Shooow Me the Inflatiooooon . . . 17 pics.

May 6, 2021

We’re 4 months into 2021 and a year out from when this COVID pandemic started. Now a central thesis that we’ve held for 2021 is that unprecedented fiscal and monetary spend will spur a dramatic bout of long-lasting and stubbornly high inflation. As the months have passed, we’ve seen the Wall Street Journal and the Financial Times pick up on this theme. Our forecast has been been proving true as commodity prices for all manner of commodities continue their rise. Let’s revisit some of the prices of the items we touched upon in our last snapshot two months ago.

Pictures of . . .

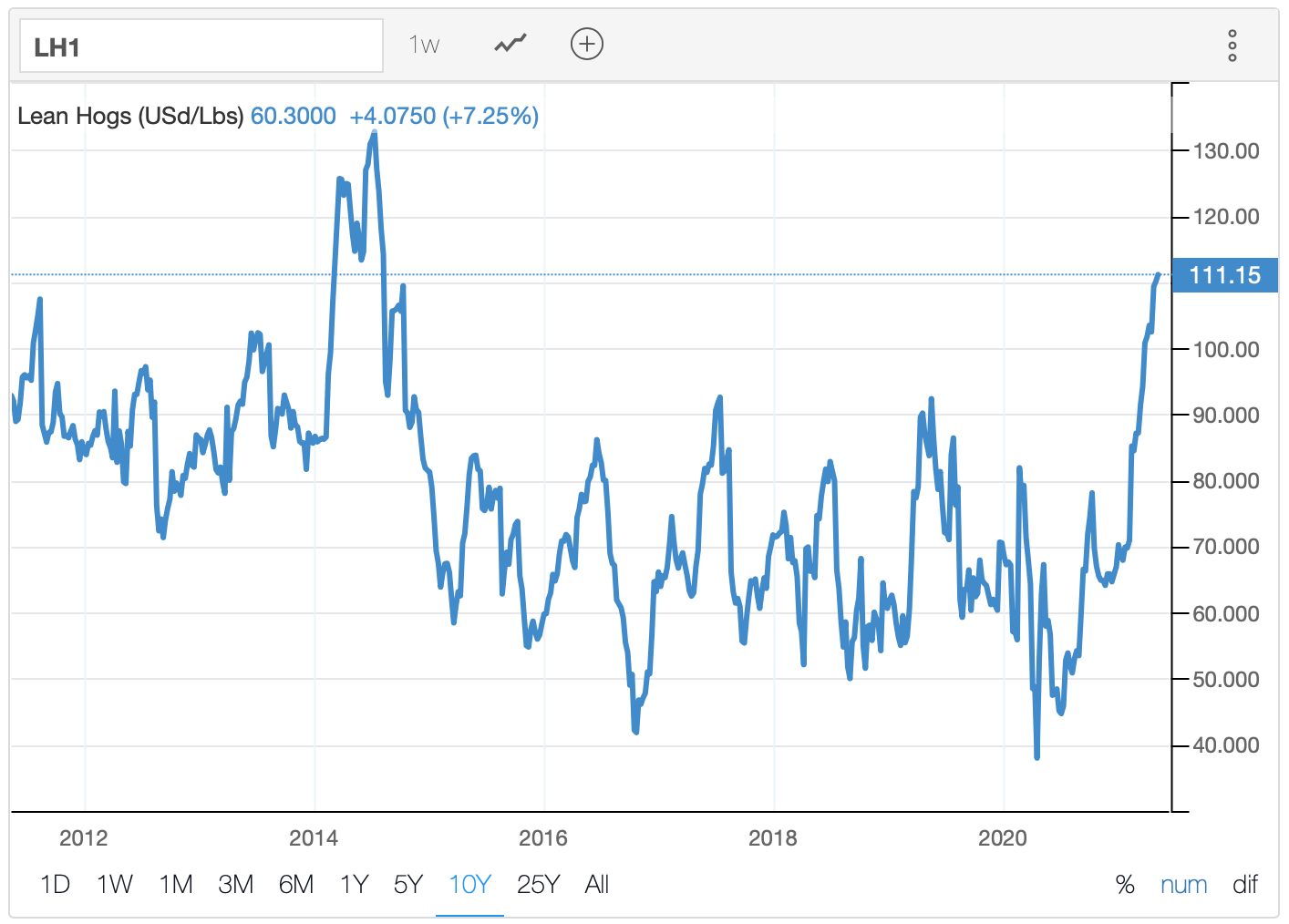

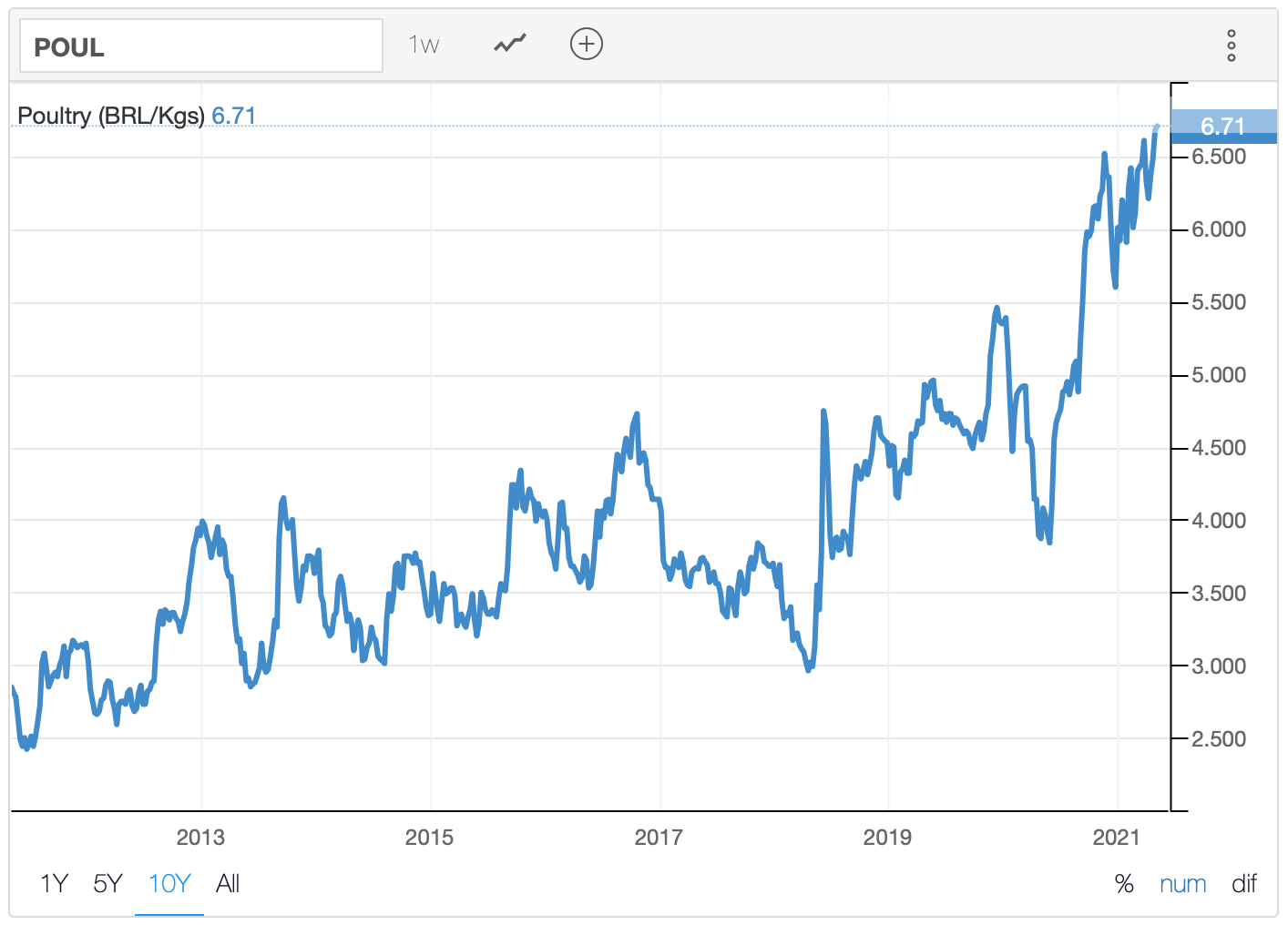

Things we eat . . .

