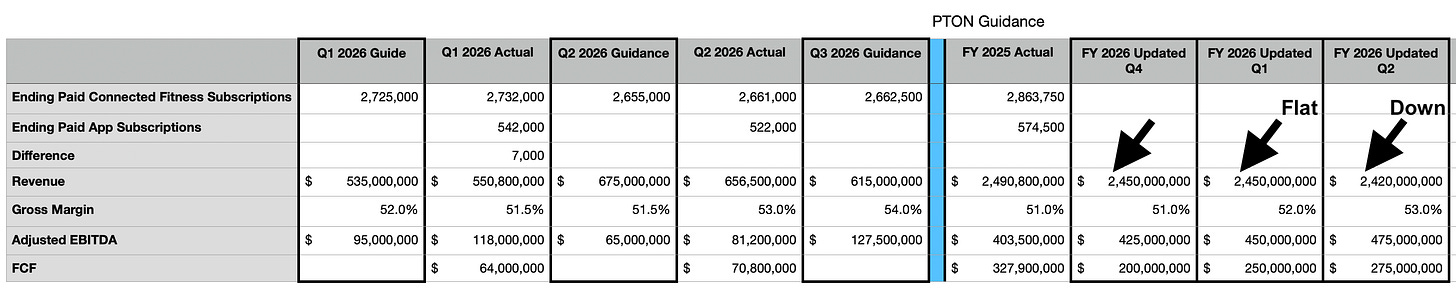

Here’s what the annual guidance has looked like in the past few quarters. Though we ended FY 2025 with $2.49B, PTON’s guidance for FY 2026 in Q1 was $2.45B, so down about $40M. 1% year-over-year, not great, but maybe they’ll beat it.

Relaunched product line and increased subscription prices, awesome. Revenue growth right?

Nope.

For Q2, however, PTON really clipped out and fell out. The company had guided to $675M during the busier holiday season, and unfortunately for shareholders, ended up landing at $657M, missing by $18M. That miss, and likely whatever insight the company already knows from its busier January season (think NY resolutions to get healthy) resulted in the full year guidance falling by $30M ($18M from Q2 and likely $12M in Q3), thus leading to the further reduction in full year guidance from $2.45B to $2.42B.

Again . . . for want of a nail . . . the kingdom was lost.

The $30M and heightened questions around growth led to a near wipeout of the company as shares lost 30% of their value. PTON’s market capitalization fell by nearly $700M.

Said another way the $30M miss was valued at near 25x revenue. More accurately, the value’s really attributable to the market’s lost confidence in the company (i.e., the diminished faith in the investment community that a turnaround is afoot). If you can’t grow top-line, eventually the melting subscriber counts will catch-up to you. A company simply can’t cut expenses infinitum, and profits will eventually follow where topline goes.

