Stocking Stuffers: Peloton, Lululemon, and SeaWorld

December 23, 2025

Heading into the holiday season now and as everyone shuts down and the market slows down. Before we wind it up, we wanted to touch base on a few companies we’ve mentioned in the past year to clean up some odds and ends.

Peloton Update

Peloton continues to chug-along and we’ll have more data to parse on how the quarter is going in the coming weeks. Fingers crossed in the final innings of the important holiday season. While Black Friday and Christmas are important, New Years is equally key since many people make resolutions to get fitter, healthier, and happier in the new year. Thus, purchases of exercise equipment extends into mid-January, so there’s still about a month to go in the selling season.

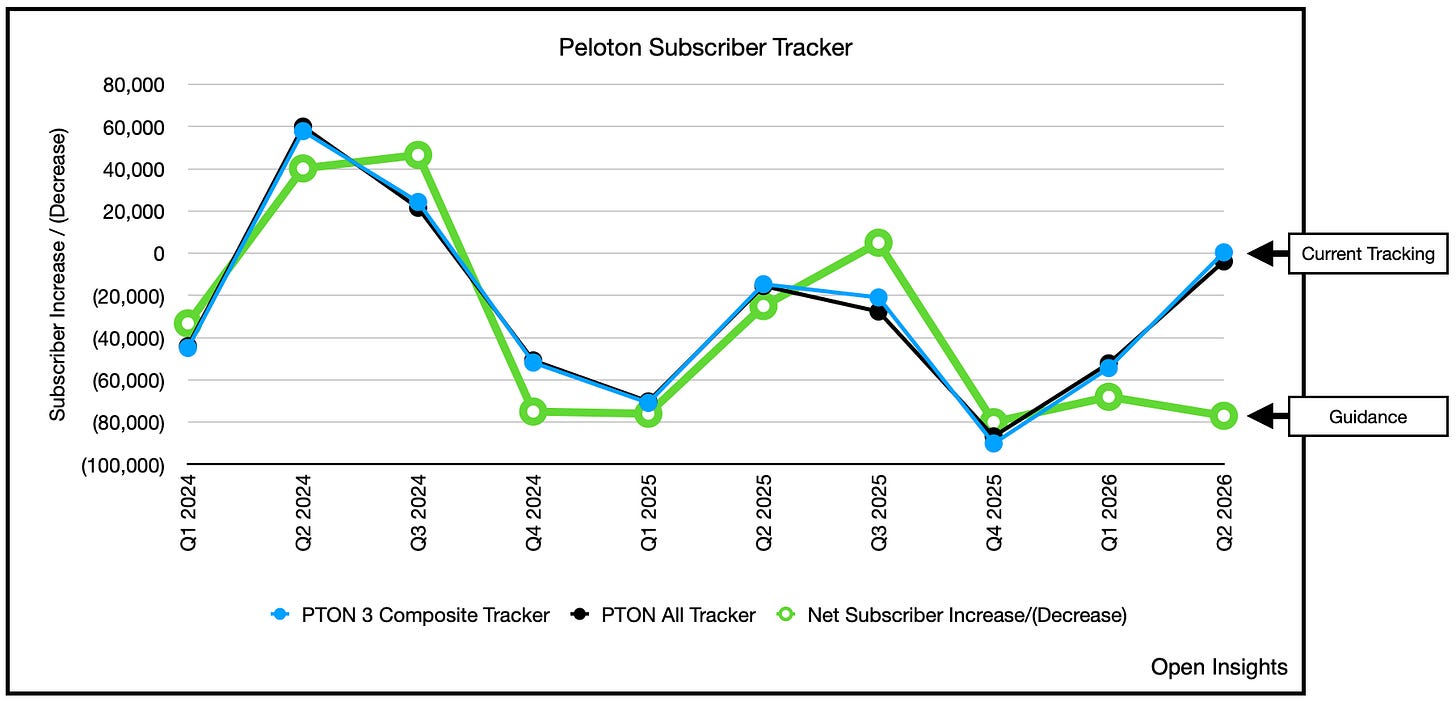

Current tracking still paints a positive picture, though take the graph above with a grain of salt because Peloton raised its subscription prices this quarter, and that likely induces a one-time 50-60K subscriber decline (our assumptions). Even factoring that in, we’re still ahead of guidance, and we think there’s a high chance it could come in even better than our figures. Another chunk of data should land in early January as people make New Years resolutions and commit to them by buying a bike or a treadmill (though much of those figures/economics of such will fall in Peloton’s Q3 report).

