Sentiment Leaves When Things Get Too Taxing

March 28, 2021

So last week we looked at how the American Rescue Plan Act (“ARPA”) played out in terms of how the funds were distributed and who stood to benefit from fiscal spend. Shortly thereafter, we began seeing news articles about the forthcoming infrastructure bill. This next round of stimulus, part of the Democrat’s agenda to “Build Back Better,” will be directed at repairing our country’s crumbling and long neglected transportation system (e.g., roads, bridges, waterways and rails) and upgrading our power grid.

There isn’t much debate about the need for such improvements, just who will get credit. Republicans were eager to pass such a bill during the Trump Administration. Despite that, we fully expect the current political rancor to force Democrats to pass the bill via reconciliation and side-step Republican opposition. By the time the bill passes (sometime in Q3), we’re looking ahead to 2022 mid-term elections and Republicans are likely to run on a platform of “fiscal prudence,” and attempt to paint Democrats as big government and wasteful spenders.

In contrast, the Democrats are doubling down, refusing to let their Congressional majority go to waste. Democrats have also proposed a separate education/anti-poverty bill that addresses domestic priorities, child care, free community college tuition, universal pre-kindergarten, etc. The administration knows that while the infrastructure bill could garner some bipartisan support, the education/anti-poverty bill will surely not. Ultimately, expect Democrats to pass both bills by reconciliation and spent ~$3T combined.

That’s T . . . for Trillion

We’ve been throwing around a few Ts lately so it’s become the figure du jour. Our minds can hardly comprehend the figure so it seemingly sounds innocuous. One thousand billions, or we should say three thousand billions, or about $12,000 for every person in the US for both bills. Let’s just step back a bit though and see where we’re at. As announcers would say, let’s recap for our fans watching at home.

Since the start of the pandemic we’ve effectively used monetary and fiscal stimulus to underpin our economy, something we didn’t really do during the 2008/9 Great Financial Crisis (which relied largely on monetary/central bank program/stimulus).

