The Selloff's for the Birds

July 16, 2022

I’m sitting next to a chicken. No this isn’t an allegory or metaphor . . . or is it?

Still . . . I’m literally sitting next to a chicken.

It’s like he owns the place. Here, next to my table, crowing at the top of his lungs. Technically I guess it is HIS PLACE since he lives at this resort in Kauai where I’m staying.

Part 2 of our summer vacation plans. As readers will remember, I “vacation” . . . but not really. I rise early, read, check the market, think, read some more, and then think some more. All the while my kids laugh and frolic, and make fun of Daddy for being “boring.”

There’s balance in life and as my wife would attest . . . I balance out the fun.

So I sit outside the hotel’s cafe in the mornings, squeezing in some thoughts before the family wakes and I “bring balance” back to everyone’s lives, and next to me sits

. . . a chicken.

A rooster I think, since he proudly displays his comb like a big personal pronoun. He’s crowing again. Loudly. Roosters . . . and yes I looked this up . . . crow about two hours before dawn. It’s called the anticipatory predawn crowing, and it’s akin to a bird call. Different birds sing at different times of the day, so it’s apparently SHOWTIME! for my little friend. As Nat Geo explains . . .

“Crowing is a warning signal advertising territorial claims, so the highest roster has priority in breaking the dawn, and the lower [ranking] rooster are patient enough to wait and follow the highest ranking rooster each morning.”

Wait, it’s 8am now and sunny.

Oh great, I’m hanging out with the runt of the pack. Ah heck, if this were the market, he’s apparently an energy investor. No wonder he’s hanging around my table. All shifty eyed and twitchy. Look closely and he’s small, like the lightweight in the S&P that he is. His crow warbly and unsteady, not the smooth screeching baritone of the other alphas. More of a strained, “sure hope this works, no, really really hope this works” song of a battered energy investor watching the volatility hit the oil markets.

Don’t worry little man, I hear you. I hear you.

It’s hard. I know. I hear the other roosters too. Ironically they’re all on Twitter, the site for birds. Crowing about inflation, rate raises, and the impending macro meltdown. The hens pay rapt attention. Fear sells and the louder the megaphone, the more ladies it reaches. Respect the macro, they crow. Respect the Fed’s action, they crow. We’re in some quadrant on some advisor’s chart, they crow. Taken together the message is clear . . . sell commodities.

Besides, the narrative has shifted. You don’t need them anymore. Besides, this is like 2008 and we see correlations. Besides, demand is horrendous and proof positive demand destruction is upon us. We won’t need commodities when the recession buries our economies. We won’t need commodities once Russia’s gamesmanship ends. We won’t need commodities now that the Fed’s gotten aggressive.

We told you so.

But my little man keeps going.

Gaw, gaw, gaw gaaaawwwwwwwww

Demand crashing? Inventories aren’t building (global + oil on water). Gaw!

