Blink . . .

. . . blink

. . . blink.

It’s the cursor again. It’s challenging me with each blink,

marring my beautiful, pristine white screen.

Write something, it’s saying.

Say something . . . say anything. N-E-Thing.

Say the thing you’re really thinking, won’t you?

You know you want to.

Just do it.

Do it.

Doooo eeeet . . . .

Fine. FINE.

Doesn’t oil prices HAVE TO skyrocket now?

It starts with this idea.

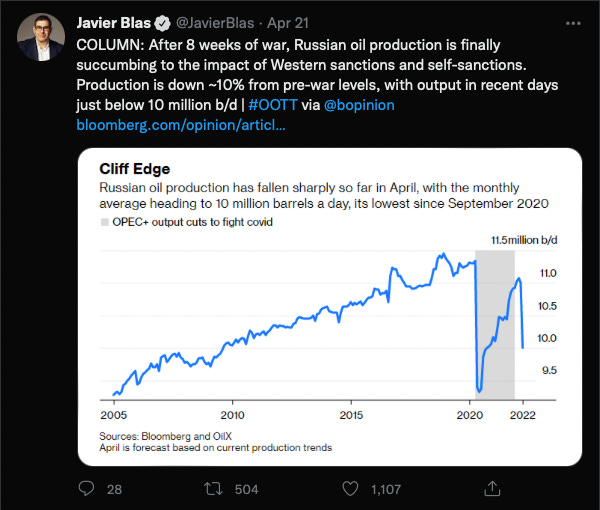

For weeks, we’ve been monitoring Russian data closely to see if there’s been any material changes since the outbreak of the war. Yet the lag of production, exports and data meant that for awhile, even after the invasion/sanctions, Russian exports seemed to have stabilized. As the weeks passed, we were wondering if we’d been wrong. Perhaps we missed something. Perhaps Russian oil production was really that resilient, and that India and/or China were able to take advantage and soak up the excess barrels. Despite storylines of Russian midstream assets filling-up, upstream production hadn’t yet fallen. That’s what we were seeing, but that’s beginning to change, and the momentum for that change appears to be accelerating.

May 15th. That’s THE DATE. The date set by the EU to begin weaning itself from Russian oil as sanctions begin to kick-in. There’s also been discussions for banning Russian oil entirely, but even without that we’re likely to see a material decline. Particularly as trading houses have recently announced their intention to withdraw from Russian oil trading. As intermediaries in the oil trading world, they greatly facilitate the . . . how do we say this . . . the “grey” market for some of these barrels. Put more indelicately, they help you skirt sanctions. Well sounds like they’re exiting that game as political pressures ratchet higher. No doubt motivated by significant arm twisting.

So self-sanctioning pre-May 15th will be followed by real sanctioning post-May 15th. It’s getting tighter and that apparently is rebounding on Russia. Compound that with capital fleeing, oil services companies (with their technical expertise) bailing, and materials for drilling and maintaining wells/reservoirs dwindling, we sure have some headwinds for Russian oil production. The appearances of robust Russian oil production may be just that, superficial.

If so, if reality is indeed starker, then the worst case scenario is in play. Russian oil production may actually decline materially, and in such a scenario, we’ll find ourselves missing such a large amount that we will globally have no way to cover/absorb such a shortfall.

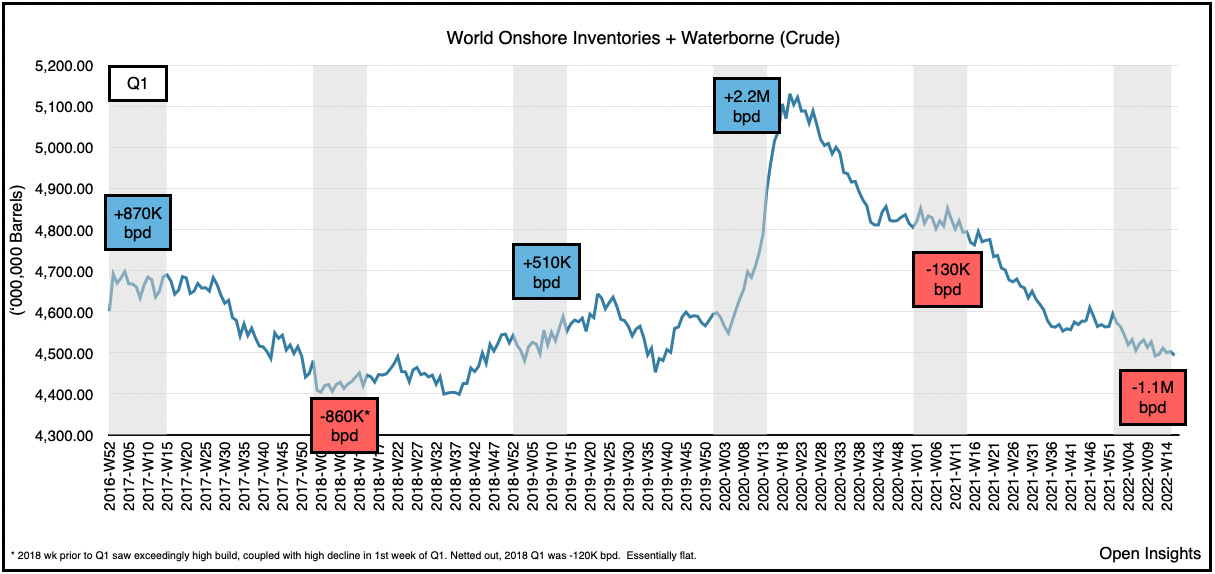

Remember, inventories were already bleeding an average of ~1M bpd in Q1, during the “slow” demand season, which on average builds 400K bpd. Even more accurately, between what we lost vs. what we normally build, the delta is ~1.5M bpd.