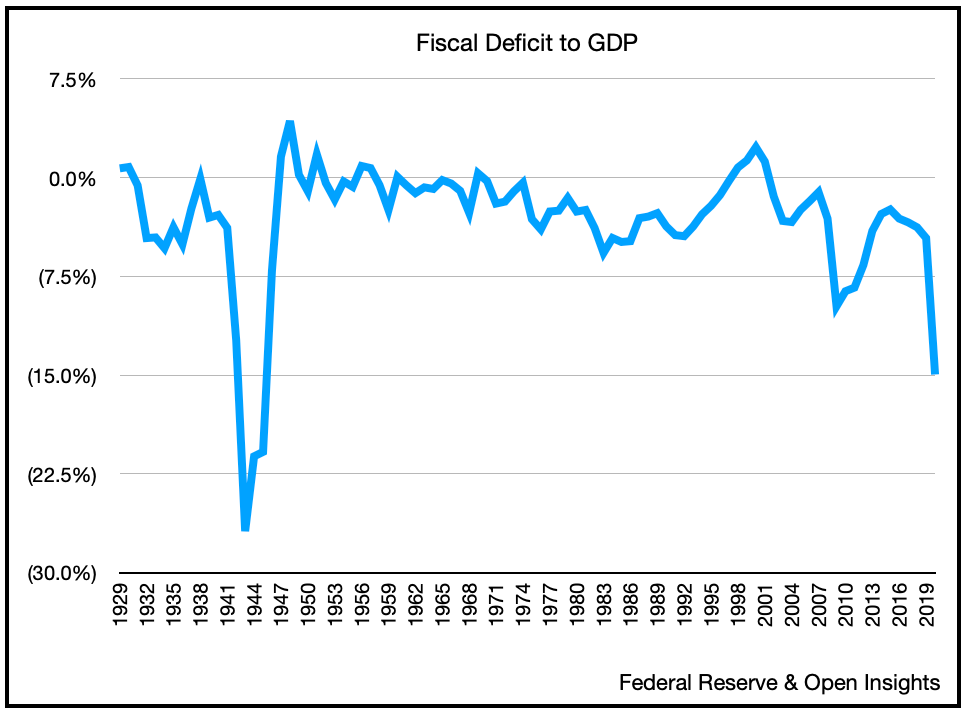

The various COVID bills (~$5.5T) have allowed us to weather a liquidity crisis and avoid a cascading solvency crisis. Hence our recovery has been much stronger and faster, one predicated more on the speed of vaccinations. Further recovery now rests on how quickly our desire to spend (and not our ability) recovers. Our fiscal largesse, however, means we’re seeing historically large government deficits.

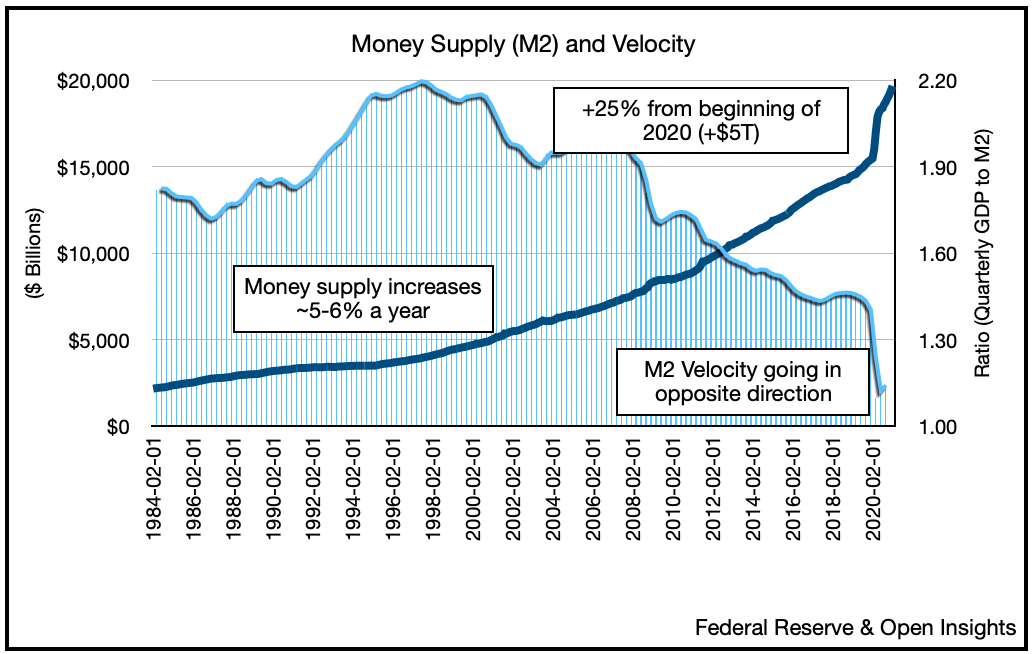

Nevertheless, the spend does means we have vastly more liquidity in our money supply . . .

. . . and in banks (bank reserves).

Our central bank’s balance sheet though has exploded higher.

Not surprising as somebody needs to buy all the Treasury bills, notes, and bonds being printed to sustain the fiscal spend and QE. Foreign and domestic bond buyers just aren’t enough, so again borrow money to spend, and print money to buy back borrowed money. Take out the middle step there and we’re left with spend printed money.

Offsets: Corporate and Individual Tax Increases

So now another $3 Trillion is on deck. Not to worry though as we’ll have offsets, revenue raisers that reduce the costs. These targeted offsets (read: tax increases) will help pay for both bills. First, corporate tax increases will fund the infrastructure bill, and second, individual tax increases will fund the education/anti-poverty bill.

What will the tax increases look like? For corporations, this is likely a partial rollback of the lowered corporate statutory rate by the 2017 Tax Cut and Jobs Act (“TCJA”). Recall that in 2017 corporate rates under the TCJA fell from 35% to 21%. President Biden will likely propose raising the rate from 21% to 28%.

