Time to Get Pinterested

December 7, 2024

This could work.

At the very least, it’s interesting.

Even . . . Pinteresting? Yes? Yes?

Yeah, my kids would eye roll at that comment too, but hear me out. Maybe there is something here worth looking at.

Okay so let’s start at the top.

Pinterest (“PINS”).

It’s had quite the journey after IPO-ing in 2019, right before COVID. Almost everyone knows what PINS is, but if you don’t know, they describe themselves as a “visual search and discovery platform, positioned at the intersection of search, social, and commerce.”

In other words, it’s your online idea board.

PINS is available in over 100 countries, and +530M monthly active users (“MAU”) use their site and mobile app to populate (i.e, “Pin”) their Pinterest boards. All of these user activities allows the company to use intent-based signals to show relevant and engaging content to its users.

As the company puts it

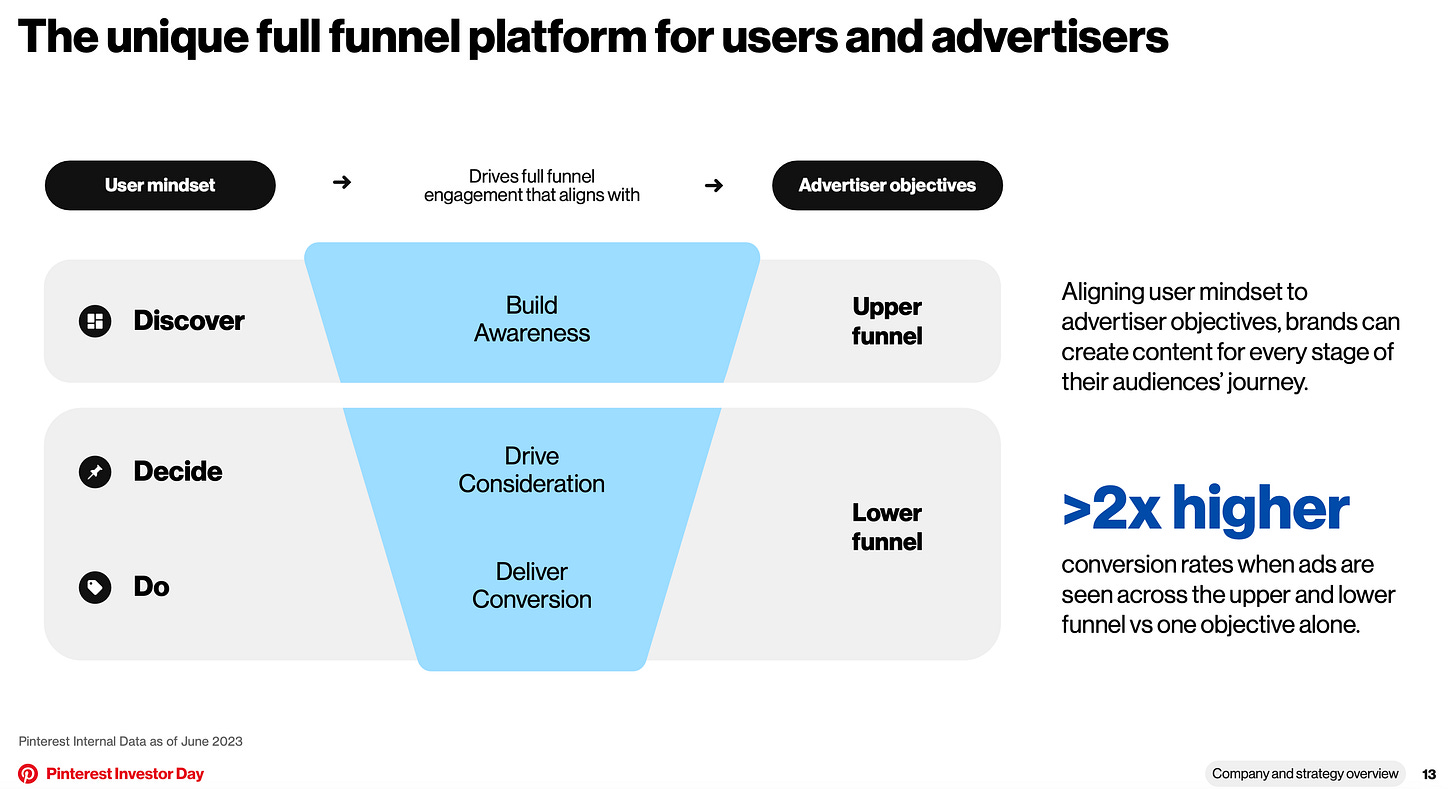

“This inspiration-to-action journey maps clearly to the advertiser marketing funnel and helps brands to reach customers at every point in their discovery-to-purchase journey through digital ads. We believe users and advertisers intentionally choose Pinterest because of our efforts to create a positive and more brand safe environment. As a result, we make deliberate decisions through our policies and product development and aim to deliver on that experience, creating value for advertisers who can showcase their product and services in an inspiring and positive environment.”

So basically, you pin it, they show you ads, and you buy it. This is interesting because it’s not the PINS that I remember. They used to sell you stuff. You’d Pin something, and they’d tried to sell it to you. So what happened?

Bill Ready. PINS new CEO.

By the way, great name for a CEO. Bill. Ready.

Bill Ready, replaced Ben Silbermann (founder of PINS), in mid-2022, and aside from having a great name to be a succeeding CEO, he seems to have the experience to pivot the company. Ready was formerly a top executive at Venmo, PayPal, and then Google where he helped guide commerce across its portfolio of products. Said another way, the man’s got deep technical chops. Since taking over, Ready has been busy pivoting PINS, trying to monetize its million of MAUs via an advertising business model.