We’re at least happy to note that the treadmills seem to be selling decently at this time, and again, the treadmill market is 2x the size of the bike market, so any momentum in this space will help as newer sales pushes older used Treads into the second hand market, broadening the user base. Peloton’s treads are selling for nearly double the average treadmill price, so “seeding” and broadening this category is important. We doubt Peloton will introduce a cheaper treadmill at this stage given the price premium commanded by its products, so it’s really the second hand market that will need to do the lifting. The updated Cross Training Treads can supplant older Peloton Treads, and the latter can start trickling into the used marketplace. Currently, used Treads are selling around $1,400 - $1,800 on Peloton Repowered. Given that the average treadmill runs around $1,000, and new Peloton Cross Training Treadmills are $2,800, the “half off” category should help.

Overall the stock has had an atrocious year as it fell by ~30% YTD despite generating nearly $350M in excess cash and halving net debt.

The company will be able to refinance its remaining debt by mid-year and free itself to return capital, and invest in further growth. We don’t think the company will stay at these levels and should move higher as net debt falls to zero, growth initiatives hit and management delivers on its promises and initiates capital return.

Lululemon Update

Another company that had some interesting news was Lululemon. Recall our summer intern Matt Nakagawa took a look at the company after its share price deflated post-earnings.

Well turns out Elliott Investment Management also sees something they like. Two weeks ago, Lululemon announced the sacking of its now former CEO Calvin McDonald, after performance “nose dived.” The Wall Street Journal reported that Elliott, took a $1B stake in the company, or about 5% when the shares traded down to $160-180/share and the company was worth ~$20B.

On the topside, the company is currently valued at 2x sales ($11B/$24B), which is comparable to Nike ($46B/87B). It’s also still growing, albeit at an anemic 1% on a local currency basis and 2% on a constant dollars basis. Free cash flow (“FCF”), however, is positive. Though Nike’s reported Q2 sales figures show a similar flat trajectory, the FCF is decidedly different. Nike continues to bleed red. Holiday sales are of the utmost importance for both companies, but on a comparable basis Lululemon can still play offense, whereas Nike appears to be retrenching.

Still 1% growth means the company is stuck in the mud. Elliott’s agitating for change, having engaged former Ralph Lauren CEO Jane Nielsen to consult and potentially(?) step-in as the new CEO. She’s been working with Elliott for months and likely has a deep grasp of the problems afflicting Lululemon. So this certainly kicks the turnaround story into high gear. The brand remains solid despite the heightened competition from Vuori and Alo, and after seven years with Calvin McDonald, it’s a good time to pivot. A change of leadership and strategy could be what this company needs. It has the resources and isn’t by any means on its heels yet. Even an incremental change will supercharge its stock, so take a look and maybe pocket a few shares as a stocking stuffer. You can find it in the discount bin.

United Parks

As you enjoy your holiday season, don’t forget the fishies. About a year ago we took a look at United Parks, the owner of Sea World in San Diego and Orlando, and a few other amusement parks.

It was an intriguing story, but we actually never pulled the trigger at buying the stock as we were invested in other companies (Peloton above). After a successful MEG Energy acquisition, we exited with a dollop of cash and this one appears to be interesting again. After what can only be described as an “ugly” summer season, investors have been swimming with the fishes of late.

