The Fed Juices It as the World Guns It

March 22, 2024

As we pivot towards drafting our quarterly letter, we wanted to quickly look at a few things that peeked our interest in the last few days.

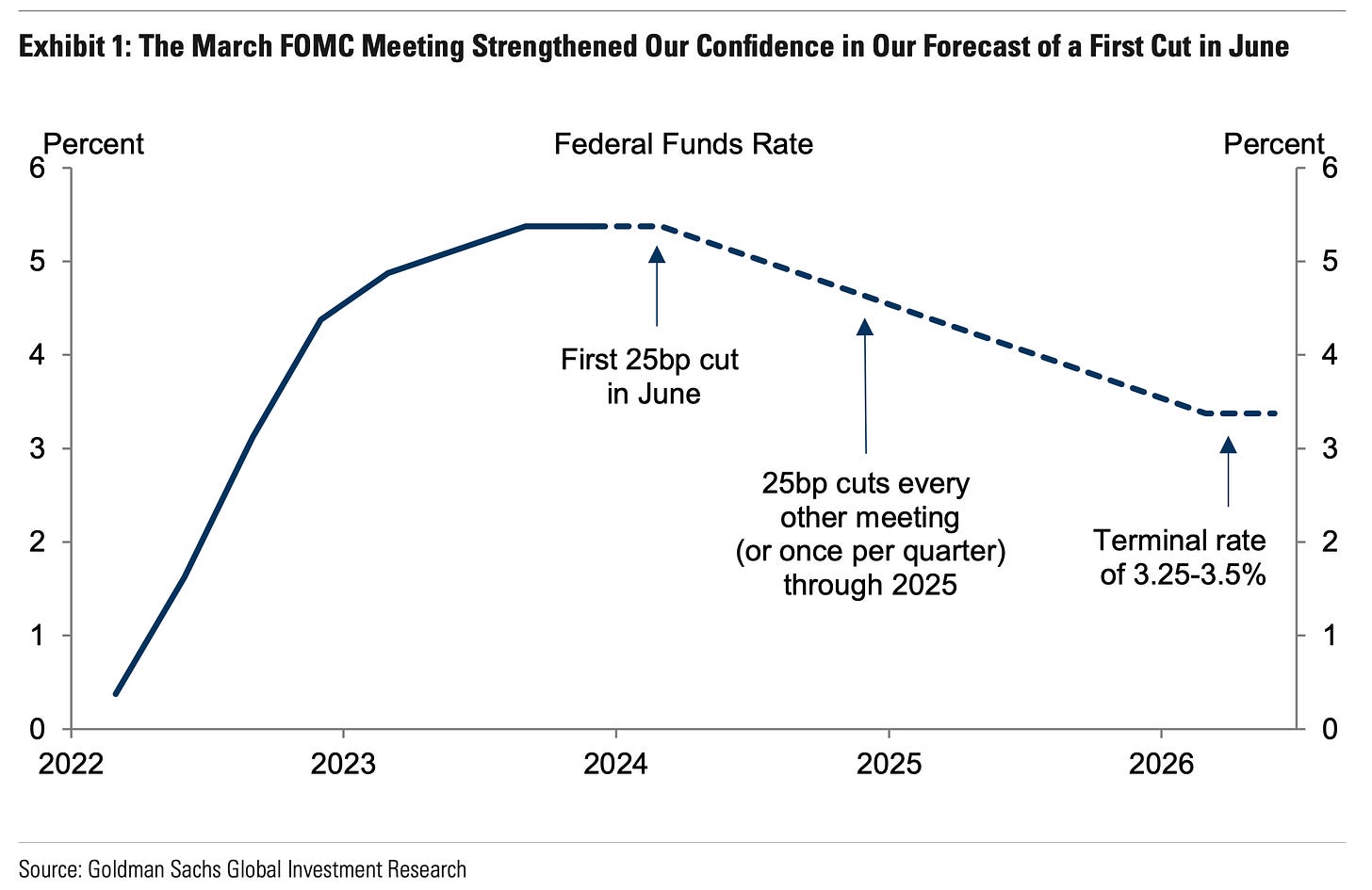

Fed meeting came and went this week and it looks like the Fed is planning for 3 rate cuts. Down substantially from where the market was previously forecasting at the beginning of the year, but that hasn’t deterred the market from climbing higher has it? The pace of rate cuts? Beginning June and then every other meeting.