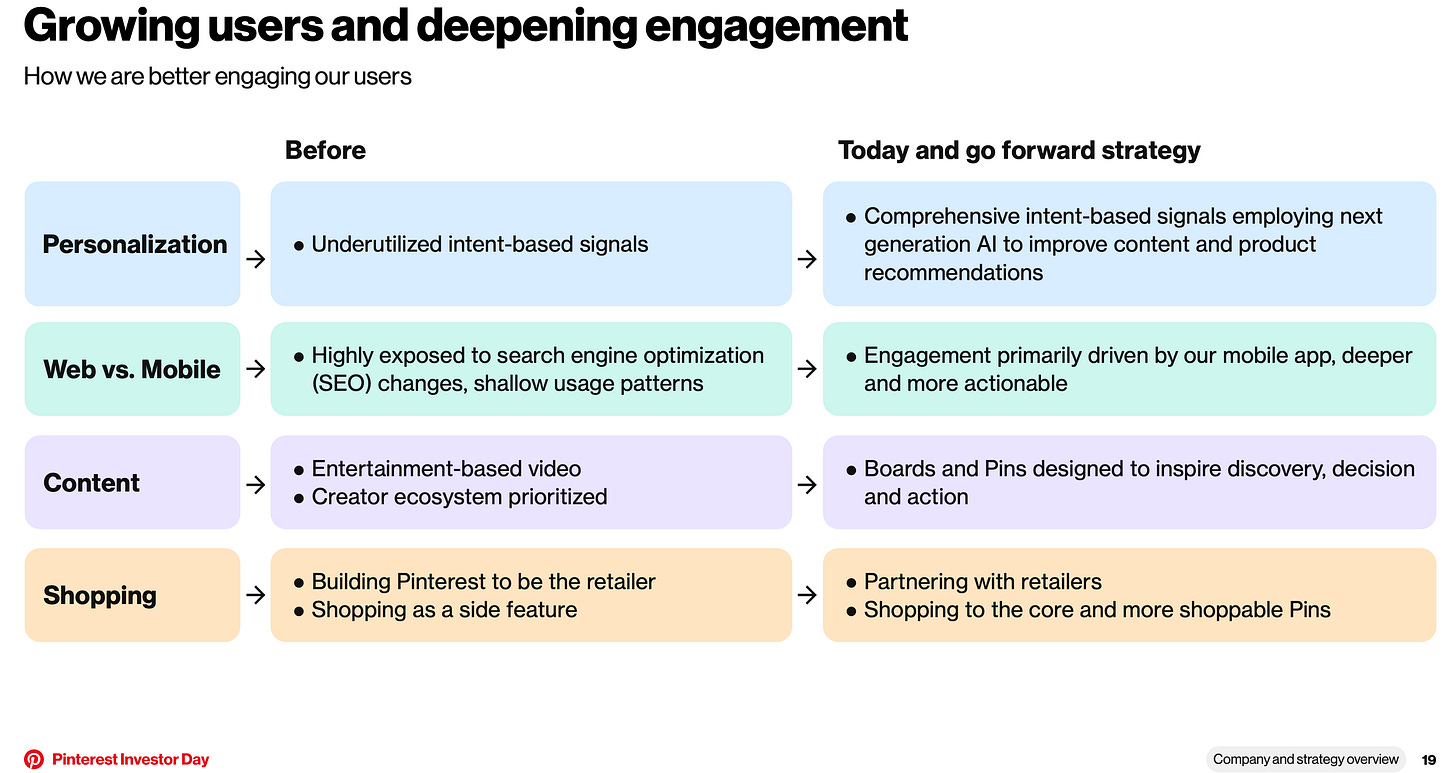

Whereas before, PINS attempted to become a combo search+entertainment+retailer, the new team is fully on board in the search+advertising boat.

The change makes sense to us, why build out the logistical services (i.e., read: low margin business of a retailer) when you can better monetize the mountain of data your users willingly give you.

Pinterest boards are literally an electronic Santa’s wishlist for products people want, and it appears PINS has finally figured that out.

Pin a bunch of things on your board? Guess what, PINS can ask retailers if they’d like to advertise on it too. Advertisements on boards are no longer an annoyance . . . they’re content. Users are literally asking retailers for their ideas. Moreover, as internet security tightens (i.e., via elimination of cookies on browsers and tracking across platforms), PINS’ access to users becomes increasingly valuable.

See that +45% return on ad spend (“ROAS”)? That makes sense when you’re effectively sending ads (more importantly paying for ads) to people who are specifically looking at the category of items you actually sell. In turn, the conversion rates are much higher.

Almost 2x higher.

It’s targeted ad spending in a voluntary sandbox of the user’s own making. It’s self-filtering and funneling. By the way, all of the above slides are from PINS’ Investor Day Presentation in September of 2023. A year later, they have certainly refined it, and we anticipate the figures will improve even further as AI enhances the search results. Again, all of this serves their go-forward strategy, which Ready reiterated in their latest quarterly conference call

“Effectively, all content served on Pinterest, including organic and ads, is powered by AI recommendation models that are trained by our unique first-party signal. And AI is only as good as a signal it acts upon.

