The Spooky Oil Market

October 30, 2025

Oil Supplies in Q2

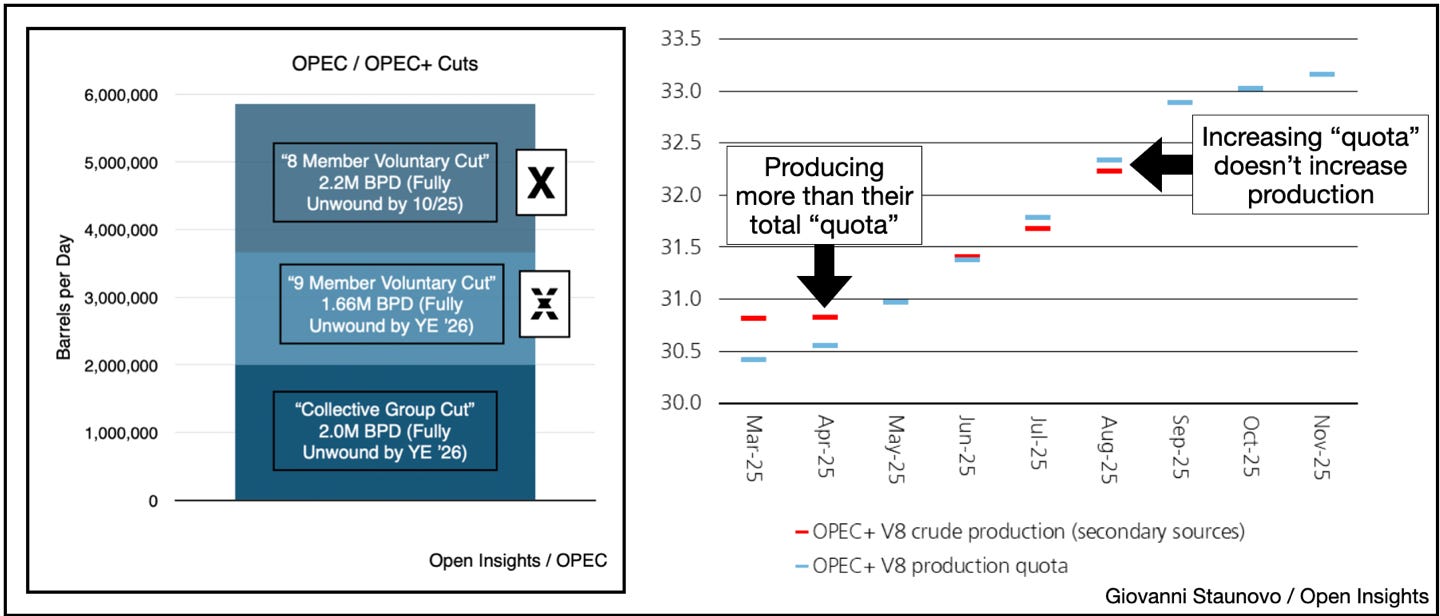

Okay we were wrong about this quarter and what’s been transpiring. As we left off Q2, inventories were building in H1 2025, as higher US production coupled with OPEC+ tapering their prior production cuts means supplies were coming. We had anticipated that OPEC+ would bring on supplies at a fraction of the cuts they’ve unwound, keeping prices in check, but what they brought back was much higher than anticipated and closer to the unwound quotas.

The barrels? They be flowing.

Despite this, as OPEC+ unwinds its second tranche of production cuts into year-end, we still think “real” production will lag. In the past few months, we can see that OPEC+’s production is leveling off even as the quota increases (chart above on the right). This is likely due in large part to OPEC+ production capacity, as we’re bumping up against the max for many of these “voluntary cutters,” and the only ones left to push actual production higher are the big 3 (Saudis, UAE and Kuwait). As we’ve now learned, they’ll likely do that as they regain market share, but for the rest (i.e., Iraq, Russia, etc.) it’ll be much harder as the physical constraints become tighter.

Still though, even if OPEC+’s ability to ramp materially higher is reaching a peak, the current pace of supply increases exceed global demand. So unless China increases its reserves (i.e., buys more), and/or the US throttles its production, oil inventories will build. For the time being, China is doing its part, but not the US as production here keeps chugging higher.