Goldman’s updated their graph, and they still think we’ll end with a terminal rate of 3.25-3.5% in 2026. Let’s call that “neutral.” Neutral because maybe inflation will likely hover around that level for quite awhile, significantly higher than the 2% the Fed’s always targeted. More on that later.

The reduction in rates will be accompanied by the softening of the Fed’s quantitative tightening (“QT”) strategy. Since the Fed ballooned its balance sheet during COVID, it’s been in a run-off mode by letting securities mature (i.e., it hasn’t been buying as much debt in the market, which raises rates). At the current pace, $60B of debt are run-down per month.

In sum, the Fed’s balance sheet has shrunken from ~$9T to ~$7.5T today, split roughly 2/3 and 1/3 between treasuries and mortgage backed securities. Now remember, easing QT will be stimulatory. During COVID, the Fed stepped into the bond market as a buyer and drove rates lower. Since it’s enacted QT and stepped out of the market, private parties have been forced to step-in and absorb these bonds, at higher rates of course. If the Fed slows its exit (i.e., easing QT by half) and reduces its balance sheet by only $30B/month, that actually means tightening becomes less . . . tight. Not by much, but certainly by some. Here’s Chairman Powell . . .

What’s obvious though is that the Fed is beginning to lay the groundwork for easing both the Fed Funds Rate and its QT policy. Though many are asking why, particularly when inflation is still running near 4%, well above its 2% target. Though headline inflation is coming down, core inflation (stripping out energy and food prices) seems to be stubbornly high.

More concerning is the velocity of inflation (i.e., month-to-month measure). Inflation there seems to be on the uptick again.

Perhaps though it’s an implicit acknowledgement that it’ll be too difficult to shoehorn inflation back into its 2% box for the time being, or at least without undue pain.

The key portion of that exchange Wednesday? “Markets believe we will achieve that goal and they should believe that, because that’s what will happen over time.” Certainly not now, because doing so requires maintaining its restrictive stance for much longer, which could throw our economic recovery and current strength into reverse. What’s worse than a little higher inflation?

Presiding over a recession.

In the end, rate cuts are coming and QT is easing. Translation . . . gravity is decreasing and asset prices are increasing.

Hence the market rally.

The rally though hasn’t seemed to broaden out yet. As we can see, MAG 7 has powered ahead month-to-date. A minor rotation seems to be afoot though as the equal weight S&P 500 has kept-up with the market-cap weighted S&P 500, so there’s some shifting of investments among the bigger companies thus far. In contrast the Russell 2000 has lagged badly, notching a 1.0% gain month-to-date, which tells you that small caps still aren’t getting any love right now. So really it’s still a mega-tech and AI show still.

How all of this plays out longer-term is dependent on a few things. Will inflation cooperate in the coming months, and what happens with the election in November?