Our AI models generate over 400 million predictions per second, ranking what our users might engage with every time they come to the platform. These rankings leverage hundreds of billions of user actions like searches, saves and clicks. They come from over half a billion logged-in users who are actively exploring, curating and refining their tastes. This vast data allows us to create highly personalized and relevant recommendations, introducing audiences to new brands, products and emerging trends.”

“In summary, we are successfully executing the strategy we shared at our Investor Day to drive curation and actionability. As a result, we are seeing steady improvement across the basket of engagement metrics we measure, including the ratio of our weekly active to monthly active users as well as an exciting increase in the mix of user sessions that include actionability like curation and outbound clicks. This increasing mix of intent-based and lower funnel user actions is directly aligned with our efforts to make Pinterest more shoppable for users and a true full funnel platform for advertisers as well.”

Sho’ Me the Money

Sounds great, but are they finally beginning to monetize all of these efforts? Are we beginning to see an improvement in revenue and operating leverage? Let’s take a gander at the financials.

Top-line revenue comes from advertising, and advertisers are attracted to eyeballs. PINS defines MAU as authenticated PINS users who visit their website, opens the mobile app, or interacts with PINS via one of its browser or site extensions (e.g., “Save” button), at least once during the 30 day period ending on the date of measurement.

After dipping in 2021 (down from the post-COVID rush), MAUs have steadily increased, driven in large part by the rest of the world (“ROW”). From a percentage standpoint, MAUs have grown overall by 11% year-over-year. Again, a large part of that growth is ROW. PINS has arguably already saturated the US and Canada with ~100M MAUs (compared to a total combined population size of 375M).

From a topline perspective, Pinterest derives a disproportionate amount of revenue from users in the US and Canada, followed by Europe and ROW.

