Recession? Nah . . . When Inflation Powers You Higher

June 17, 2023

Lot’s to talk about so let’s just launch into it.

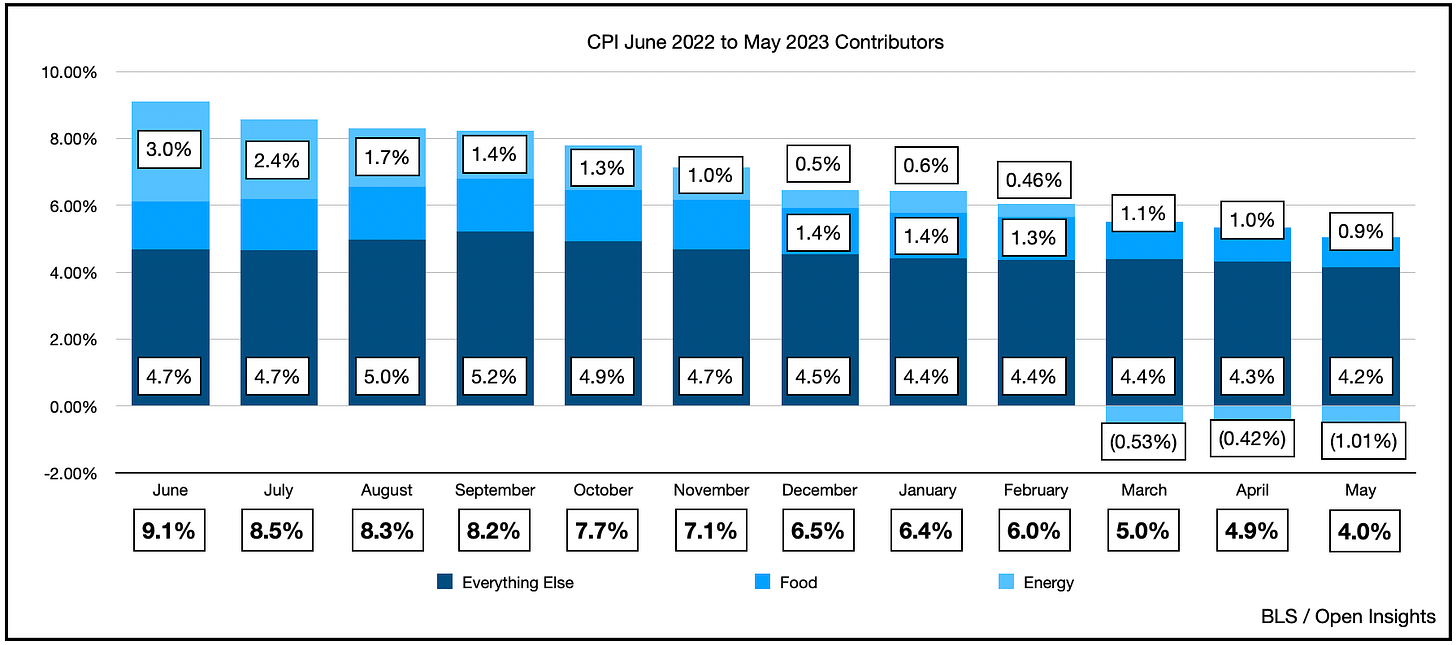

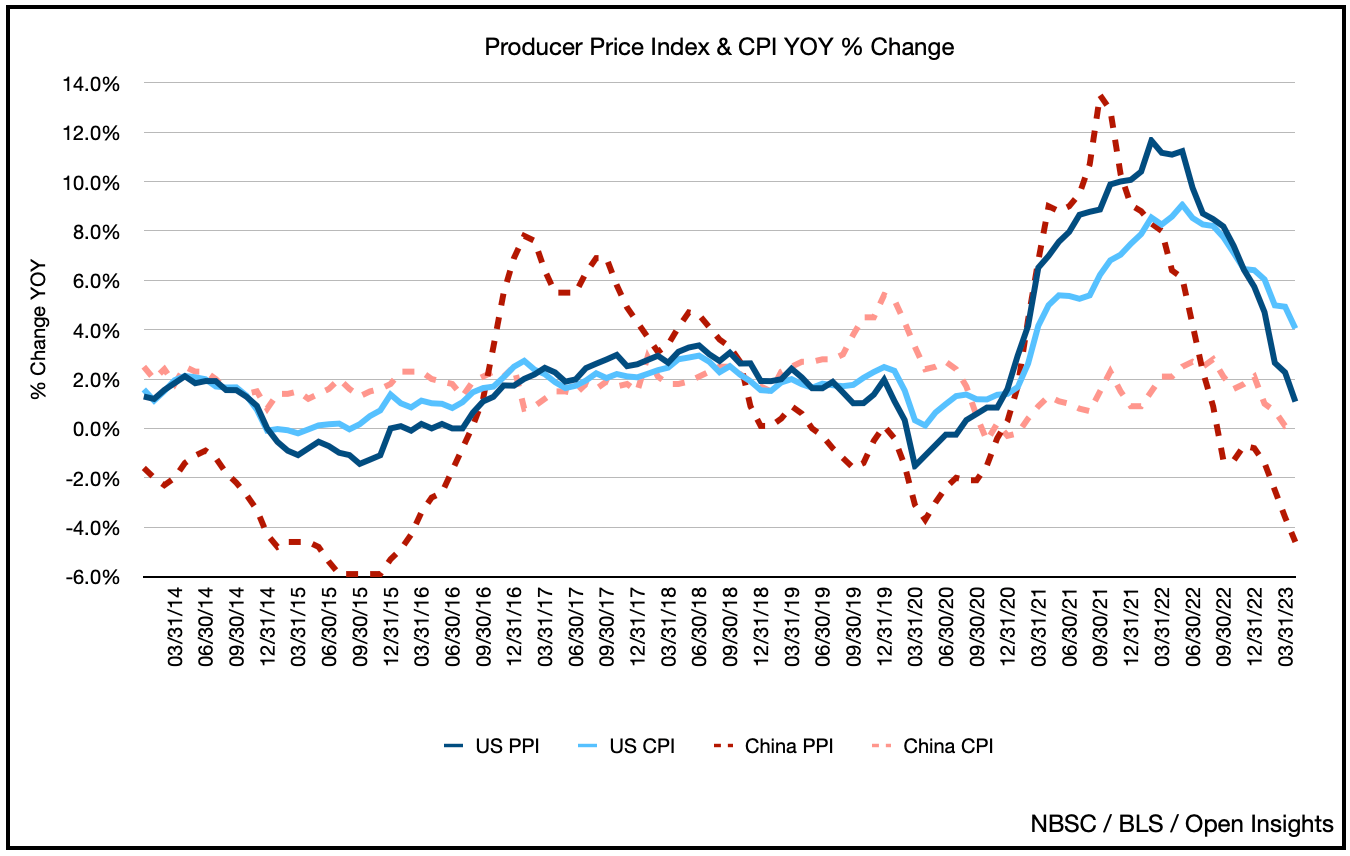

This week we had many of inflation reports. Both the Consumer Price Index (“CPI”) and the Producer Price Index (“PPI”).

CPI came in softer, at least at the headline level, which made the markets happy, as inflation is slowly coming down.

Since interest rates again compensate you for: 1) inflation, 2) risk of loss, and 3) a return, falling inflation should translate to falling interest rates.

