Slam Oil Long Enough, and It'll Hit Back

September 13, 2024

In case you didn’t know, this has been oil prices for the past year.

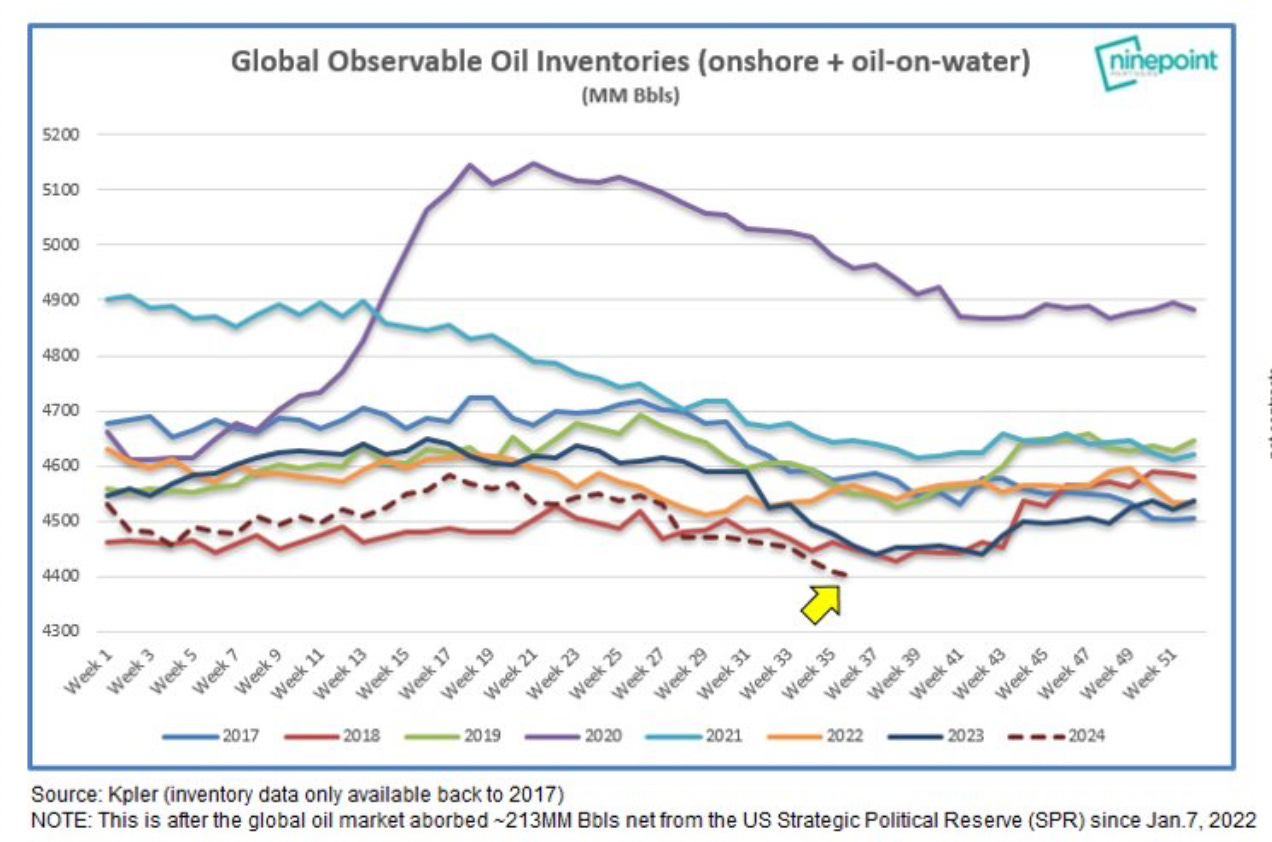

Bouncing along range bound between $75-$90/barrel for most of the year. Not great by the $100/barrel standards of 2022, but not bad either. Crude supply meeting refinery demand just enough, but not quite, coupled with OPEC+ and US shale discipline, has resulted in a continuous pull for oil inventories (chart from Eric Nuttall, Ninepoint).

Yet, despite the resilient global demand, Mr. Market woke up in Q3 . . . and chose violence as it sold off nearly 20% in the past month.

Sure there’s a bevy of reasons being tossed about. Concerns about China’s growth, global growth slowdown, impending US recession. All of it perhaps, sounds convincing when the market’s searching for reasons. The analysts of Mr. Market are more than happy to provide one if you ask long enough. What’s going on? It’s this. Are you sure? It’s that then.

The trigger could’ve been all of the above, but that certainly doesn’t explain this.

What does though is momentum. Quants, algos, trend-following trades, momentum traders. Sometimes they’re all the same, and when most of Mr. Market’s trades these days are dominated by machines, a cascade can happen.

Again we reiterate, there are two markets for oil, a physical one and a paper one, and they’re two sides of the same coin. For every real barrel that’s being traded, one that finds its way to the refinery, there’s +30 barrels that exist in the minds of our computers, acting as a side-bet on someone’s ledger. That side bet though? It’s betting on Armageddon.

Oh that’s hyperbole, Open Insights. Armageddon?

Seriously?

Okay, no. Yeah, you’re right . . . whatever Armageddon is?

We’re below that.

This my friends is the current “paper” positioning. An amalgamation of all those side bets in the US (or the ones we can at least see from the Commodity Futures Trading Commission). Just note the title at the top from Goldman Sachs . . . '“Total Oil Net Managed Money Plummeted to its All-Time Low . . . .”

How bad is sentiment in the paper market? Crude positioning has never been lower. That chart on top goes all the way back to 2011.

Crude positioning? Lower than COVID levels when the world nearly halted all movement. Gasoline? Below COVID levels, and so is diesel. Funny because last time we looked out the window, airplanes still flew and people still traveled.

Oh . . . at all time highs.

So now what? Now we see how this plays out. Again we harken back to the old adage, the physical disciplines the financial. The one barrel actually being burned matters, and when sentiment’s blown out of the oil markets and it becomes “untouchable,” producers get real skittish. Slam oil from $80/barrel to $65/barrel, watch producer’s budgets into year-end get real conservative and marginal producers fall by the wayside.

US production growth before all the tumult was already slowing, as discipline holds.

Producers were more interested in growing via M&A than drilling as rigs and frac spread counts flattened and fell. Again, that was before what happened these past few weeks.

This will have repercussions. Bully the physical market too much, and it will get . . . physical. If we simply ran an inventory balance to prices, Brent prices should be ~$80/barrel.

Brent, however, just touched the low-$70s. Interestingly, Goldman pointed out that if the paper market were to simply normalize from these skewed levels, oil prices would rise by $7/barrel, back to . . . you guessed it . . . near $80/barrel.

Still, that was before, and this is today. Today we’re sitting with WTI a $69 and Brent at $73/barrel. Today’s a far cry from last week, and even longer than last month. The longer this persists, the more supplies will be strangled, and ironically the more oil will be consumed with lower prices. Don’t fret though, inventories are at all time highs right?

Oh . . . that’s right.

How Mr. Market “feels” affects how the physical market reacts. Just be careful when the physical pushes back.

We’ll be watching when it does.

Please hit the “like” button and subscribe if you enjoyed reading the article, thank you.

a bit late to the party, but thanks for sharing.

Interesting and refreshing analysis.