The Week in Review: We Witnessed the Trifecta

November 12, 2022

The trifecta.

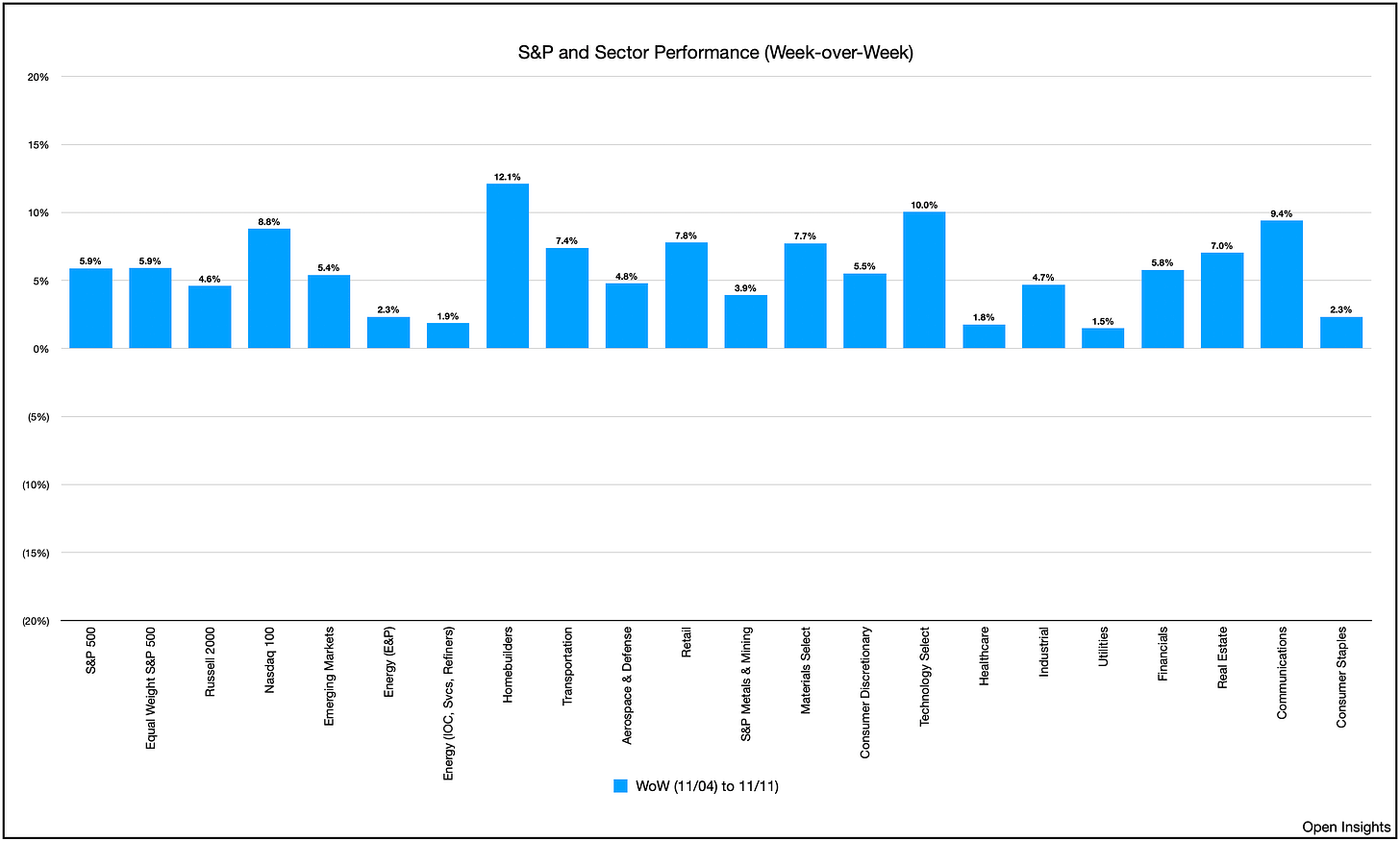

It’s a form of betting where the bettor selects three place winners in the correct order. For example, Horse X, Y, and Z will finish in #1, 2, and 3. Statistically it’s one of the hardest things to accomplish since the variables are too numerous to calculate with any precision. It’s hard enough to pick a winning horse, let alone three in the exact order they finish. As difficult as that sounds, the market sure gave it a go last week as it hit the trifecta, and sparked a rally like this . . .

Our three horse trifecta?

ZCP in the CCP - China Reopening

Galloping Gridlock - Republican control of the House

See Pea Eye - Lower inflation data

In that order.

Let’s take a look at the first one.