Now this figure has recently dipped. It’s “flat” of late because of China, where the country’s zero COVID policy continues to wreak (or wreck) havoc on the Chinese economy.

Estimates place the fall in demand at nearly 1.2M bpd. Ironically, as @jorge_moj puts it . . . thank goodness for COVID. It’s said tongue-in-cheek of course, but think about it, had it not been for COVID in China, we’d already be drawing barrels just as Russian production falls, and prices would be well north of today’s $100/barrel. Given the determination of the CCP to continue with the policy, we’ve no doubt that COVID will eventually be contained. It’s simply a matter of time. If we know anything about COVID, and Omicron in particular, it’ll spread and burnout fast. China will try and contain it, and they’ll likely be successful because well, it’s China, and they’re “determined.” Xi’s determination dictates your efforts, and despite the social media outrage, your efforts will entail full compliance.

Still, we can easily see the quarantines and restrictions linger for another month. Thereafter, China’s economy will regain traction. Cascade a few monetary/fiscal stimulus programs, and we should see the country reaccelerate economically by the summer, and in turn, so should their fuel demand.

So that ~1.5M bpd? It will come back. 1.5M bpd shortage doesn’t sound like much, especially when measured against our ~100M bpd addiction. 1.5%, meh. Never mind that historically a 1% extended shortage means oil prices climb into triple digits. Never mind that, but again consider Russia.

Energy Aspects estimates that by May, Russian oil production will have declined by 3M bpd, and level out at 2M bpd thereafter. So take 1.5M bpd and add another 2M bpd. Simple maths equal 3.5M bpd.

3.5%.

If that’s not enough, misery loves even more misery as summer demand piles on. Add another 2M bpd for seasonal demand and we’re ~5.5M bpd.

5.5%.

Nah that couldn’t be right? 5.5%? That’s impossible. Surely demand destruction sets in right? Also there’s a timing element to it all. The Russian production drop off peaks in May and should subside a bit by June as India and China grab at cheaper discounted barrels. Smooth it all out and a shortage of somewhere between 3-4M bpd seems “more reasonable” and maybe “more conservative” as we head into the summer months.

What about demand destruction? Shouldn’t we account for that? Well how much would you like?

1M bpd? Perhaps, but not yet because although we are slowing economically, we’re still growing, only at a reduced rate than the beginning of the year (i.e., we’re not yet at a recession and we’re still missing alot of stuff).

What if we used 2.7M bpd for demand destruction? Happy? Why 2.7M bpd? Great Financial Crisis (“GFC”). It’s the equivalent of demand lost during the worst quarter of the GFC. Let’s assume it gets bad. It gets 2008 bad because the Fed increases interest rates so quickly to tame inflation that it cattle prods the economy into a stupor.

So 2.7M baaaad. Michael Jackson BAD

. . . shamone.

So using 3-4M bpd of supply gap, we then drop demand by a “shamone-bad-GFC” 2.7M bpd and we’re still left with a 300K to 1.3M bpd shortage in a GFC environment.

Stunning.

If we don’t get a shamone-bad-GFC, and stick with a 3-4M bpd supply gap? We’ll still be okay right? We’re in the process of releasing 240M barrels from our collective strategic petroleum reserves. It’ll swamp the market and should gradually be absorbed in . . . (tap on the calculator) . . . 80 days with a 3M bpd shortage.

80 days.

OMG.

We’re going to destroy demand.

We’re . . .

Stop blinking at me cursor.

We’re going to $200 oil.

Whoa, whoa, whoa

Okay, okay. Let’s not hyperventilate with hyperbole. Let’s play this out. We can’t be structurally short that much forever can we? No, no, we’ll have to produce more. Actually we will produce more. How?

Well it won’t be from public oil companies, which have already pledged capital restraint for this year, so it will likely be a mixture of private companies (who won’t be able to produce much more materially) and OPEC+. Privates (and even publics) for that matter are constrained. Pick your reason, labor, materials, and/or capital/shareholder constrains, they’re all there, and these challenges won’t subside at least for a year. So that leaves OPEC+. Though our pleas for additional barrels have fallen on deaf ears lately, if oil prices begin climbing beyond $120, 130s, the calculus will shift.

Runaway prices benefit no one as even OPEC+ producers will begin forecasting demand destruction. So we think the Saudi and Friends summer tour might come around later this year. Even if they do increase, we’re not sure they can that much as we think their real spare capacity lies somewhere ~1-1.5M bpd, which is half of the shortage we’re seeing (before a 2.7M bpd shamone-bad-GFC demand hit of course).