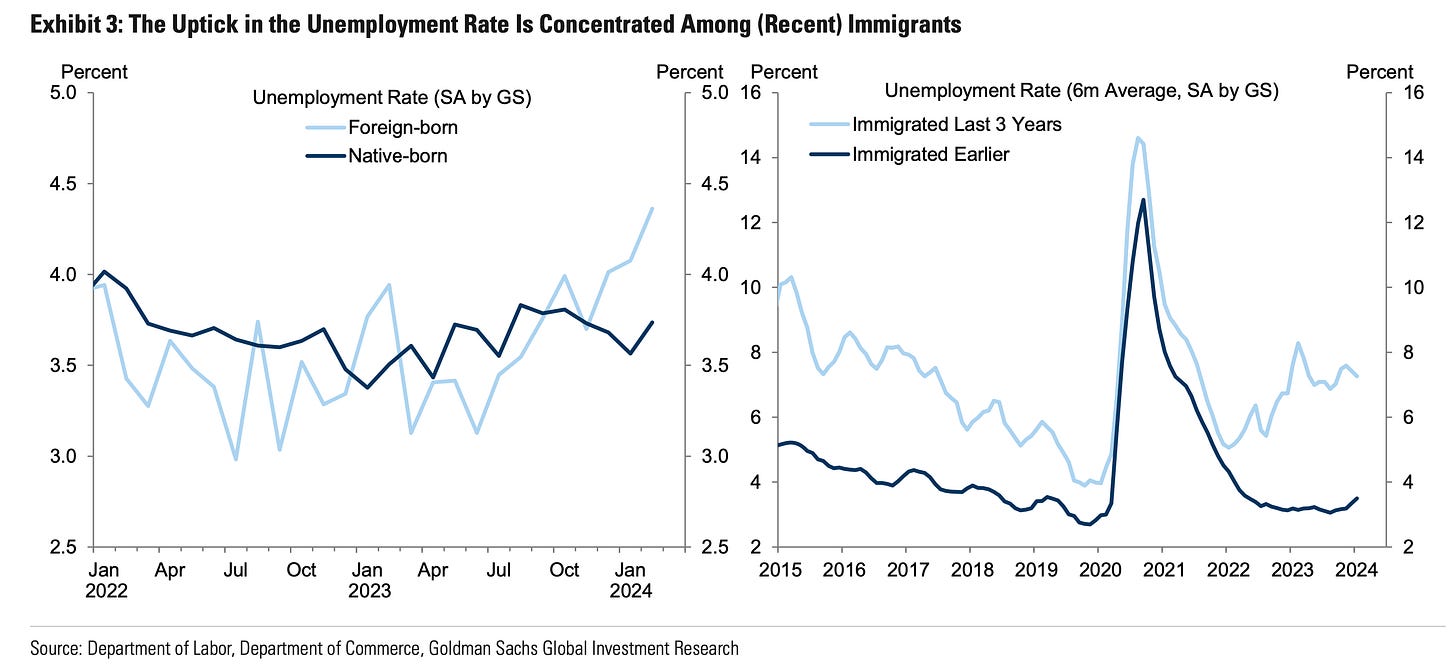

We do think that inflation will continue to hold around these levels. One of our key assertions for inflation climbing higher was that service costs will keep inflation higher in the coming years as spending shifts to services, and services = wages. As the labor market has tightened (because of post-COVID retirements), wages will naturally stay higher, in turn stoking inflation. That theory though has been put to the test. An unexpected source of labor appeared as the influx of migrants from Central/South America have relieved some of the wage pressure. Normally, immigrants to the US number ~1M/year, or about 0.3% of our 330M population. In 2023? 3.4M. Nearly 3x the amount as migration increased. Politics aside (and yes we need to put that aside), the economic impact is very real. For the labor market, it helped ease the shortages coming out of COVID. Softening the labor market = softening wage inflation, but it also pushes unemployment higher. On balance, this should be deflationary, so for those worried about inflation . . . that’s a good thing.