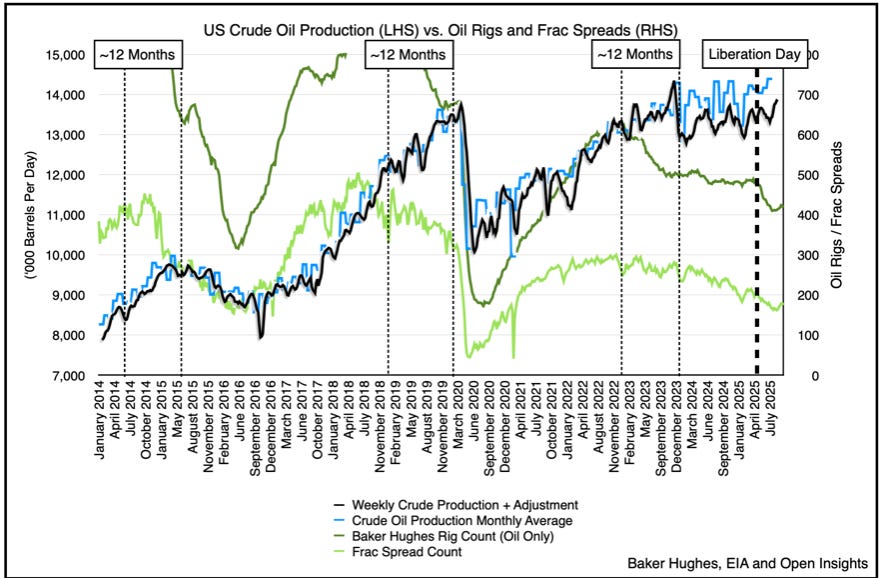

Although rig counts declined post-Liberation Day, the Israel/Iran ruckus in Q3 (and the short-term oil spike) allowed producers to hedge and we’re seeing that trickle through to capex budgets. Greater efficiency in drilling have also helped firms to maintain their production profiles, even with rig counts and frac spreads falling. As the kids say though . . . don’t get it twisted, yo.

We don’t think this is permanent as the number of rigs and frac spreads coupled with the lower Tier 1 inventory levels means US oil production will slow as the headwinds build. This has always been a capital treadmill, and if few producers are making money at today’s level, then production profiles will decline like free cash flow. Price will constrain all.