PPI also came in tame, and from a headline perspective, it wasn’t too egregious. All of this isn’t entirely surprising if we look overseas as well. China’s CPI and PPI have both been low and trended lower, even with their reopening. Unlike the West, thus far, the Chinese have refused to stimulate heavily. As supply chains have unsnarled post-COVID and consumer demand for durables have waned, the inflationary pressures on durable goods has subsided. Hence a relatively calmer PPI and CPI all-around.

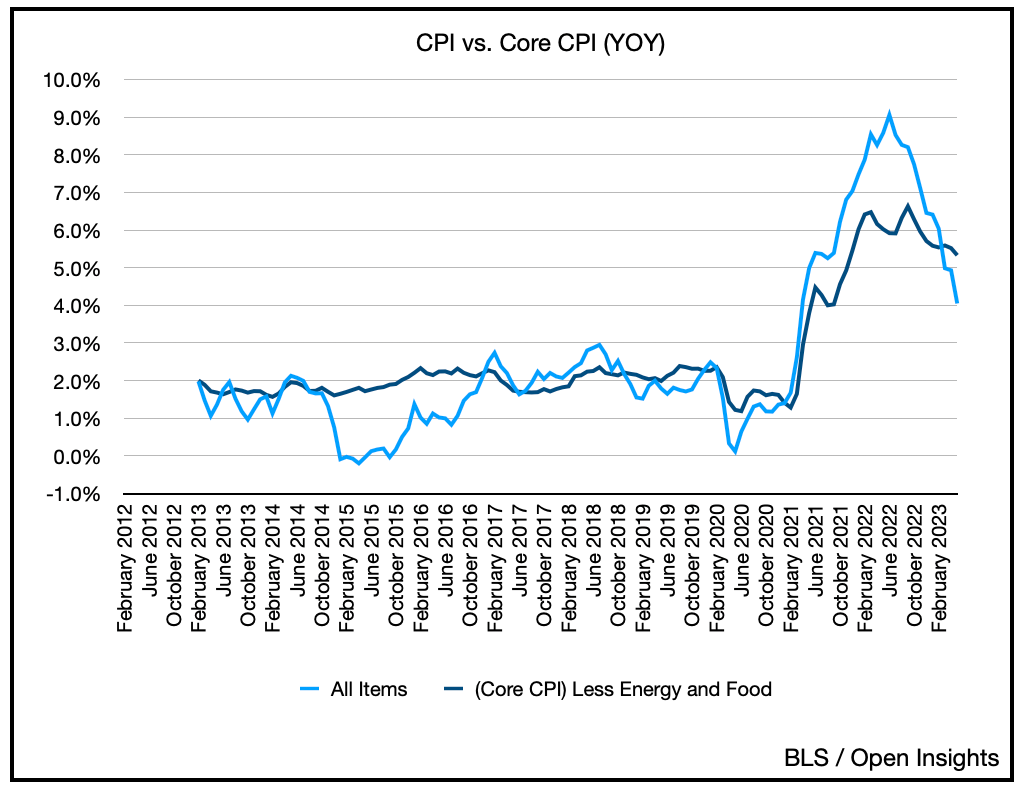

Having said that, what’s more concerning is “core CPI” (i.e., core inflation). When you strip out the volatile energy and food costs, (i.e., non-durable goods), core inflation is very sticky. It’s like the Terminator . . .

