The Footrace at Fluor vs. NuScale

December 5, 2025

When you're researching bubbles, sometimes you come across quirky fact patterns in the market place.

Just take a look at this situation, NuScale power.

NuScale, if you don’t know is a US company that designs and markets small modular reactors (“SMRs” for short). The company’s stock also trades under the NYSE as SMR, and has agreements to build SMRs throughout the US.

NuScale, along with most other nuclear energy companies, have been the darlings of Wall Street, with nuclear energy as the perceived clean energy source to power the bevy of data centers to be built for the coming AI revolution. Again, like many things with AI, the hype precedes the reality. As of the most recent Q3 filing, NuScale has about $680M of cash and little debt. Aside from $400M of accounts payable, it has no real liabilities. Okay so it’s not what we consider “asset heavy.”

What about the business? Well that my friends is great! $30M of revenue in the past 9 months YTD), which of course leads to ginormous losses, and really we’re talking ($256M) of red ink in cash. Yeah, it’s a nuclear meltdown, but fret not because it has the kissed the hand of the administration, and all licenses will be granted and projects will be completed. It’s not a cash burn that requires a capital infusion . . . this is investing. So what’s this cash bleeding business that will need to raise capital (i.e., read “money” via dilutive stock sales to get its projects off the ground) worth?

$7B

That’s right, it loses money, will need to issue more shares, and hasn’t broken ground on anything quite yet.

$7B

What’s even more nutty about this is just 6 weeks ago, this thing was worth north of $16B! That’s fun.

What’s not so fun? That “correction” since October 15th. A lot of that is the euphoria leaking out of the AI nuclear trade. Sure it’s bouncing a tiny bit here, but that drop-off was steep. It’s what happens when mo-mo turns into a car crash and momentum investors jump off. Euphoria turns to despair . . . or dystopia.

Still though, don’t get twisted yo. It’s still worth . . . $7B.

Know what else is worth $7B? This guy . . . well not the author, but this one . . .

Fluor Corp.

Fluor Corp, if you don’t know is an engineering services company. Full disclosure, I used to work there, many many eons ago. It’s a stodgy company run by engineers tackling big engineering projects. Oil and gas, power, infrastructure. Think refineries, embassies, power plants, people movers, etc. One of the largest engineering, procurement and construction (“EPC”) firms and there’s not many left. Mind you there were quite a few of them years back, but the chase for big projects led to some costly misjudgments.

Like building a house, building refineries and other large projects in far flung places around the globe often come with unexpected costs. Change orders, commodity prices moving against you, political turmoil, economic uncertainty, war, etc. Thus, you’d often bid on a cost + basis. $1B project? Tack on 15%. $10B? Tack on 12%. Whatever the case is, make sure you cover your costs, and get a little something extra. Unfortunately, as with all things, people begin to race to the bottom on price. Yet instead of reducing what they charge, EPC firms began to shoulder more risks to win the projects. In comes the fixed price contract.

Imagine building a refinery for $1B on a fixed price contract, hoping nothing goes wrong. Good luck with that. As you’d expect, many things go wrong and profitability inevitably plunges when you shoulder those costs because you inadvisedly bid “fixed price.” Risk is always two-sided in a contract. You either have it, or you don’t, and when you have it and it goes wrong, you eat it. EPC firms cratered and so did FLR’s stock. In comes the new CEO and today, the company’s on more solid footing, with less competition.

