Salmon vs. Tsunami

March 10, 2021

Hmm . . . well that’s interesting, we actually may be wrong. Well, not that interesting if you consider we’re often wrong, but maybe about some of our original COVID thoughts. Let’s clarify that, the timing of what we thought.

Remember we said this about the coming global economic recovery in our previous article “Here Comes the Rich Zombies.”

“Capacity constraints will abound, call it asymmetrical demand meets finite capacity. The travel, restaurant, live entertainment, and other industries have cut capacity to the minimum in order to simply survive, and they won’t add capacity until we have additional clarity on the success/efficacy of the vaccines as they roll out.

As we vaccinate the high-risk population in January/February, COVID deaths and hospitalizations will dive. Nonetheless people likely won’t begin booking vacations until they receive their vaccinations, and for some that will be in April/May, which means bookings (i.e., demand spike) could come right before the summer season, leaving companies with little time to increase staffing. Even if they do, they’ll add capacity cautiously, unwilling to commit opex/capex in the event the pandemic recovery takes more time. This also means that these companies will likely be capacity constrained for the back-half of the year, and perhaps even into 2022.

It’s simple supply/demand, but with the added twist of a pandemic, which compels companies to be conservative and only add capacity when the hordes are assured, which means it’ll be too late. The onrush means prices will spike. Airline tickets, hotel fees, car rentals, etc. In turn, that means margins (i.e., profits) will leap.”

The above was predicated on the thought that as we vaccinate and venture out, recovery would begin occurring in April as Spring Break and Easter travel increased, followed by a “BANG ON” summer whereby hordes of pasty white zombies who’ve sheltered at home for the year expose themselves to UV rays and reunite with other hordes of melanin challenged friends/family. We, however, may be wrong. They’re coming and they’re coming fast.”

So are the zombies not showing up? Are we not going to have a “BANG ON” summer? Quite the opposite. They seem to be congregating already.

Come Fly With Me

As we look at daily flight tracking data, we’re noticing a pick-up lately. The chart on the left is total number of flights worldwide and the right is subset, commercial flights. See the trend?

Note that these are 7 day moving averages, so they aren’t “one-day” blips of data. What we’re seeing is a material improvement in the number of flights globally. If we drill down into the number of commercial flights, we can also see an increase. Since mid-February, we are averaging almost 40,000 more flights per day and 10,000 more commercial flights per day. March is off to a strong start, recovering from the dip experienced in January/February as COVID reasserted itself, but as vaccination programs accelerated, so too has confidence in traveling.

We’re seeing this data confirmed in the US as well. For instance, the Transportation Safety Administration tracks the number of passengers who pass through security checkpoints at US airports. These stats have also taken a leap. Sunday’s count of 1.28M passengers was the highest since the holidays, and the 7 day moving average has now exceeded 1M passengers a day, a figure we haven’t breached since March 2020. People are definitely moving, and they’re moving fast.

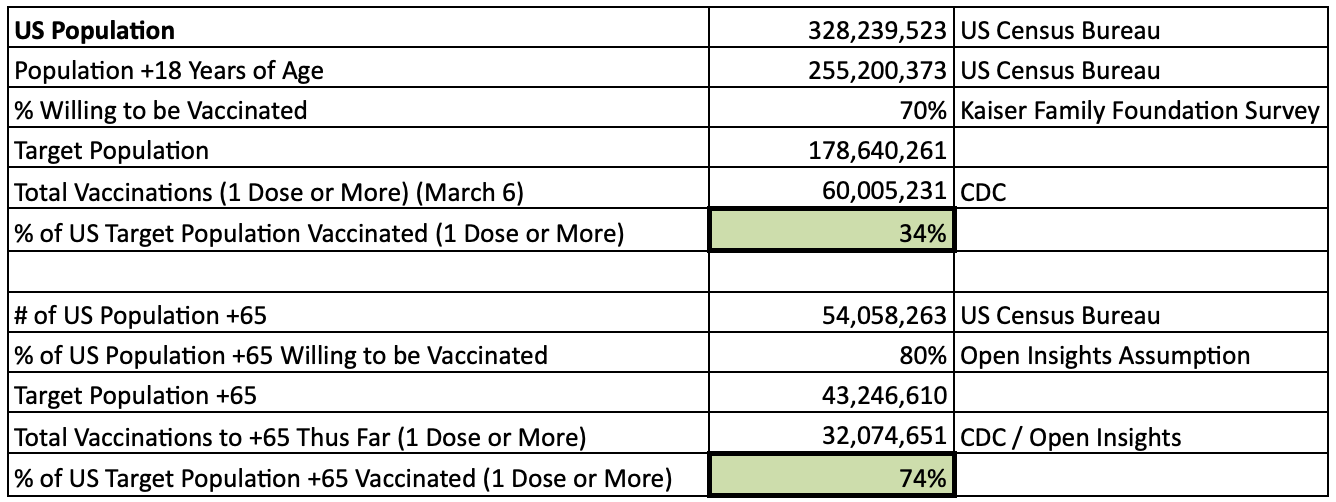

This is largely explainable by how effective the vaccination programs have been. COVID cases, hospitalizations and deaths continue to fall, which is giving people more confidence in the vaccine. Recent surveys have shown an increasing willingness by people to receive a vaccine, which feeds into a self-reinforcing cycle of higher number of vaccinations, better clinical outcomes, better COVID data, and increasing confidence in the vaccinations. For our purposes, we’ve yet to change our underlying assumption on the % of those willing to be vaccinated, but even if we use our baseline 70% assumption, we can see 1/3rd of the US target population has received at least 1 shot, and almost 3/4 of those over 65 have received theirs.