“Inflation is out there, it can't be bargained with, it can't be reasoned with, it doesn't feel pity or remorse or fear, and it absolutely will not stop . . . EVER

Okay, maybe not EVER, but like the Terminator, at 5.3%, it sure is clingy, and declining significantly slower than the 4% headline CPI. (Side note - highly recommend the Arnold documentary on Netflix, fascinating).

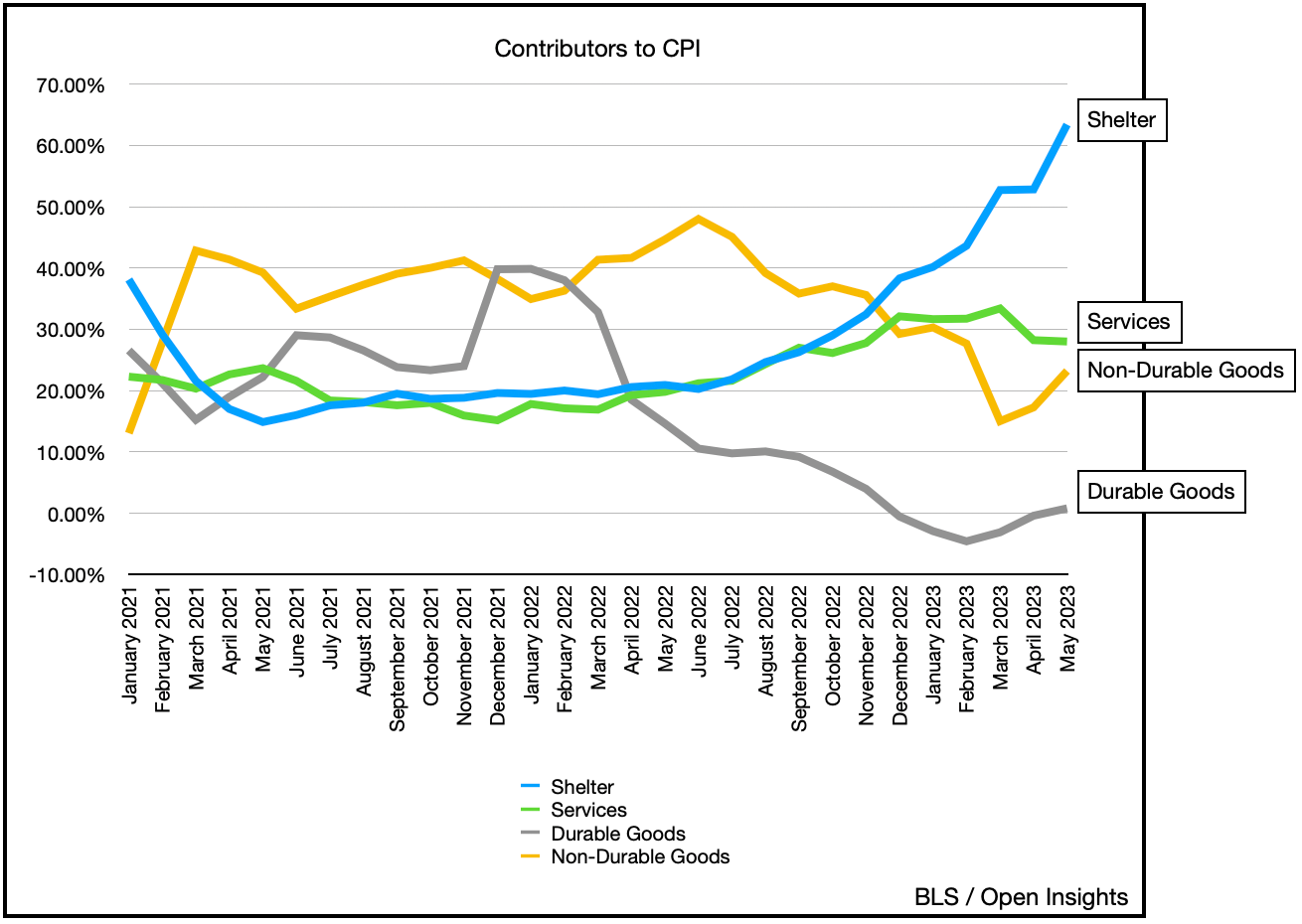

