The Pivot: Oil in H2 '21

July 2, 2021

As we head into H2 2021 now, the oil trade continues, and as we anticipated, tightening supplies whether voluntary (OPEC+) or involuntary (everyone else) are now running up against increasing demand. That demand is actually increasing isn’t surprising as vaccination rates continue to rise in developed markets. Our original forecast that ~70% of those over the age of 18 in the US would want to be vaccinated came in pretty close.

At least 95% of those over 18 have had 1 dose or more. More importantly those over 65 are running at similarly high rates. Europe also continues on its path to recovery, as we showed a few weeks back. In addition, data from follow-on clinical studies have also shown that current vaccines (J&J, Pfizer, Moderna and AZ) are still effective even against the latest delta variant of COVID. As noted by NBC News

An analysis released June 14 by Public Health England found that two doses of the Pfizer-BioNTech vaccine were 96 percent effective against hospitalization from the delta variant and two doses of the AstraZeneca vaccine were 92 percent effective.

Despite increasing cases, hospitalizations and deaths have not (thankfully) risen materially, and we anticipate that to continue. In the context of markets where vaccines are readily available, COVID is becoming more of a “voluntary” illness. We also believe that as vaccinations continue, the Overton Window (i.e., the range of public policies acceptable to the mainstream population at any given time) will keep shifting on the pandemic. Whereas before when COVID raged uncontrollably, the preferred path was one of increasing restrictions. Governments emphasized mobility restrictions, and adopted policies that limited personal freedoms and minimized human contact. Flattening-the-curve became eliminating the virus and herd immunity.

The moonshot achievement that characterized the vaccine development/distribution will now fundamentally alter the discourse. For highly vaccinated countries, the idea of reimposing lockdowns is completely unpalatable (and to us ineffective and unnecessary). Even one of the most successful countries in controlling the pandemic, Singapore, has proposed halting the way it tracks COVID cases, as it seeks to shift to a policy of “living with” COVID in the future, treating outbreaks as one would treat influenza, chickenpox, foot and mouth disease, etc. With 2/3rds of its population vaccinated this will likely be how the pandemic ends in other countries. Not with a bang, but a fizzle. Life goes on.

As COVID fizzles in the developed world, we do, however, reemerge with a “BANG”. We’re now fully pivoting from “buying things” to “doing things”.

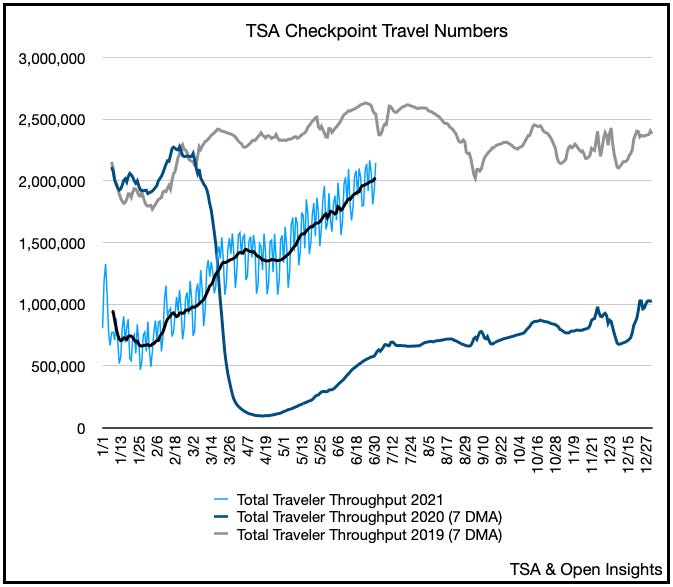

Flights are packed . . .

So are restaurants . . . (OpenTable)

That’s developed markets. Emerging markets (i.e., Asia and Latin America) are now on-deck as US tops-off and Europe’s vaccinations climb. One of the largest EM countries (i.e., India) should also recovery quickly. With more COVID infections there, a high percentage of the population has some immunity. Wider vaccinations will only reinforce the effective immunity already there. Cases will fall quickly and stay low after Q3.

