Uh Oh as We All YOLO: The Commodity Whipsaw

January 27, 2023

This is my son. Well that was him about 5 years ago.

Still the same little dude, with the same little face.

He’s funny because that look you see? He still does it.

It usually appears after I tell him a dad joke. It’s part amusement, tinged with some intrigue, but colored with deep skepticism. You amuse me old man . . . tell me more . . . but tread carefully.

I LOL at this photo because I can see the look in me. I see an older reflection of it in the dark corners of my computer screen. Why? Because of this. Visa’s Q1 2023 conference call. Vasant Prabhu is Visa’s CFO.

Uh oh.

Now this is amusing.

Uh oh . . . because play this out.

The unemployment rate is low . . . we all have jobs.

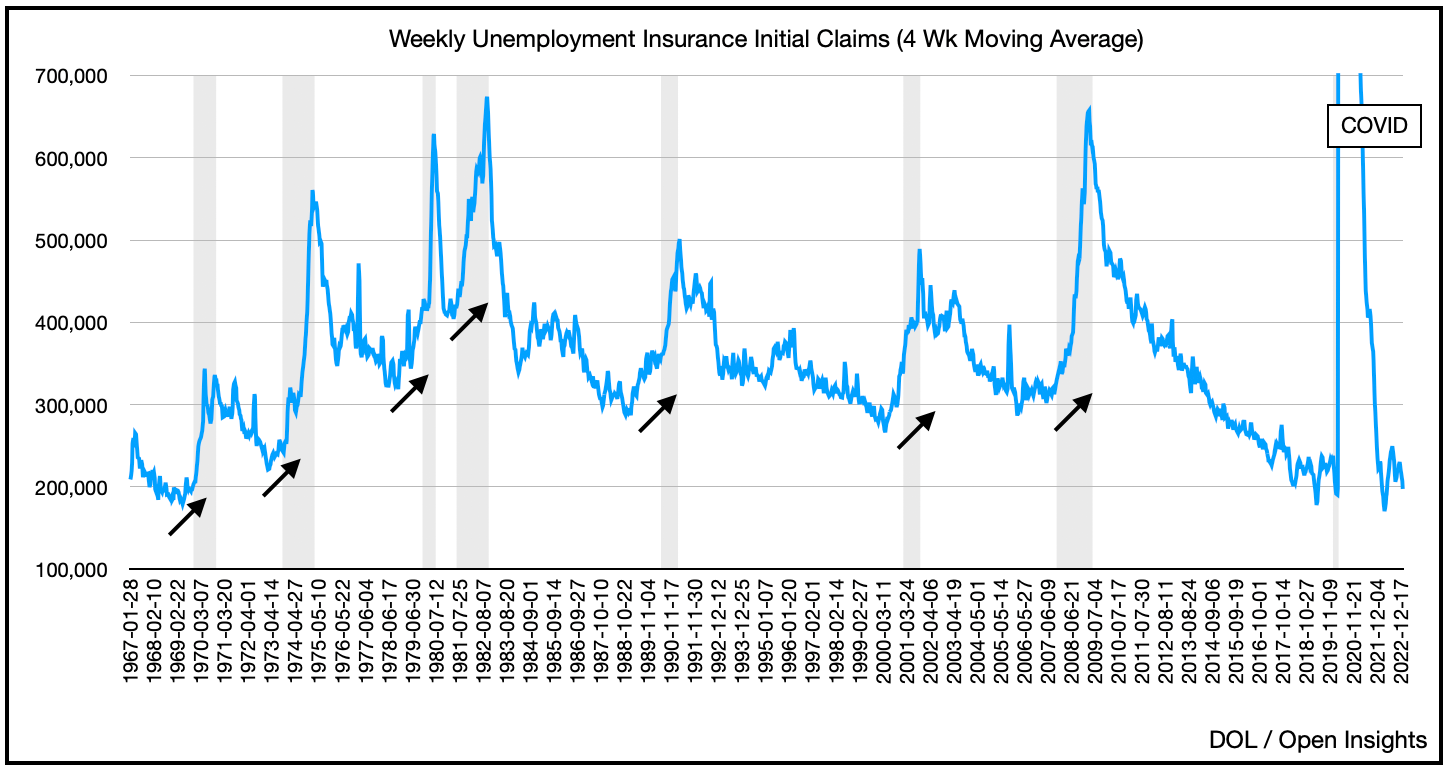

Initial claims for unemployment aren’t trending higher . . . most of us still have jobs.