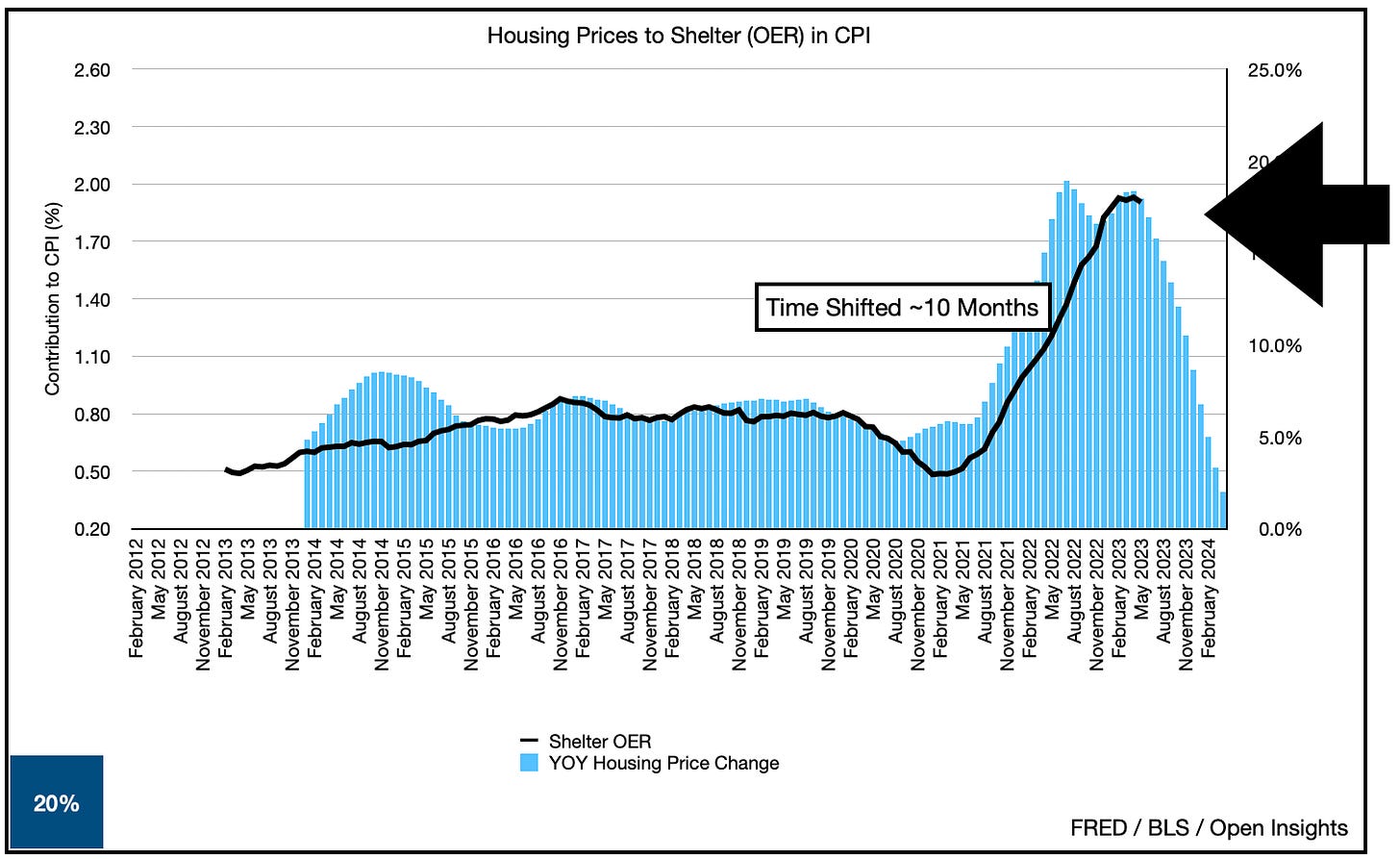

In large part, whether it’s Core CPI or headline CPI, today’s inflation figures are being driven by shelter costs.

As you can see, the rising cost of shelter is disproportionately impacting inflation and contributing largely to the 4% headline inflation figure. Even though we believe it will simmer down eventually based on the latest housing data, eventually could mean a year.