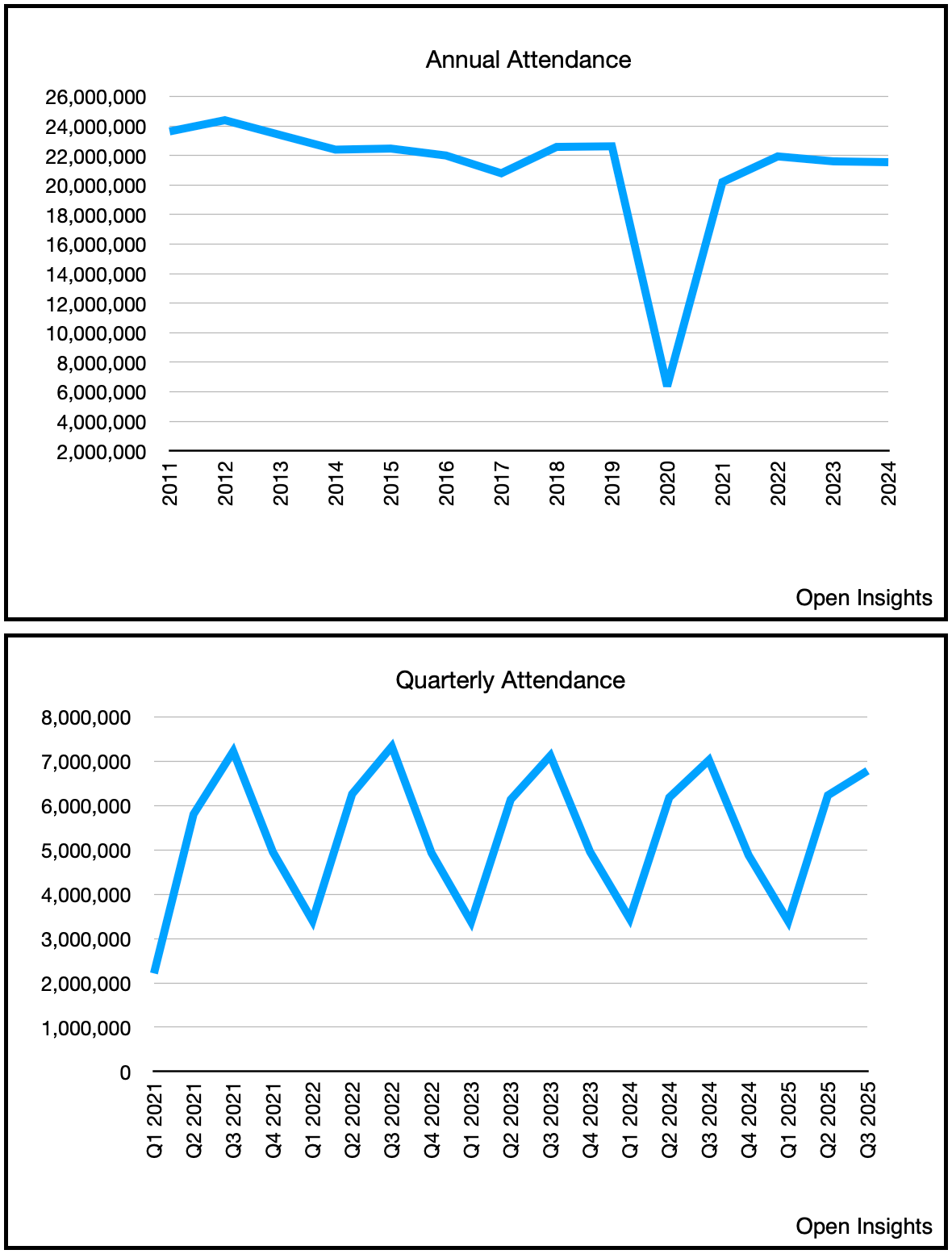

You’d think with the stock caving 40% YTD, there’s something existentially wrong with the business, but other than a softer summer season, we’re not entirely sure this isn’t just a market temper tantrum. The issue here is park attendance, which obviously translates to admission revenue and in-park spending. It’s been pretty flat of late, and we saw a hit to the all-important summer season as quarterly attendance fell because of 2 reasons 1) the opening of Epic Universe at Universal Studios and 2) weaker consumer spend. Given its lower price point, SeaWorld tends to attract a lower demographic of consumers, and in the current “K” shaped economy, the lower K are the one’s harder hit. It’s not so severe that we’re seeing a major downdraft in SeaWorld’s park attendance, but enough to result in a negative year-over-year comp.

