IDK.

It’s as simple as that. It’s confusing these days because it’s not obvious where things are headed. There’s been so much handwringing about the economy and many have questioned whether a recession is near. Maybe the market is telling us something. The stock market (as represented by the S&P 500) has fallen 6.4% year-to-date, and that figure only looks tame because of last week’s ferocious 5.8% rally from the lows. The Nasdaq 100 (i.e., Big Tech) is down 11.7%, and again only benefiting from an 8.4% bounce as well.

So year-to-date it doesn't look that bad.

Sure the market is down, and the only sectors that are really outperforming are energy, mining, utilities and financials. Nonetheless, before last week, bearish sentiment abounded. A recession is coming, stagflation is coming, a fall is coming. That’s what we heard, but it “seemed better” as the market didn’t take another leg lower.

Pay to Play

Maybe it is, but maybe not, and that’s what we’re trying to figure out. We can certainly see the arguments for why a recession is looming. Things are getting expensive; there’s no denying that. Money, commodities, and wages. They’re the input costs for EVERYTHING.

Well, things have to get expensive because we just don’t have many things. Yet, that’s the very thing . . . if we don’t have the things, don’t we have to work to get the things?

First, here are three input costs: commodity prices, the cost of money (interest rates), and wages. Higher?

Yes, yes and yes. Fair enough, but we all have desires. Passion aplenty for stuff. Like Gollum in the Lord of the Rings . . . we wants the things, we needs the things.

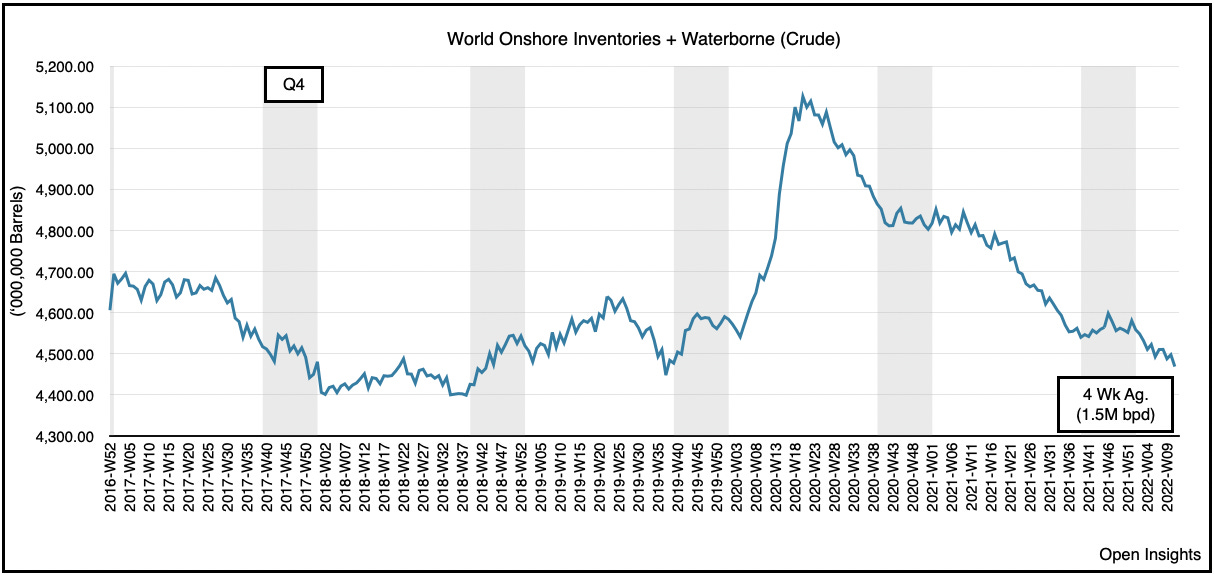

. . . but we still don’t have any inventories, or at least not much.

Part of that inventory includes cars . . . which we certainly don’t have.

Nor houses to even garage those cars.

It’s probably for the better, since we don’t really have enough oil to drive the cars anyways, so silver lining there.

Yet, that’s the thing. If we don’t have these things, don’t we have to go to work to drill, mine, manufacture, or build the things? Despite our services oriented economy, manufacturing still represents 11% of GDP. Housing is nearly 15-18% of GDP when you include not just building homes, but also the associated services and goods economy that revolves around it (e.g., broker/agent, mortgage and escrow fees, construction, insurance, sales of home durable goods, home improvements, etc.).

More broadly, services represents nearly 3/4ths of this country’s economy, and it’s also been recovering at a steady clip.

Even if we’re not talking about making things, we still need people to restart services. As COVID fades and masks mandates expire, people are much more comfortable going out and traveling, dining, and living. Thus, our services economy is also recovery (e.g., number of airline travelers through TSA checkpoints are running only -10% from 2019 levels).

