The Oil Market Waffles

November 18, 2022

You know that thing inside your brain that tells you “hey, if you cook something about this long, it’ll be alright?” Yeah. I’m missing that piece. Actually, I probably have that piece, but it’s permanently set on blackened cajun style because . . . well because this is my waffle.

My family knows this, and the minute they step into the house, they typically scream . . . “Daddy burnt something!” No kids . . . I charred it. I do it with waffles. I do it with toast. I do it with fries, I do it with most. Not sure why I Dr. Seuss’d that, but there you go.

I do it with pretty much anything that can and shouldn’t be burnt. I’ve even burnt and destroyed a tea kettle before. Yes, that’s right.

I’ve burnt water.

So I bring this up because that’s my waffle, and as dark and as toasty as it looks . . . I ate it.

Why? Because meh. I mean, it’s not charred-charred. Sure it’s dark, but seems wasteful to throw it away. I like to think that the setting was precisely wrong, but I was directionally correct.

Which then made me think, that waffle? Yeah . . . that’s oil. Precisely wrong, and yet, directionally correct.

Let’s take a look because this is oil the past few days.

In early October, oil prices had bottomed out to $78/bbl Brent. Through OPEC+ actions and tighter inventories, oil prices then vaulted higher to $91/bbl by November 4. Since then, we’ve been tumbling, shedding well over $12/bbl in the span of a few days. Spreads have also fallen and you can see it in the prompt. It actually reached con tango today, though the rest of the curve is still in backwardation. The decline? Toasty.

Now it’s since bounced off the floor somewhat, so there’s that, but what’s causing this? Well we think the sell-off has more to do with sentiment and some technical factors more than it has to do with fundamentals. That’s an ambiguous statement because when a commodity sells off that significantly, we all want the reasons to be pinpointed. Unfortunately, the market’s seldom that clear. Hence, let’s work backwards and go from big to small.

Could it be fundamentals? Doubtful because this is what we’re seeing fundamentally. Here’s the satellite view on inventories as of today (Nov. 18).

Global inventories (what’s on water and what’s on land) have been pretty flat for a few months (the left chart).

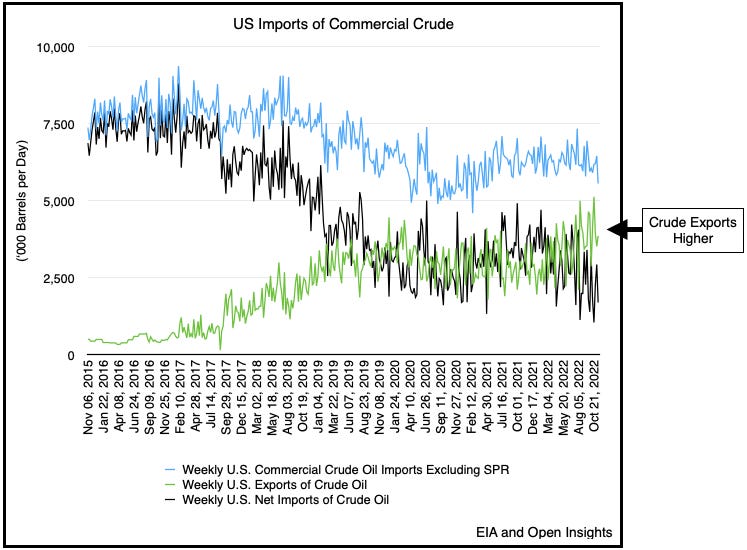

(#1) Oil on water has increased since week 30 as customers shun Russian crude, forcing them to reroute supplies to Asia Pac, which takes much longer. US exports are also higher to compensate as those barrels are pulled to Europe to backfill the lost oil.

(#2) Strip out oil that’s sitting in offshore floating tankers, we can see oil on water has increased throughout the summer. Thanks Russia.

(#3) Although there’s more oil moving across the water and “in the system,” what’s interesting is that as the crude has arrived, much of it has moved onshore (i.e., there’s sufficient space and demand for the crude to import it and store it inland), hence offshore storage never increased.

(#4) As the barrels have been brought ashore, we can see that onshore storage has trended lower, which means the crude is being consumed by the refiners.