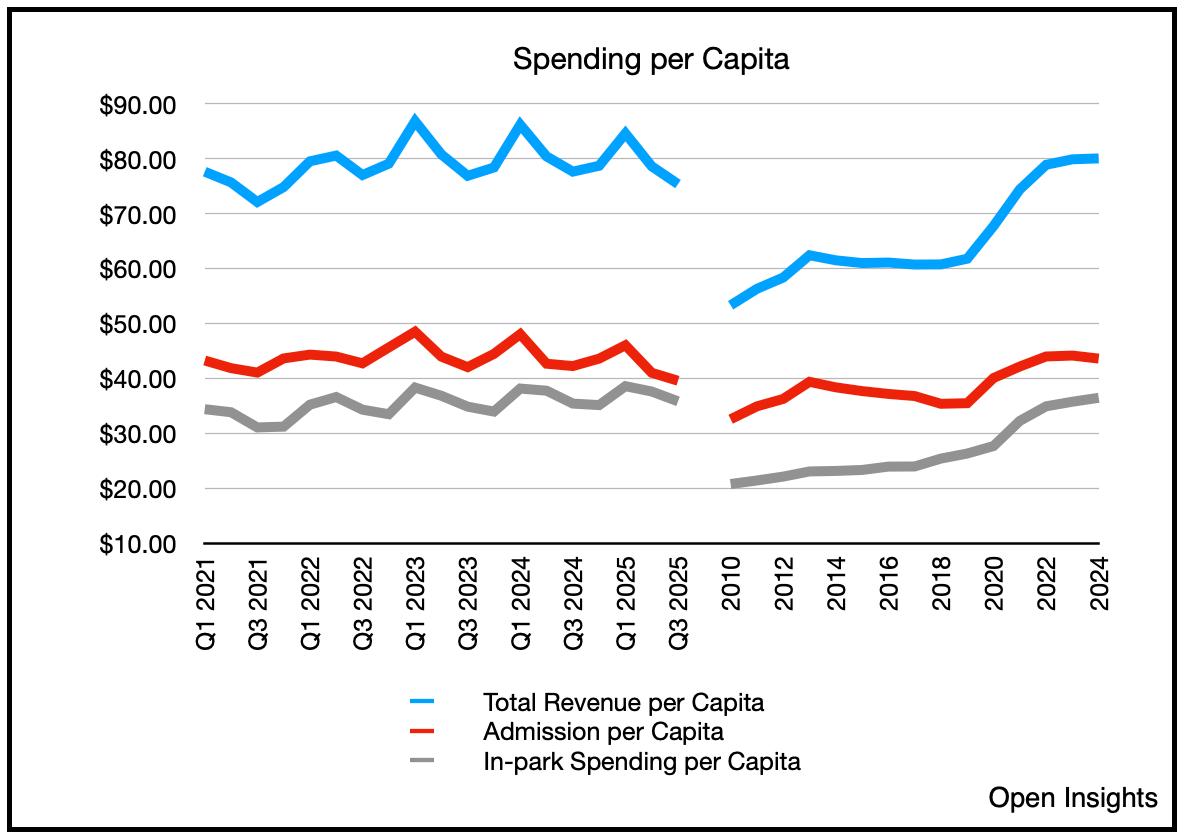

So that bottom-chart above tells the difference. The “shark’s fin” just wasn’t as prominent in this year as in the past. The good news is that when the park-goers are there, they are spending more.

