Ruh Roh, Why 4% Unemployment Worries Us

June 7, 2024

Ruh Roh?

That was my first articulate thought. To what?

To this.

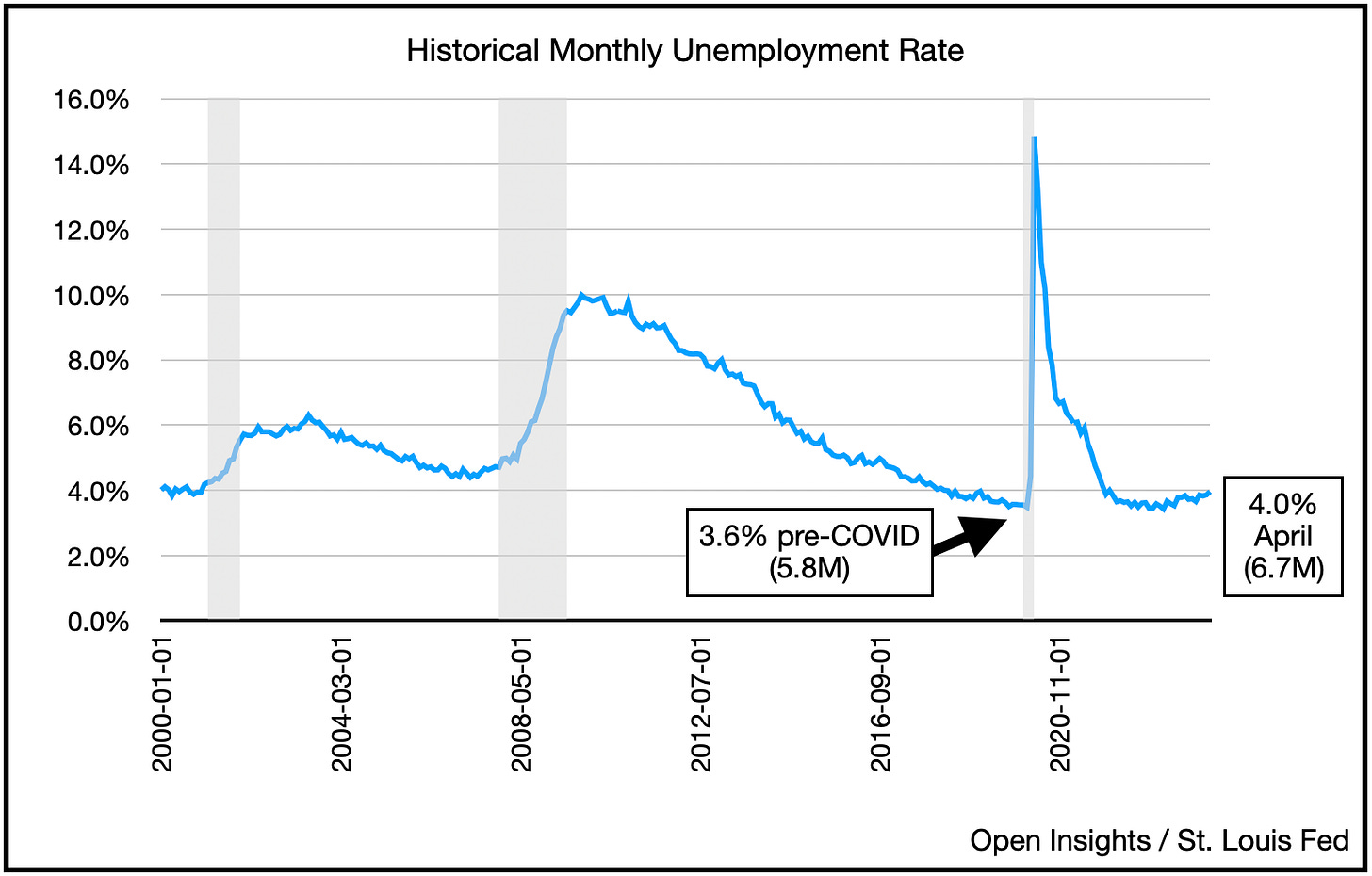

4%.

Unemployment rate hit 4%. It’s just “another number,” but this one I tend to worry about a little bit more. You know, it’s a consumer driven economy after all.