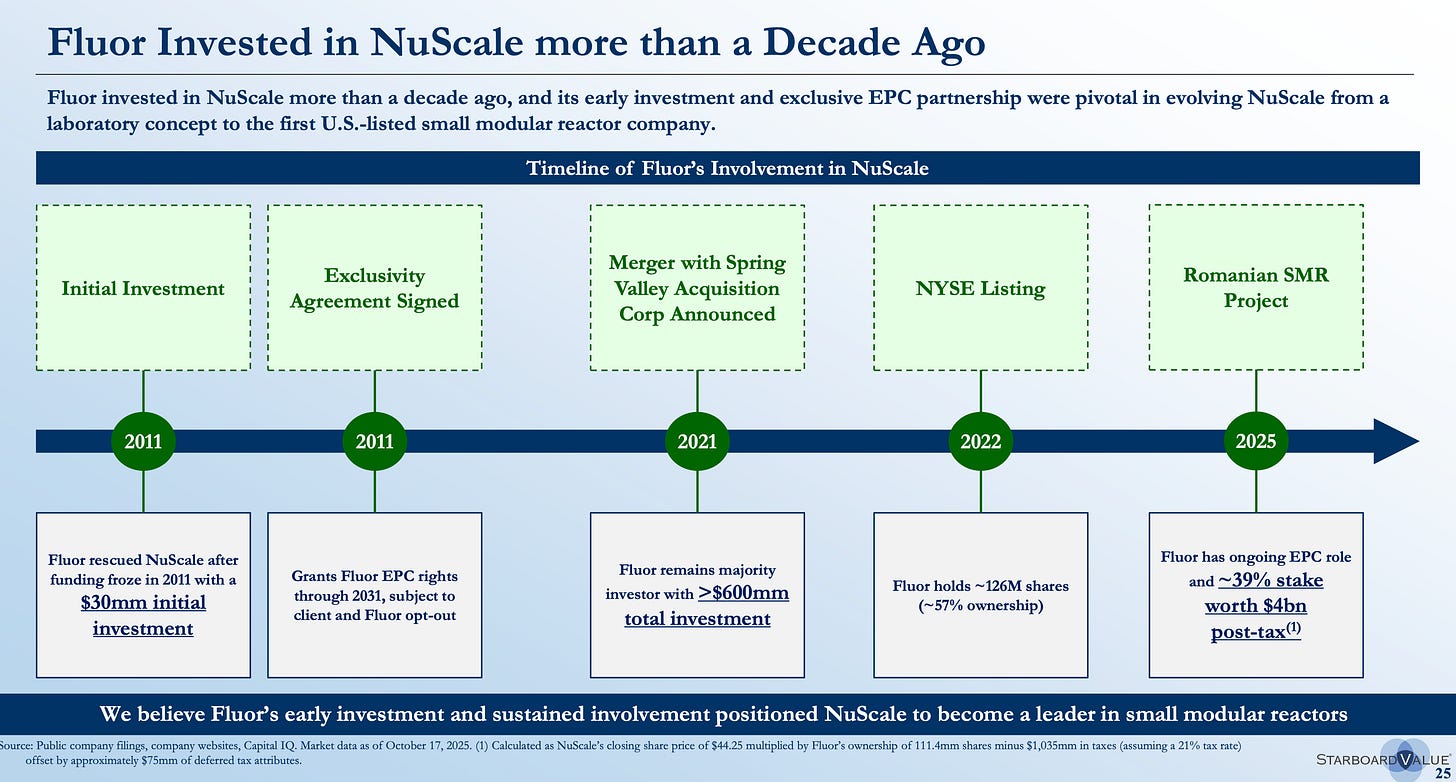

Here’s where it gets interesting. About 15 years ago, FLR actually bailed out a tiny company called NuScale as funding froze post-financial crisis. It was this pet rock of an investment, really an equity infusion into a company that maybe one day could develop its nuclear power plants, and then FLR would have first dibs at the engineering work. So in addition to providing a cash life line, FLR received not only equity, but an Exclusivity Agreement on any project NuScale would embark on would be serviced by FLR.

Fast forward 11 years later, and NuScale has gone public, with FLR holding about 126M shares. It’s since sold down about 15M of those Class B shares, but still owns 111M shares. Leap another few years later and boom . . . AI. NuScale pounces on that wave and investors pounce on the stock. SMR shares go nuclear despite having no revenue or any profits imaginable, shares reach $44/share and the market cap jumps past $16B.