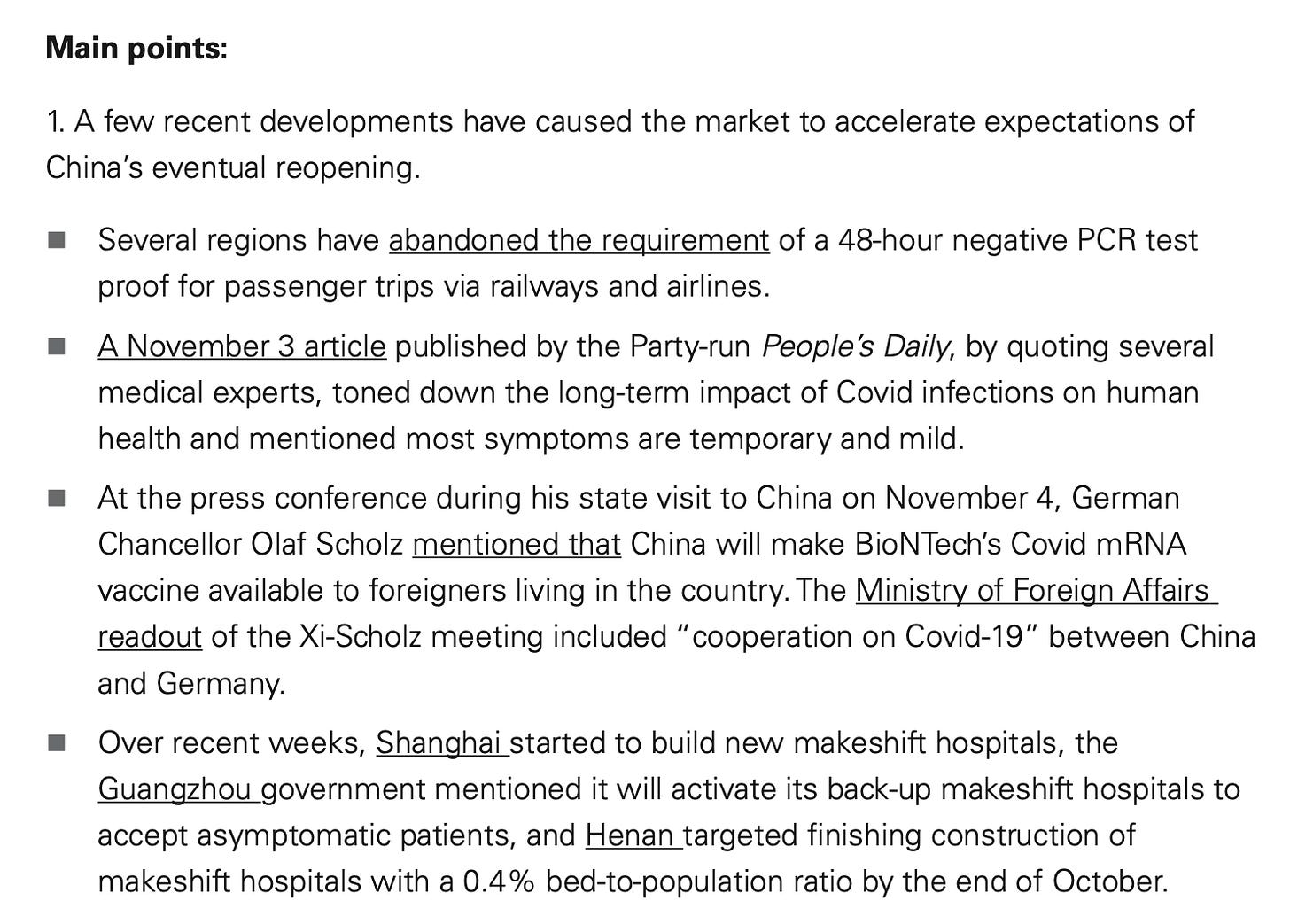

Rumors of China’s reopening sparked a rally early in the week. Denials issued by the Chinese government then led to a sell-off as investors remained skeptical about the Twitter-originated rumor. Still, what was denied initially by government sources, was eventually confirmed by . . . government sources. No, China hasn’t fully abandoned its zero-COVID policies (“ZCP”), but it is beginning to ease restrictions, and signs are appearing that they are planning a wider relaxation and may be willing to tolerate higher infection rates. Most recently, a few developments have occurred (from Goldman Sachs):

While auspicious, the fact remains, the speed by which China can fully reopen is predicated on the vaccination rates of its elderly population. Those over 65 years of age will need to be boosted in large numbers before the country can fully reopen, and that will depend largely on the successful introduction of China’s internally developed mRNA vaccines, which are currently undergoing clinical trials. We surmise though that if government officials are exploring the relaxation of the draconian ZCP, then the vaccines are likely showing significant promise. Not that that’s a surprise as the platform technology is based on the same ones used in the US.