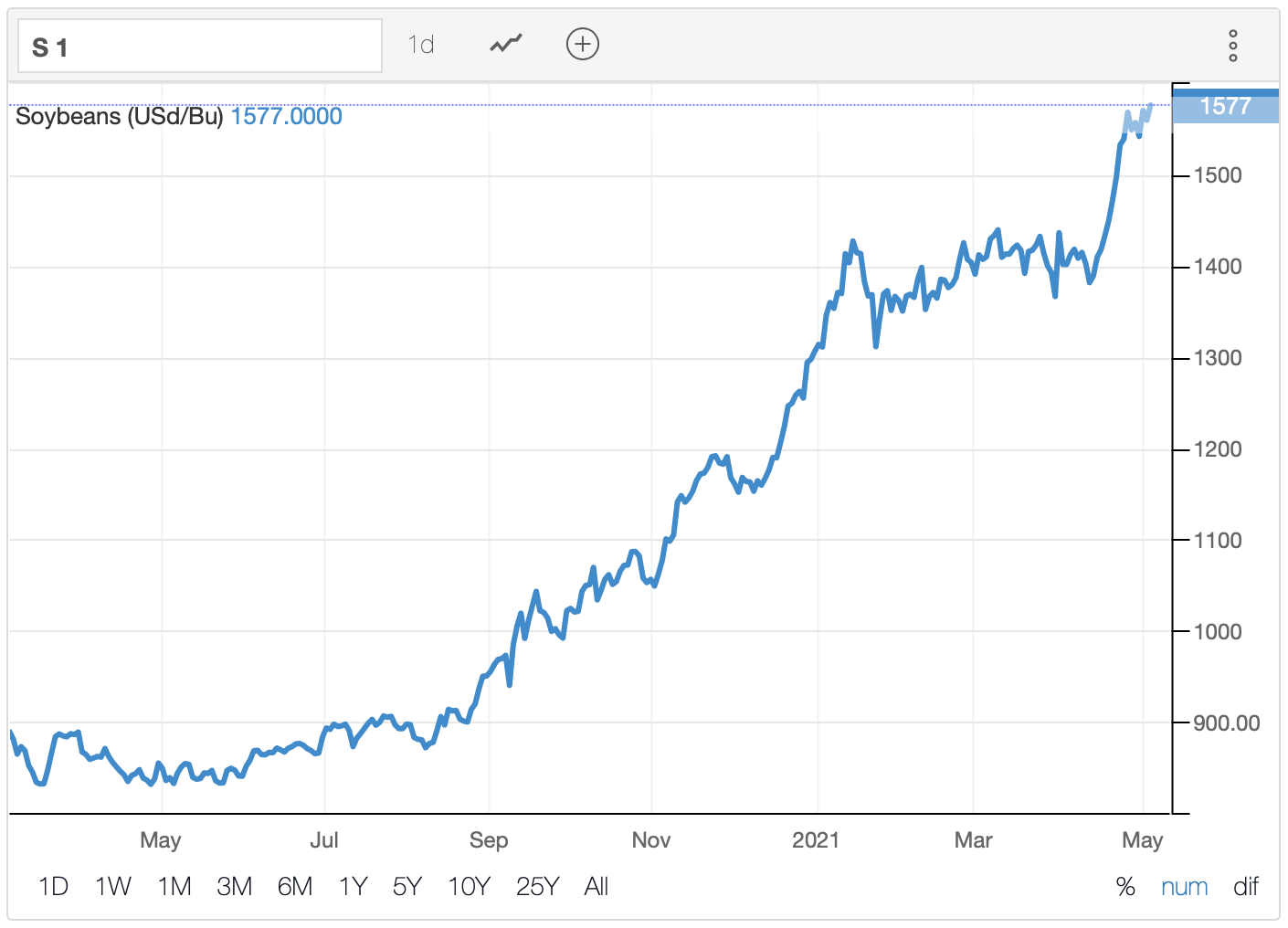

Things we, piggies, chickens and cows eat . . .