Soaring Energy Demand

All of this is to say that energy demand will stay high and continue climbing into year-end. We still anticipate a near full recovery by year-end, even with muted international air travel. Elevated domestic demand and an increase in air cargo flights will mitigate that impact, and even then, international air travel will recover in 2022 as countries in DM normalize.

Surprisingly, post-pandemic behavior is such that our energy usage has intensified. Energy demand is increasing for a few reasons. First, despite vaccinations, we’re still a bit skittish in using public transportation. Nationally public ridership fell by 80% at its peak and remain at 60% levels as social distancing measures took effect and we were told that public transportation were petri dishes for germs. It will recover, but it will take time. Moreover, migration from large cities to second tier cities have also reduced ridership for public transportation. Our desire for a personal protective bubble plus our flight to the suburbs means we’re in our cars more, and that’s driving our recovery for gasoline demand, etc.

In addition, our newfound appreciation for online shopping has also intensified diesel demand and added pressures on the supply chains. Furthermore, consumer demand is up while supplies are down, which is why we’re constantly bombarded with stories of shortages in chips, consumer goods, cars, etc. All of these are repercussions from a disrupted COVID supply chain. The manufacturing and logistical disruption will likely take another year to normalize, during which pent-up demand will again mean that the global economy runs hot in the foreseeable future as we play catch-up and restock. Throw in the lax monetary policies and massive liquidity infusion, there’s plenty of added-tail winds to fan those flames.

Translation . . . an increased demand for energy. These two things are creating a situation whereby even with international jet travel still down relative to 2019, our energy consumption is already outpacing supplies, and will continue to do so well into 2022. Undoubtedly we will experience seasonal effects. We could build during the winter (early 2022) as refinery maintenance season goes into effect, but over the coming H2 2021 and into 2022, the shortage will increasing become obvious.

Supplies

As for supplies? Well . . . what we’ve been saying about supplies, that the seeds of our energy crisis has long ago been sown (i.e., the persistent underinvestment in oil drilling since 2016 will have implications in +2021) have already begun to show. COVID, ESG, dearth of capital, you name it, have all combined to create a maelstrom that’s dragging production lower. The near insolvency of the entire North American oil industry in 2020 meant that we emerged with a new radically different E&P business model, one focused on capital returns. The days of relentless and senseless unprofitable production growth was one of COVID’s greatest casualties.

Fortunately for shareholders, that now ushers in a new era of shareholder returns, but unfortunately for the world, it will bear the brunt of paying for it. The old marginal producer is dead, long live the more expensive marginal producer.

None of this is entirely surprising if you’ve been following oil. Marathon Asset Management wrote a book called Capital Returns that illustrates this type of cycle.

In case you didn’t know, we’re at the “9 o’clock” position. Sure investors are still pessimistic, but the improving supply side is causing returns to rise above cost of capital. Hence oil companies are set to announce some much improved cash flows in their Q2 calls. As oil prices continue their march upwards, we should expect that to continue in the quarters ahead . . . so long as they stay disciplined.

When will E&P equities catch-up then? Well let’s pair the industry capital cycle with Marathon’s second graph . . .

The answer? Who knows. Nonetheless it will. The market is after all a weighing machine, and as earnings/free cash flows inflect, either investors will buy the shares for their newfound value and/or the companies will self-cannibalize (i.e., institute share buybacks). Eventually the scarcity in available shares will drive up stock prices, we’ve little doubt of that. It all starts with the E&P management teams and directors. So long as they continue their strategy of returning capital to shareholders instead of seeking production growth, then the shares will appreciate in short order. Time will heal the old wounds among members of the scalded investment community, but nothing’s a better salve than significant free cash flow.

As oil prices climb here, skepticism and cynicism will continue. Many will expect it to retrace and retrench. $50 before $80, $60 before $90, they’ll say, but if our analysis is correct, any pullbacks will be minor, dictated more by seasonality than fundamentals. The market is currently pricing oil ahead of where inventories dictate (e.g., US below), but accurately so because of where inventories are headed.

The coming weeks will be telling, and if OPEC+ can agree on a path forward then we can remove another layer of uncertainty.

H1 2021 was a decent six months in our oil recovery, and we believe H2 will continue that trend. In the meantime, enjoy the July 4th weekend, and celebrate our COVID recovery . . . and all that is ‘Murica.