Wait, If the Bear's In Canada . . . the Bull's Home Alone

July 14, 2023

Banff, Canada.

Can’t recommend it enough. After spending a week in Maui relaxing, the family then took another trip north of the border. Hiking, jogging, and generally taking pictures of the beautiful outdoors. If you’ve been wondering where everyone’s going, after traveling to these two disparate places it’s clear . . . they’re all on vacation. Not like we didn’t know that. You could see it in the TSA screening lines. Everyone’s headed somewhere.

Explains why our plane to Maui was jam packed. Perhaps an aberration though to a popular island destination. Nope . . . Banff was bustling as well. So much so that the park ranger asked people not to stop on the nature trail.

“Just keep moving everyone, nothing to see here” she whispers.

“Why is she whispering and why is everyone looking up?” I aassssk . . .

Ooooh. Bear. In. The. Tree.

Picking. Up. Pace.

(Public service announcement - that bear was in a tree that was about 5 stories tall . . . yeah those fluff balls can climb).

Wait. I also just realized . . .

If the bear is in Canada, the bull’s all alone at home . . . aaaaah that explains the market (S&P 500) . . .

Boom. A lot of that boom is coming from the bust in inflation.

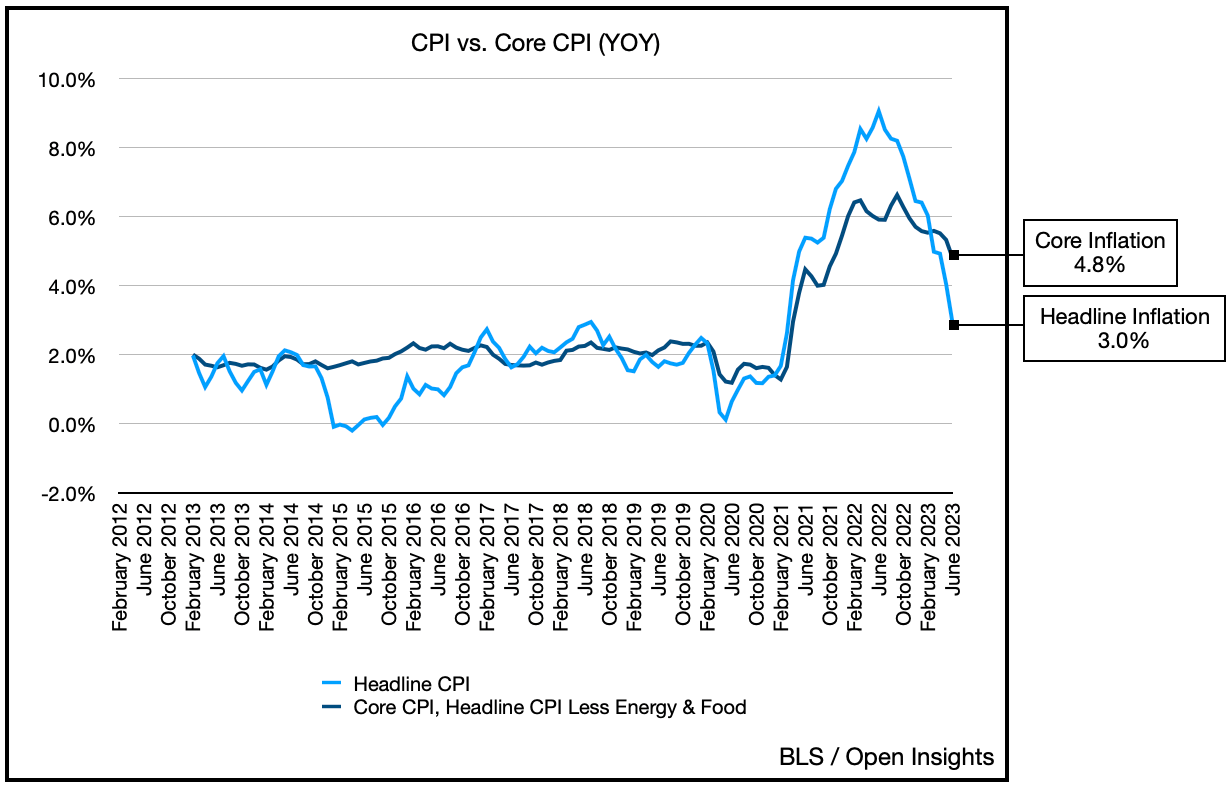

Headline inflation dropping down from 4% last month to 3%! Fantastic. Remember, it was only 12 months ago that headline inflation printed a monstrous 9.1%, which sent everyone into a tizzy and spurred the Fed into action with its interest rate hikes. While it’s great that headline inflation is falling, we still have a “core” issue.