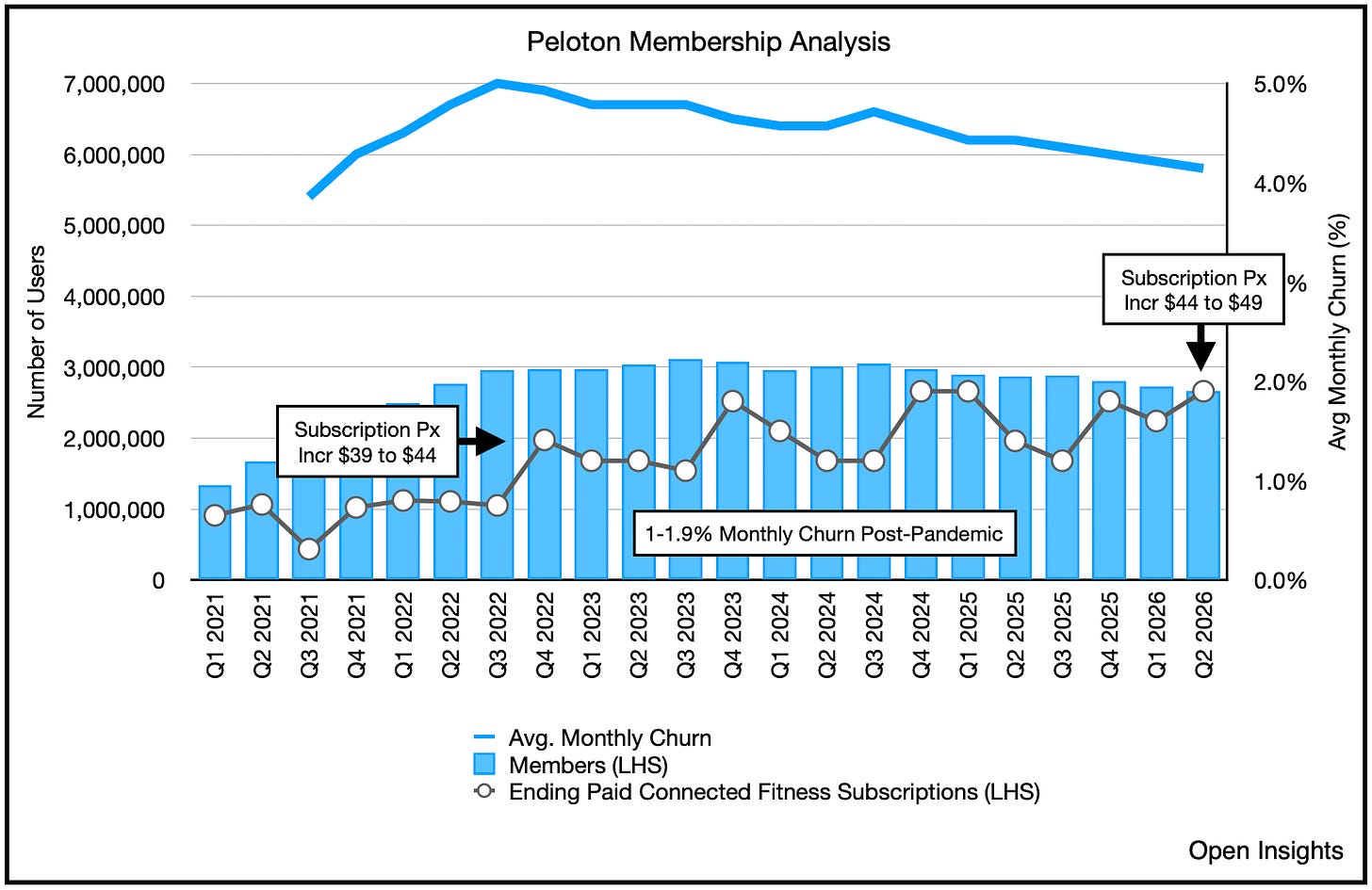

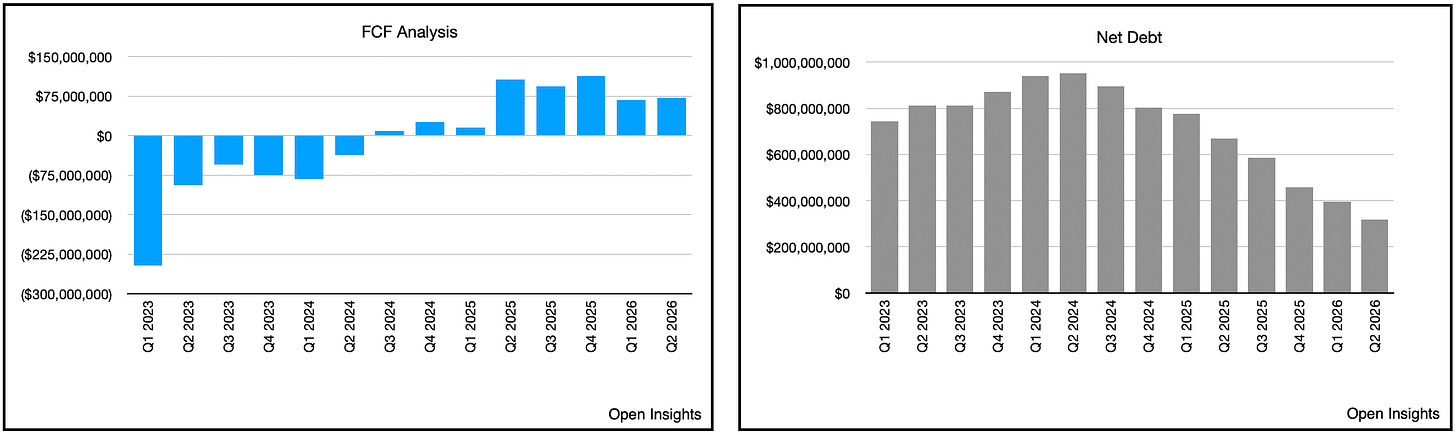

Yet, there’s still time. The company is free cash flow (“FCF”) positive, and the existing users still love the product. This is still a very sticky business, and even with the price increase, subscriber churn rates didn’t blow out.

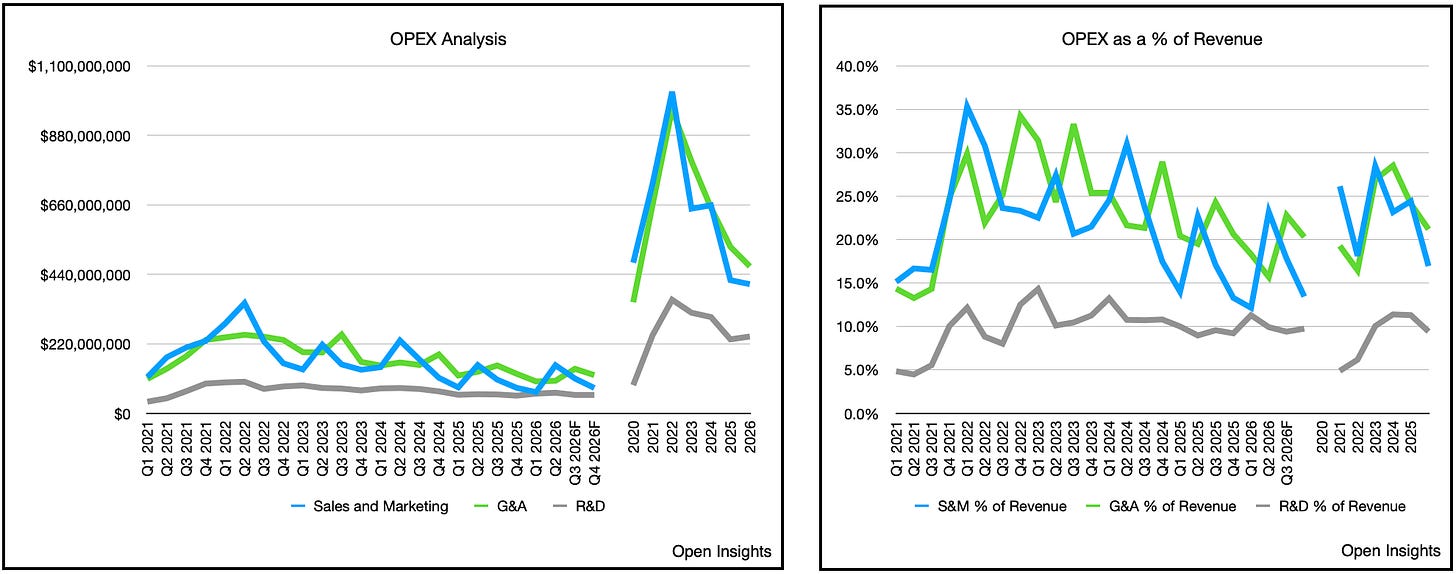

In contrast to the disappointing top-line, the bottom-line metrics continue to march higher as operating margins, Adjusted EBITDA and FCF have all been guided upwards as expenses have been brought down (both in totality and as a % of revenue):

The cost reduction efforts have resulted in an increase to the bottom-line guidance.