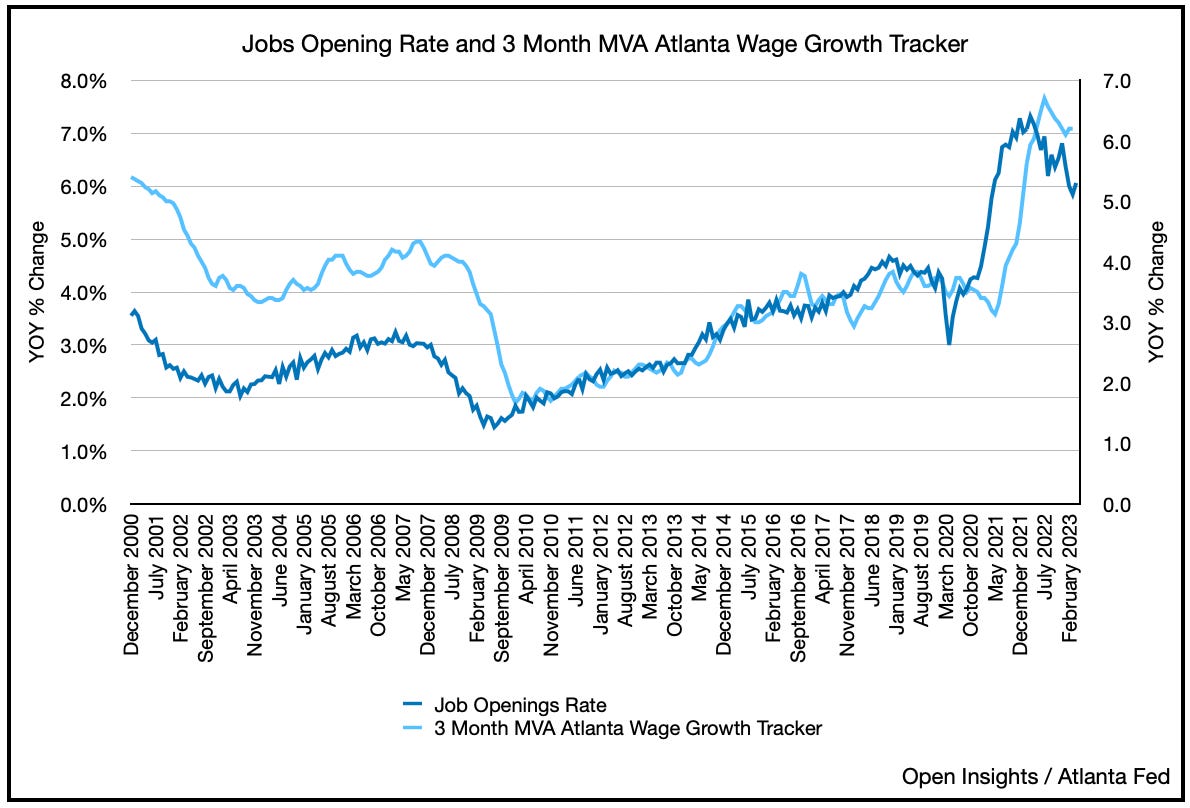

If we’re right though, the fall should be swift, and arguably shave about 1.5% from headline and Core CPI. So if Core CPI is running at 5.3%, all else being equal, we can expect Core CPI to also come down to ~3.8%. Then it comes down to services. Services is essentially wages, and wages are a byproduct of labor demand, and that appears to be softening.

So there is a path to lower core inflation, somewhere in the high-2 to 3% range. Having said that energy, food costs, consumer demand, etc., may just nudge the headline inflation back up. Why?

Because the consumer is still strong, and remember consumer demand is nearly 2/3rds of this economy.

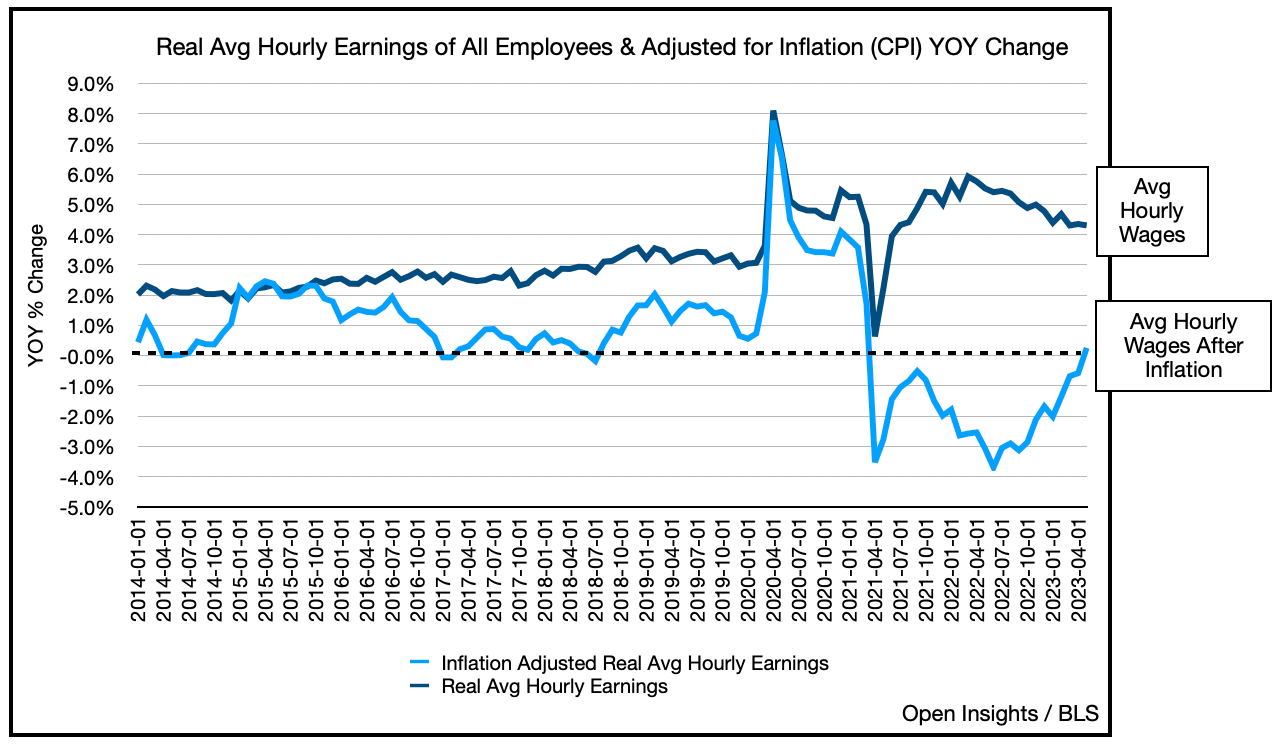

Wage inflation is finally giving workers a taste that things are getting better (i.e., their wages are finally keeping up with inflation).