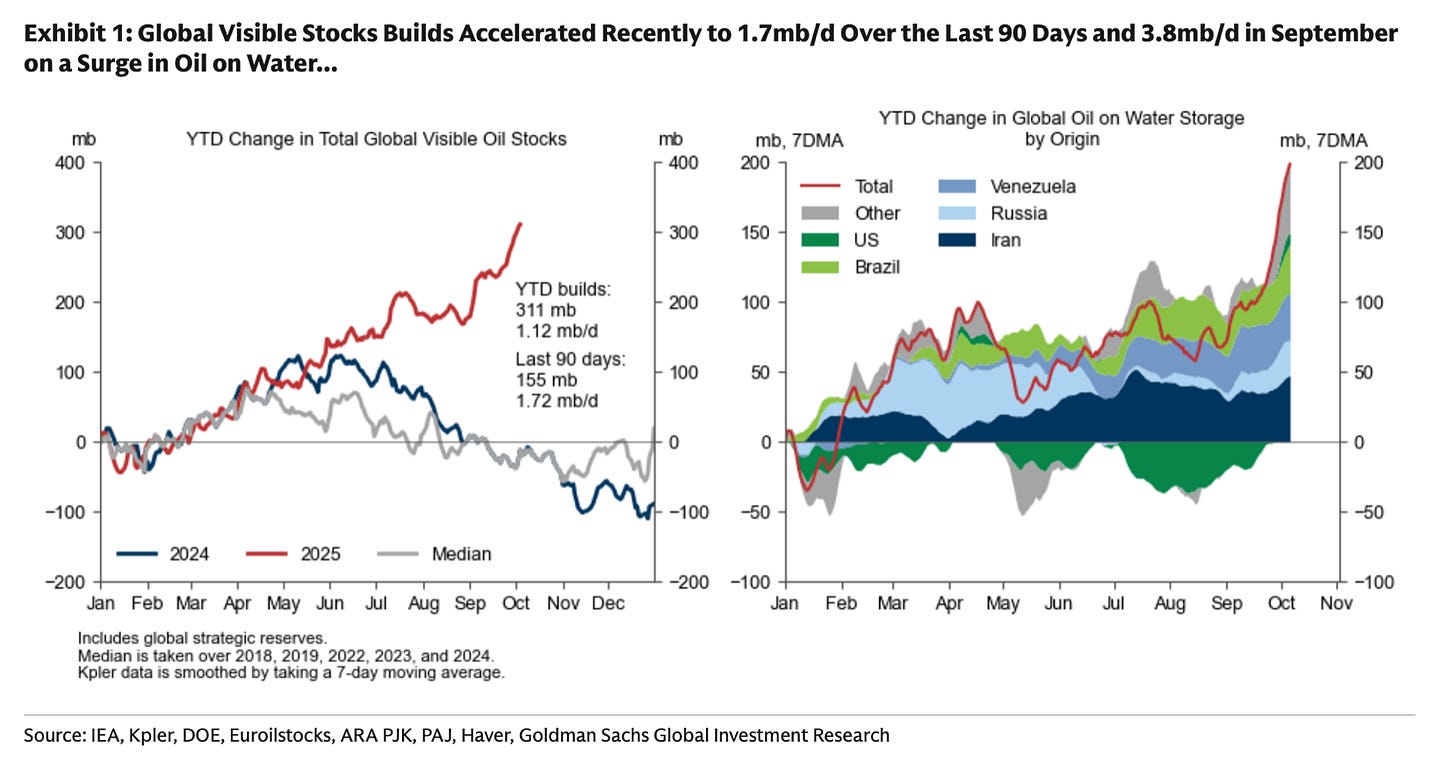

Still with OPEC+ unwinding, US production maintaining (and even increasing a bit), and Brazil/Guyana coming online, we are well supplied. Though global demand is higher than forecasted by nearly all of the energy agencies, it’s not high enough to accommodate the trifecta. In the end, global inventories ramped.

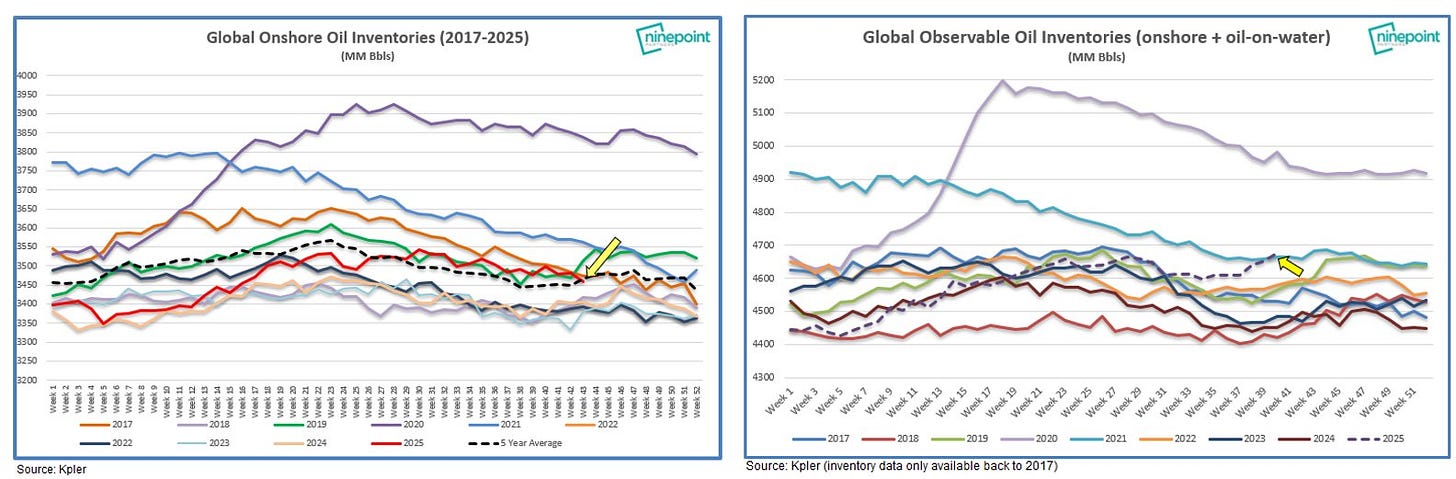

After trending with seasonality, inventories decoupled this past quarter, and began to build as oil-on-water increased substantially. It appears that previously sanctioned suppliers have also been given the green light to export fully.

