Rudolph With Your Nose So Bright, Won't You Guide the Fed Tonight?

December 17, 2021

So the big news this week was undoubtedly the Federal Reserve’s (“Fed”) last meeting of 2021, held on Wednesday. Days before, Wall Street analysts had surmised that with the elevated inflation data, the Fed would be forced to accelerate its tapering of Quantitative Easing (“QE”), from $15B to $30B per month, ending the program ahead of its March meeting. Doing so also effectively pulls forward the end of QE and sets us up for raising interest rates.

Sure enough the market got what it expected as the cabal of central bankers pulled back on the monetary reins in an attempt to keep the economic reindeers from surging too fast. You could almost hear them collective scream “whoa Dasher, whoa Dancer, Prancer and Blitzen, Comet and Cupid, Donder and Blitzen.” Whoa even Vix . . . by the way, who names a reindeer “Vixen”? Still, like a Vixen, economic indicators are coming in . . . hot.

Producers and consumers are experiencing decade high bouts of inflation, and more is set to come. Yet with Rudolph’s guiding light and their dashboard of economic indicators, our central bankers may have a path forward.

Double the QE tapering and 3, yes boys and girls, 3 hikes of . . . the most famous fund rates of all (as evidenced by the Fed’s “dot plot,” a polling of central bankers and what their targets are for the fed funds rate (notes below are ours)).

By the end of 2022, we’ll likely see fed funds rate increase from the current 0.25% to . . . wait for it . . . 1.0%! Clearly this needs to happen because again, inflation keeps sliding down our chimneys and really jacking up the prices of those milk and cookies for Santa.

Remember, the Fed has two mandates: 1) price stability and maximum employment. With employment levels fairly robust and unemployment likely headed lower in the coming months because of the historically high number of job openings, Fed can now shift its focus to price stability. So inflation must be tamed, and the Fed is beginning to tame it.

Is it though? Because can a 1% fed funds rate (a whole year from now) really temper a 6.8% YOY inflation figure (one that we actually think is understated and set to rise)? Isn’t that akin to throwing a snowball at the sun? Sure, a higher fed funds rate will push up Treasuries and bonds with longer maturities (i.e., the 3, 5, 7, 10, 20 year treasuries), but perhaps not sufficiently, which leaves it to the market to “price-in” the higher expected inflation. For now, it’s doing so, but only on the front end, which means the market is again saying that this inflation thing? Kinda transitory even if the Fed has abandoned that specific term.

Maybe. Maybe it’ll be transitory. In theory, making money (i.e., credit) more expensive should reduce spending. Reducing spending should drive down demand, and less demand leads to less inflation, but that’s in theory, and it reminds us of that quote from the famous bagel franchise owner.

“In theory, theory and practice are the same. In practice, they are not.” - Albert Einstein

Maybe it’ll be for just 2022. We’ll see how the year unfolds, but wage increases tend to beget higher prices, which begets more wage increases. So we’re not so sure 2022 will spell the end of higher inflation.

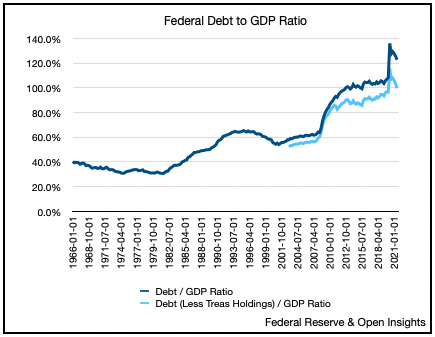

Heck, we’re not even sure the Fed wants that. We’re not sure they’re willing to sacrifice growth and our economic recovery at this stage, nor are we even sure they could given our elevated GDP/debt ratios.

In truth, and this is the truth, we need inflation to absorb the monetary avalanche we intentionally set-off in 2020-2021. Our GDP/debt ratios are at such extremes that no amount of blame shifting, tax the rich/Big Tech, spur economic growth/productivity, improve bilateral trades, tighten tax enforcement talk can possible right the ship. Yet if you spike that GDP while slowing the debt accumulation, you could reverse the trend. Since defaulting, adopting austerity, and substantially growing our way out of this financial conundrum are political non-starters or unlikely, the only way out of this mess is to spike GDP . . . with inflation. We wrote about this almost a full year ago, and we’re now coming back full circle.

So we need to endure higher inflation for awhile longer. We’ll choose stronger inflation over slower growth, and despite inflation’s deleterious affects on the lower income classes, we’ll swallow those social consequences in whole and instead “redistribute income” (i.e., via taxes/child care credits/student loan forgiveness, etc.) our way around it. In truth, and this is the truth, maybe it’s not Rudolph guiding us, but the Mandalorian because . . .