Moreover, if there’s been any doubt about China’s intentions, then note that China has recently ramped up crude oil imports by more than 2.5M bpd. This deluge of sludge should help replenish inventories stored on land, which have shrunk considerably since the all-time highs notched during the COVID crisis. China’s reawakening will increase demand by nearly 1M bpd, adding further strength to an already tight market, but increasing imports should help stave off the inflationary impact of higher product prices if China does indeed reopen further.

If that wasn’t enough, China coming back will benefit exports from Japan, Korea and the EU. Basically, the #1 export customer for the first two countries, and the #3 customer for the last region. No wonder the US dollar fell in sympathy, as others strengthened.

A reopening not only benefits the global economy, but also those of us in the energy trade. China’s increasing appetite coupled with a fading US dollar should benefit oil demand in the coming months. Add to that the impending Russian sanctions, low inventories, OPEC+ cuts, and weakening supplies, and we’re looking at the possibility of oil prices climbing higher asymmetrically skewed to the upside. What’s a bit stunning is that we don’t need all of these factors to impact the oil market, we only need one.

So there’s your first horse.

The Second Horse

Our second horse, Galloping Gridlock, was in a two horse race herself. Pitted against another horse called The Democrats, Galloping Gridlock could only win if The Democrats failed to take both houses of Congress. As election day passed, many close races were still undecided. It’s now T+5 days, and we can at least begin to see the general outline of what’s occurred. The American people have largely spoken and what do they want? Gridlock.

Individual decisions made in the voting booths led to a collective rebalancing of the House of Representatives. A Republican red wave morphed into a pink ripple, and only the lower house flipped in favor of our elephant friends. Democrats, however, tenaciously clung to their slim majority in the Senate as Nevada, Pennsylvania, and Arizona stayed blue. In fact, Democrats may actually extend their lead in the Senate if the Warnock/Herschel runoff in Georgia goes to Warnock.

Still, one chamber flipping is enough, and control of the rancorous House fell to the Republicans, which means more hearings, politics, and intransigence. From the market’s perspective, it also means . . . more fiscal discipline. Why? Because nothing will get passed as Republicans stifle President Biden’s legislative priorities. So as we tumble into the last two years of the Biden term, we’ll experience gridlock in the first year, and apathy in the second as everything freezes and the 2024 Presidential campaign heats up.

Politically, that’ll be called a “doozy” as Republicans now need to figure out the direction of the party. Is Governor Ron DeSantis, who resoundingly trounced Charlie Crist in Florida, the new party leader, or do Republicans continue to back former President Trump in his desire to retake the White House? Given the underwhelming performance of President Trump’s candidates in the mid-term election, we’d question the sagacity of that move for the 2024 general election. Democrats would likely rejoice, and may even support a Trump candidacy given the headwinds that a Trump nomination would face in a general election. Still that’s a year away, and for the time being, the theme for our current form of government isn’t democracy . . . it’s gridlock.

The Third Horse

Last but not least. See Pea Eye finishes third . . . oh sorry CPI. If there was ever a hallelujah moment it was that one. Gridlock’s second place finish means fiscal austerity may reign (not intentionally adopted but politically induced). CPI’s decline, however, means we’ll potentially see some monetary reprieve, respite from the incessant banging from Chair Jerome Powell’s interest rate hammer. Yes, inflation year-over-year still notched 7.7%, but look at the trend!

Thank goodness the CPI didn’t print an “8” handle, otherwise the market, which expected 7.9%, would’ve collapsed into a bloody mess as it would then raise the odds of even higher rate increases from the Fed. Instead, 7.7% was an early Thanksgiving turkey served-up with all the fixings so the market gave thanks. The Dow leapt 1,200 points, the Nasdaq gained 6%. It was a feast for the bulls as all the doomsdayers shook their heads in awe, disgust and short covering. A bear market rally? Perhaps, but if CPI continues to trend lower for a few more months, it could well justify the Fed pausing as it’s now “data dependent.” We had wrongly anticipated an 8.0% print for CPI, directionally correct, but precisely wrong. Back to the drawing board for us on that, but the broader trend is clear. Inflation is heading lower for the time being, and so will the pressure to keep tightening financial conditions.

So an important week, and three very important data points. The market hit a trifecta this week, and such feats are rare. It could spark more rallies into the year-end because one thing is clear, there’s been much pain out there, and there’s certainly a strong desire to rally into the year-end.

For us, nothing has changed. A reopening China, political gridlock that forces austerity, and easing inflation reducing the need for ramping rates higher are all beneficial to our energy thesis. So for us, we’re happy to be winners even if we weren’t directly holding the tickets.

We just like to see the ponies run.

Run boys run.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.