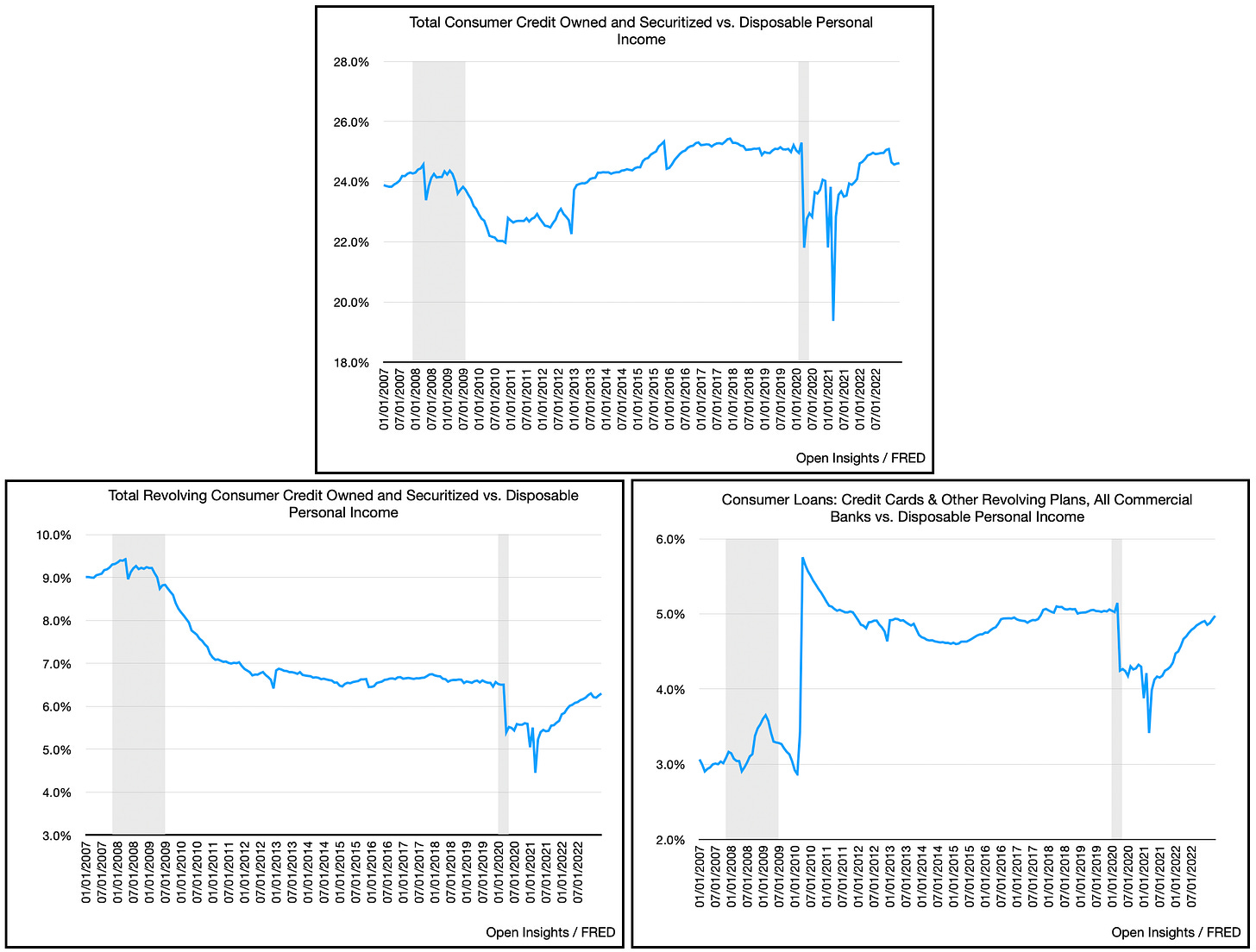

The higher wages are making household financial metrics look better, which is the funny thing about inflation. Hold debt steady, and your income can suddenly “shoe horn” you into a previously tight debt load. What was too constraining and unbearable, can suddenly seem more comfortable. Higher absolute debt balances? Sure, but if wages are inflating . . . the debt ratios become okay.

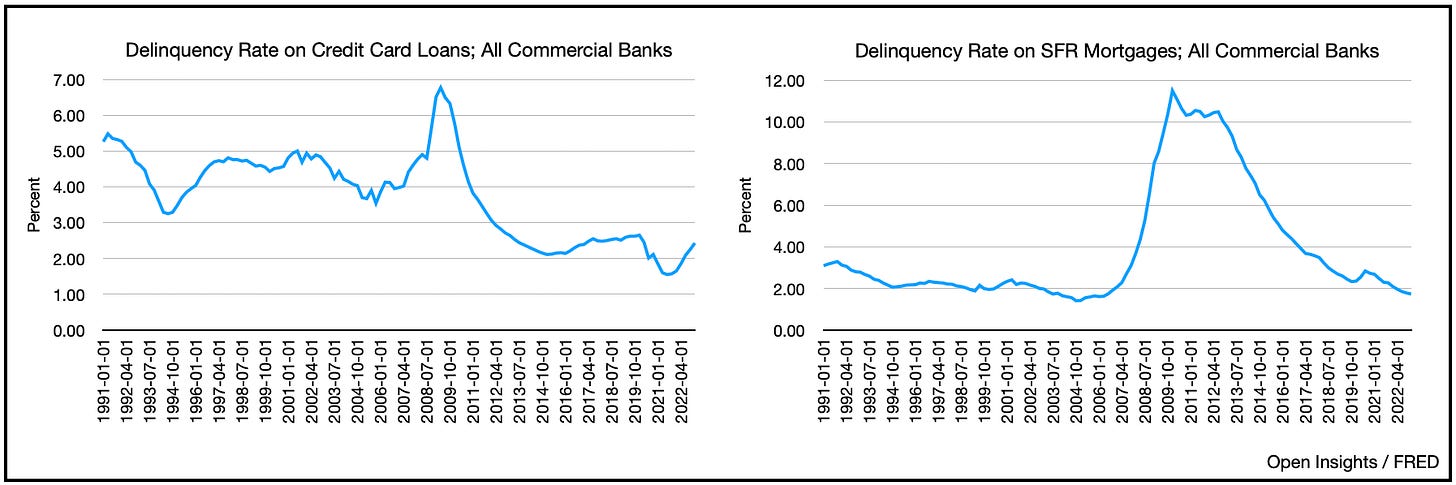

Don’t believe that? Well look at delinquency rates . . . they’re near the pre-COVID lows today.

