Republicans Eating Their Own

October 20, 2020

As expected, the Republican Senate will begin distancing themselves from President Trump as their titular leader if his reelection chances

dim. The President’s best chance to salvage his campaign would be to pass a large bipartisan fiscal stimulus bill, one that many economists and Wall Street analysts believe is necessary to tie-us over until we can successfully introduce a safe and effective vaccine. We can see the economy weakening, as evidenced in party by unemployment claims. They’re creeping-up, climbing by 53,000 last week. Despite the fall in continuing claims, the data indicates its because they’re expiring, and not that jobs are becoming plentiful.

We know that internal Republican polling also indicates a high probability of defeat because otherwise there’d be little reason to abandon the President in his hour of need. So watch as Senate Majority Leader Mitch McConnell repositions the Republican Senate and pitches to the electorate that voting for Republican Senators are a way to defend against a “free wheeling / free spending” Blue Wave. What’s unsaid is that it’s also a way to stymie a prospective Biden administration before it even begins, ostensibly weighing him down with a recession just as he takes office.

Politics being what it is, another conclusion we can draw here is that this is about political self-preservation pure and simple as analysts, economists (regardless of political persuasion), and even Fed Reserve Chairman Jerome Powell support additional fiscal stimulus, and yet Senate Republicans refuse because of fiscal prudence? Dubious.

The market, however, is waiting to see how the fiscal drama plays out. It’s not wrong because there is leverage. If the White House and House can agree on a bill, House Democrats could force the issue and lay the defeat of any package on the doorstep of Senate Republicans. Ostensibly paint Senate Republicans as callous to the needs of the electorate and use that as a cudgel to hammer the message that a Blue Wave is necessary in the remaining weeks of the campaign. As of last Friday, the S&P 500 was up 9.4% for the year, thanks in large part to the unprecedented monetary stimulus and federal backstops to support the floor and fiscal stimulus (CARES Act) to spur demand, but fell by 1.6% on Monday. On Tuesday, the market rebounded. As they say, we will see, though we give it low odds a bill of that size can make it out of the Senate.

Wait and See

Though Wall Street may not like the weakening economic numbers today, the hope for a larger Blue Wave stimulus should prevent it from teetering over. Just wait until after the January inauguration, the pundits will say, the stimulus is coming. In contrast, if the Democrats capture the White House, but not the Senate, then expect a much smaller relief package (likely less than $1B) as the Senate will regain the advantage and stymie the administration. Interestingly, a Trump win coupled with the Republicans recapturing the Senate means a larger stimulus package can be expected, as they could immediately reward voters for their wise choice. So it’s a barbell, sweep with either party and well . . . party, but split the vote and suffer the consequences.

Blue Wave

For our purposes, we anticipate a Blue Wave. Polling can often be inconclusive and flat out wrong, but we doubt polls aren’t off by 10% (Biden’s current lead). We know that’s national polling and you have to dive into the electoral college map, but in doing so, we believe the President has a tough road ahead. We’re less than three weeks away now and barring a Biden/Harris campaign collapse, we’d paraphrase the late-great-Laker announcer Chick Hearn and say that this one’s in the refrigerator, the Jell-O’s jiggling and the butter’s getting hard. More importantly, Republicans are telling you the polls are accurate. Parties don’t turn on their own unless it’s survival.

Looking further ahead, if we assume a fiscal stimulus won’t pass before the election, then we’ll have to wait until post-inauguration when a Blue Congress can deliver a package. A Republican Senate in a lame-duck session will have no motivation to help out the incoming Democrat in the White House. In fact the weaker the economy, the better the political landscape (for Republicans). This also means that President-elect Biden will likely need to focus on the economy as soon as he takes office, thereby tabling tax reforms, etc., which means we don’t anticipate those rule changes (e.g., increasing corporate tax rates from 21% to 28%) to be “in play” until 2022. 2021 will be all about the stimulus and recovery.