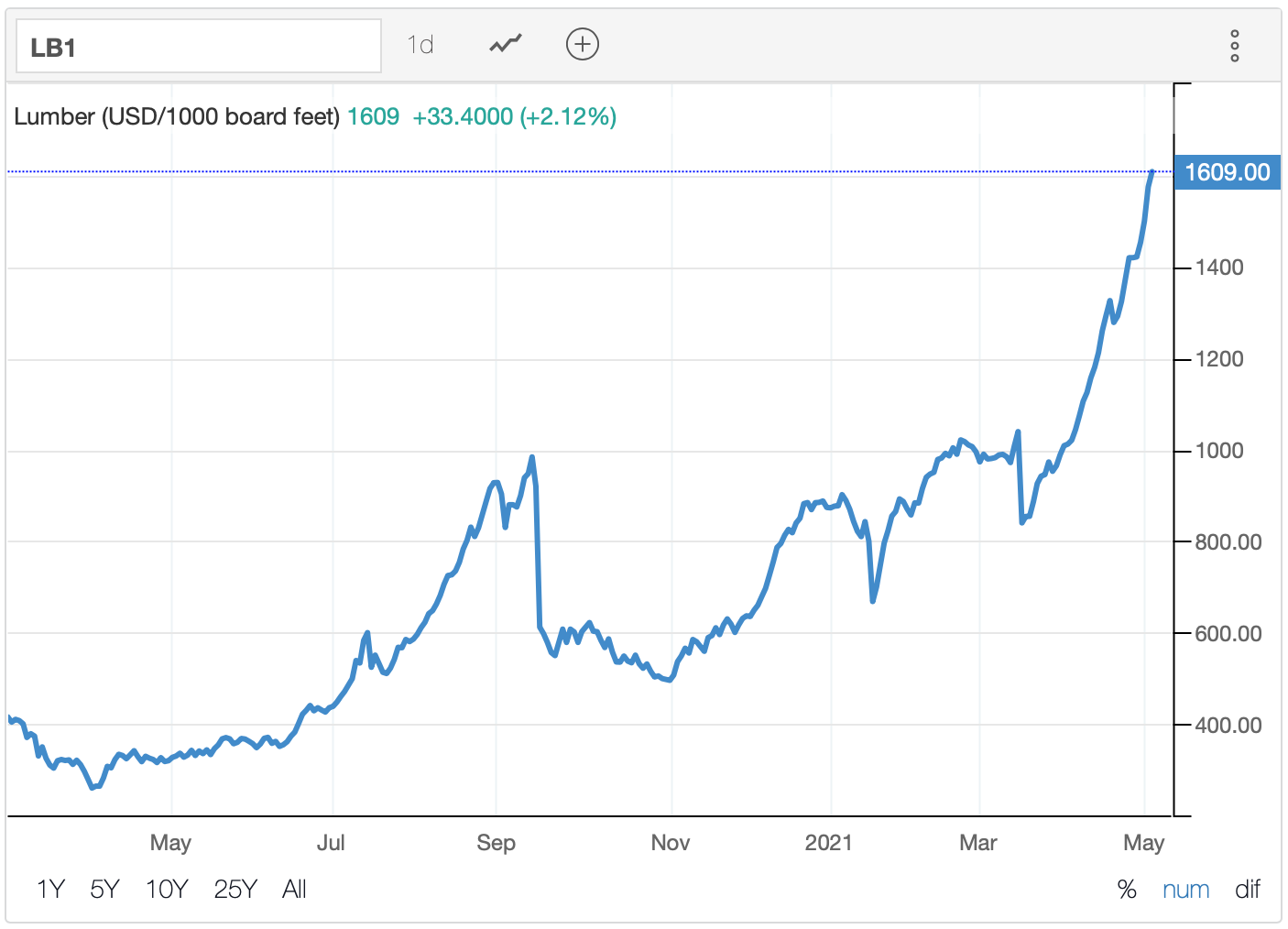

Things we build with . . .

