The Intern Buys an NBA Team . . . for pennies on the dollar.

August 12, 2025

Can you believe it??

Our intern’s third article! Kids sure grow up fast these days don’t they?

*sigh*

OSC: Welcome back Matt, congrats on surviving 2/3rds of the summer internship so far.

Matt: Thanks.

OSC: Onto the last month before you restart your journey at UC San Diego. Since you expressed an interest in sports, we had you look at lululemon, Nike, Crocs, and now Madison Square Garden Sports Corp. (“MSGS”). Tell the readers a bit about MSGS, and why we found it interesting.

Matt: When you hear "Madison Square Garden,” your mind likely jumps to “The World’s Most Famous Arena,” a stadium nestled in the heart of Midtown Manhattan. But Madison Square Garden is just one part of a much larger organization. Today, the company, owned by James Dolan and the Dolan family, has been split into two publicly traded entities: Madison Square Garden Entertainment Corp. (“MSGE”) and MSGS.

MSGE oversees the company’s entertainment and real estate assets, including iconic venues like the Sphere in Las Vegas, Madison Square Garden, Radio City Music Hall, and the Chicago Theatre.

MSGS manages its professional sports holdings, most notably the New York Knicks (NBA) and the New York Rangers (NHL). In this article, we’ll focus on MSGS and explore how the sports division operates and generates revenue.

OSC: So tell me a bit about MSGS and its ownership structure?

Matt: Most of the Dolan wealth comes from Charles Dolan, the patriarch of the family, who founded and sold Cablevision and HBO. Charles Dolan recently passed in December 2024, leaving his son James in charge. Today, the family controls both MSGE and MSGS.

MSGS has a market cap of $4.79B composed of approximately 23,761,099 shares with a price of ~$202/share.

If we look at the company’s debt, as of the latest quarter, MSGS’s net debt totals out to only $0.2B (i.e., $0.1B of cash + $0.3B of long-term debt). With an enterprise value of ~$5B, this company is essentially lightly levered.

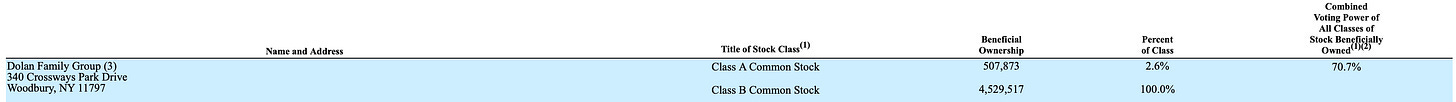

We know that the Dolan family controls this company, however, let’s break it down by voting power and economic interest to get a true sense of their holdings.