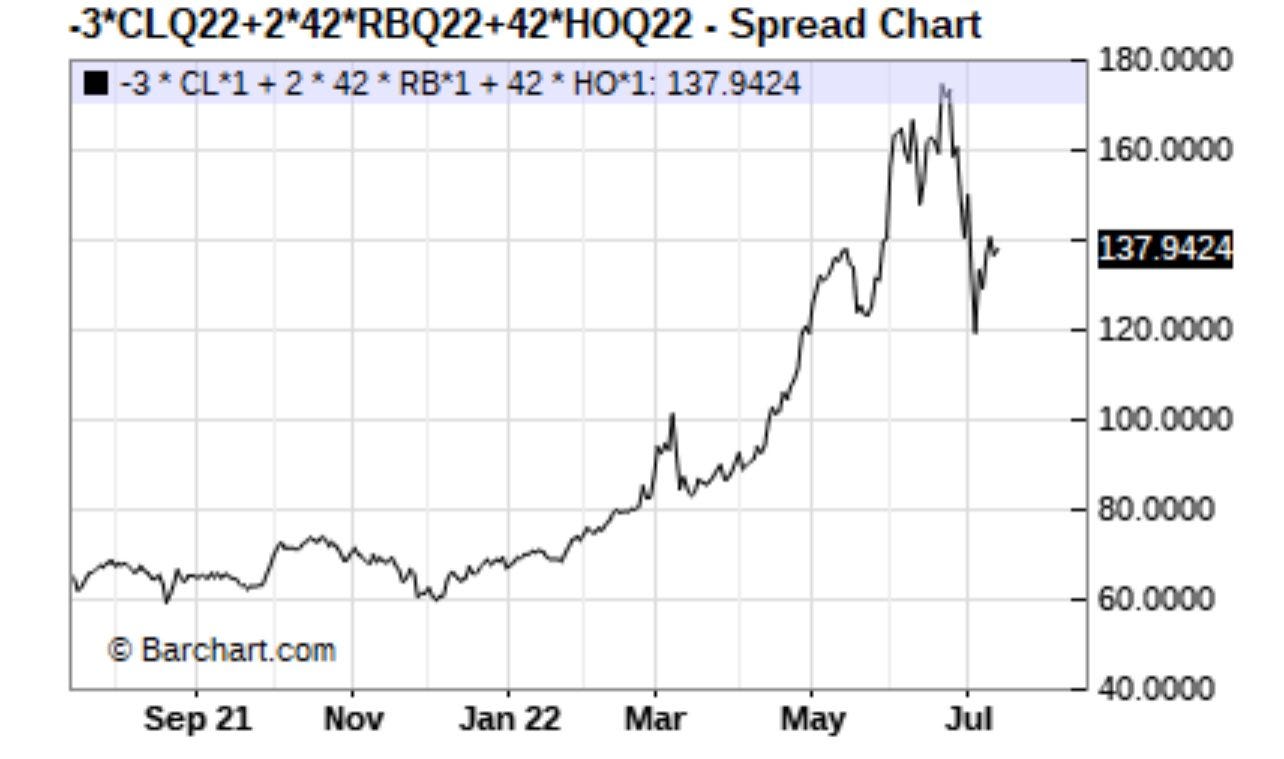

Product supplied (i.e., implied demand falling)? Crack/refinery spreads are still exceedingly healthy. Gaw Gaw!

Front month prices down? Spreads have resumed their ascent. Gaw!

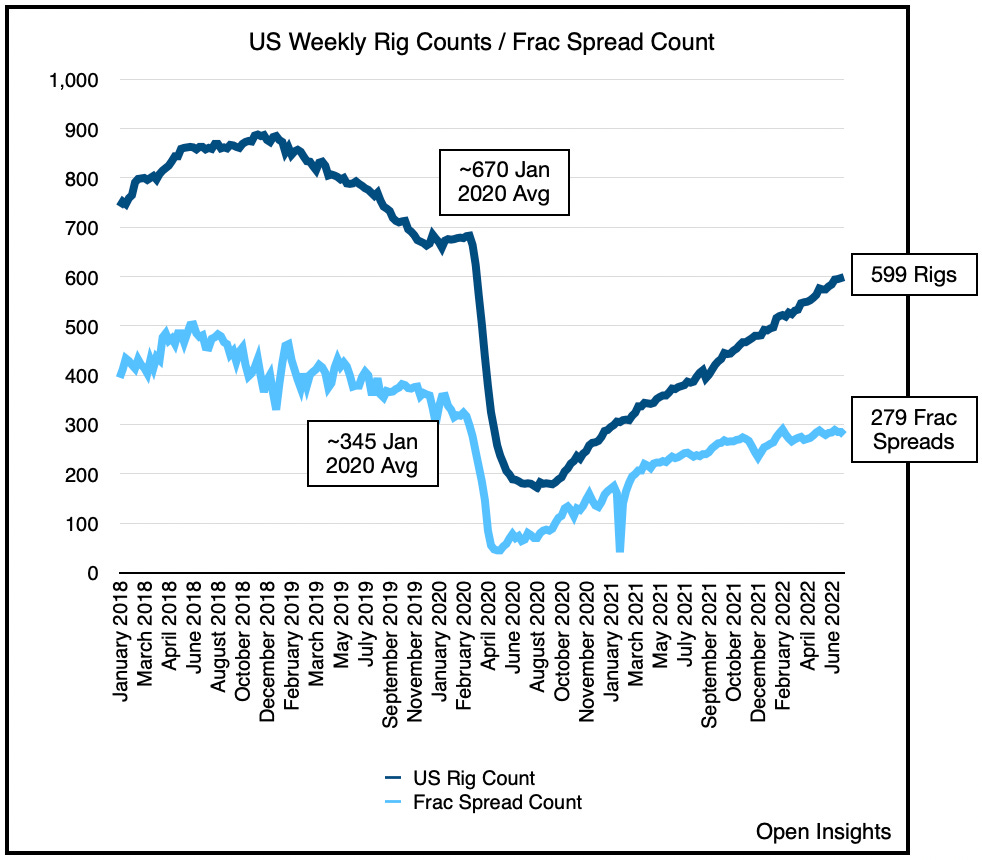

US production isn’t growing materially. Gaw gaw!

Nor will global production ramp anytime soon.

OPEC (i.e., Saudi Arabia)? It’s definitely not coming to the rescue (rig counts) . . .

Gaw gaw gaw gaaaawwwwwwwww!

Okay, okay my man, I get it, it’s NOT THE FUNDAMENTALS.

It doesn’t matter right now though. The hens aren’t paying attention to you. The other alphas are drowning out your voice. You weren’t alpha before and you certainly won’t generate alpha again.

No wonder why he sounds panicky, he’s certainly trying, but the hens aren’t paying attention. They’re all stooped next to the loudest roosters. They had their sets earlier, and it was rapturous. I know because I woke up to it.

Now I’m hanging with my man, but we understand each other. We’re grinding because that’s what we do. We’re not alphas today, but we will be tomorrow. We know what matters is fundamentals. We know the physical disciplines the financial, and while a recession can tame demand, or a Fed induced recession can bludgeon it, demand inevitably recovers and rises.

Demand is inelastic.

Still we sit, patient for our day/days to come again.

Gaw gaw gaw gaaaawwwwwwwww!

Still . . . no ones listening . . .

It’s okay . . . they will.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

One day soon those Alphas will change their tune, and remind you that they were really crowing about energy for months. You just weren't listening closely. They will continue to crow and proclaim themselves king of the hill. And you can smile while listening to them telling everyone to pile in, as you cash out.

Spot on! Those other roosters didn't have a clue a year ago and they don't have a clue now.