The Oil Football and Why It's 3rd & 30.

September 3, 2021

Ah I love the summer. Sitting at the park, picnicking. Lounging and laughing with our pasty friends, many of whom haven’t seen sunlight since March 2020. We’re all soaking-in the warm sun now, enjoying its rays while gazing into the appropriate social distance and breathing in fine freshly filtered N95 summer air.

As we sit in our carefully curated and vaccinated bubble, I’m watching two people play catch with a football. The American version mind you, not the “soccer” you European folks are want to do. That good ‘ole oblong pigskin being tossed around. This . . .

As I watch that football being thrown back and forth, I can’t help but be reminded of something we illustrated awhile back. I’m reminded of . . . that’s right . . . oil. This is usually the point where my kids would eye-roll so hard as to cause whiplash, but bear with me. Every investor knows that when you’re fully invested in something . . . everything becomes about that thing. So, let’s play catch.

Here’s The Thing

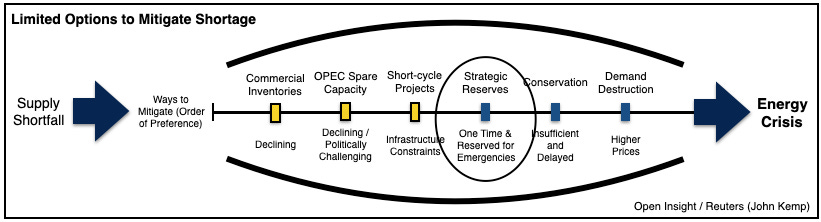

We drew our football a few years ago to illustrate what an evolving energy crisis would look like, and we were reminded of it at the park.

As supply shortfalls morph into an energy crisis we should begin to see the market take increasingly exigent steps to mitigate the rising prices. Said another way, more and more of the signposts on our football should light up, which indicates that we’re on track.

Absent wholesale conservation and/or demand destruction (which usually only comes when higher prices arrive), many of the options are short-term in nature. As we watched that football fly through the air, it reminded us to check back on whether our illustration has been right, and lo and behold, this is what we’re seeing.

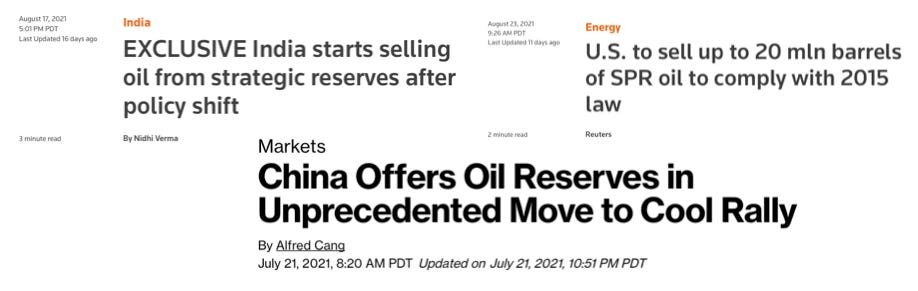

As we move through the options for mitigating a shortage, you’ll note that the choices become increasingly unpalatable. Each additional step taken means we further sacrifice our long-term supply stability for a short-term price declines. Moreover, you’ll know things are REALLY getting tight when politicians begin dumping strategic petroleum reserves (“SPR”) to stem the tide of rising oil prices.

Politicians, whether in China, the US, or anywhere else, are focused on one thing, job security. They’re heavily incentivized to contain oil prices in order to quell price inflation because inflation can lead to social discontent and political downfalls. Yet, SPRs are “strategic” for a reason. They mitigate production outages during natural catastrophes and bolsters a country’s ability to project geopolitical power. It’s both a shield and a sword against the “what ifs” in life, but when the threat of discontent today outweighs the potential threats of tomorrow, the reserves must be released. So sure enough, they’ve done so . . .

Now in fairness, US sales were legislatively mandated by Congress to fund improvements to the US SPR infrastructure. The sales, however, are typically sold in piecemeal throughout the year. For this fiscal year (which begins October 1 for the federal government), the US is selling the full amount at the very beginning of the fiscal year. Effectively front loading the sale of SPR in the coming months, after having made this controversial request . . .

So really, it’s also getting in on “the game”. There’s a finite number of tosses when we’re using SPR draws to mitigate higher oil prices. As we noted earlier, China has already released nearly 80M barrels since April, bringing SPR stores down from ~930M to ~860M (having started at ~810M pre-COVID). Can we prolong the game? Sure, but eventually, inevitably, China and India, the fastest growing consumers of energy will need/want to refill those SPRs. If our supply shortfalls continue, they’ll have to do so at higher prices.