In addition, the administration proposes to increase the minimum tax on global intangible low-taxed income (“GILTI”) from 10.5% to 21%. Companies that use intangible property extensively (i.e., patents, trademarks, know how and copyrights) can “house” them in low-tax countries (e.g., Cayman Island, Bermuda, etc.), and via transfer pricing, shift and base erode profits from higher tax countries. Raising GILTI rates would recapture some of the lost taxation.

Increasing both the statutory rate and the GILTI rate will leave few industries unscathed.

Robinhood, the Federal App

As for individual tax increases, the Biden Administration proposes to increase the marginal tax rate for high-income earners from 37% to 39.6%, and tax capital gains at the highest statutory rate (up from the current 20%). Ostensibly, these proposals will only impact those making over $400,000, so it’s a politically well targeted argument. We’re “redistributing” income from the wealthy to those in need. If you vote against it, then you’re voting against education and pro-poverty.

Collectively all of the revenue raisers will bolster tax revenues by ~$3.3T over 10 years, offsetting the contemplated $3T spend. Now that’s obviously hokey math since the tax revenue is over 10 years, whereas the spend is today. We’re also assuming that the market doesn’t deteriorate significantly so as to make the capital gain calculations suspect, but let’s just roll with it.

Roadshow, but We See Traffic Ahead

We don’t know the specifics yet, but we’ll find out shortly as the administration plans to embark on a road show to begin discussing the bills. What we can say is that just from a corporate tax standpoint, the proposed increases could reduce S&P 500 earnings by 9%. Goldman Sachs estimates 2022 S&P 500 earnings to be $203, but falling to $185 if the above proposals were passed and assuming a 2022 phase-in.

Been Looking for Sentiment All Night, Have You Seen Her?

9%. Let’s think about that figure for a second. The S&P currently trades at 3,974 today (March 26). It’s forecasted to earn $203 in 2022, so a forward PE ratio of 19.6x. Shave it to $185, we’re now talking about a 21.5x multiple.

Now this might not seem like much at a time when we’re seeing 10 Year Treasury rates at 1.66%, but how attractive will an earnings yield of 4.65% (the inverse of a 21.5x multiple) look if 10 Year Treasuries soon yield 2-2.5% in the face of slightly higher inflation?

Even if interest rates didn’t rise much, multiples itself is a measure of sentiment, and sentiment-wise we’re heading from bad, to better, to good, to great, to YOLO Party Blast-off (i.e., euphoria). Once we’re at the last stage of euphoria, what’s next?

If all we’ve known in the past 12 months (a year in which we’ve seen markets race to new highs) is a supportive monetary/fiscal backdrop, improving earnings and rising sentiment, doesn’t removing one leg of the stool begin to threaten those highs? Said another way, anything that’s not better than euphoria is . . . a total bummer.

Biden’s tax proposals, if passed, may just be the start of our comedown. Add that to increasing worries about rising inflation and interest rates, and we’re beginning to worry about two legs of the stool now. After trillions spent and trillions distributed, reality and consequences may just be intruding on our party. Sentiment? As always, she’ll be the first to sense that things are changing.

Like a good book, the story culminates, and then ever so slightly things begin to diminish. Soon enough, it’s the finale. If reality bites (e.g., rising taxation, lower corporate earnings, increasing interest rates, rising inflation, or geopolitical uncertainty) in any way, we’ll be able to shrug-it-off in the coming months because the recovery narrative is simply too strong. Yet the market is always forward looking, and if sobriety and the repercussions of a global liquidity/debt binge awaits, market participants may not wait for the last call. However, you feel about infrastructure spending paired with corporate tax increases, or education/anti-poverty measures coupled with income redistribution, we’re fairly certain . . . talking taxes is a real buzz kill at parties. As a former tax attorney, we know from experience. So watch sentiment carefully, she was the first to arrive, but she’ll be the first to leave when it all gets too taxing.