What’s really concerning isn’t the headline CPI inflation figure (which includes food and energy). Strip those volatile items out of the inflation calculation you get what they call “Core CPI.” Fore core, we’re still looking at a 4.8% YOY increase. The Fed gives more weight to Core CPI than headline CPI . . . and 4.8% is a long way from their 2% inflation mandate.

So while headline inflation is declining, that’s good support for the Fed to ease up, but they won’t if Core CPI stays robust. It’s why the market’s still betting that an additional 0.25% rate increase will go through in July. What it’s hoping for, however, is that Core CPI starts to fall as well, and eventually plateau at the Fed’s desired 2% level. That’ll give the Fed reason to pause, and then eventually cut rates because arguably, rates are already higher than necessary given the falling inflation.

Possibly.

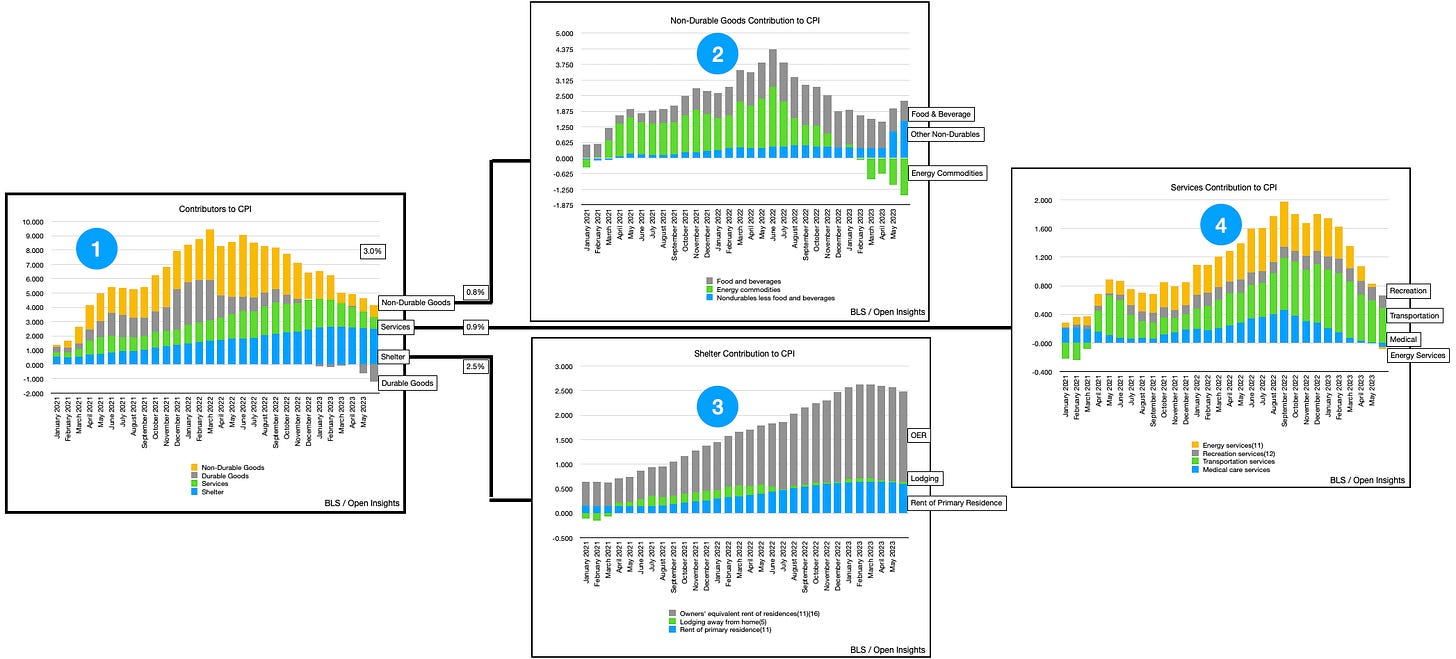

Let’s just focus for a minute on Core CPI. It should be heading lower based on the real-time indicators we track. It’s dominated by shelter, and per our tracking chart, right on cue, shelter has started to tip over as the increase in housing prices and rent have moderated.

All else being equal, we should see Core CPI (i.e., that 4.8%) decline by 1.5% by early next year. Still, all “else being equal” means a 3.3% Core CPI print, which is above the Fed’s 2% mandate. Bleeding that down further will require services to decline and services is wages. In turn, wages depend on employment, which although is moderating, it’s still pretty robust vs. pre-pandemic levels.