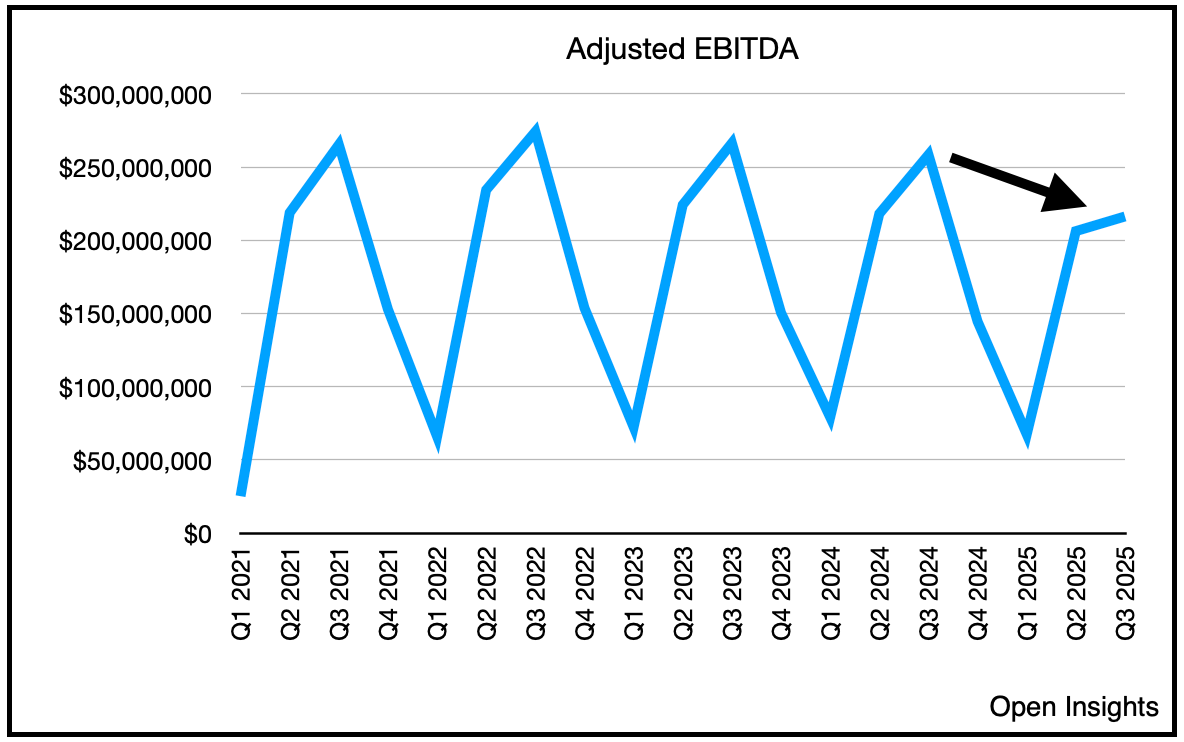

Yet, the company’s having to discount tickets to get them in the park, so lower ticket prices are mitigating the positive uplift of higher in-park spend. Since park costs are relatively fixed, we’re left with earnings that must suffer. Negative 10.2% for the trailing 12 months (~$700M to $630M).