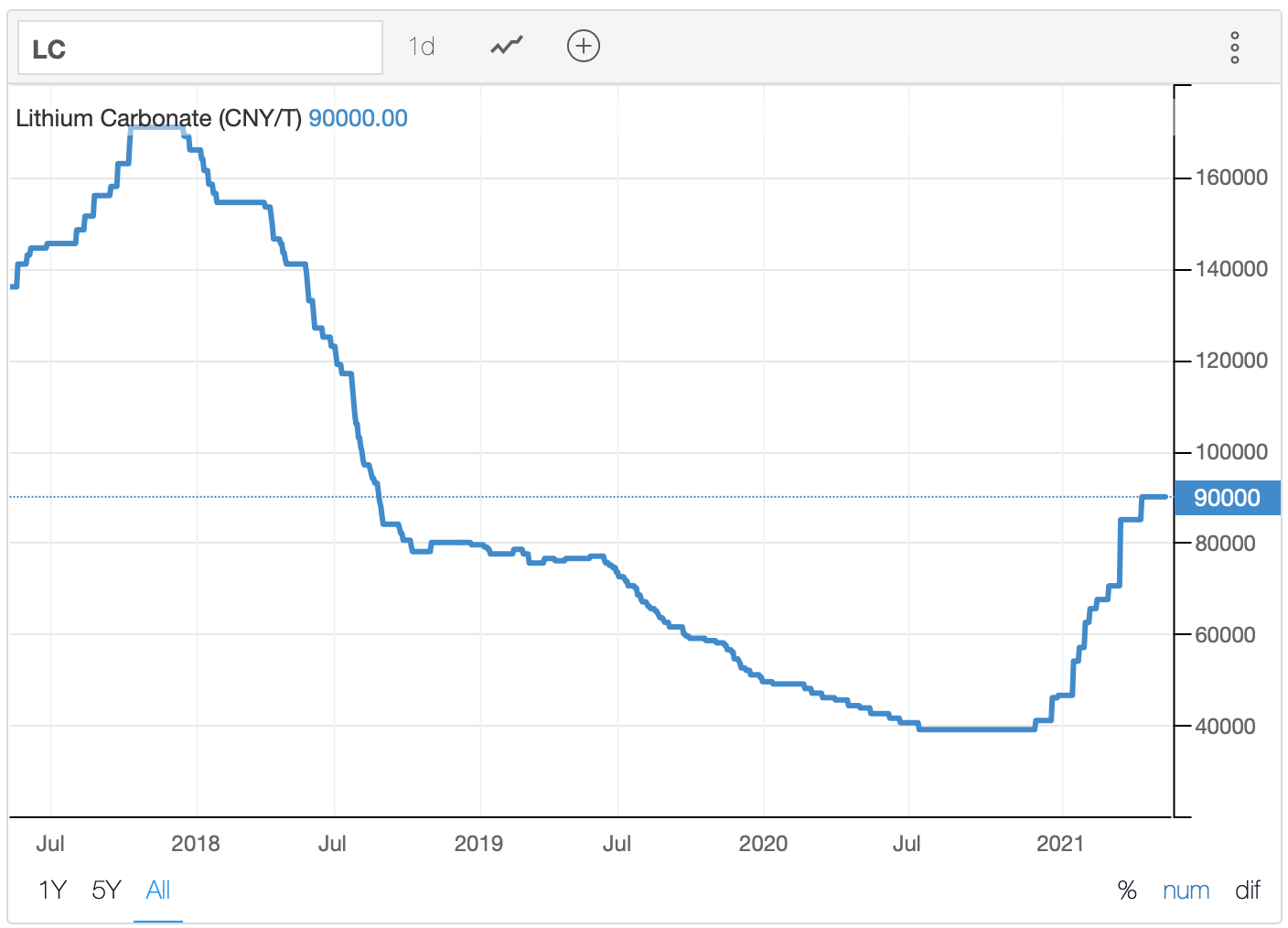

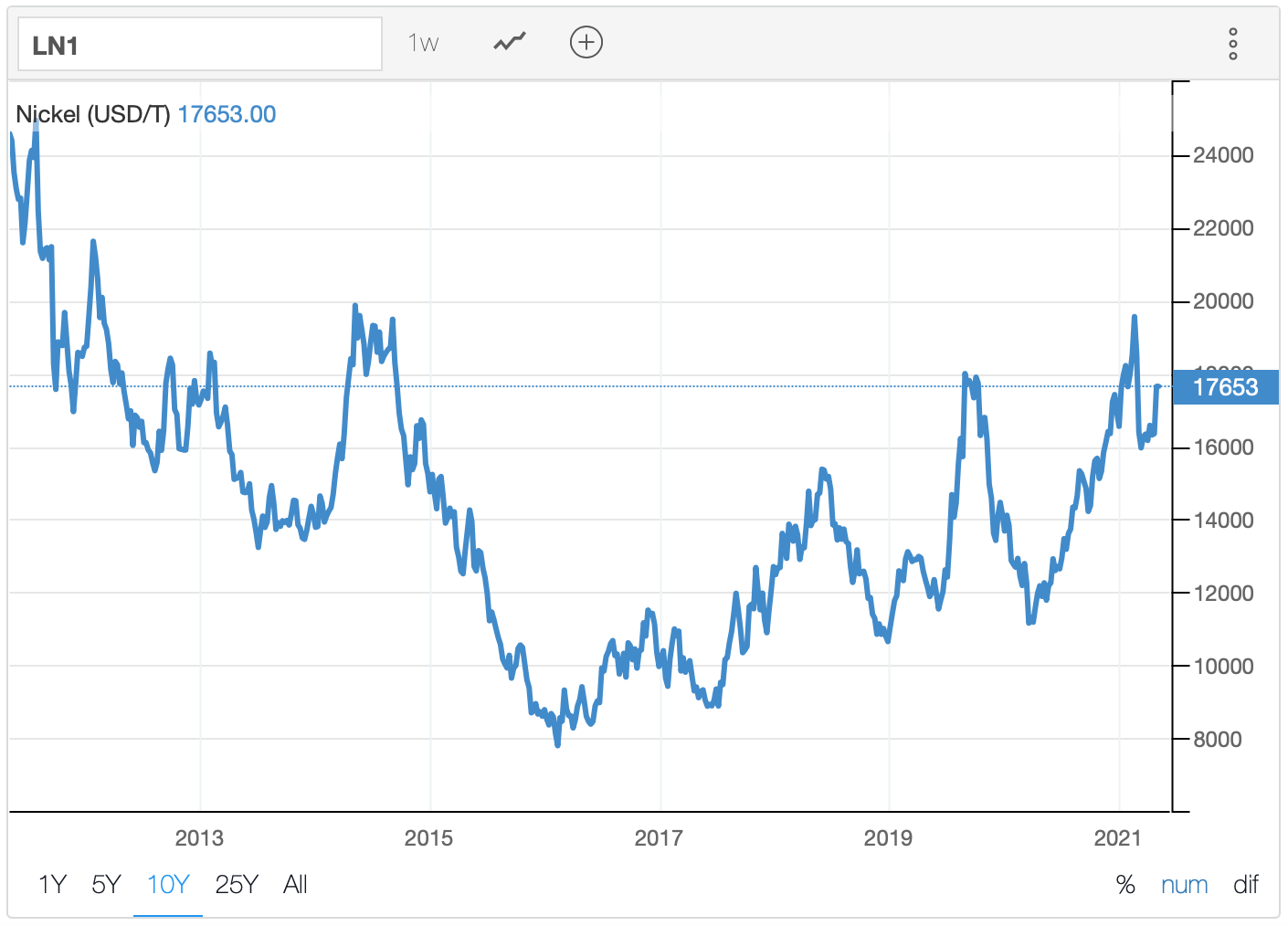

Things that go into the stuff we make . . .

Things that move things . . .

Things that matter (overall commodity indices) . . .