The Bear Side

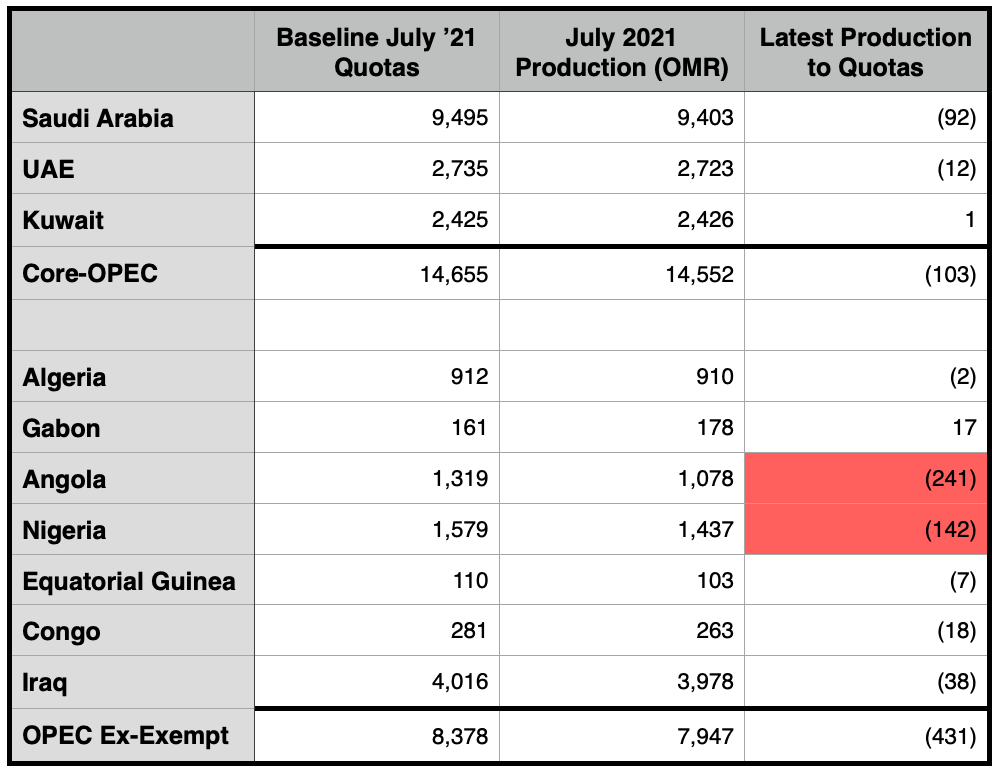

Bears in the oil market have been clamoring that this is really a managed market. OPEC+ has it well in hand as they’ve deliberately held barrels off the market in an effort to rally oil prices. Their spare capacity can be brought back online at any time, and effectively curtail any price increase. So that supply shortage you’re seeing? That game of catch? It’s an illusion.

Is it? Because in recent months, it certainly seems as if even some OPEC+ producers are struggling to raise production.

Remember, each OPEC+ member is allocated a quota (i.e., a max production number) under the current agreement to “manage inventories.” With Brent prices today at $73/barrel (well north of what’s profitable for OPEC+ producers to pump), there’s no reason to not produce at your max quota to maximize income. No reason, that is, unless you can’t. For Algeria and Nigeria, 400K bpd is a material amount to underproduce. It’s close to 15% of their allotted quotas, so it represents a significant shortfall. That certain members are producing less means the dearth of drilling and the increasing decline rates (as old wells die off) are taking their toll.

Take Russia as another example. It’s an OPEC+ member, and Russian oil production (crude and condensates) declined in August by 0.5% to ~10.4M bpd, marking the fifth month that Russian oil production has been effectively flat. The CEO of Lukoil, Russia’s second largest oil producer, recently said that it has restored more than half of its oil wells mothballed in May 2020. Doesn’t that statement really mean Lukoil has lost close to half of its old wells before May 2020?