In all regions, we can see that revenue growth is outpacing user growth. In the US and Canada for instance, YOY revenue growth is coming in a 12.8% for Q3, even though user growth was ~3% for that time period. The discrepancy is even greater for Europe and ROW, where revenue growth was 12% and 42%, respectively vs. user growth which was 10.7% and 16.5%, respectively. In other words, PINS is monetizing users much better than before.

The all important holidays are coming up, and there’s certainly a seasonality component to PIN’s earnings.

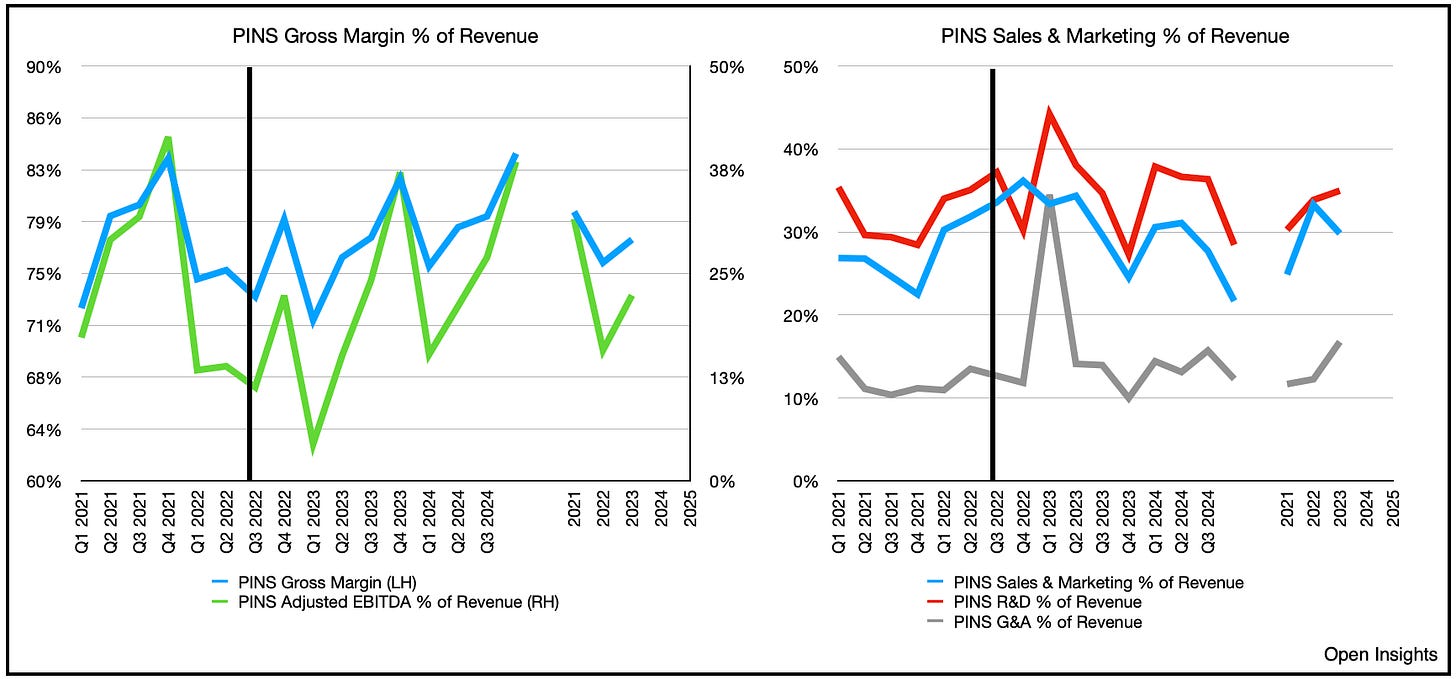

Still since Ready took over in Q2 2022 (black line), revenue growth has accelerated as has gross margins. In contrast, costs have been contained and are beginning to trend lower as a % of revenue, which speaks their efforts to juice operating leverage.

Eventually, the company’s targeting Adjusted EBITDA margins in the low 30% in the next 2-4 years. It’s currently in the low-to-mid-20s, so there’s significant progress to be made. The company appears to be concentrating on that though, as headcount has stayed relatively flat from 2022 to 2023, increasing from 3,987 to only 4,014, so you can see them making more lemonade with roughly the same lemons . . . errr lemonade makers.