As inflation subsides, our rising wages will feel a sudden tailwind of easing inflation . . . boosting real wages (i.e., I’m still getting raises, but price increases are easing . . . yay me).

We’re not overextended on debt . . . yet, which bodes well for more spending.

Particularly on services, as YOY spend on services continues higher, while goods, the lesser component continues to ease.

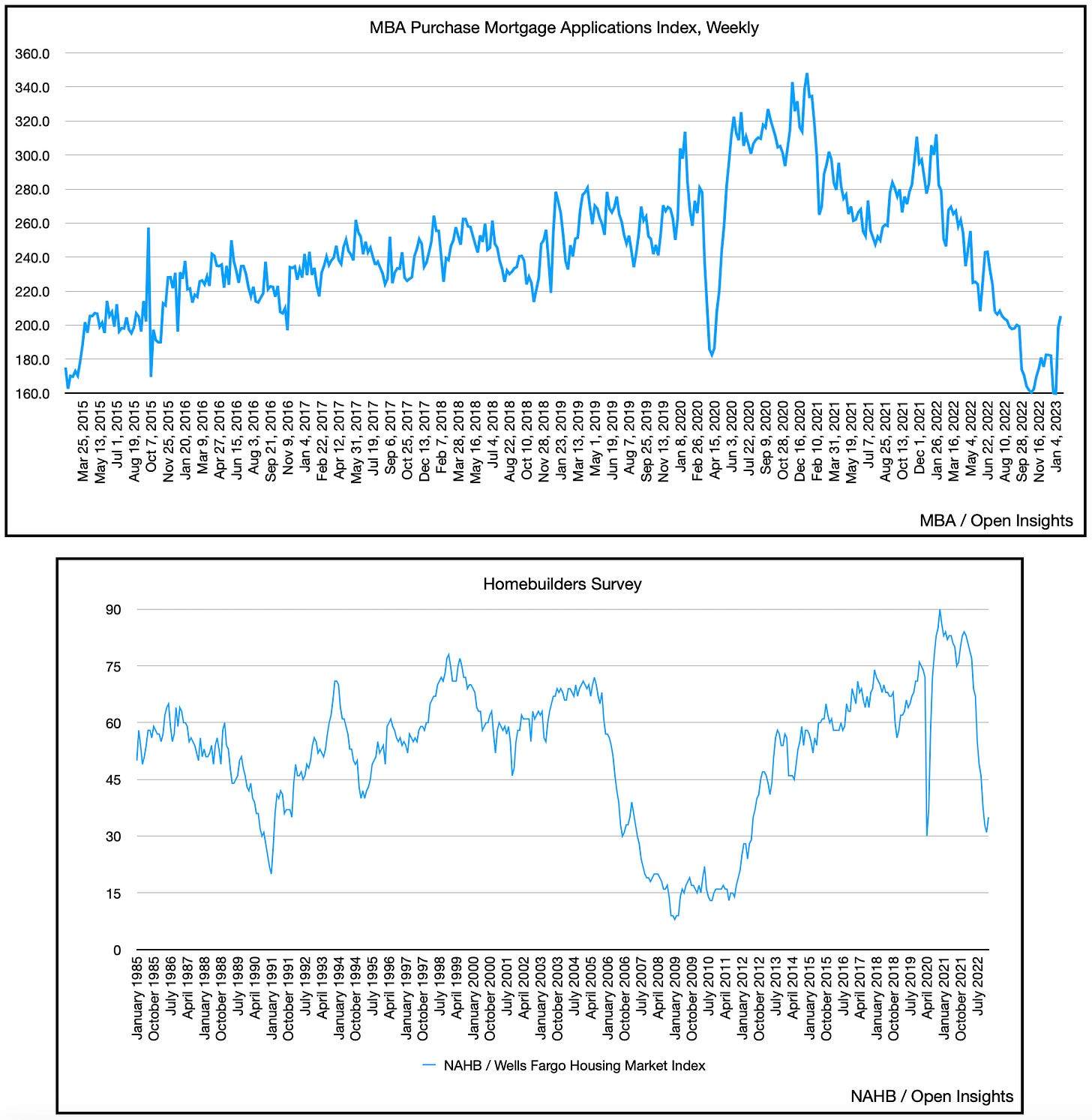

Couple all of the above with . . . . what’s that? Is that housing bottoming and bouncing? Makes sense as rates ease here, and that’s nearly a quarter of our economy.

So why the uh oh?

Well this . . . Chinese savings.

While we believe the article gets the information right, we think the narrative isn’t quite accurate. Just as the West YOLO’d in 2021, the East will do so in 2023. Those who can spend will spend, and they will spend a lot. We’ve said it, and we’ll say it again. Theeeyyyy’re back.

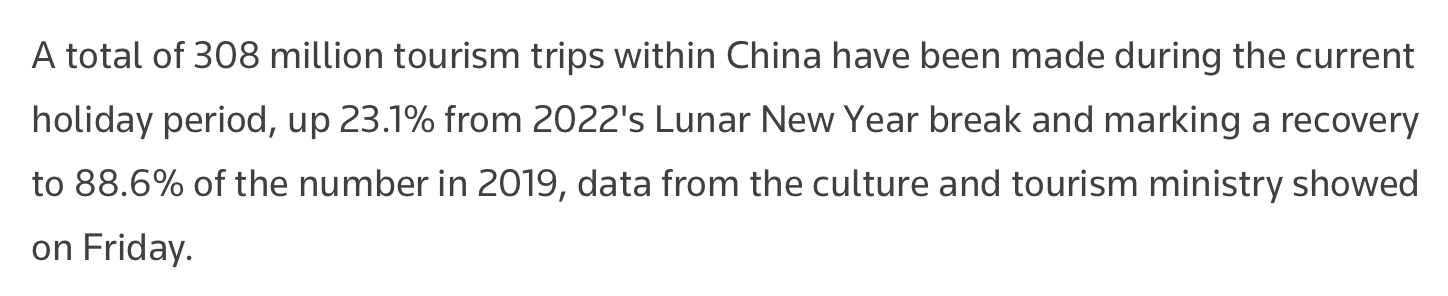

Remember, China just reopened in December. 8 WEEKS AGO and we’re at 88.6% of 2019 domestic travel levels. So just cascade that logic. Think about the implications as our continuing consumption link-up with China’s (one that’s also STIMULATED by loose monetary/fiscal policy as they recover). Couple that with a recovering EU (or at least “not collapsing EU”), things will really get going as we head into the summer. So what? Well this . . .

Yeah.

That.

As consumption rips, so too will the thirst for everything. Energy, commodities, etc. This shift is too quick because few anticipated it. Poll almost every analyst near year end last year, and they all assumed a continuation of the zero-COVID tolerance policy in China. As the other 80% of the global GDP kept churning, we simply looked after ourselves. The other 20%? They’ll exercise self-restraint in their self-imposed straight jacket. No more as they shed the last vestiges of mobility restrictions.

They’re returning, and as their consumption increases so will the prices of commodities. In turn, rising commodity prices may fuel the next wave of inflationary pressures. While inflationary pressures on goods will ease, housing, wages, and commodities will likely press higher. All of this just as the Fed begins to ease its rate raises.

Talk about getting whipsawed. As the unstoppable force (rising inflation) meets an immovable or slow moving object (Fed), investors may just get caught in the middle.

Wait . . . I know I’ve seen that look before.

Uh oh indeed.

We recently released our YE letter, and it’s available for readers. As it contains performance figures for our fund that’s available only to accredited investors, readers will need to drop us a quick note to confirm that they’re accredited prior to accessing it. Feel free to use the button below and we’ll send you the letter via email. Thanks for reading.

If you’d like to subscribe to Open Insights, press the subscribe button below.

Excellent article, as always. Love the writing style. Good luck !