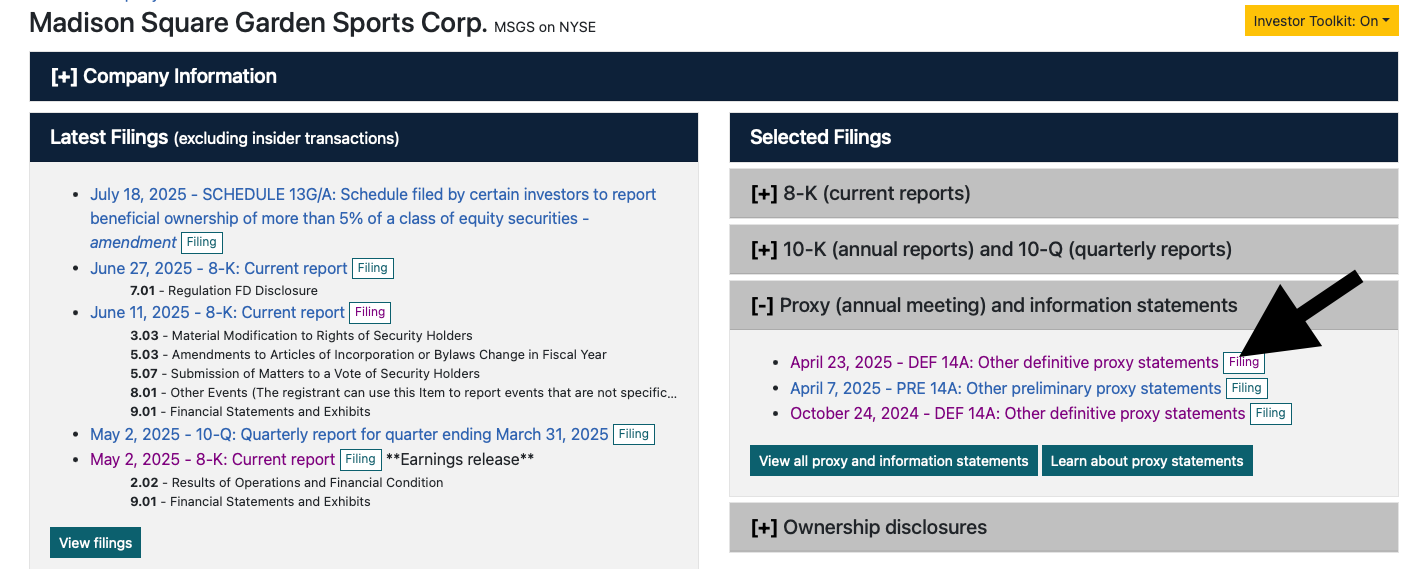

Looking at the company’s filing in its proxy statement, MSGS has approximately 25M shares outstanding, with 19.5M Class A shares and 4.53M of Class B shares.

While Class A shares carry one vote each (19.5M votes), Class B shares carry ten votes each, totaling 45.3M votes. Altogether, that’s 64.8M votes, with Dolan controlling about 70% of them.

By examining the total number of outstanding shares and the Dolan family's ownership of common stock, we can estimate their economic interest in MSGS. The Dolan’s own all 4.53 million Class B shares, as well as 2.6% of the 19.5M Class A shares. In total, the Dolan’s own approximately 5M shares out of 25M shares outstanding, or ~20% of the economic interest in MSGS. So to reiterate, the Dolan’s have ~70% of the vote and ~20% of the economic interest in MSGS.

OSC: How does this company generate its revenue?

Matt: The majority of MSGS’s revenue is driven by its two flagship franchises: the New York Knicks (NBA) and the New York Rangers (NHL). Together, these teams account for approximately 95% of the company’s total revenue, while the remaining 5% comes from their respective development affiliates, the Westchester Knicks (NBA G League) and the Hartford Wolf Pack (AHL).