From a cash flow perspective, the trend has definitely ticked higher (note cash flow figures below are cumulative for the quarters (e.g., Q2 is 6 months, Q3 is 9 months).

Adjusted free cash flow (i.e., cash from operating activities less capex) are also higher, mainly a byproduct of low capex spend, which means most of the costs are expensed and embedded within opex. Since capex is minimal, PINS’ use of Adjusted EBITDA ties fairly closely to our Adjusted free cash flow (“FCF”), but as we’ll talk about later, stock based compensation is a real issue.

Here’s the bull case for PINS, or at least one that’s not too far fetched. If the company achieves its 15% topline growth in 2025 (mind you that begins in only a few short 3 weeks), we’re looking at nearly $500M of incremental revenue (a 15% increase from PINS’ $3.6B of projected revenue for 2024). If we assume an 80% gross margin, we’ll see about $400M of that cascade below. Given the company’s hawkishness on operating leverage, we’d anticipate more of the incremental increased revenue will fall to the bottom line. If so, we anticipate Adjusted FCF to climb to nearly $1.2B by 2025. Not bad for a company worth about $18.5B (i.e., $21B in market cap less $2.4B of cash). Stair-step the growth into 2026, and you might actually start getting some real-traction, because another 15-18% year-over-year of growth, that cash flow starts to really inflect upward. It’s not entirely a far reach also. The digital advertising space itself is growing at 10% CAGR, so assuming PINS is able to refocus its business (and continue its current trajectory, after proving out the viability of the business shift in 2024), we should see continued growth.

What could it grow to? Well just look at META as a comparable. 6x the users, or 3B MAUs. Take a look at their revenue per user.

Again here’s PINS.

See? A far far cry. Of course we’re not saying PINS can 10x its US and Canadian per user revenue, it need not to. It’s simply an illustration that with nearly 600M MAU, it can capture more of the market share even as the market grows. Certainly in ROW where it’s pulling in an anemic 14 cents per user (vs. Meta’s $4.50). For us, the strategy shift is in its early days, but it’s showing traction.

Stock Compensation, A Real Expense

Now there’s probably one large knock on this company, and that’s stock based compensation (“SBC”). Unsurprisingly, as a tech company, these guys hand out stock options and restricted stock to employees, and that comes at a significant cost. How much? On a GAAP basis, it’s about $775M a year, and it’s handed out mostly as restricted stock. It’s around 25-30M shares that are being granted each year, again as part of employee compensation. Given that about 20% of those grants typically expire, with 675M shares outstanding, you have to factor in a 3% or so dilution every year. Since PINS has a share buyback in place (ostensibly to mitigate the dilution), you have to also keep in mind that those share buyback plans won’t really “shrink” share count, and are there to paper over the dilution. Hence, it’s a real cash cost, as the FCF never “flows” to shareholders. So let’s say for 2025 this company earns $1.2B in free cash flow, for a company worth $18.5B company that’s a 6.5% return. Yet, subtract out that 3% of stock based comp, and you’re looking at around a 3-4% return NTM. Not great unless you think this thing grows, and operating leverage increases as operating expenses are contained.

Bottom Line

Ultimately, this is what we’re thinking. You keep growing topline by 15%, by 2027, you’ll see nearly $5.5B of revenue. Assume they achieve their 30% Adjusted EBITDA margins, we should see $1.7-1.8B of Adjusted EBITDA. Apply the same 22x multiple the market’s using today and we’re looking at a $37.4B market cap company. Since Elliott’s involvement, the company’s kept share count pretty flat, so figure that will continue. Throw it all into a mixer, and we’d expect PINS to come out to be a $55 stock by 2027 (from $30/share today). We think at a $30/share entry price, it’s a fair trade. In a less frothy market, at sub-$30s, PINs would be a much better bargain, one with a bit more margin of safety. Overall though, the company is executing, and you get to buy into the position with much of the risk surrounding the strategy pivot and new management team sorted out. We think this one should be on our radars.

So get Ready . . . Bill Ready . . . to get Pinterested.

Pun-derful.

Insert eye roll.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you