So demand from refineries appears to be “okay”. No, it’s not “bang on” fantastic, but from Asia to Europe and to the US, we’re basically looking at refinery margins that are at or above Q3 levels, which implies that product demand has leveled out. Overall, product demand has been tepid, neither robust nor falling, materially, which means it’s not a customer demand fall-off.

So if not fundamentals, what gives?

Frankly? Probably this . . . (COVID cases in China).

uncertainty around this . . .

a little bit of this . . .

some of this . . .

and a whole heckuva lot of that . . .

To be fair, all of these things are viable concerns, but they’re also things that if you play the scenarios out, shouldn’t impact the trajectory of where energy prices are headed in the medium-term. Many are temporary and over the next few months should fade.

Just think about the Shell Zydeco pipeline outage. The outage is pushing oil back into Cushing, OK, which is where WTI is priced at. As storage there bumps up because of the pipeline outage, WTI prices are falling, and in turn taking Brent along with it. So that’s the supposed theory. That’s plausible, but oil prices were falling even before that outage. Nonetheless, if this is an issue, it should prove temporary as the pipeline should be fixed in a few weeks, and flows/inventories should level out.

As for China and the “will they/won’t they reopen” question, we’ve discussed China in detail here. We believe their reopening will be in fits and starts. Instead of a country-wide reopening, they’ll ease restrictions and let the local authorities reopen (and in turn, push the risk/responsibility/blame onto them if they fumble the relaxation). We’ll call it a soft reopening, but eventually as China’s internally developed vaccine gets approved and disseminated, the pace will quicken. As for rising cases and wholesale lockdowns? We think those days are past as they’ve proven economically too painful and politically too unpopular.

Recession you say? Well here’s a redacted chart on financial crises and oil demand. We’ve since redacted the chart and overlayed recessions (gray bars) on it.

For the most part, unless it’s a financial crises that grinds everything to a halt, oil demand steadily rises through time. Could a financial crisis strike the global economy as we tighten financial conditions? Certainly, but we would eventually recover and it would only worsen the supply situation, shutting-off capital to fund any new drilling/exploration. The reckoning we anticipate? It’ll emerge once again.

As for Russian sanction impacts? It’s much more conservative to assume that there will be no Russian crude/product drop-off in December. Doing so means any supply interruption will be a tailwind. Moreover, that’ll likely be the case because in a world short-energy, we have to assume that consumers will somehow wiggle their way into compliance. It’s too far fetched to think that some form of smuggling, rebadging, reblending, relabeling, etc. won’t occur to facilitate Russian crude from being exported. It’s likely the West wouldn’t accept the barrels directly, but indirectly after the crude’s been reprocessed in India? Send it. We stand with Ukraine . . . but we love our SUVs. So let’s assume no-change and hopefully be pleasantly surprised.

Lastly, on the outbreak of peace in Ukraine. After this press gaggle, and thinking through Putin’s options, we still believe this war may go on for a bit absent a decisive military victory. Here’s the link in full.

As the West reaffirms its resolve, bolstered by Ukrainian victories on the field, we doubt Putin would willingly begin negotiating a peace accord from his current position of weakness. Doing so would expose him to internal threats after the debacle. The only alternative we see is if Putin somehow escalates the price of the war for the West. Absent military capabilities, it’s likely he pushes on the economic front, and for him, that’s where energy comes in. Before this is all said and done, we think there’s a high likelihood he weaponizes energy prices. Suffice it to say, this conflict has a ways to go, and as Putin becomes increasingly cornered militarily, politically and economically, we’d expect the intensity of his unconventional attacks to amplify.

Ultimately, as we step back a bit, the oil market’s a bit like my waffle. Energy’s never been particularly palatable to most investors, and the volatility is one of the main reasons. As investors and traders get singed here, they’ll look at the waffle and many will toss-it. Whatever the reason, selling begets selling as people get stopped out, and downward momentum takes over. For us, sure we’re a bit toasted and it’s hot, but fundamentally we’re still directionally correct. We know that the volatility is part and parcel of this commodity trade, and in fact, it’s one of the main reasons why we find ourselves in a situation where we’re globally short.

If, however, fundamentals continue in the right direction, what’s detested today will become delectable tomorrow. Tastes change. So enjoy that waffle, blackened and all, and quit . . . waffling.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Very creatively written that hits the bullet points. Enjoyable read

thumbs up!