US & China: Soft Like Marshmallows

October 29, 2021

You’re soft. Like this guy, the Stay Puff marshmallow guy from GhostBusters. All spongy, no backbone.

Marshmallow soft. Better yet since it’s college football season, super duper soft, like my wife’s school haha, you’re this guy . . .

. . . when you’re trying to be this guy (Go Bears!).

Wait, what’re we talking about? We digress. Oh, GDP. Yeah GDP.

US Q3 GDP in fact, which the Bureau of Economic Analysis just reported to be 2%. 2%. Two itty bitty percent . . . yeah that’s soft.

Down from 6.7% in Q2 as we recovered from the depths of COVID. It was bound to weaken slightly, as the Atlanta Fed’s “real time” GDPNow was tracking even lower, but 2% sure is a a hefty drop from Q2. Still though, it was slightly better than GDPNow’s real time read of 0.5%, so the stock market of course rallied on the day.

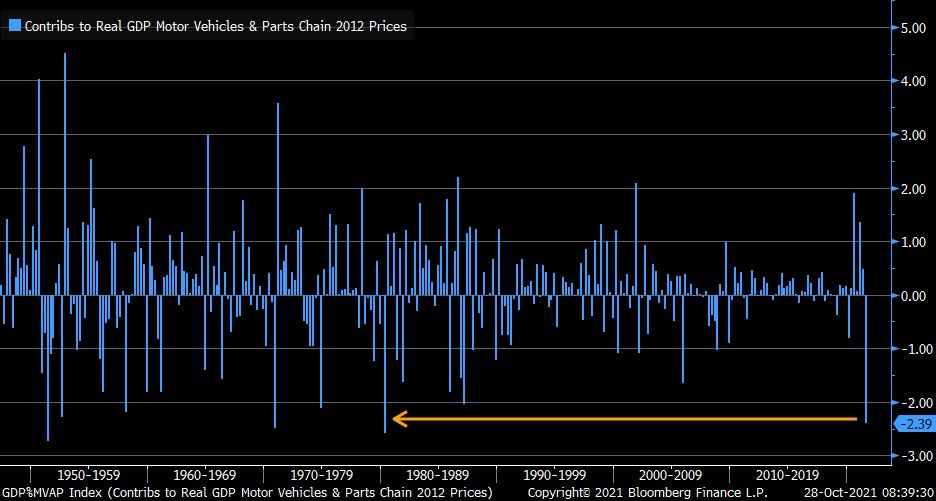

A lot of our softness comes from atrophy. There’s just no muscle. We need muscles. Muscle cars preferably because the biggest detractor? Autos. Specifically car sales. Negative 2.4% “contributor” to the quarter. With contributors like these . . . who needs detractors?

As you can see from that graph posted by Liz Ann Sonders at Charles Schwab, that fall was a doozy. Chip shortages . . . who knew. Well pretty much everyone.

Fortunately, car manufacturers are learning to tinker with their cars to reduce chip intensive features for the time being, and also starting to see their supply chain constraints ease. Quarterly reports from a few of them have been positive and for a few of them, production lines idled last quarter will be restarted. Sure some the cars won’t have as many bells and whistles, but at least the manufacturing lines will begin humming again. If so, car inventories and sales will rebound in ensuing months, thus really “contributing” to GDP in later quarters.

Who’s going to make the cars though? Given the labor shortage, will they even find people? Well a few of them just got laid off by the government. 8.8M to be exact, freshly off the federal unemployment payrolls and ready to take a job (we hope).

Perfect, because we sure have plenty of job openings lately . . .

These newbies will be welcomed by the millions of overworked laborers, who’ve been putting in extra hours as they’ve been shorthanded.

Although our output has increased, much of the jump stems from working longer hours. Said another way, we haven’t become more productive, we’re just working longer. Still, if we get some labor reinforcements, then perhaps it could free-up the bottlenecks, allowing people to work on what they do best (i.e., actually increasing productivity), instead of this . . .

Yet hold on. The fact that we’re hiring in mass mean’s there’s confidence and there’s real demand. It’s something James Paulsen at the Leuthold group has pointed out.

The last thing corporate leaders tend to add is headcount (it’s hard to fire/layoff employees during downturns), and if they’re doing so, then that means there really are bottlenecks and a need. That tidbit dovetails well with new orders, because again, why invest in long-lead (and expensive) physical assets unless you were confident about the pace and scale of the economic recovery?

So maybe it’s not all that bad and maybe GDP will reaccelerate as the delta COVID impacted Q3 fades. (shrug emoji)

Another Marshmallow

Then there’s this guy. China. Our partner, whether we like them or not. They’re soft too . . .

Sure they’re trying to be tough though . . .

Act tough . . .

. . . but in the end, they’re soft too.

Yet as we explained, this Chinese marshmallow will probably fade if regulators begin easing up on the regulatory crackdowns. The tighter policies are targeted at addressing certain social/economic issues critical to their 5 Year Plan and long-term political stability, but over-tightening and adversely affecting their economic engine would make little sense and be counter productive. We believe China will ease its multi-front regulatory campaign as we head into year-end. In fact, it’s already hinting at it to Wall Street and the global financial community. After all China has Chinese New Year and the Beijing Winter Olympics coming up in the first week of February 2022, and having a stalled global economy for the world to see isn’t great for posterity.

Still for Q3 at least, that’s what we have. Two big softies, two giant marshmallows floating in a big ‘ole global hot cocoa just in time for winter. Then again maybe we aren’t that soft and really just a few months removed from being Delta ill, nursing our way back to health.

Maybe we’re also being too hard on ourselves (right China???). Maybe . . . just maybe we’ll be back when things sort themselves out and we stop the self-flagellation just in time to ring in the new year. Yeah . . . we’ll ponder that as we sip our hot cocoa and play with our marshmallows.

Soft’s never tasted this good.