The Economy Stinks? You're Likely a Republican.

February 9, 2024

Why so glum chum?

My wife says that. You know, former kindergarten teachers always like to rhyme things.

We wrote this article a few weeks back, figuring that the animal spirits in our economic landscape will begin to lift, and sure enough it has.

The Animal Spirits are Stirring. 2024 Here We Come.

Oh watch out. Sentiment appears to be climbing. The animal spirits are beginning to rear their heads. Despite the negative news out on the economy, the impending recession this, and the imminent crash of that, consumers are starting to perk up. Let’s repeat that . . .

It’s certainly risen in the past month. Rising stock market, plentiful jobs, and an overall increase in our economy helps.

GDP Now?

3.4% Wahoo!

Still though. Why so glum, chum? Why this dislocation?

You shouldn’t be feeling so mellow . . . fellow.

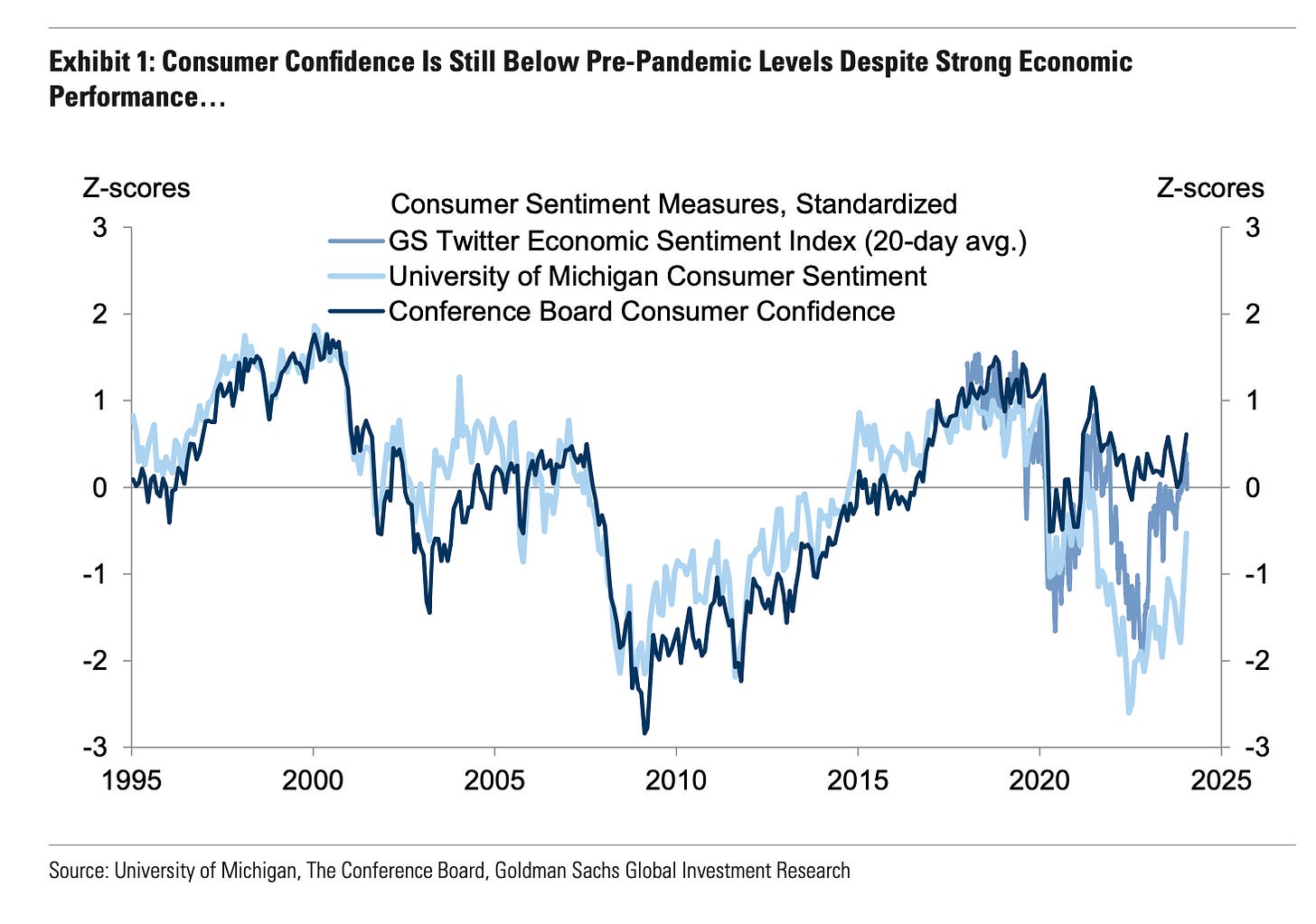

Why’re you seeing blue boo? Economic indicators are actually decent, but that sentiment still lags. Not by a bit, but by a lot.

Still seeing blue I guess . . . or red maybe. So along comes Goldman Sachs with an interesting report published the other day about our election year.

Economic sentiment? It actually really depends on what political party you’re affiliated with. I know . . . shocking.

I guess that’s not surprising given our polarized political atmosphere, but it is interesting. Interesting because it’s affecting the economy now. How you perceive the economy influences what you spend your money on, how much you spend, and in turn, how the broader economy does. Like Ray Dalio said, one person’s purchases is another person’s income. Democrats though seem to be handing over that cash a little happier than Republicans.

Now now. Don’t get “all twisted yo.” When it comes to investing, you almost always have to leave your own political leanings aside. We’re talking about maximizing capital return here, not how liberal, or conservative you are. Not about who’s more corrupt, or whose cronyism is better or worse. The one thing we can probably all agree on is . . . aren’t there better candidates? Nonetheless . . . we digress.

What we care about is data, so what’s the latest set of data tell us?

The economy is . . . still darn good.