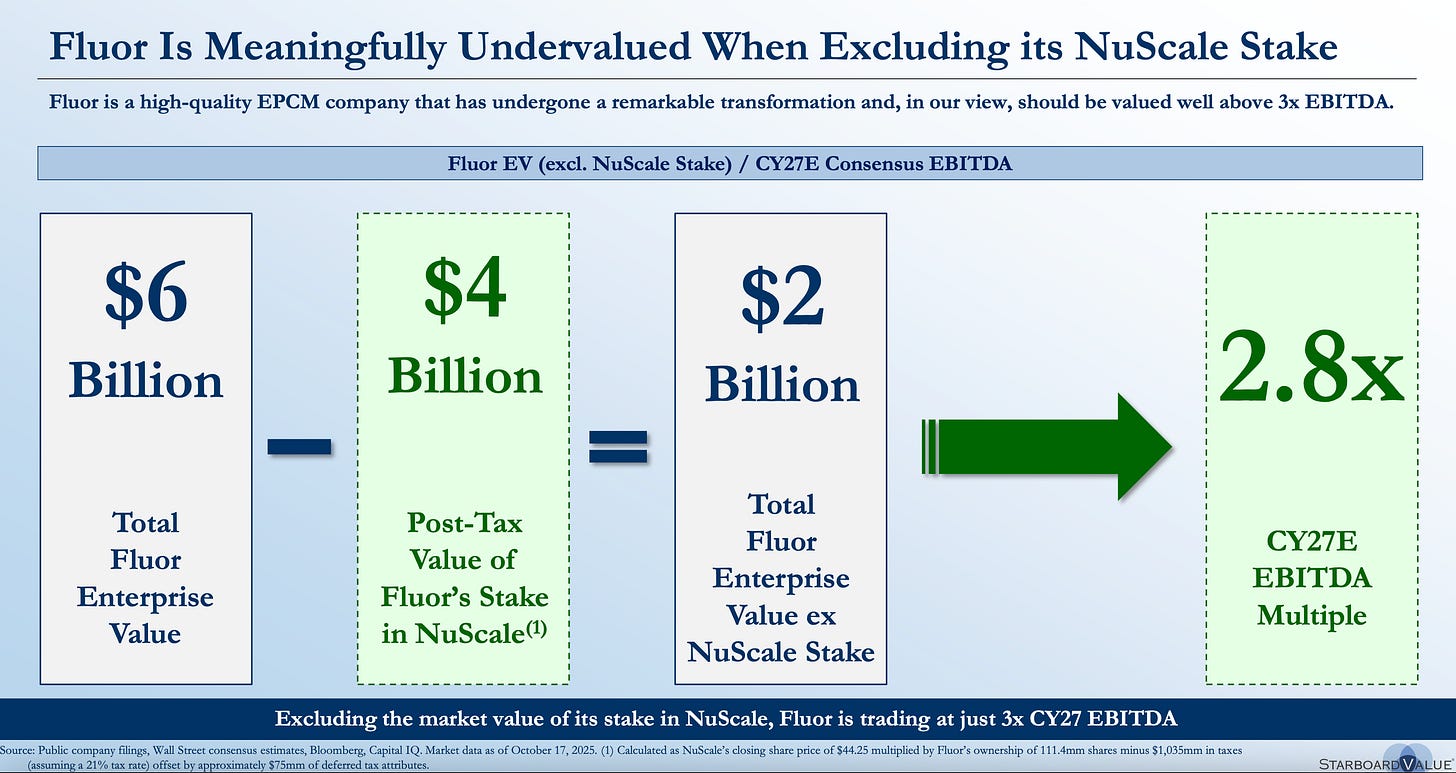

A month ago, before the recent spate of AI volatility, the stake was worth nearly $4B, which means you were buying FLR’s EPC business itself for $3B. Its stake in a small previously “immaterial” company had ballooned to be worth more than FLR’s entire organic business itself. Since October though, market volatility has halved the value of SMR, but at $22/share, or $2.4B of value ($2B post-tax) against, it still accounts for ~30% of FLR’s entire $7B of market cap or a third of its $6B enterprise value.