How do we get 1.5M bpd? That’s the difference between what they produced in Q1 2020 (pre-COVID) vs. what they’re producing today. Nah they have more you say?

How? With 1/3 less rigs than in Q1 2020.

Let’s give them the benefit of the doubt though. Let’s assume they can do it even without a third of the rigs. No seriously . . . stop laughing. Let’s just assume that, and even if they gave us everything. 1.5M bpd. We’re still short given our 3-4M bpd hole.

So without shale, and with OPEC+ a shell of its former self, in the short-term, the only viable solution is price.

Prices need to skyrocket now to literally destroy demand. It has to price out some of the poorest and yet fastest growing consumers in the world, and possibly even price out some of the wealthiest. 3-4M bpd, the exact figure doesn’t matter, the sheer size of that type of shortage isn’t sustainable. If ESG wasn’t dead before it almost certainly will be if this comes to pass.

As will the current political parties in power. Whether it’s Democrats in the US or incumbents in other countries, they’ll be blamed for the rising costs. Whether they are partly or wholly at fault doesn’t matter, what matters is they’re in the chair, and that’s where the buck stops.

With depleted SPRs, rising energy prices, and a slowing economy, of course the incumbents will lose. Politics first and foremost is about assigning blame. Yet, will the newly elected pivot and play nice with Putin? Unlikely because how’s that going to work? You vilify someone and then six months later start to cozy-ing up to them? No that’s a political bridge too far, it’s too soon and one mass grave too many. Especially for an electorate stirred into a Ukrainian flag waving frenzy after seeing months of destruction, and especially to a psychotic mafia boss who attacked, sacked, raped, and plundered a country filled with people who look . . . JUST LIKE YOU.

So it leaves us with this in the US, if it really gets bad enough, we may actually see a second “Bipartisan Infrastructure Bill” (“BIB”). Except unlike the first one which emphasized roads, bridges, etc., this one would be a national drive to improve energy security under the auspices of a BIB type of program. If the polling is correct, Republicans are likely to retake control of Congress. If so, they’ll also be more willing to pass BIB, which will allow them to claim part of the political win and show the electorate that they can govern sensibly. Unlike the obstructionist Republican Congress during Obama’s administration (which they certainly will be to a large extent), on this specific issue, they’ll be forced to compromise. Largely because not doing so means energy prices and the economy will be moving in different directions. So too will voter anger, and nothing motivates or seeds political compromise like voter anger.

So when the Republican party, armed with a mandate, throws its collective energy and efforts into a national program to develop all energy resources, expect something to pass. It almost certainly will include oil and gas drilling. It will include nuclear and it will include coal. Yes, it will almost certainly include solar and wind as well. To appease environmentalists, the President will throw in a gamut of subsidies for carbon capture sequestration and green energy. He’ll need to pacify them, but not necessarily pander to them as he’s removed from the midterms and the “fringe” electorates that dominate those elections. He’ll be refocused on the general electorate and the swing states. So let’s throw money at the problem. It is after all magical money being printed, so might as well make it bigly.

No, you’re right. None of this solves our short-term energy issues. Almost nothing will at this stage if the above comes to fruition, unless if you want to play nice with Putin. It’s about the future, and one where you still want a semblance of global commerce and stable, albeit higher, energy prices.

So something has to give, and we think it’s the political anger that forces a top-down change in policy. We believe this because in the coming months, the veneer of decarbonization, outsourcing energy independence, and prioritizing the environment at the expense of basic energy security will be stripped away by the corrosiveness of shockingly high energy prices. Delusional dreams are beginning to collide with reality, and we guarantee you reality will win.

Putin knows this, which is why he’ll be patient. He’ll occupy Easter Ukraine, and hunker down because ever the pragmatist, he knows his leverage over the world increases by the day. Having militarily lost the conflict, he can still will in some sense by staying alive. He can make the Western victory a pyrrhic one. He can win by simply breathing because for us, the air is getting thin.

Higher energy prices are coming and we think its going to be BAD.

Michael Jackson BAD.

Shamone.

There. I wrote it.

Curse you . . . cursor.

Please hit the “like” button below if you enjoyed reading the article, thank you.

First, excellent article. Thank you. But why did you take out the -2.7 Mb/d GFC shortfall in the final calculation? Recall, Q1 saw a 1 Mb/d shortfall vs a 0.4Mb/d build=> -1.5 Mb/d. EA says another -2 Mb/d of ruskie oil coming off. Seasonal demand ups another 2 Mb/d. Ergo, -1.5+-2+-2 = -5Mb/d. Conservatively round down to say 3-4 Mb/d. If oil demand destructs by 2.7 Mb/d (as in GFC in 2008) => 0.3 to 1.3 Mb/d short. Round it up to 0.5-1.5 Mb/d. If OPEC+ did put 0.5-1.5 Mb/d, with a 1/3 of the rigs=> A balanced market with the above assumptions!? I don't think OPEC would do this as it's not in their interests but you took out this -2.7 Mb/d oil GFC shortfall assumption thereafter. Or maybe I misread it.

Excellent and right