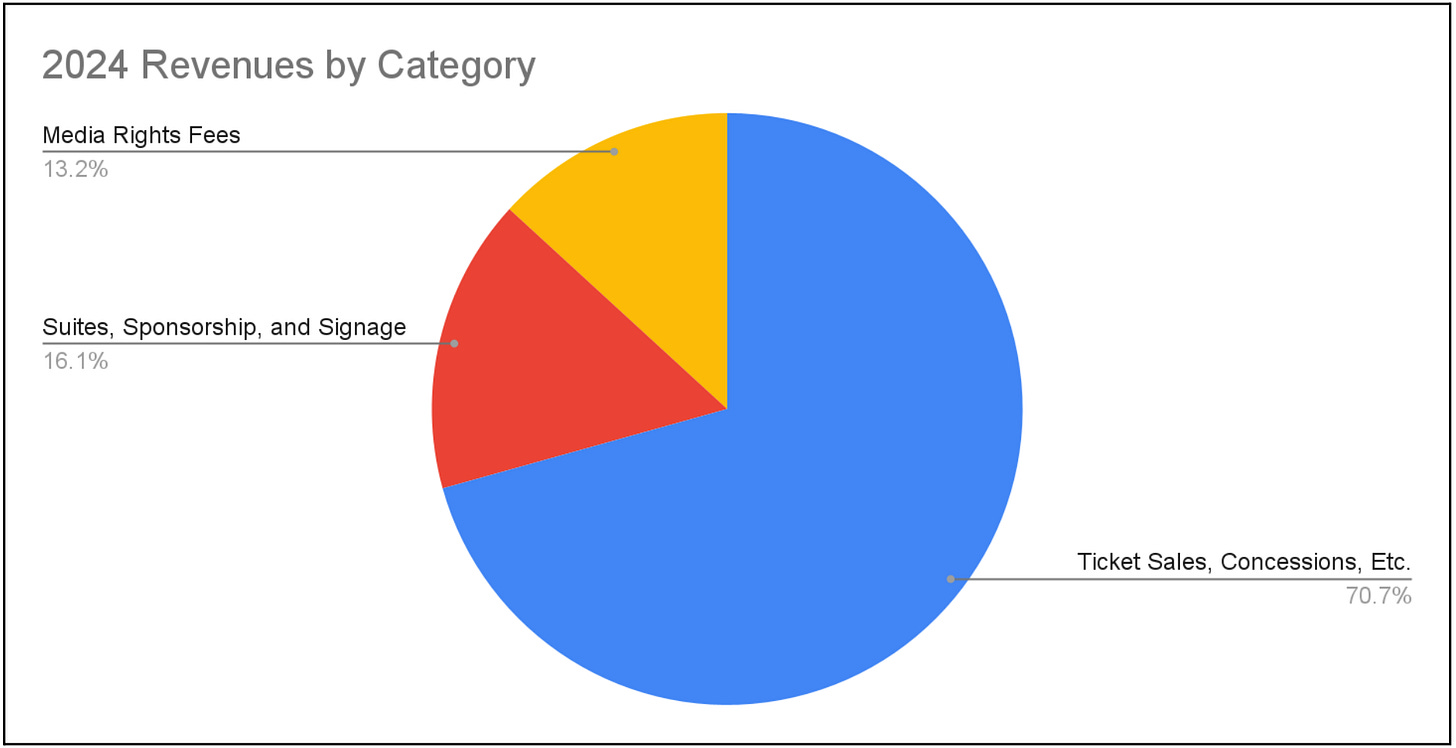

More specifically, ticket sales, concessions, and merchandise account for 70.7% of revenue, followed by suites and sponsorships at 16.1%, and media rights fees contributing 13.2%. Clearly, live events remain the primary revenue engine for both the Knicks and Rangers (note all information in charts below from MSGS Form 10K/10Q).