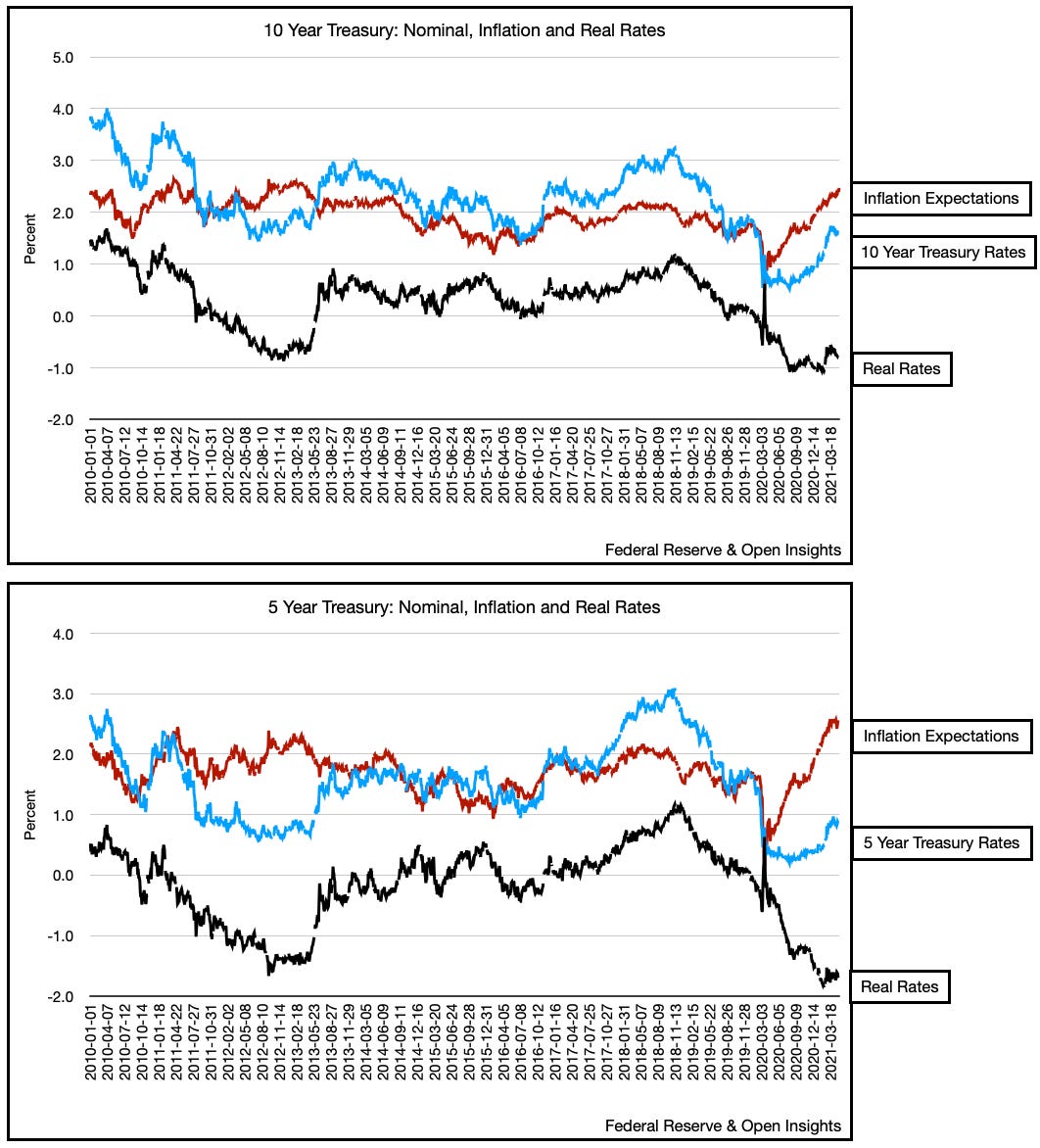

. . . and ultimately things that count (money), or more specifically, the cost of money . . .

So as we can see, prices continue to inflect upwards (for almost everything), and from what we know of the commodity supply situation, they will continue to do so. Much of the inflection stems from supply issues, not demand, and the tightness will persist given the dearth of capital investments in the commodity sector these past few years. The commodity pressure will also shift as oil becomes the next commodity to inflect higher as we emerge from our shelters. Moving and traveling means our energy intensity is about to jump.

As we see inflation play out, our thoughts turn to a few different things that may impact the trajectory of our inflation. One short-term (demand shift from goods to services) and one long-term (jobs). We’ll address those two items in a few more days as we’re still gathering the data. One other thing we’re pondering is our COVID recovery. So let’s spend a few moments on that.

Red Swan

Although our forecasts for the US and EU are on-track, China has crept back into our thoughts. China’s handling of the COVID pandemic has been nothing short of amazing. Helped in part by a political system that can impose and stomach a top-down lockdown, this is one of the few examples where having centralized authority and government/societal rights trump individual freedom can help . . . well at the very least in curbing or stopping a pandemic.

No doubt the lack of infections are also due in part to China’s vaccine, developed by Sinopharm. Yet as we reopen, as China reintegrates itself into global society, the question becomes, will a dampening COVID virus see China as a pristine forest to ravage? Will the wildfire rekindle there and spread, particularly with the newer variants?

