Review of Peloton's Qtr Results: Another Beat and Raise

February 10, 2025.

Three words to summarize Peloton’s (“PTON”) Q2?

Beat and Raise.

Yup, that’s about what we expected.

The big arrow? That’s the Q2 Actual performance. PTON pretty much beat on every metric, and most importantly the profitability ones (Adjusted EBITDA and Free Cash Flow (“FCF”)). Going into the quarter, we had a strong suspicion that the company was sandbagging guidance, underselling expectations so they can exceed them, and sure enough they did. The market did too, but still found it pleasantly surprising, sending the shares up +12% for the day. So after reviewing the numbers, what’s our take? Expect more.

Updated FY 2025 numbers were all pushed higher. PTON gave shout-outs up and down the leaderboard.

Subscriber counts? 2.715M to 2.76M, check

Revenue? $2.45B to $2.455B, check

Gross Margin? 49% to 50%, check

Adjusted EBITDA? $265M to $325M, check

FCF? $125M to $200M, check

Yet, as great as they were, when we looked at them, like Matthew McConaughey’s character in Wolf of Wall Street, we said . . . “those are rookie numbers.”

Again we go back to the FY 2025 guide. Let’s just pretend PTON’s updated Q3 guidance is correct (though we think it’s understated), and the full fiscal year guidance is right. If so, then that means subscriber counts are projected to fall off a cliff by ~15% to 2.4M subscribers in Q4 (i.e., about 7x what we typically see).

Given historical cadence, you can see above how improbable that is. It’s not just us, but even PTON’s own full year revenue guidance conflicts with their updated Q3 guidance. Why? Because though you lose nearly 400K subscribers paying ~$40/month, the projected revenues for the full fiscal year imply that the topline dollars decline by only half what you’d expect in revenues, which makes little sense unless you believe PTON will sell much more hardware to offset the lost subscription revenue in the Spring (which it historically does not). So taken together, we’re setting up for another beat and raise. The investor relations team at PTON along with the C-suite have already gamed this out, and if we know it, so does the Street. So don’t be too surprised by the reality of a beat. Everybody loves positive earnings momentum . . . it does wonders for a stock multiple.

What about expenses? Well operating expenses should continue to decline as we head into H2 2025, though not as much as H1. Remember that $200M of cost restructuring announced in May 2024 (“Restructuring”)? Much of it has already flowed through by last quarter. It’s important to remember that the $200M Restructuring included $100M of headcount reductions with the remaining $100M of savings to be seen “in the next 7 months” (i.e., by December 2024). So if we 80/20 the remaining $100M of savings, that leaves $20M of lower operating expenses to be captured in H2 2025.

Still we think marketing expenses will still continue to come down, and by more than announced. Eventually, marketing likely settles ~20% of revenue, which would be a far cry from 24.4% we saw in FY2024 (Q3/Q4 2025 are projected).

That’s 2025. For 2026, things get a bit more complicated. It’s important to note that PTON has been selling significant stocks from its inventory, so some of that FCF we’re seeing this year is coming from the fact it hasn’t needed to reorder bikes, treads, rowers, etc. from its manufacturers. As inventory levels right size that tailwind to FCF will turn into a headwind as they’re forced to replenish stocks, so something to note as we get into 2026.

For now, it looks like PTON is keeping around 3 months worth of stock on hand, though we anticipate this will trend lower before we finish the year.

What PTON is now, however, is a cash generating machine. Adjusted EBITDA for FY 2025 is guiding to $325M and FCF of $200M. Updating our figures, we think $380-400M is more likely, with FCF coming in at ~$240M to $260M.

So how does the company bridge what it’s worth today at ~$8.30/share to where we think it should be ($10-15/share given current guidance)? Further expense reduction and growth.

Slashing Costs and Growing

For the first, we briefly discussed it in our last article.

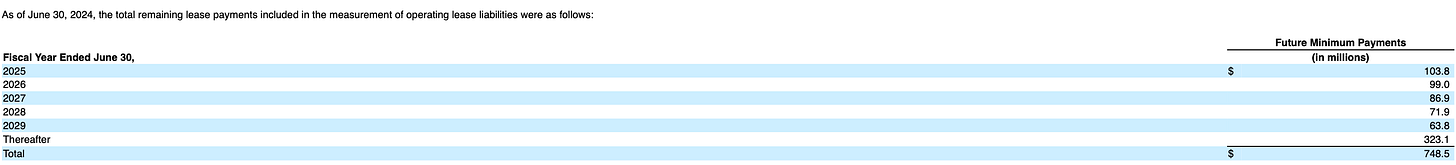

The company’s G&A expenses are still too high for a company of its size, and a large part of that is due to the high fixed infrastructure costs. The CFO addressed some of this in her remarks (i.e., it’s related to IT and office leases), and if we take a look at their lease commitments, PTON has a way to go.