We really are inflating our debt away, well at least on the consumer front right now. We weren’t that highly indebted to begin with, and the COVID pandemic coupled with government stimulus keep us afloat, and left us in an arguably healthier financial position today than pre-pandemic. It’s why you keep seeing headlines like these.

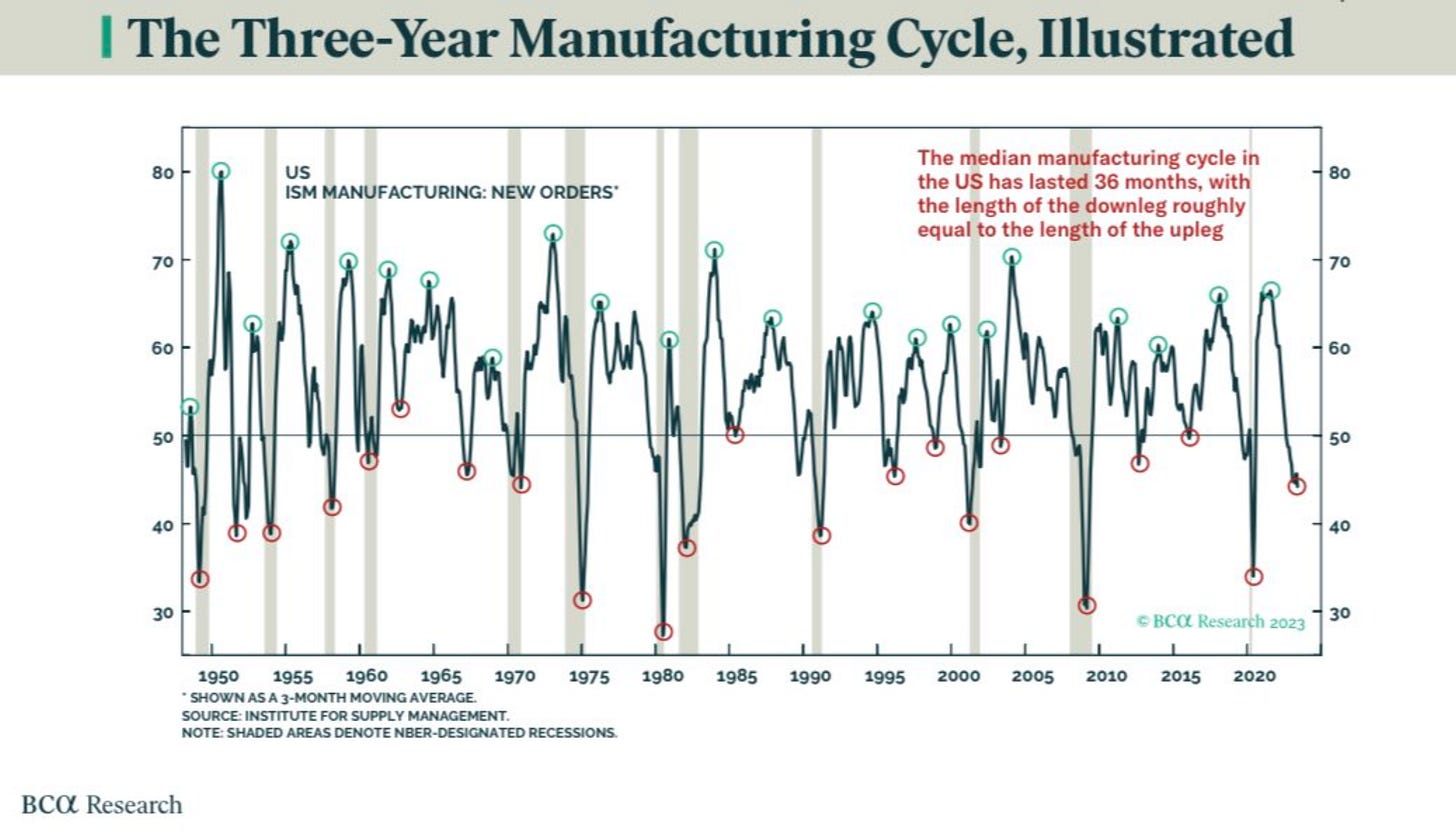

Demand isn’t that bad and the consumer isn’t stressed (yet). Interestingly, if manufacturing actually begins to pick up here, it may take the real economy up another notch (chart from a Peter Berezin, BCA tweet).