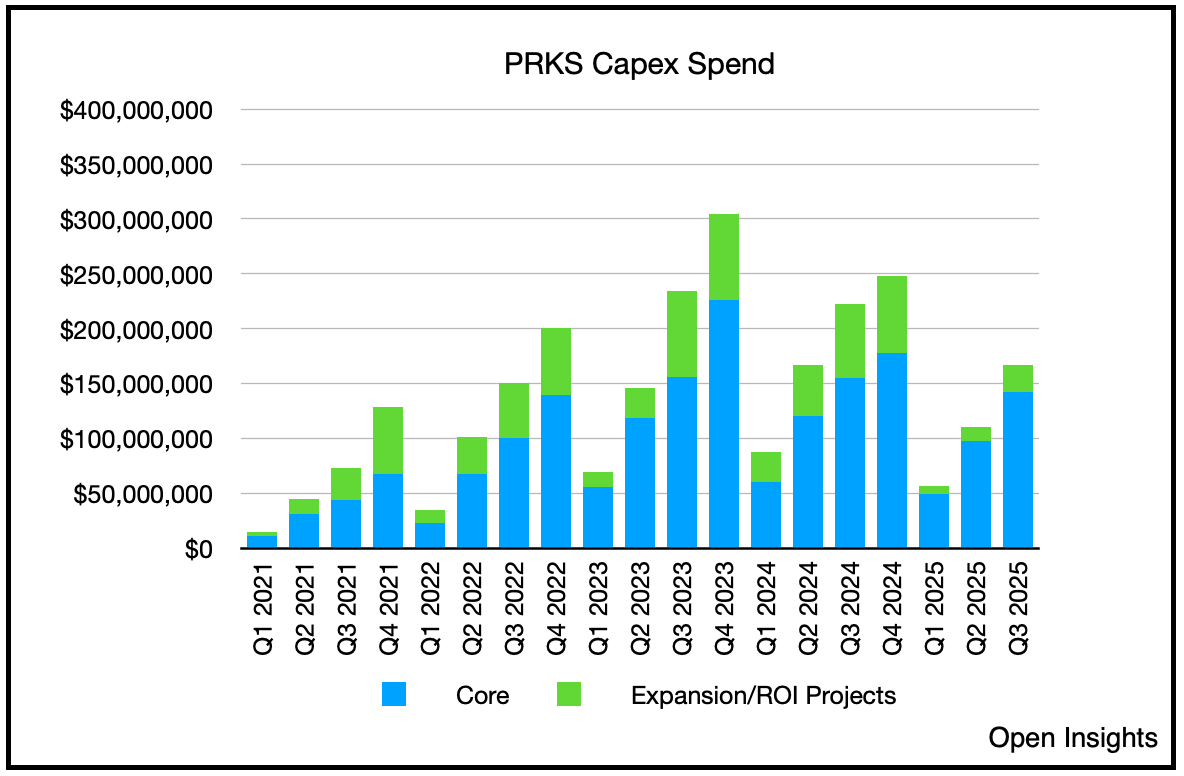

Mind you, this is adjusted EBITDA (i.e., the metric management likes to use because they get to “adjust” and exclude a whole host of pesky expenses). FCF though is still hovering around $400M on a TTM basis, so management has dialed back capital expenditures to preserve cash flows.

Assuming that the holiday season is flat to last year, PRKS will still generate ~$400M in FCF, for a $2B market cap company. If you assume a similar “bad” summer season for Christmas, then we’re looking at $350M, again, not terrible for a $2B company. Undoubtedly, the company will continue to cannibalize shares at an accelerated pace especially at these levels. Shares haven’t been this cheap since the beginning of COVID, and arguably the business is much better. The next catalyst will be what PRKS does with its land.

Here’s what Marc Swenson said on the prior Q3 call:

“On real estate, we continue to discuss alternatives with potential partners and have recently received specific proposals that we are actively evaluating. As we have discussed, we own over 2,000 acres of valuable real estate in desirable locations, including approximately 400 acres of undeveloped land adjacent to our parks, including significant developable land in Orlando. We do not believe that the public markets have or are appropriately giving credit to these attractive and valuable 100% owned real estate assets.”

This is almost assuredly true, but PRKS has been slow in developing this asset and shareholders have been patiently waiting for further developments for nearly years.We think they’ll continue to slow play this front though while Hill Path compels PRKS to gobble-up additional shares, thereby increasing Hill Path’s ownership percentage.

As of Q3, Hill Path owns about 27M shares out of the 55.5M outstanding, so 49%. For all intents and purposes it owns the company, and spiking the price while it’s trading at today’s discount makes little sense. We think if the price stays here, Hill Path will likely take out the company in total, and then turn around and develop the land privately, capturing the upside itself. For minority shareholders, taking a position here would be a bet that there’s value here, and you’ll likely be able to extract some of it before Hill Path takes their ball and goes home.

The Consumer

You can see with the companies above, we’re a glutton for punishment. Most of these consumer stocks are down significantly for the year, and have been pummeled as the “K shaped” economy takes hold, despite being operationally healthy and generating decent FCF. We think they will recover, and at the current levels they’re being priced for distress when the businesses are anything but. So take a peek while you wait for Santa, they might just make great stocking stuffers.

Happy Holidays.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.