Gross Profit Margin increased year-over-year from 49.1% to 53% and for the full year PTON forecasts an increase from 49.6% to 53%.

Adjusted EBITDA has also been increased. At the beginning of the year PTON guided to $425M, and as of today, it’s guiding to $475M at the midpoint. We anticipate the company reaches $500M as we hit Q3.

Lastly, FCF has similarly been trending higher, guidance moving up from $200M at the beginning of the fiscal year to $275M as of today. Similarly, we think this will eventually land around $300M by fiscal year end.

As FCF lands, debt should be somewhere in the ~$200M net debt range, and ready for refinancing in about three months (May).

So where did we go wrong?

Subscribers

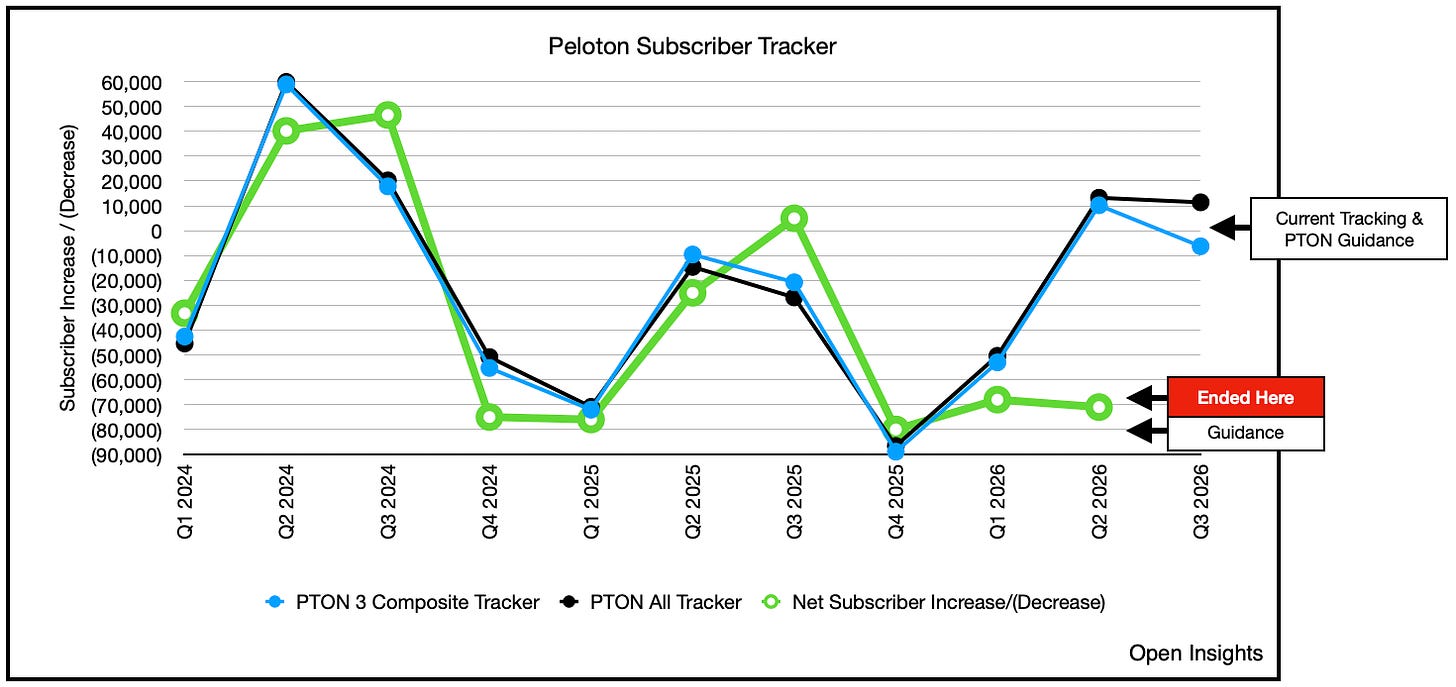

Well it appears that our internet scrape data pointed at too high of a subscriber count addition. Though interest/search for the new products was high, that didn’t necessarily translate to more sales. There could be a lag effect as the consideration cycle for exercise equipment is longer, but that would be too optimistic a view to take given the aggressive promotions PTON ran during the holiday season. If performance marketing didn’t move the needle then, what happens to sales afterwards once marketing budgets soften?