It’s always been the way, it’s the only way. Address growth first (real or just in prices) and deal with inflation later. So tug on the reins you central banking Santas, but we should all know, you’re not tugging that tightly. Just as we knew the word “transitory” didn’t make much sense a year ago, we also know “reining in inflation” will fall into that category.

Tech Ripples

Still, even a small pull could translate to large corrections by the herd. Tech, and by tech we mean the unprofitable, high-growth story stocks in tech, may continue to cascade lower as the hissing sound you hear is the market bubble for these high flyers beginning to burst. Just look at this chart from Charlie Bilello:

We can talk about how interest rates affect DCF models because the higher the rate, the higher the discount on cash flows. In turn, the lower the present value of those cash flows and the value of the asset today. Really though, we think Buffett explained it best, rates are like gravity, and the higher they go, the stronger they’ll pull on asset prices. This is particularly true for story stocks, the ones where profitability is years away. “One day” they will dominate. Sure, but increase interest rates and the discount rate on those “one day” future cash flows also changes, and it’ll definitely change the valuations today. We’ve written about this through the year, and although we highly doubt anyone did a real DCF model on these companies, the point stands.

So now we’re bifurcating. The market is sifting through a lower growth world in which inflation will likely push up both interest rates and the prices of goods. If so, then the market should begin to sift through two things. Companies that have the pricing power, the competitive advantage, to be able to pass along those increased costs (e.g., Big Tech), and the commodity producers or players whose assets are becoming increasingly valuable (e.g., commodity producers) or whose businesses perform better in a higher interest rate environment (e.g., financials). Either way, what isn’t the way are story stocks priced not for perfection, but imagination. The fairy tale narratives that scream “we are the future.” Maybe so, but that day is not today, and that day is further delayed as we see rates rise.

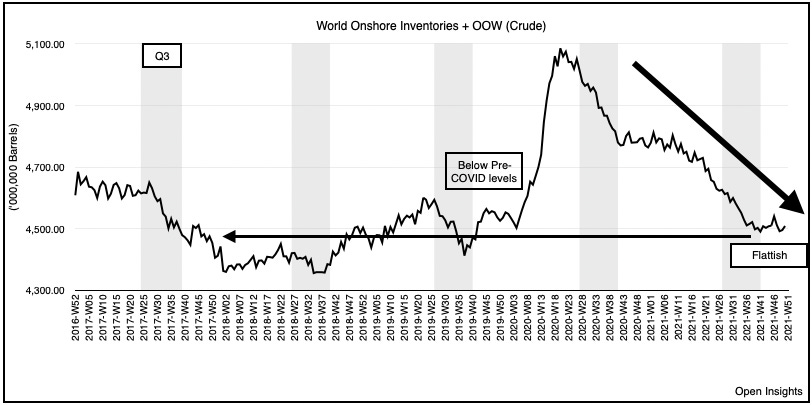

Oil

As for oil, a quick note. These two pics are what we’ve been focused on this week The first is global inventory balances. Globally, onshore inventories continue drawing, but we’re seeing oil on water increase to offset that. Producers are shipping more and that’s offsetting the declines in onshore storage. This may be temporary as oil on water fluctuates, and if it falls slightly from the recent surge, then the onshore declines will show up (as we aggregate the two together to get a picture of “everything in the system”). For now, balances appear flat for the past few weeks.

Second, this picture.

This is US product supplied as reported by the EIA. We’ve used this chart as a proxy for product demand in the US, and it’s also a good indicator for “how are we doing during COVID.” Well by the looks of it, we’re doing quite well despite the media headlines of higher COVID cases and Omicron transmissions. Mobility seems to be increasing and demand continues to stay high.

Note that for 2021 the chart above compares this year to 2019 and not the artificially depressed 2020, which is to say, product demand for the Big 3 (gasoline, diesel, jet fuel) (i.e., things that move things) and products that make/heat things (i.e., other oils and propane) are both higher than 2019 in the past few weeks. So despite oil’s recent volatility, consumer demand appears robust as we enter the holidays. Europe is under greater mobility restrictions, but demand there looks to have plateaued, and not fallen materially, with jet travel only slightly depressed. Asia looks largely unaffected for now. Ultimately, inventory balances and oil prices will drive off of demand as we head into Q1 and the winter season, but thus far, it’s looking positive as we close out the year.

One more note for next week before we head off for the holidays, so expect that sometime early in the week. Meanwhile, happy holiday shopping this weekend and thanks for boosting those retail sales.

Please hit the “like” button below if you enjoyed reading the article, thank you.

Excellent

One of the major factors, as inflation takes hold, is the shared expectation in the business community of the need to keep rising prices to counter it. At some point you have to supply a shock to the system to bring that impulse under control, that is generally done via a recession.