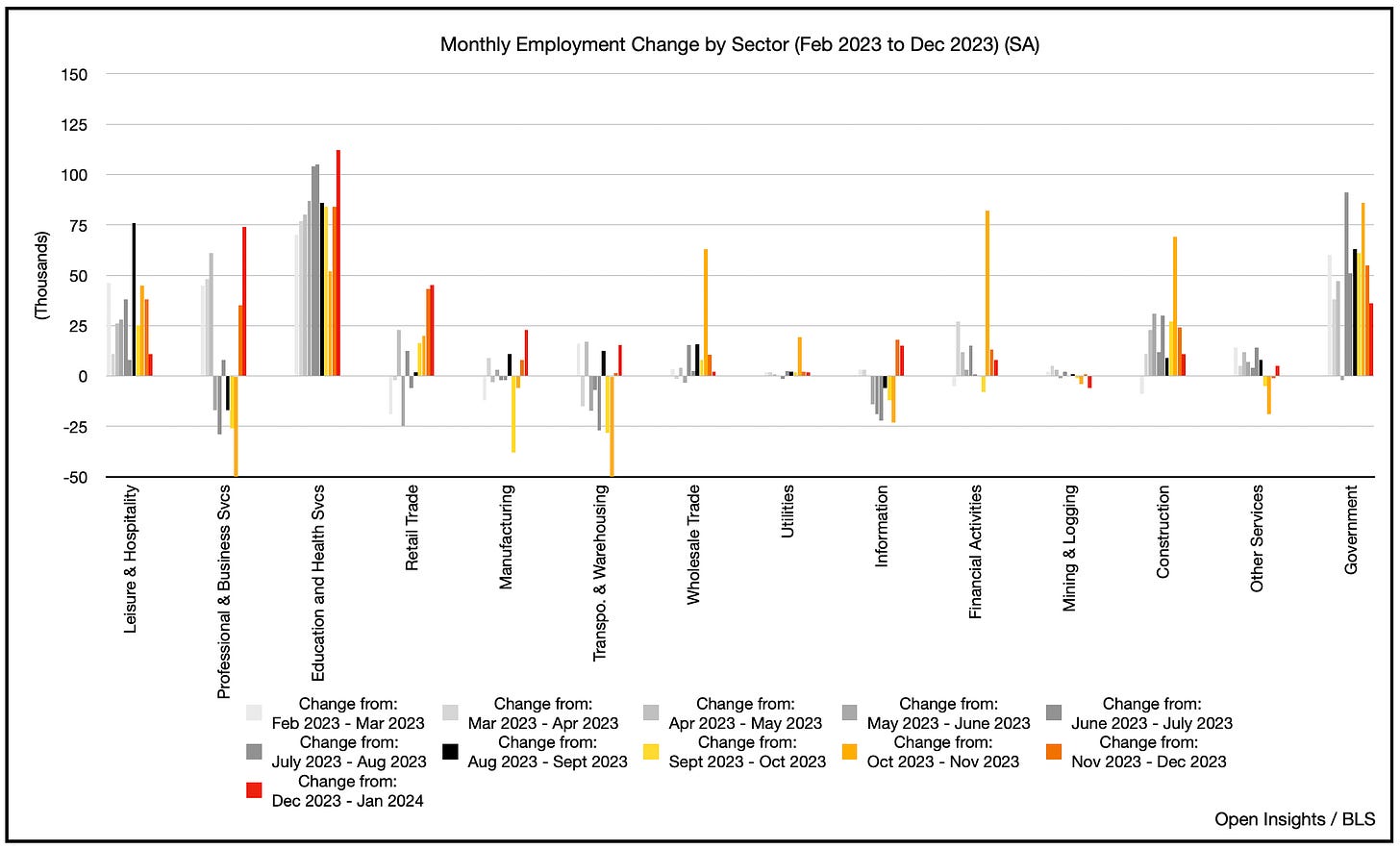

Job openings for the latest month (December), increased, and that slight tick upwards means there’s even more job openings than unemployed persons as of December vs. November.

Surprisingly too, it wasn’t all just “health care, education, and government jobs,” that vaulted higher (a sign of government stimulus), but professional and business services increased as well. Don’t look now, but information also saw additional hiring.

Those who are gainfully employed also continued to see their wages keep pace with inflation.

Consumer balance sheets? Not bad either. Although debt is increasing overall, incomes are keeping pace with that increase. Arguably the consumer is better off than they were when you factor in income to debt ratios.

Heck dive deeper into consumer debt, and you can see why the consumer is flexing. Where are all these people getting them dollahs? Hmm . . . look at the quantum of student loans. The government’s forgiveness of the loans and borrower repayments have arrested the steadily (and admittedly unsustainable increase) in those loans.

We believe that’s part of the reason why consumers have shown spending strength in other areas. So overall, what does this mean? Well according to Goldman . . .

“We have found that the economic variables that matter most for the election outcome are consumption growth, GDP growth, job growth, and both the level of and recent changes in consumer sentiment. Real economic performance appears to matter more for election results than financial market developments (e.g., equity returns). Headline inflation appears to matter more consistently than core, which is intuitive because the core measure excludes items with the greatest salience for consumers’ perception of inflation.”

Given our electoral college system for choosing Presidents, only about three or four sates really matter these days (most of the other states lean heavily to one political party vs. another), and thus the perception of the economy in those states are critical. So how are they feeling?

Not too bad, and turning up it looks.

Overall, we’ll need to hold a few disparate thoughts as we work our way through a volatile 2024. Objectively, the economy overall is decent and consumer balance sheets are strong. Consumer sentiment, however, is weaker than what we’d typically expect to see given the current state of the economy. This perception gap is heavily influenced by political party affiliation. Going forward, what matters is whether this perception improves/declines in the coming days if the economy is to fully recouple. As for the election? What matters is the economic perception of three to four states (i.e., the swing states). Fortunately, those states are also highly correlated to the national dataset, so we’ll have a good pulse on that.

Ultimately, whether you’re seeing blue or red right now matters. It matters to the economy and it matters to the election. Regardless of what party or color you’re rooting for, we for one hope we’ll all see green as our economic engine continues to turn.

So turn that frown . . . upside down.

Please hit the “like” button above if you enjoyed reading the article, thank you.