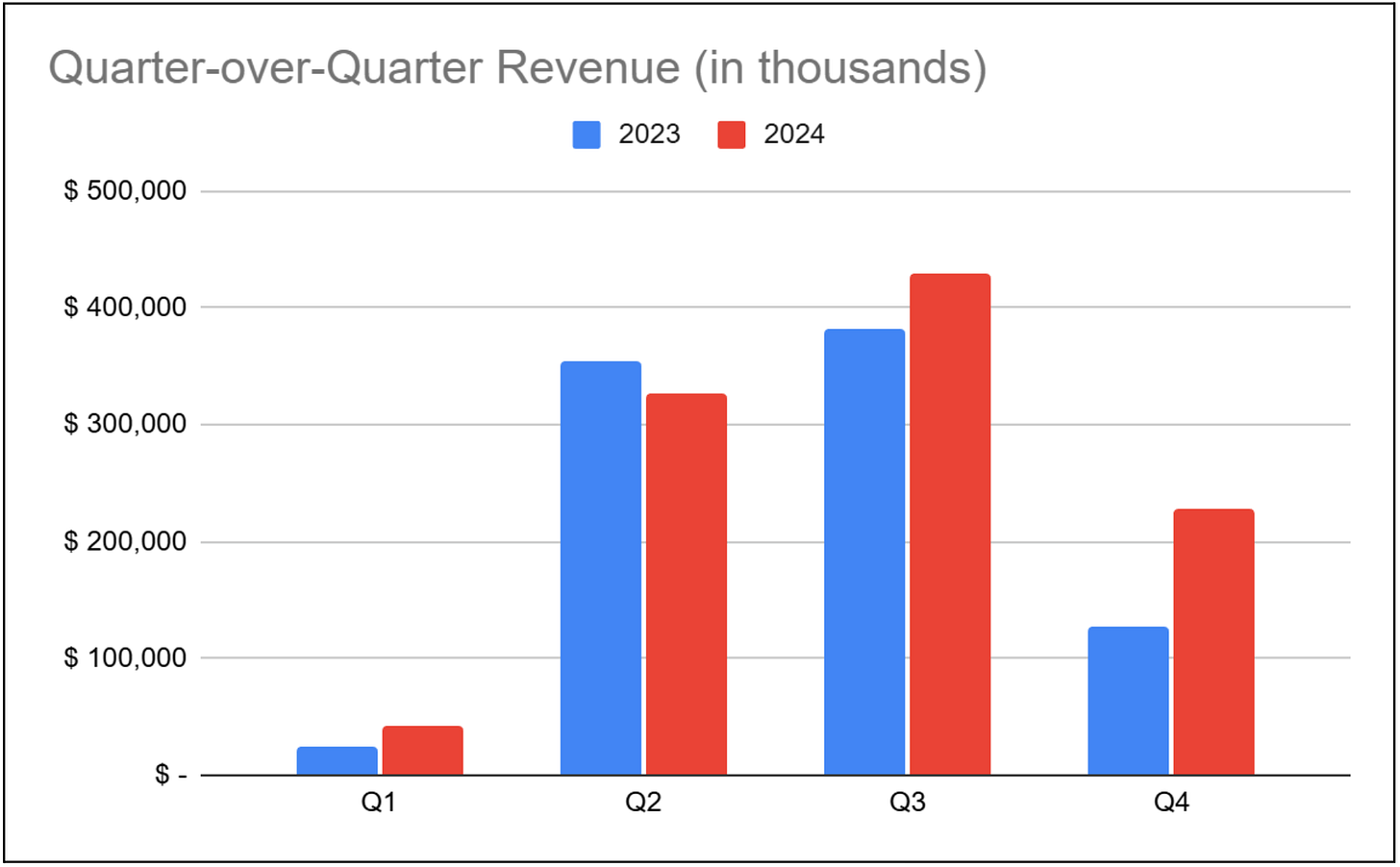

Revenue cadence, however, isn’t consistent throughout the year. Since both the NBA and NHL seasons run from October through June, the company experiences a natural dip in revenue during the offseason, and that decline is typically reflected in the company’s fiscal first quarter.

The seasonal fluctuation is a predictable pattern though as game-related revenue obviously slows when teams are not playing.

Overall, the company generated $821M, $887M, and $1B in 2022, 2023, 2024, respectively. The rise in revenue was largely related to the on-court/on-ice success of the Knicks and Rangers during their respective seasons (i.e., making and advancing in the playoffs).

OSC: Great, so the better they perform “on the field,” the better their financial metrics appear, makes sense. So these successful sports teams must be kicking off tremendous cash flows right?