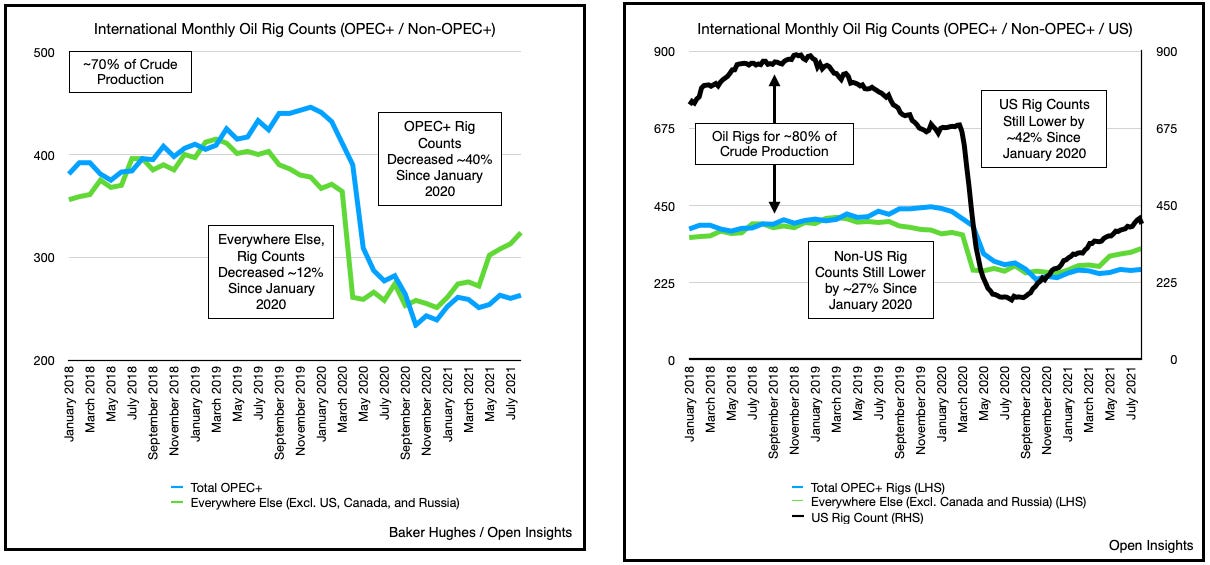

No surprise though because it’s what we thought, as we come out of the 2020 COVID slump, many old wells shut-in will simply never come back. The low production from many legacy wells won’t justify the expense of reopening them once shut, which means the treadmill speeds up for even conventional producers to increase production. It all becomes more challenging when even the slow drip of older wells no long exist. As for new wells, we really still aren’t drilling. Although worldwide rig activity is trending higher, we’re arguably 3% from pre-COVID demand levels with nearly 30% lower rig count numbers (updated for August).

Ida-ling Oil Production

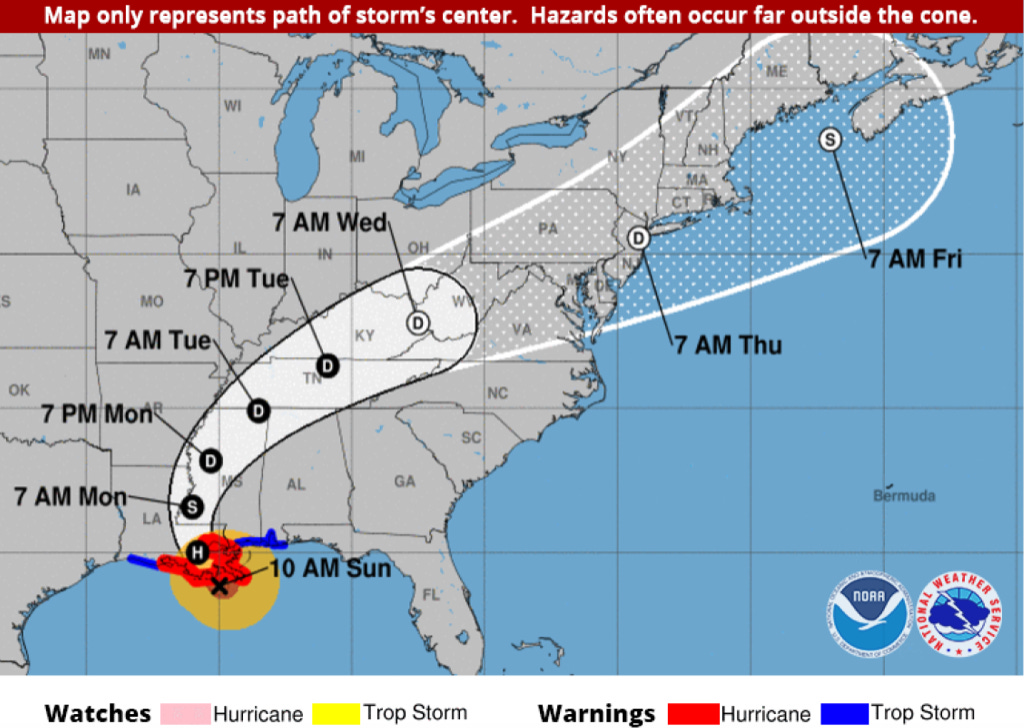

Still it puzzles us how this game continues because Delta is fading globally and COVID fatigue has set-in as vaccines become widely available. Those who were worried are likely vaccinated by now, and those who aren’t . . . well they never will be, which is why EVERYONE is YOLO-ing now and demand is returning. Seasonality would normally play into inventory balances in the coming weeks, but this year will be different because of Hurricane Ida.

As Ida made landfall, it effectively shut down 15% of US oil production. Over 93% of oil platforms in the Gulf of Mexico have shut-in production, depriving the world of about 1.7M bpd of oil production. In total, we’ve lost +11M bbls of crude as of Thursday. Offsetting the crude loss is 2M bpd of refinery outages, which we anticipate will last in full/partially for another 3-4 weeks. Initially, refinery outages will mean less crude demand so crude inventories will begin building as GoM production restarts. Refineries, however, will take longer to recover given the power grid damage in Louisiana, but that means product stocks will decline as refiners stay off-line. Product draws should offset the crude build, and net/net we forecast a reduction of total liquids by ~25-30M barrels.

Ah well . . . who cares right? Despite coal prices screaming, natural gas prices flying, oil, that other major energy source, should be fine right? It’ll be the outlier because coal is coal and gas is gas. Oil is just different. In the short-run, we’ll just keep watching people play toss on a lazy summer day, but in our minds it’s 3rd and 30, and it sure seems like we’ll need a Hail Mary soon. We’ll see.