So while we had forecasted only about a 40K subscriber count lost, the company delivered a 71K reduction, and that’s a significant number of equipment not sold and subscription revenue not earned. Some of this could also be a one-off impact from the higher subscriber cancellations than we modeled (we used prior price increases as an estimate). Though that could be a factor, we think the 1.9% churn this quarter was still lower than anticipated, which means that as we lose subscribers, those that are left are the “hard core” users, and thus tend to be stickier . . . which is a long-winded way of saying . . . they likely didn’t sell as much equipment.

So where does the data point to today for Q3?

Ironically very near where PTON’s guidance is for the quarter. Still that Q2 miss sure does casts aspersions on the accuracy of that tracker (though you can see it has historically been very accurate).

We think it’ll creep back on trend though because the price increase last quarter did throw a monkey wrench into the entire exercise. Moreover, if PTON is guiding to the range our tracker is seeing (with the most important New Year / January sales already under its belt), that gives us comfort it’ll meet it.

Product Sales

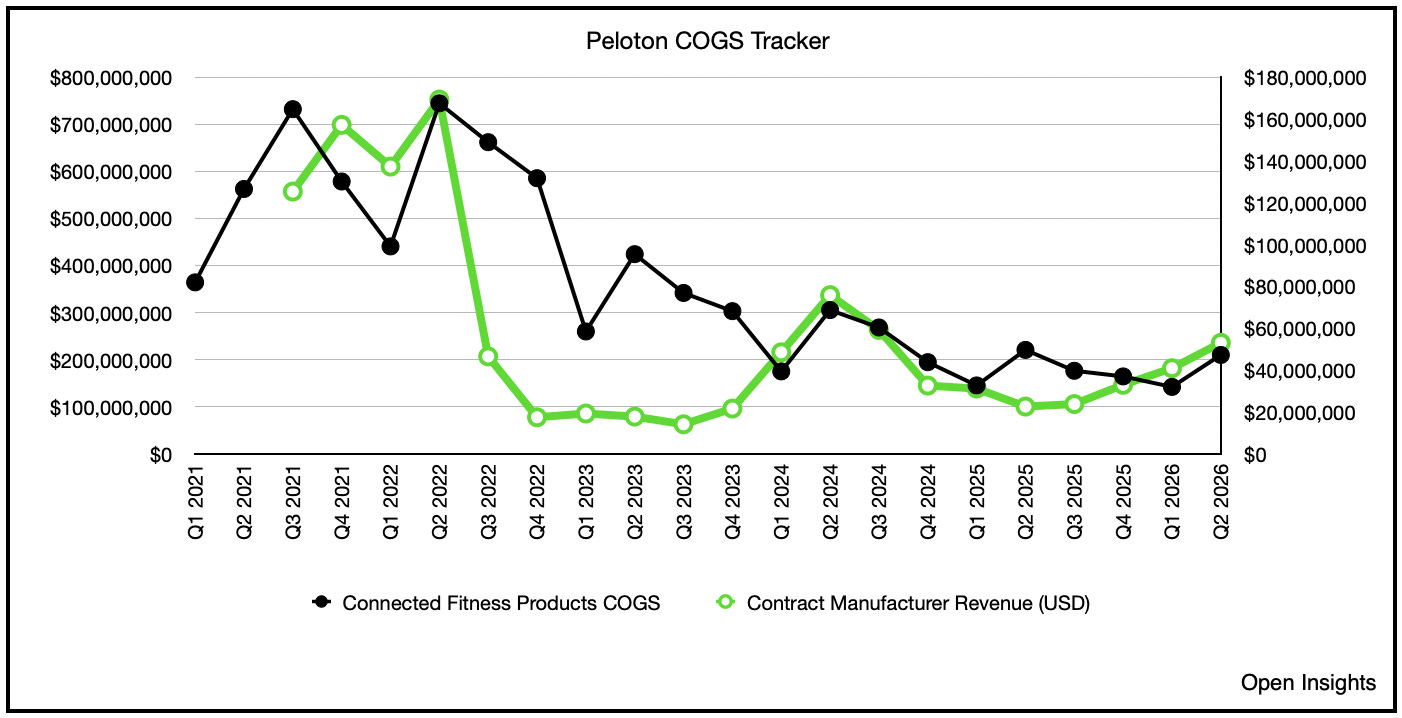

What’s slightly more accurate was tracking PTON’s Cost of Goods Sold (as a proxy for Connected Fitness Products Revenue assuming a 15% margin).

You can see we can land fairly close to where PTON’s end up, but since it PTON missed earnings by $20M, it doesn’t take much for a small blip to swing our forecasted numbers. We assumed too high of a COGS, which led us to assume miss on the Connected Fitness Revenue. We’ll temper that forecast next quarter.

Keys to the Kingdom

So overall where does that leave us? Well it leaves us where we started.

FY 2026, which ends on June 30th, is a reset year. We just thought the inflection would start this quarter with the introduction of the products as a catalyst. This hasn’t panned out, which means we’ll need to reassess PTON’s other plans.

The company has slashed expenses, continues to repair its balance sheet, will refinance debt shortly, and re-introduced a new line of products. H2 2026 likely sees an introduction of a cheaper PTON Tread, which will help with attracting new subscribers. Again the treadmill market is nearly twice the size of the bike market and PTON recognizes that its treadmills are twice the average price of its competitors and uncompetitive in the marketplace. Lowering the price means tapping into a larger addressable market and potential subscriber base. This likely happens in the September/October time frame, which would be just in time for the holiday season.