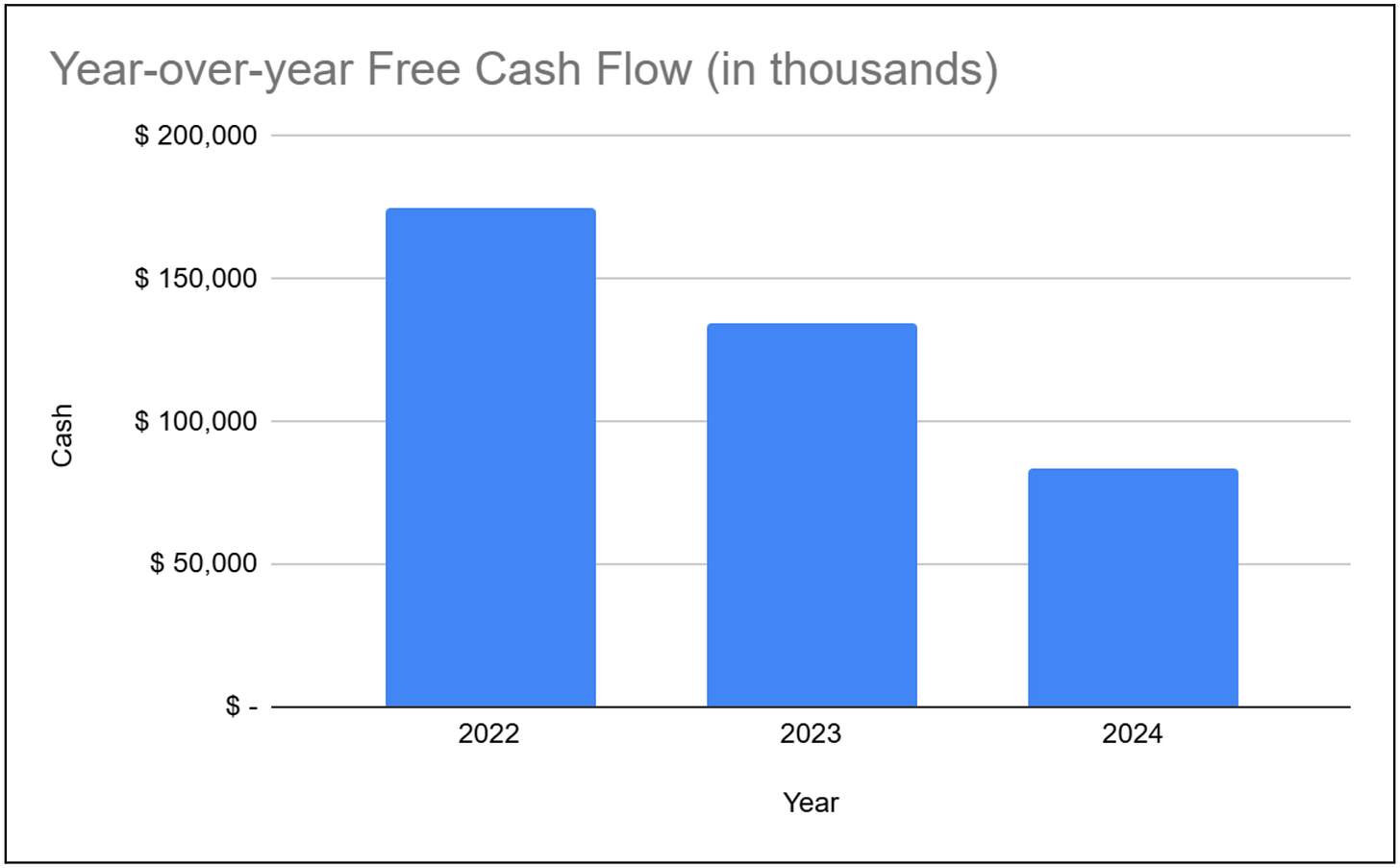

Matt: Not so. If we look at MSGS’ cash flow statements, we can see that this company doesn’t generate much cash. From 2022 to 2024, MSGS generated between $80 to $175M in cash.

OSC: How does a company that has a market cap of $5B generate that little of cash?

Matt: Payroll. Let’s take fiscal 2024 as an example. In 2024, MSGS generated $1B in revenue, but operating expenses (i.e., mostly player salaries) totaled $850M leaving the company with ~$150M in operating income.

After interest and tax expenses, MSGS was left with only ~$58M in income. We can then take that $58M of net income, and bounce over to the cash flow statement. Once MSGS makes certain working capital and non-cash adjustments, we’re left with $92M of cash from operations. Take out capex, and it leaves us with $80M of free cash flow (“FCF”).

OSC: So what did they do with the cash?

Matt: You would think that they’d buy back shares or institute a quarterly dividend, but that’s not the case. The company has only issued special dividends (e.g., one was paid in December 2024, which coincided with Charles Dolan’s death). If we think about it, it makes sense. There’s no reason for the Dolans to buy back shares as they already control the majority of voting stock. Plus, this company is generating very little cash, so preserving cash would be a much more rational decision than buying back shares when you already have control.

OSC: So this is a $5B company with very little debt, that spits out a weak $100M or so of FCF every year, depending on whether or not Jalen Brunson can carry the team and make the playoffs. That seems to be a paltry 2% earnings yield, which doesn’t appear to be particularly appealing as an investment, so where’s the hidden value here, the unappreciated gem?

Matt: The sports teams. Again, MSGS is composed of two of the most valuable sports franchises (i.e., the Knicks and Rangers) in their respective leagues. While the teams do not generate tons of cash day-to-day, their long-term appreciation is enormous as media rights and the value of sports franchises continue to gain in value.