Jobs, Jobs, and More Jobs

So as we reopen, we had initially expected the crush to overwhelm the constrained leisure and hospitality industry. We had visions of pasty patrons armed with stimulus checks descending on unsuspecting vacation villas ill-equipped to handle the crowds.

What we hadn’t anticipated though was an early pick-up in hiring. The February jobs report published last week showed a month-over-month improvement in employment. Unemployment fell from 6.3% to 6.2%, a minor change, with total non-farm payroll adding 379K jobs. Most of those added jobs came in the leisure and hospitality industry.

If we compare February 2020 figures with February 2021 figures, there’s about 870K more unemployed workers (top chart) in the leisure and hospitality sector, but last month we added almost 370K jobs in that sector (bottom chart). Note the top chart is only measuring the “extra” unemployment in each sector from Feb 2020 to Feb 2021, as we’re attempting to isolate the pandemic’s impact on unemployment.

Although the first chart is a seasonally adjusted figure, and the second non-seasonally adjusted, the directionality is what we’re looking at, and that’s in a firm uptrend. We are adding jobs in the most impacted sector. We also need to bear in mind that this was February data, a time when the vaccination programs had only just begun. March figures should be even better.

Per Goldman Sachs, 2/3rds of the remaining job losses are in highly virus-sensitive sectors. Thus, if we reopen quickly, then the jobs rebound should inflect sharply. Despite our 6.2% unemployment rate today, the firm forecasts that we’ll end 2021 at 4.1% (vs. 3.7% in December 2019). This isn’t far-fetched as both leisure & hospitality and retail should see significant demand increases going forward if travelers and patrons return in droves. Even government jobs should rise as the latest stimulus bill (the aptly named American Rescue Plan Act (“ARPA”)) provides state and local support.

Financial World vs. the Real World

Interestingly, while the “real world” continues its recovery, the financial world has suddenly become jittery. As the economy reheats, the question on everyone’s mind is does inflation? Certainly if we look at the bond market of late, investors are anticipating more as inflation expectations have risen. On the 5 year Treasuries, inflation expectations has risen to 2.4%.

On the 10 year Treasuries, it’s increased to 2.2%.

We can see the deleterious affects on interest rates as both have trended up sharply. As inflation expectations rise . . . so too does interest rates. The 10 year Treasury increased from 1.3% to over 1.6%, but has settled back to 1.5% as we type. Yet, that small move upwards promptly induced altitude sickness for high-flying growth stocks, SPACs and other tech stocks last week. What happens when inflation really ramps?

We’ve long been on record to say that inflation, inflation expectations, and in turn interest rates will continue to rise as we reopen because:

This is the staggering amounts of money we are effectively printing,

Why this time it’s different, and lastly

Market commentators will no doubt shift from saying that the recent rise in inflation risks are transitory, a byproduct of the reopening economy. As economic growth heats up, as demand rises, we can always expect inflation to increase. Yet, that’s the interim step; the justification used to soothe frayed nerves when the market corrects. It’s also the initial arguments proffered as we march steadily into a secular environment of higher inflation. As we noted previously, we’re merely experiencing the initial repercussions of what’s been happening all these years. A confluence of factors that will lead us into a higher cost environment later.

Whether it’s because supplies will underwhelm or demand will overwhelm, the consequences will be the same. The basic raw materials and fuel that powers our collective economies are getting more expensive, and that added cost will ripple through.

What’s adding to that cost is the desire by wealthier countries to tackle climate change. Decarbonization and electrification are the goal, but as we siphon capex from old energy to new energy, energy simply gets more expensive overall. In addition, for metals and rare earth elements, our demand will increase because not only do we want to sustain our current living standards, but we also want to begin building the new one. Whether it’s energy and/or raw materials, our consumption is increasing just as supplies are slow to return. In the end, the fallout will be on prices.

The Tsunami

Nonetheless, how does the market react going forward amidst a higher inflationary backdrop? That’s likely a longer-term issue. For now, we still think the market will march steadily upwards. Growth stocks, meme stocks and tech stocks will not only recover the recent dips, but regain strength as they build towards a new high.

The just past ARPA means $422B of direct stimulus payments are about to be air dropped on the eager public, and if this survey by Deutsche Bank (via CNBC) is to be believed we’re about to see almost $200B of it land in the stock market.

We know it only talks about $170B, but let’s look at the prior checks shall we?

So yeah, we’ll err on the side of a larger figure. Let’s say $200B. $200B can do wonders to these stocks. TSLA trades about $25B worth of shares per day. $200B is also just the start. Add some leverage in the form of options, derivatives, margins and it’s exponentially more than $200B. Sprinkle in some broker/dealer delta/gamma hedging, mix well, and serve hot. For now, the Nasdaq came close to, but bounced before it touched the 200 day moving average. Today it’s in full rally mode, and you can expect that to continue in the coming weeks. ARPA just passed the House and now it’s on its way to President Biden. By next week, checks will begin landing in bank accounts.

In the short-run, we’re anticipating a blow-off top. When the entire ownership of a company like GameStop changes hands every 1-2 days, we’re well beyond fundamental analysis. This is a trader’s market and a momentum driven one. We’re playing musical chairs at lightening speed with reopening juicing recovery stocks and stimulus checks juicing momentum/tech/meme stocks. We have an accommodating central bank and we have a government contemplating the next big fiscal infrastructure package. The market’s going higher, inflation’s going higher, everything’s going higher. It’s hard to be salmon swimming against a tsunami. For now, just go with it. Like we said . . . it’s gonna be sooo EPIC.