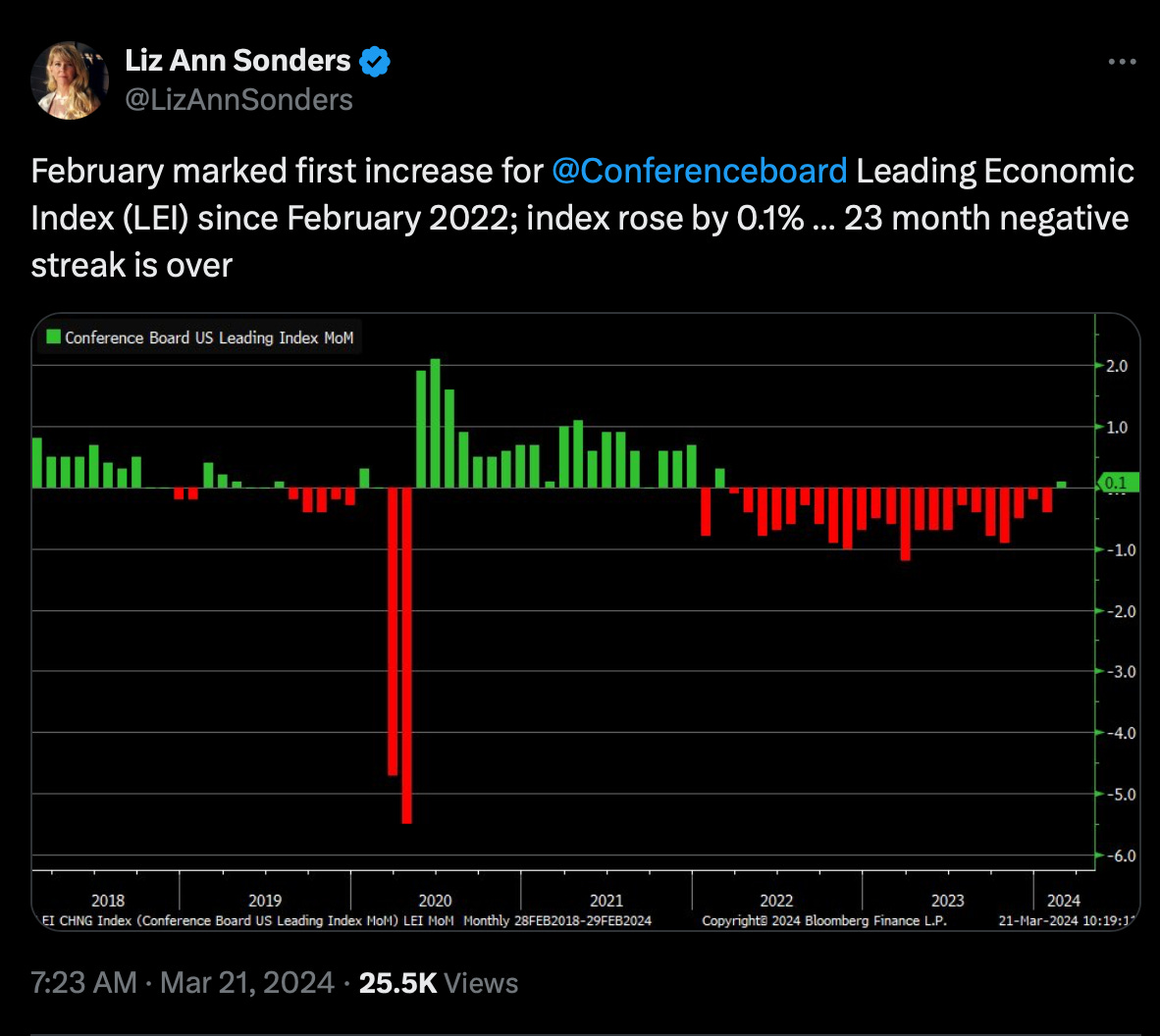

It’s still early days as to how this will trickle through to the inflation data, but it is a shift in how we see the inflationary forces. Maybe the Fed gets its cake and eats it too, a strong economy coupled with falling inflation. We’re skeptical because even with the expanding labor supply, the remaining undercurrents of inflation still exists (i.e., near-shoring, commodity undersupply, heightened global demand driven by economic growth, restocking, and supply chain uncertainty) to keep it sticky.

Moreover, we’re still left with nagging thought that we’re in a late cycle rally, but one where there’s still a tremendous amount of excess liquidity sloshing through the system. The themes and the pockets may have changed, but the overall impact remains. We’ve ping-ponged from GameStop/AMC/Bitcoin/Robinhood in 2020/2021 back to Bitcoin/NVDA/semiconductors/AI today. Sure we had a brief interlude in 2022 as inflation gripped the market, but aren’t we “back baby?” What if the “real world” starts to catch-up?

Now we add the Chinese stimulating their manufacturing economy, a global synchronized recovery as US GDP maintains, Europe and Japan recovers, and China gunning its engine. What if this growth coupled with excess capital on steroids actually impacts demand for real world things? Doesn’t this capital begin to leak out into the real world as animal spirits turn up?

Is that why commodities have perked-up recently? Could the world be gunning it as the Fed juices it? The real world certainly thinks so.

Full-circle . . . in a late cycle, hopped up on go-go juice.

If so, hold onto your butts. We’re going higher.

Please hit the “like” button above if you enjoyed reading the article, thank you.