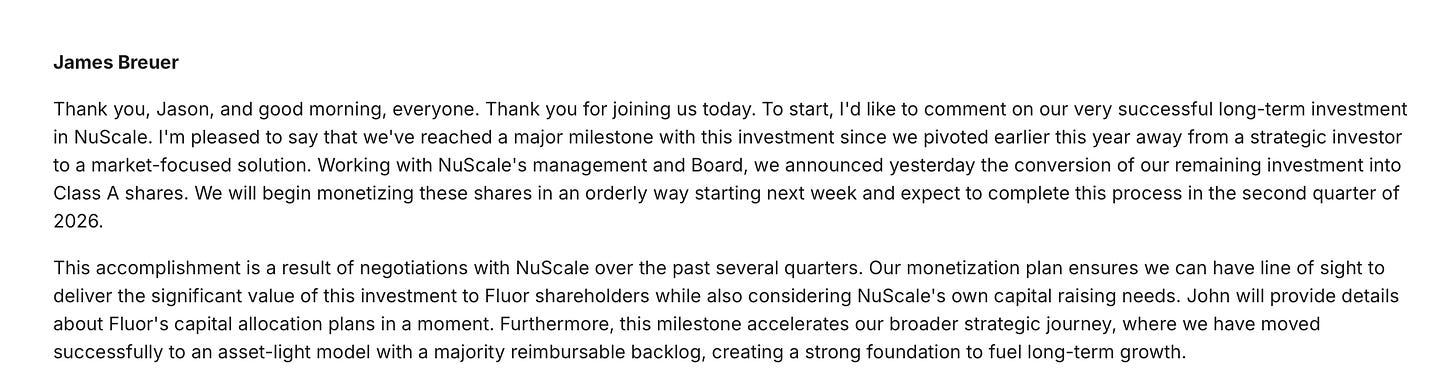

That type of dislocation doesn’t last long. So in comes Starboard Value, an activist investor that took a position in Q3 and began prodding FLR’s management team to aggressively divest its NuScale stock and turbocharge a share buyback. It appears to have succeeded:

FLR currently has about 160M shares outstanding, with a $7B market value ($6B in Enterprise Value as it has excess cash). The NuScale holding represents nearly 30% of that value at $2B (assuming post-tax cash). If FLR can sell down its 111M shares at today’s $22/share level, the company can repurchase nearly 45M FLR shares in exchange. In addition, FLR has increased its share repurchase plan (independent of the NuScale sell down) by $800M, which should retire an additional 10% of FLR’s outstanding shares. So altogether, we’re looking at nearly 35-40% of FLR’s shares retired.