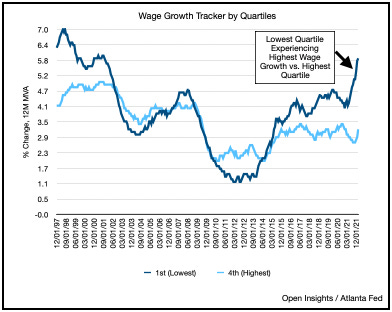

So yes, don’t we all need to get up and go to work? To motivate people we need wages to rise. Wage increases that actually exceed inflation because if they do, then we’ll actually be earning more in real dollars. Thus far it’s close, but not quite.

Consequently, wages need to increase even more. They will though because there just isn’t enough people given the number of jobs and the low unemployment rate.

Workers will take full advantage here because they know it pays to switch jobs.

Even better for the economy is that the lowest wage workers are seeing the biggest increase in pay . . . good for them because they’ll be impacted most by inflation, and good for us because lower wage households spend nearly all their earnings on goods and services in the economy.

So yes, while we’re seeing commodity prices climb, interest rates rise, and wages increase, the fact is they need to because we need to incentivize an increase in economic output.

So it’s why we pause when we hear words like recession and stagflation. Stagflation? Maybe. Recession? Possible. But, but . . . but how when we don’t have enough? It explains in part why Goldman Sachs continues to forecast a 2.9% growth in US GDP.

This figure is inclusive of the 0.7% drag on disposable personal income coming from the higher costs of everything.

The structural shortage in raw materials, the shortage in inventories, and the dearth of labor means we’ll all have to work at full capacity to restock our shelves and rebuild our lives. Full capacity means full employment, and full employment begets higher wages. Higher wages begets everything else because the more we earn, the more we’ll spend. Could we be faced with an inflationary wage spiral where higher wages drive higher demand, leaving supplies always short? Perhaps, but that’s a different problem than a recessionary economy.

West Meet East

Hanging over all the above is Russia’s invasion of Ukraine. Our structural shortage is set to exacerbate as two of the world’s largest commodity providers battle one another. Fortunately, the global economic engine could also rev higher. Omicron’s spread has largely finished in the West and shows signs of diminishing in the East with Japan, South Korea and Hong Kong showing recent declines. China is also balancing economic advancement against health & safety factors. Despite rising COVID cases, authorities appear to be relaxing their “zero tolerance” policies and allowing economic activity to continue. We agree with China’s policy shift as doing otherwise in a world short of “stuff” will only further endanger their economic advancement in the coming years. A lighter COVID lockdown coupled with renewed vows of financial/monetary support (i.e., pledges to “boost the economy”) are no doubt caused by Xi’s attempt to buttress the economy ahead of his election and the CCP’s 20th National Congress. We anticipated as much late last year and wrote about it in a series of articles. No one likes a Debbie-downer when it’s a year to celebrate. Regardless of the reason, this means on that side of the world, there is some pull, and as we noted above, we will as well.

Convinced?

No. Not entirely. I mean, IDK. Things are getting expensive and will be even more so in the coming months. European recession? Yes, already there. Russian depression? Undoubtedly. Emerging market inflation, instability and political turmoil? Very likely given the lack of commodities and the forecasted shortages.

The US and other developed markets? Perhaps not. Stagflation maybe, maybe we simply grind higher, and look back with nostalgia on the days of “dollar menus” and cheap “$4/gallon gas”. It certainly seems that’s where we’re headed. Prices will grind higher because they must. Our wages will also grind higher because there’s no other choice. Sure we’ll enter into an inflation spiral as we make more, spend more, and prices climb more. Still that’s better than the alternative right? Having nothing. No jobs, no wages, no stuff.

To think that we fall into a recession is to bet that the economic machine will grind to a halt and we will simply not work our way out of a structural shortage. That doesn’t “feel” right to us. We’re more apt to just demand more and then spend more.

Even if the Ukrainian invasion hadn’t accelerated the commodity shortages we’re experiencing today, they were bound to happen. It was only a matter of time before our inventories depleted and forced the repricing. In the coming years we’ll all pay more . . . for EVERYTHING because we’re starting from nothing.

So take a good look at the prices you see today . . . they’ll be a fleeting memory soon.

Convinced?

Yeah, IDK.

Please hit the “like” button below if you enjoyed reading the article, thank you.

One thing you have to factor in, is millions of cheap laborers coming across our Southern border. Lots of desperation, unhappiness in the working class coming. Social unrest will follow. One of Marx's great insights was that in a capitalist society, just because you want, need it, does not make it real. Only the ability to buy it, makes it real.