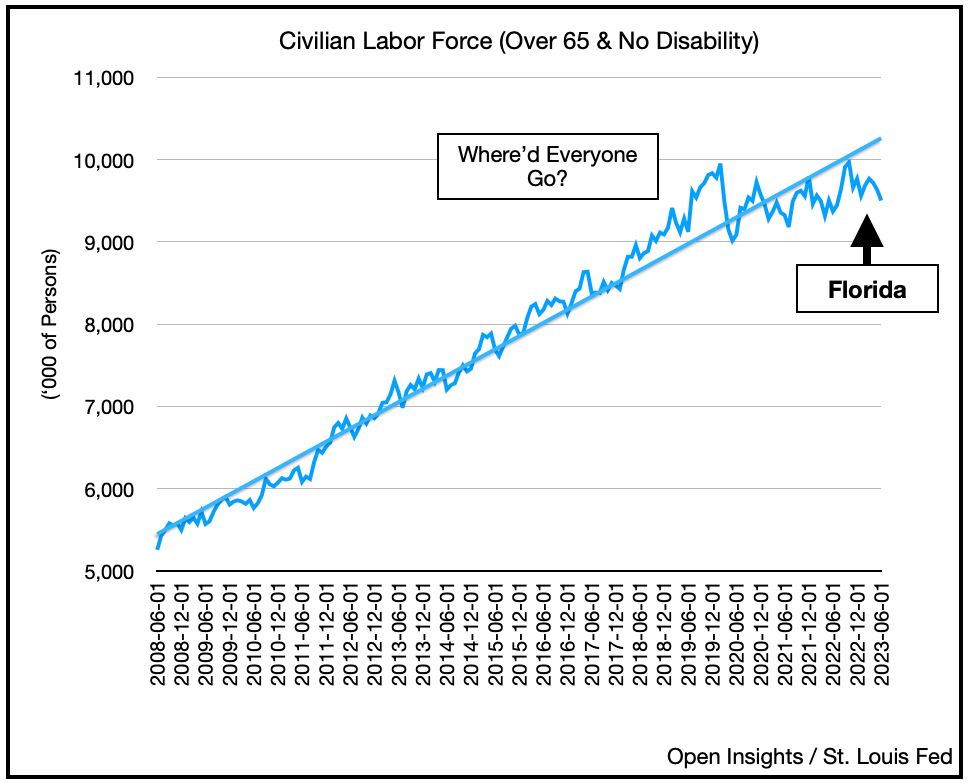

It may even stay that way because even after all these months, those who’ve taken early retirement appear to be staying with that decision. Though some elderly workers have returned, the trend is still clear, we have a demographic cohort that’s simply done.

Good for them. Good for us too we guess since the poor stiffs still working will enjoy higher wages, and that’s always good if inflation falls a tad.

So will Core CPI decline? Yes, but 2%? Unlikely. Below 3.5% that’s tough, and we’ll need certain things to break right. Durable goods is already falling, but we believe that will turn as retailers clear out excess inventories. As store shelves get skimpier, the discounting tends to slow. Moreover, if the Japanese Yen, Korean Won, and Chinese RMB all strengthen as manufacturing recovers (i.e., those are major exporting countries), while the US dollar falls, then durable goods (i.e., stuff) will get more expensive.

As for headline CPI? That’s another story. Since headline CPI includes food and energy prices, those will play a role a crucial role.

Just look at how much of an influence collapsing energy prices have been for headline CPI (#1 and #2 above). In the #2 chart, we can see the decline for energy (i.e., “green”) has been dramatic and has played an outsize role in the easing of headline inflation. Food inflation has also calmed down and we don’t anticipate it to take off again absent an outlier event. Thus, headline’s CPI will largely depend on energy.

While shelter will also decline for headline CPI, energy may provide an offset to that tailwind. Remember this time last year oil was at $120/barrel, and it then fell to $80/barrel by year end. So as we roundtrip that, the base year impact on inflation will start to decrease. In other words, energy will transition from a tailwind, to a gentle breeze, and then potentially to a headwind. If energy prices climb high enough, at some point it could actually push inflation higher. That doesn’t happen until oil prices climb beyond $80/barrel (and nearer the tail end of the year), but it’s a possibility. If oil reaches say $100/barrel by year end, it could largely offset the decline in shelter, in which case, headline inflation move much from here.

Overall inflation as we stand today is at a crossroad. How energy prices recover (or don’t), will play a large role in how inflation plays out and how aggressive the Fed will be with its interest rate policies. The market (and the rise of growth stocks) is certainly pricing in a robust interest rate cut in the near future, but if we’re right about oil inventories declining, that may become increasingly difficult if energy prices move higher and inflation fails to decline dramatically. Ultimately, we believe the winds are shifting for energy, so that feedback into inflation could undermine the market’s continuing confidence.

If so, investors here are positioned offsides when the physical commodities market tames the financial one. Mr. commodity bear market may just decide to mosey down from the tree.

When it does . . . investors might just get Banff’d.

Please hit the “like” button below if you enjoyed reading the article, thank you. We’re set to send out our quarterly letter next week, if you’re interested in reading it and are an accredited investor (“AI”), please drop us a note that you’re an AI at this link and we’ll send along the letter next week)

Excellent.