Vaccines and COVID

Assuming a Blue Wave, we can expect the market to muddle through as it awaits a larger spending package. We anticipate a COVID vaccine can buoy the market in the meantime. If all works out, Pfizer/ BioNTech should release preliminary data in the coming days and then apply for emergency approval in the third week of November. Following Pfizer’s data release, Moderna should be second (in November), followed by AstraZeneca (outside of the US) and JNJ (Q1 2021). The companies have already begun manufacturing at risk so vaccinations will begin shortly after approval. Goldman Sachs anticipates there will be 560M doses of all vaccines available by year- end. Credit Suisse has a slightly higher 700M figure. Given population figures, the developed world will quickly have a surplus of vaccines as manufacturing runs increase in early-2021.

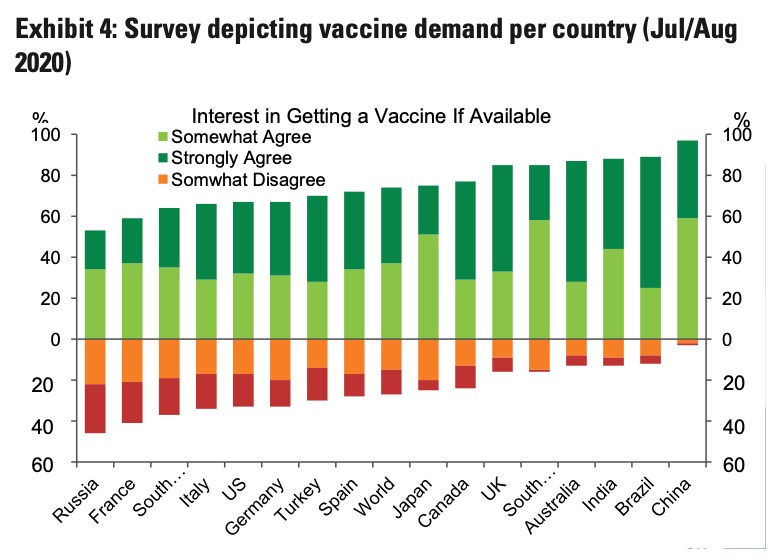

As the US has elected not to join COVAX (and pool/share vaccines under WHO’s framework for equitable distribution), our vaccination rates will initially be higher than the world (though it will taper off faster as vaccination compliance is lower in the West).

Over the long-term compliance rates in other countries (particularly Asia) will be higher.

In the beginning, first responders and higher risk populations (i.e., elderly and those with co-morbidities) will be the first to be vaccinated. Given our robust logistical medical supply network, we think the ramp in production and distribution will occur quickly. The Pfizer vaccine requires refrigeration (transportation with dry ice) and two doses per vaccination, so it’s logistically more complicated to handle than a flu shot. Nonetheless plans have been laid to distribute the vaccine with national supply chain companies such as McKesson, which should insure a smoother roll-out.

As for COVID cases and hospitalizations, we’re seeing this currently in the US.

The above is data from The Covid Tracking Project. Cases continue to spike on a 7 day average, but notice hospitalizations (i.e., those currently hospitalized in the US)? We’re waiting to see if that’s peaking. Prior trough-to-peak timeframes ran about 6-7 weeks, so we’re hoping we’ll see the same thing here in this “third wave.” Here’s deaths:

Thus far, the number of deaths per day have stayed low, which again speaks to the greater availability of efficacious treatments than in March/April. Suffice it to say, COVID fatigue and the economic harms of total lockdowns means governments have shied away from large scale closures and kept schools open. So although COVID continues to sweep through the states, the economy can still recover.

Join the Distribution List

So that concludes this letter. We’ll endeavor to send these out weekly, so if you would like to be added to our distribution list click on the subscribe button above. This is our start and it’s our invitation to you to join us and share your thoughts. Welcome to Open Insights and let the conversation begin.