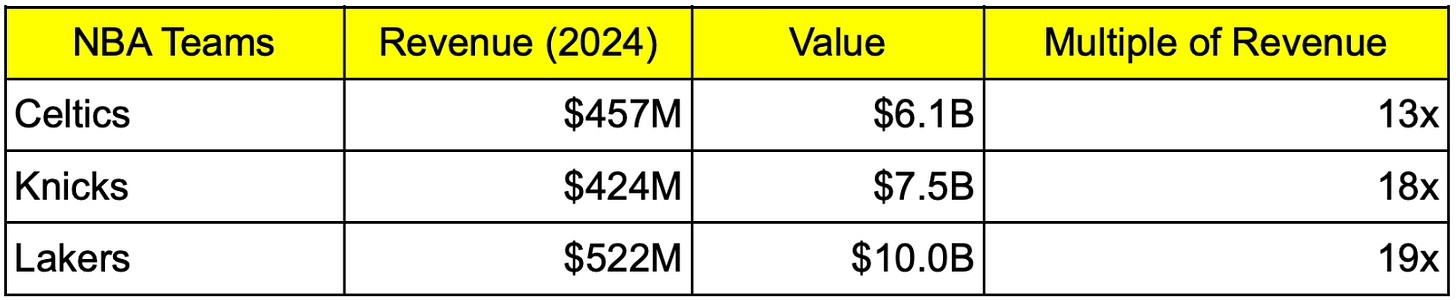

Let’s just compare the two NY teams to other teams in their leagues. In the NBA, the Boston Celtics and the Los Angeles Lakers were recently sold in separate private transactions, and provide a timely comp for the New York Knicks.

In 2024, the Boston Celtics generated ~$457M in revenue, and it sold in March 2025 for $6.1B (i.e., 13x revenue). Furthermore, the Los Angeles Lakers generated ~$522M in revenue in 2024, and the team sold in June 2025 for $10.0B (19x revenue).

(Forbes https://www.forbes.com/)

In contrast, the New York Knicks generated $424M of revenue in 2024. Given the size of the greater New York market (20M population) vs. the Boston (4.9M) and Los Angeles (18.6M), the Knicks would arguably garner a similar, if not higher multiple as the Lakers. Forbes magazine values the Knicks at $7.5B, using an 18x multiple.

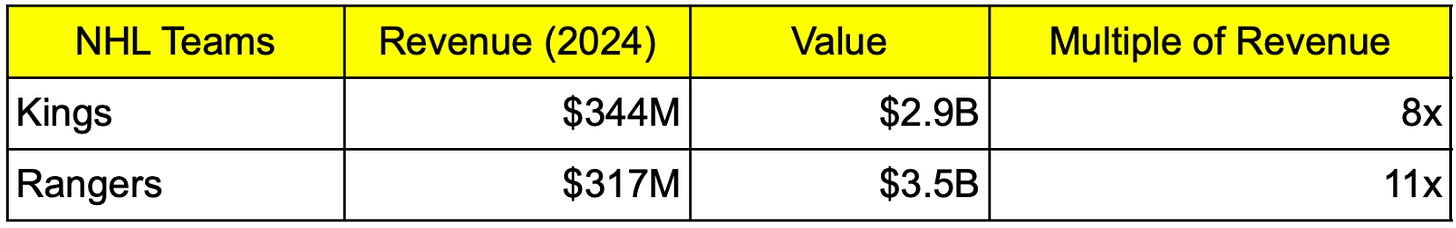

Turning to the Rangers, we can compare them to the Los Angeles Kings. As of 2024, the Rangers generated $317M in revenue while the Kings generated $344M. The Rangers are valued at $3.5B and the Kings $2.9B. As we can see, Forbes values the Rangers at 11x their revenues while the Kings at 8x.

When comparing these two franchises to their peers, we can see just how valuable these assets are for MSGS even if we exclude the minor league teams. Think about it, the market cap of this company is totally understated. Currently, MSGS sits at a $4.8B market cap, which is far below the combined asset value of $11B using the sum-of-the-parts analysis above.

OSC: So what gives? Why’s the market cap so much lower than the value of the assets in the company?

Matt: The Dolan discount. To start with, the Dolan family has the majority voting power in this company, so they already determine the strategy of the company, and while the Dolan’s continue to enhance the value of the assets, they’ve cared little about the stock or shareholders.

Second, the FCF of this company is anemic, which means there’s little shareholder return while you wait.

OSC: When can we expect this discrepancy to change, and the stock to rerate to better reflect the underlying assets?

Matt: Truthfully, there’s no clear timeline for when a change in ownership might occur, or a realization event may occur. While we wait for that outcome, MSGS kicks out very little cash flow, and in turn, low shareholder returns. The Knicks and Rangers are two incredibly valuable sports teams, however, their value may not be fully recognized until the teams are sold.

OSC: No wonder the stock’s languished. Institutional investors, who’re judged on their monthly, quarterly, and annual performance can’t own this stock since it’s a “value trap,” though one hiding in plain sight. If the Dolan’s don’t care to rerate the stock, investors (who need to show performance), can’t own it.