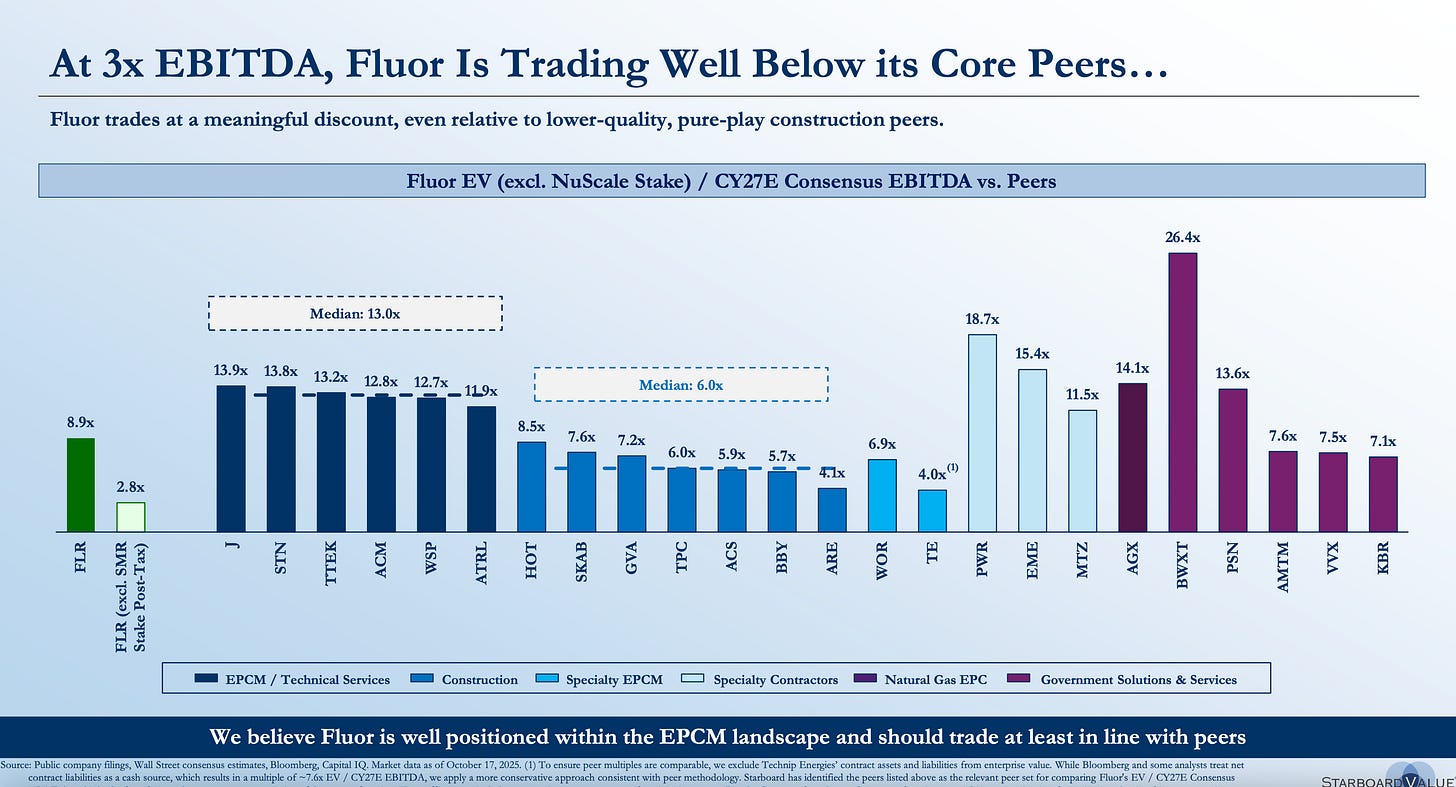

Now when Starboard ran its figures, NuScale’s stock was trading at $44/share and FLR stock was trading slightly lower, so instead of 2.8x CY27E EBITDA, we’re really at 5.6x CY27 estimates today.

Still the general reasoning holds, and relative to its remaining peers in the EPC space, it’s still fairly cheap.

What’s important isn’t necessarily the 2.8x EBITDA that Starboard is using, but the fact that even at 5.6x today’s figure, it “ain’t” 13x FLR’s peers.

So it’s a foot race. It’s a foot race between how long this AI bubble can go on before FLR can sell down its holdings and repurchase its stock. FLR’s agreement with NuScale is an orderly divestiture from November until the end of Q2 2026, so give or take 7 more months with November already in the books and soon December, and each month of divesting 15M NuScale shares.

It’s a reasonable bet though that this gets done, after which we’d expect FLR’s shares to bounce higher into the $65-70/share range from today’s $44/share price (all else being equal). Quirky times indeed, but hey, when it’s freaky in your favor, you might as well watch.

We sure like seeing a good race.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

let's take some modest assumptions :

- fluor knows the likely value of its smr stake

- fluor knows the total cost and risks to get to market at smr survivable scale

- fluor knows its tech may be good but not overwhelmingly superior to the dozens of global alternatives

when one considers the regulatory hurdles, and favoritism to okla and whoever may be opportunistic for trump&friends, it seems greatly sensible to exit ASAP w/tolerable shareprice down pressure.

Bought the dip in FLR at 38.50 earlier and have written covered call 3x. Picked up $7.50 extra. Nice write up but not sure if the $22 for SMR will hold.