As noted in a recent Reuters article summarizing an “evidence assessment” document prepared by the WHO’s Strategic Advisory Group of Experts (“SAGE”) . . .

“WHO experts have voiced "very low confidence" in data provided by Chinese state-owned drugmaker Sinopharm on its COVID-19 vaccine regarding the risk of serious side-effects in some patients, but overall confidence in its ability to prevent the disease, a document seen by Reuters shows.”

China’s head of China’s Chinese Center for Disease Control and Prevention, Gao Fu, recently stated the following when addressing the vaccine . . .

“We will solve the issue that current vaccines don’t have very high protection rates,”

Hmm. So “very low confidence” in the vaccine data, but it works? Yet, China’s own head of its CDC says maybe not? Who to believe? Maybe the real world?

Two days ago, Bloomberg reported that Seychelles, the world’s most vaccinated nation (+62% of its total population), has been forced to reintroduce restrictions as COVID cases increase. 59% of those who’ve been vaccinated received? You guessed it, Sinopharm’s vaccines.

Now we know, most commentators will say, China will simply re-lock, impose restrictions locally to stamp-out any flare-ups. True, but the starts, stops and restarts will almost certainly introduce a bout of volatility on the global markets. It could also delay the global recovery, especially the current narrative that all is well in China, and we’re all just waiting for everyone else to recover. The flip-side of that could be greater Chinese stimulus, something they’ve tapered off recently as their recovery has been stronger and more robust than the West.

In the end, we anticipate China will need booster shots, sooner rather than later, because for the most part, the country is “thinly” protected. If we’re right, better get that IP “borrowing” machine started, or maybe they already have it . . . ah well, if not, they probably soon will.