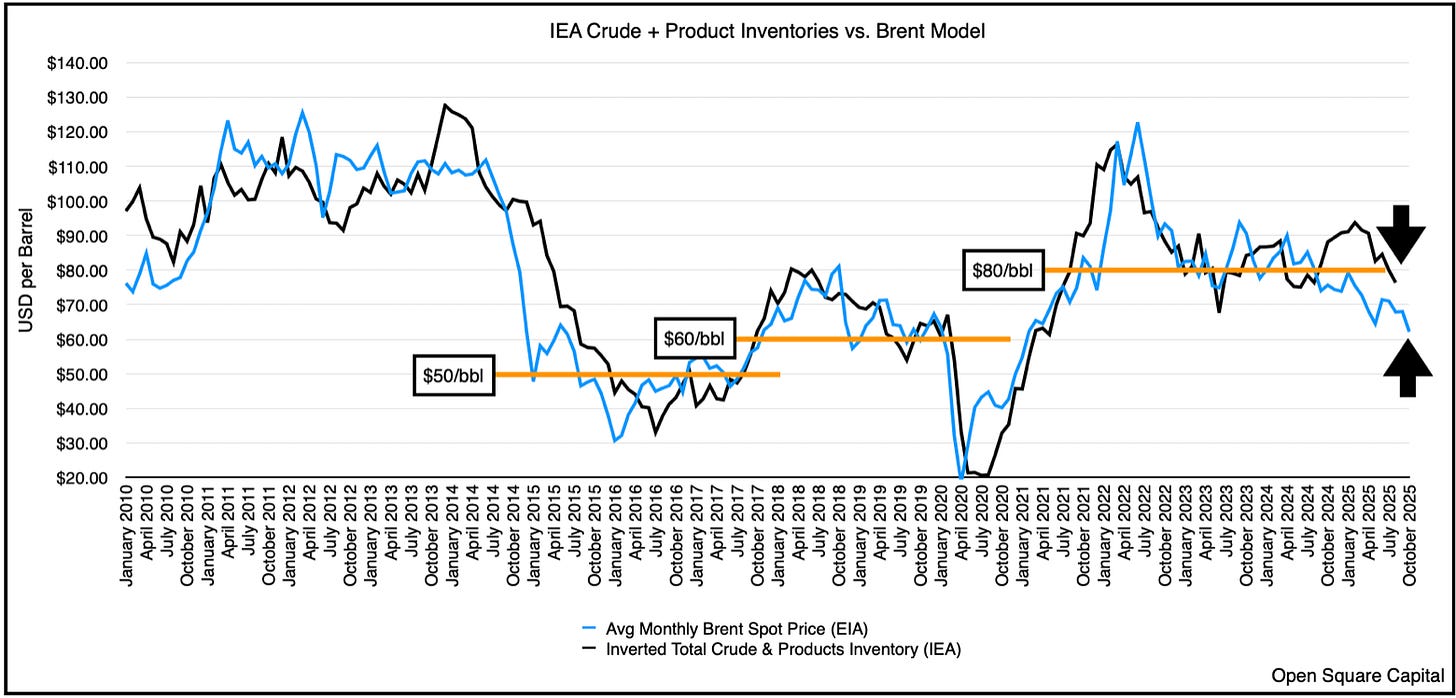

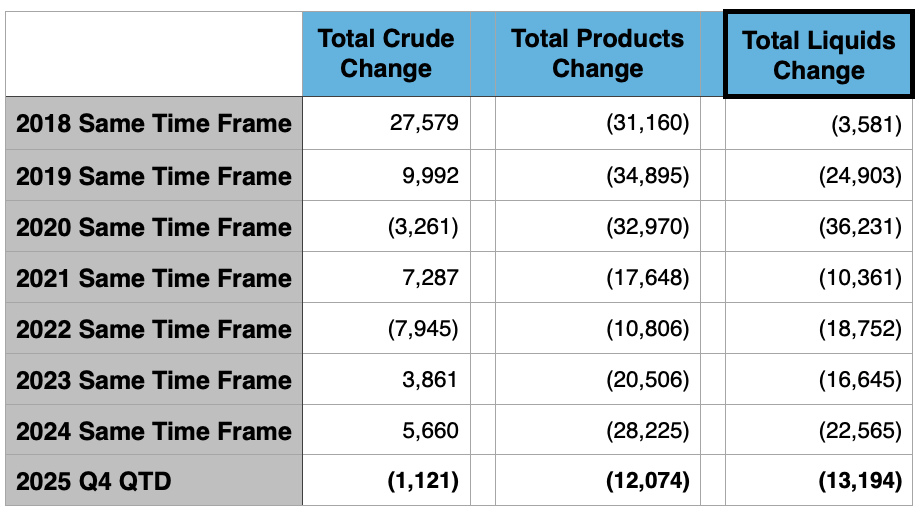

In turn, OECD inventories (i.e., where about 1/3rd of the barrels reside, but where oil prices are determined) have also increased. Typically 1/3rd of global inventory changes eventually find their way to OECD inventories, and as such, prices reacted as OECD have built by ~100M barrels YTD (again note that global stocks in total increased by 311M barrels YTD).

Prices today though imply that OECD inventories will build by ANOTHER 100M barrels, but we’ve yet to see that so far. So call it a “pre-loading,” and one that’s depressing prices today, though the actual barrels have yet to show up. As of Q3, oil prices were down ~15% YTD.

In the past few weeks in October, they’re range bound, but in a low $57-61/barrel range.

Suffice it to say, conditions today are extremely bearish as nearly every analyst anticipates more OPEC+ unwinding, more US production, and more oil from sanctioned countries. More, more, and more. The question is simply by how much. IEA has bandied about COVID like builds (+4M bpd), but last we checked the world wasn’t going through a pandemic shut-down. Just taking a step back and using satellites, inventories in the nascent Q4 time period have been building in the recent weeks, but not anywhere near expectations.

Oil-on-water has vaulted higher, which makes total balances look bearish, but it’s being offset by lower onshore inventories. Our guess? Sanctioned barrels (think Russia) is finding its way to water as their refineries get hit by the Ukrainians. So it’s a hiccup in the system. Since the crude can’t be refined, it’s steaming towards another port/refinery of call.

What about inventories in the OECD countries where oil is priced you ask? Well our proxy real-time tracker doesn’t show significant builds yet, but it is October, so let’s wait until we see November and December. So far, so good though, and 2025 Q4 QTD for OECD territories? Kinda like every other year.