Matt: Correct. Essentially, the only way we can see a major increase in this stock is if the Dolan’s were willing to transact the assets by selling a piece of the Knicks and/or the Rangers. This would give the market an opportunity to revalue the embedded assets (i.e., an opportunity to “mark-to-market”). Selling would also likely generate an enormous amount of cash, potentially paving the way for major shareholder returns (i.e., a stock dividend or buyback), which would catalyze the stock.

Realistically though, there’s little incentive for James Dolan to sell either team today, given their majority voting control over the company, and the fact that both teams continue to increase in value. As it stands, they’re likely to retain ownership for the foreseeable future. Upon each of their passing (there are 6 Dolan children), control would transfer to his children, and it’s ultimately their decision whether or not they want to hold on or sell.

OSC: Well that’s not terribly compelling . . . so why even bother? What’s the play here?

Matt: Death and taxes.

OSC: Dark . . . but as the kids “age out,” transactions may occur?

Matt: James Dolan is 70 years old, and after a life of partying . . . well . . . we’re not sure about longevity.

OSC: Betting against a future octogenarian . . . spoken like a true hedge fund manager. What’s even more intriguing is something that MSGS just did, what is it?

Matt: This.

In an April 2025 proxy statement, MSGS is asking shareholders to vote on a proposal to approve the redomestication of the company from Delaware to Nevada by conversion. In simpler terms, this means MSGS is seeking to change its legal incorporation from the State of Delaware to the State of Nevada.

Currently, MSGS is incorporated in Delaware, which imposes a 6% state corporate income tax. Nevada, by contrast, has no state corporate income tax. While companies often consider redomestication for various regulatory or legal reasons, there’s a possibility that this action is being taken for tax planning purposes.

OSC: Hmmm . . . tax planning can’t happen in a vacuum, there needs to be business reasons. MSGS is touting legal liability and cost savings, but they appear to be inconsequential.

Matt: Right, so maybe this change in legal incorporation is part of a larger income tax, capital tax, and estate tax plan being carried out, and a prelude to some type of transaction that would trigger taxes. It’s conjecture, but we’re extrapolating from the filings.

OSC: Very, very interesting. Is this a buy then?

Matt: Yes. If you can stomach knowing that the stock may not move . . . until it does. While the stock may show very little increases year-over-year, we can expect its value to shoot up when the right time comes. And in this case, the right time is when the Dolan’s sell. Even though we have no clear picture of when that will occur, it will eventually occur.

MSGS generates very little cash that a dividend or share buy-backs would be minimal, but the value of the two sports franchises will keep appreciating. We know from recent transactions that sports franchises have continued to appreciate dramatically. At the end of the day, the stock is really all about patience and waiting for the moment where the company will realize the value of its underlying assets. In the meantime, shareholders can know that the assets within will continue to appreciate even if their shares do not reflect the increase contemporaneously.

OSC: So it’s great candy (valuable sports teams), in a bad wrapper (public company shell). Since it’s under Dolan’s control, public shareholders are just on a ride-along until the family decides to sell. You’d go into this investment knowing he has almost no incentive to rerate the shares because if he or his siblings pass today, the market value (for estate tax purposes) and the corresponding tax would be half what it’s really worth.

Moreover, institutional investors (mutual funds, hedge funds, etc.) can’t own it even though it’s clearly undervalued. The candy inside will keep appreciating since everyone loves candy . . . err sports.

As team values rise around the leagues, you know that your assets (i.e., the Knicks, Rangers, and minor league affiliates) are also appreciating along with it, the difference here is you’ll be buying it at half the price. The only thing you’d have to stomach is the uncertainty of when a transaction happens to close the private to public valuation gap.

It’s a bit of an asymmetric play to the overall economy and market, which is what makes it interesting. I think the argument that the Dolan’s are terrible capital allocators is neither here nor there. It’s hard to mess up sports teams, and even the worst ones managed by racists (see Donald Sterling and LA Clippers) have sold at unheard of multiples.

Here, the stock may not rise for years, but it eventually will if/when the Dolan’s transact (whether through buybacks, a sale, or some other monetization transaction). So treat it like the Dolans, buy it and park it in the portfolio, knowing you own an NBA team.

That’s pretty interesting . . . Knicks for the win.

Matt: Exactly.

OSC: Great work Matt, and a fun idea.

Matt: Thanks!

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Also, I should've mentioned that I very much enjoyed and appreciated this entertaining, informative summary. Great work!

Isn't James Dolan 70 years old, not 76?