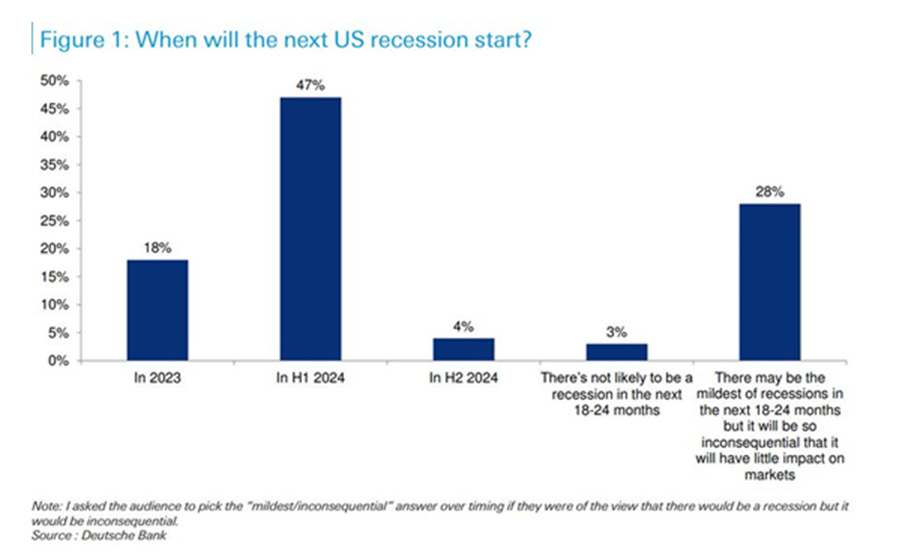

Taken together, all of the above is why the most anticipated recession keeps getting pushed out.

If, and we know it’s a big if, inflation really starts to head lower in the coming months, lower headline inflation, the inkling of lower interest rates, coupled with a rebounding/continued strength in the real economy may set-up an interesting H2 2023.

The market is certainly beginning to sniff this out given its YTD gains. Is much of this priced in already? Potentially, and there’s also a potential for a blow-off top, but inflationary driven growth is fueling growth here, and few investors have ever seen that before. Top line sales, people’s salaries, and everyone’s investment income (e.g., interest income) are creeping higher here, and it’s making things decidedly different from what we’ve experienced in the past decade. While expenses are also rising, we may just be entering a period where they begin to fall away as deflation starts to accelerate.

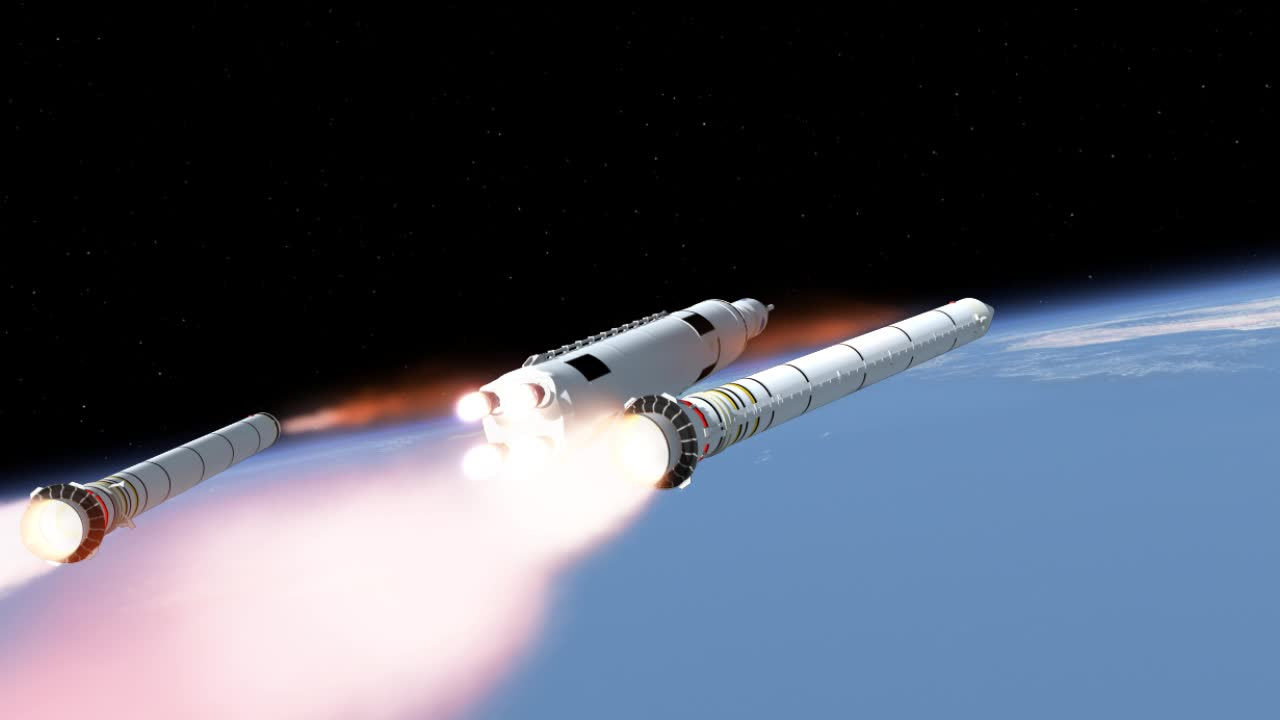

So top lines grow a bit, but not so much for expenses . . . kind of like this rocket.

To the moon you say?

IDK . . . but we sure seem to be zooming higher, and for good economic reasons. As for energy? Something needs to power those boosters, and in the end, that bodes well for demand.

So strap-in ladies and gentlemen, this could be a wild ride into the wild blue year-end.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.