The office leases are particularly sticky though, and unless PTON exits, or is able to sublease the space (difficult given the vacancy rates for commercial real estate post-COVID), we have to assume the figures above will be around for awhile. Just as an example, PTON leases 300K/sq ft of HQ space near Hudson Yard in NYC at a cost of nearly $95/sq ft. In 2022, it had tried to sublease about 1/3rd of the space, but we’re unsure how successful it’s been in doing so. On the fringe though, the closure of retail locations should bring lease obligations down, but “low hanging fruits” these are not. G&A does need to come down, but the fruits hanging higher-up will take longer to pluck. As for IT leases, there’s less information as to how long and how much those are, so we’ll wait for updates on it.

Growing Revenue

That’s what it’s about now. Keep churn down, keep your subscribers subscribing for longer, and keep them happy. That’s preserving the moat, but what about expanding it? For offense, we have to get revenue up, which really means getting subscriber numbers up. You can get revenue up in a few ways. Raise prices and/or increase the number of customers, preferably both. For prices, sure, the company can raise prices. Tack on $5/subscriber and force them to pay $49/month, and all of that revenue free falls to the bottom line. 2.8M subscribers * $60/year = $168M of extra revenue that’s pure profit. From our own estimates, Adjusted EBITDA and FCF suddenly jump to $500M and $400M, respectively. Slap a 10x multiple on that new cash flow and suddenly this stock zooms from $8/share to $12-$15/share.

We’ll probably see a bit of a higher churn, but not much more. Can PTON do that?

They could.

Should they? No . . . not yet.

You don’t want to turn-up the heat on your subscribers if your business is viewed as a melting ice cube of members. PTON needs a plan, and more specifically, the CEO Peter Stern needs to come up with one. Based on his comments in the conference call though, we think he’s working on it and will unveil it as the calendar year progresses. In the meantime, PTON can continue to minimize its already low churn rate. We can see it in metrics below (Greenlight’s RobinHood Presentation on PTON).

1.2% for the latest quarter, and a projected 1.2% for the next quarter. PTON’s churn for the quarter fell close to half of Netflix’s 2.3% . . . and we know, NOBODY CANCELS NETFLIX. What’s particularly interesting is that if you read between the lines, churn could actually fall further. Here’s Peter (CEO) on the conference call, followed by Liz (CFO).

Let’s parse those words a bit. Members who engage in 2 or more disciplines have a 60% reduction in churn rate. If your average churn rate is already an anemic 1.2%-1.9% depending on the quarter, any further reduction and you’ve become the tar baby of subscriptions . . . super sticky.

Makes sense though doesn’t it? Like anything, the more you use something, the more likely you’ll keep it, which is why this is the proverbial Trojan horse released last quarter.

The PTON Strength+ app. It’s a PTON app specifically designed to provide members with customized strength training programs. Based on your inputs (type of equipment you own, the muscle groups you want to work, and workout time), the app uses AI to custom generate a series of programs to meet your needs. The app costs only $9.99/month, so it’s not terribly expensive, but would allow PTON to enter the “gym space.”

One of the key challenges for PTON has been the in-home centric connected fitness experience. As COVID restrictions lifted, gym memberships grew as people chose to work out communally, and PTON has been stuck in the low growth at-home market. As PTON promotes the Strength+ app and refines the PTON App+ (which provides the more traditional instructor led classes in yoga, running, biking, pilates, etc.), it has the ability to cross-market to customers who prefer to work out in gyms, but now have a customizable software application to guide their workouts. What’s particularly intriguing about the Strength+ app is that there’s no music, so you can play your own podcast or music playlist to accompany the workout. Since music royalties are the largest component of Connected Fitness Subscription COGS, PTON can generate higher margins when members use the Strength+ app (and even gamified experiences like Lanebreak). We don’t anticipate this to be material, but it should help control/reduce PTON’s COGS by decreasing music royalty expenses.

More importantly though, the app effectively allows PTON to “meet members in more places” (in Peter Stern’s words). More customers partaking in the PTON experience in locations outside of the classic “in-home experience” would certainly be a win. If we pair the apps above with niche PTON gym collaborations (i.e., like the LA Fitness Peloton room), we may be seeing the first inklings of the company’s new strategy.

Whether the strategy will garner more subscribers remains to be seen, but at the very least, if more existing members embrace a few different modalities, it should help keep PTON’s low industry leading churn in check, which provides a solid foundation to grow on.

Overall, PTON’s Q2 results were a home run relative to Wall Street’s expectations. As earnings momentum starts to gather, and enthusiasm around the new CEO’s strategy crystallizes (whenever he reveals it), we should see the stock appreciate further. Even based on a conservative multiple, the shares should trade in the low-mid teens with today’s expected guidance. Running into the 20s and 30s though will require topline growth. TBD, but PTON’s certainly been hitting its stride.

Keep it up, and together we’ll go far.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.