Still you can’t argue with prices, and we’ll just have to let the market stifle supplies with low oil prices. Still if we’re right and builds are much less (say 0.5M bpd), or 15% of what the market “expects.” What happens when we turn then calendar? If our oversupply in a weak slow demand season is small, but we head into a spring/summer 2026 season with higher demand, what then?

By then, OPEC+ spare capacity will be near zero (absent significant investment and/or ramp-up), US production will likely have declined a tad, and overall demand will be higher as growth continues unabated?

That’s the scary part of all this. The analysts would have you believe that the spookiness lies in this Q4/Q1. The builds are coming, and may already be in the room with you. Nah, the real scare? It’s likely in 9 months when we realize . . . we’ve been worried about the wrong thing all along. Still for Q4, just hunker down . . . something wicked is supposed to come . . . we’ll believe it when we see it.

Happy Halloween.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Great article

This is a really well thought out analysis. I agree with you that the consensus view of massive inventory builds seems overblown. The fact that OECD inventories haven't shown the 100M barrel build that prices are implying is a key tell. Your point about OPEC+ bumping up against physical capacity constraints for the voluntary cutters other than the big 3 is really insighful. The dynamics here are complicated becuase you have Russia's refineries getting hit by Ukraine shifting crude to water rather than actual new supply. I think you're spot on about spring/summer 2026 being the real concern when demand picks up seasonally and spare capacity is near zero. What worries me most is the market focusing on near term oversupply and not looking at the structural underinvestment across the sector, which affects majors like TotalEnergies and others. The fact that US producers are hedging but still facing lower tier 1 inventory and declining rig counts tells you the tredmill is slowing down. Really appreciated this contrarian take on the supposedly spooky Q4, the real scare might be 9 months from now like you said.