Yes, yes, 4% is historically low, we know that, yet something quirky starts to happen around 4%. 4% seems to be when the wheels start getting wobbly on the Mystery Machine. Here’s the same chart, but zoomed out by oh . . . . 75 years.

See what I mean? Them gray lines? Recession. If you want to see it another way, here’s a Charles Schwab table that’s always been interesting to me.

Historically, unemployment rate has troughed around 4.3% before a recession starts, and once the recession starts, unemployment rate registers around 4.7% average.

Post-COVID, unemployment rate hit an extremely low 3.5%. You know the reasons, labor constraints and mass retirements severely depleted the labor force. Even today, we’re still seeing a residual drag from this shift. Some people have just checked out, and they’re sticking to that decision.

So 3.5% as our trough is probably too low. Go back to the average and if we’re looking at 4.3%, then we’re already plowing towards that direction.

Job openings data for April didn’t particularly boost our confidence either (that came out 3 days ago). As background, the unemployment data above was for May, whereas the May job openings data lags by a few weeks, so we get April first, and as of April, it was still trending lower.

Now there are still 8.1M job openings, about 1M more job openings than immediately before COVID (left chart), and 1.6M more job openings than unemployed (right chart). Despite the “robustness” of these numbers on an absolute basis, what’s clear is the trend. Job openings are trending lower.

More contemporaneous data seems to indicate that they will continue to trend lower. Here’s Indeed.com’s online job postings by employers . . . see the trend?

So unemployment rates are a bit of a “jobs today” whereas job openings hint at “jobs tomorrow.”

What’s equally as interesting is wages. As job openings trend lower and unemployment higher, one would think that wage inflation would begin to decline. That has not been the case. Year-over-year wage inflation continues to be sticky near 4%. It again notched 4.1% in May (YOY % using average hourly wages). So while inflation is making those Snooby Snacks more expensive. Wage increases are keeping pace as “real average hourly wages” are still in positive territory.

If you’re wonder where wages are going, they tend to follow job quits, which kind of makes sense. Quitting employees tend to be a leading indicator because it probably means they have mobility, they have options. They’ll quit for better jobs, which usually translates to better pay.

So again, same trend . . . 4%-ish, notice that we’re still a looooong way from the historical 1-2% wage increases. Again wage increases lead to service cost inflation, and services is nearly 2/3rds of what we spend our money on. So inflation may be stickier than we think. This could change though if the economy deteriorates, and that may be the biggest mystery to solve.

We know the above is a bit to digest, but these are the clues. Overall, in the past week we’ve seen a flurry of labor data released, and if you step-back and view it holistically, we’re starting to see the downtrend. Let’s not be overly dramatic and claim that there’s evil lurking in the mansion, but something is definitely creaking in the manor and it’s worth investigating.

Remember the market is a relative-front running machine. What we mean by that is it cares much more about the near-future than it does about what’s occurred, or what’s currently happening. Unless it’s an immediate red flag, it’s all about the future, and your perception of it vs. mine. Since we express our viewpoints through our positioning (i.e., our investments/bets), it’s all about getting pre-positioned and beating you to the buy or sell.

We’re not saying that a recession is imminent, but just play out the fact pattern above. The consumer drives this economy, and the fuel for that engine is wages. Before wages though comes jobs, and though job openings are still above pre-COVID levels, and unemployment is arguably low vs. pre-COVID periods, on a relative basis, they are deteriorating from where we were 6 months ago. The trend has been steady and consistent, and that trend has been lower.

Fast forward another 3-6 months and you can begin to see what’s to come. Unless we U-turn the economy, and consumption increases, on a relative basis, we’re more likely to see lower job openings and higher unemployment as we cross into H2 2024. Moreover, what happens to consumers, their jobs, and the economy at large, will likely drive the electoral outcome in November . . . and in turn, the stock market’s reaction.

Life happens fast, and the relative-front running machine faster. On and absolute basis things are “fine” today, but on a relative basis? They’re certainly getting less so.

Ruh Roh indeed.

Please hit the “like” button above if you enjoyed reading the article, thank you.

I agree, we need to inspect the foundation, although nothing is collapsing yet