More importantly, investors are still waiting to see what the other new vectors for growth will be. This won’t really start until PTON refinances its existing debt in May. Once done, it’ll lift the overly restrictive debt covenants that prevents the company from pursuing M&A to flesh out the product portfolio as Peter Stern pivots the company from fitness to wellness.

Investors are currently demanding that the company slash operating expenses to pay down debt. Fair enough, but once that process has run its course, what becomes of the enhanced FCF? That should be answered in May.

Remember, it’s about a return of capital and return on capital. We need to see both as investors, and Stern’s plan needs to begin snowballing as we get into the latter half of the fiscal year. We anticipate seeing more M&A, content licensing deals, and joint ventures as PTON moves the brand into other categories.

Ultimately, experiencing this sell-off was largely our self-inflicted. While the trackers are directionally important, we placed too great of an emphasis on their precision. Sales of new equipment did indeed turn out sluggish, and PTON has now been forced to reset expectations after a banner FY 2025 where they handedly beat and exceeded expectations. It can no longer only keep cutting expenses and enhancing the bottom-line to garner a higher share price. What matters is growing the top line, and while that’s difficult, it’s exponentially harder when debt covenants tie your hands. Those knots will loosen soon, and thereafter, we’ll get a better picture of how PTON reacts after getting knocked.

Though our confidence in the path forward is tempered, we can say with confidence that the sell-off is overdone. This is now a $1.8B market cap company generating $300M in FCF, with a very slowly declining subscriber base, and optionalities to the upside.

At 3.5x market cap to Adjusted EBITDA ($500M), or 6x market cap to FCF, we’re certainly in discounted territory. Again it comes down to the perception of growth (or lack thereof) of the user base. This investment hinges on it, and the market undoubtedly thinks the company won’t or can’t deliver. Therein lies the asymmetry. If PTON and its management team can nail that, then the shares will rerate considerably higher.

For now though the market wants a nail . . . before the kingdom is lost.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.