Waiting Patiently for Oil . . . at the DMV

February 3, 2023

Okay . . . G345. This shouldn’t take long, I hope.

Fingers crossed.

Now serving . . . G343 at window number 10 . . .

Yeah, I’m at the DMV. The Department of Motor Vehicles. You know the place, the government purgatory where all drivers must wait to renew their license.

Now serving . . . G344 at window number 15 . . .

Oh here it comes.

Now serving . . . F26 at window number 7

That was weird, why’d it skip . . .

Now serving . . . H321 at window number 24

What the?!

Now serving . . . F27 at window number 6

OMG, what fresh hell is this? . . . it’s the DMV of energy investments.

If you’ve been in this space long enough you begin to appreciate that things take time, things never happen the way you think, and things never happen when you think. Heck, sometime things just don’t even happen.

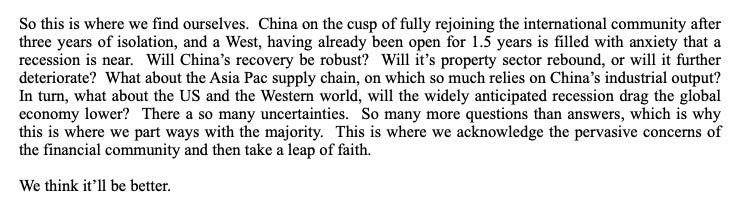

So this is what we wrote a few weeks back when we released our year-end letter.

Leap of faith.

If not a rousing call-to-arms, it was at least a guide for how we were thinking as the calendar flipped another year and we all got older.

Leap of faith is pretty apt when writing about the global economy and projecting energy demand. After all, 2023 will be driven largely by global demand, particularly as supply growth remains restrained. Forecasting global demand though is tricky, and whether you believe the IEA, EIA, or any third-party research vendor/sell-side investment bank, it’s still a guess. OPEC & S&P Global Commodities Insights are modeling +2.2M bpd of growth. IEA forecasts +1.7M bpd, and the EIA only +1.1M bpd. That my friends is quite the range.

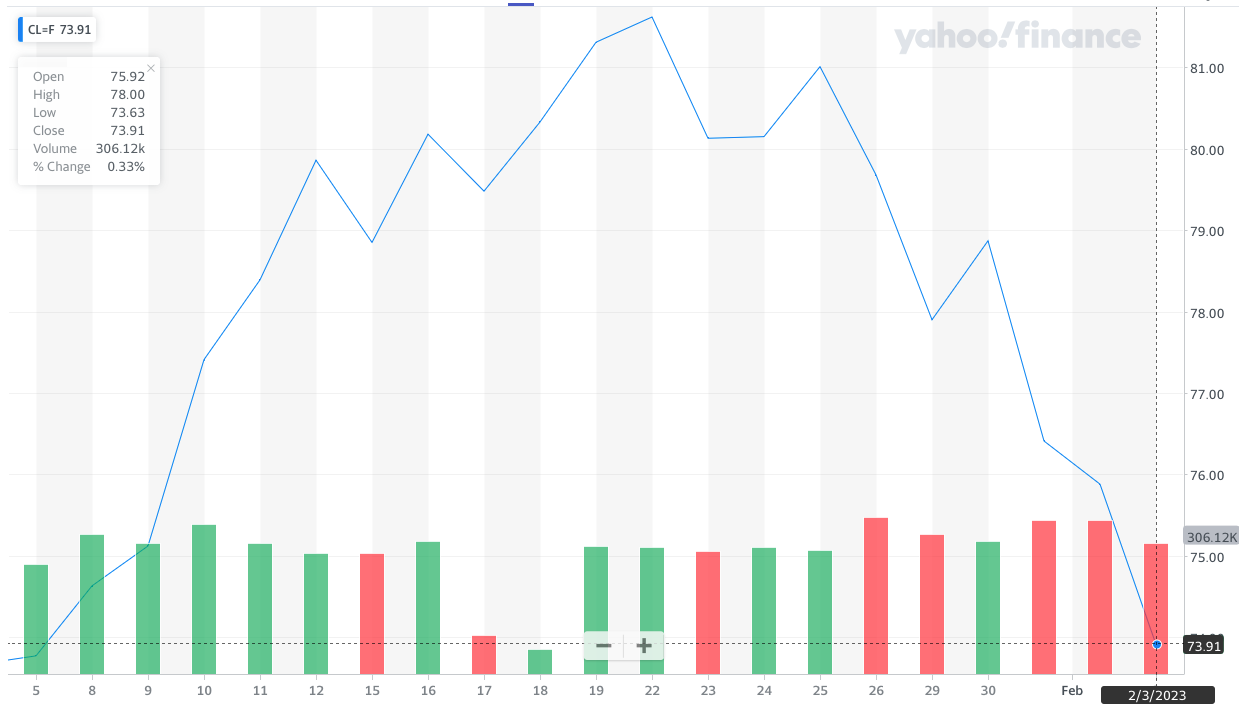

Whoever you believe, in the end it all comes down to China. The success of their reopening (both in velocity and force) will dictate how the energy markets (and investments) fare in 2023, and for now, oil’s anemic performance in the past month has everyone wringing their hands.

There’s significant consternation about what’s happening. Oil’s been extremely weak of late, and the “China isn’t reopening” chorus has gotten louder.

Really? Isn’t all this a bit premature?

First off, they’re still celebrating. Chinese New Year was last week, but the holidays typically last for two. So this second week is a bit of a travel week as people start heading home. Even as the Chinese equivalent of an egg nog hangover wears off, we can see people beginning to venture out.

Leisure travel’s been robust . . .

Moreover, they’re not just going out, but they’re going further.

They’re also planning for more.

As they venture out more, there’s even a hint that they may be home shopping. Could the other pillar of the economy (the all important property sector) perform better? Possibly. It’s hard to shop for homes when your economic stability and livelihoods are threatened.

According to the Shell Research Institute:

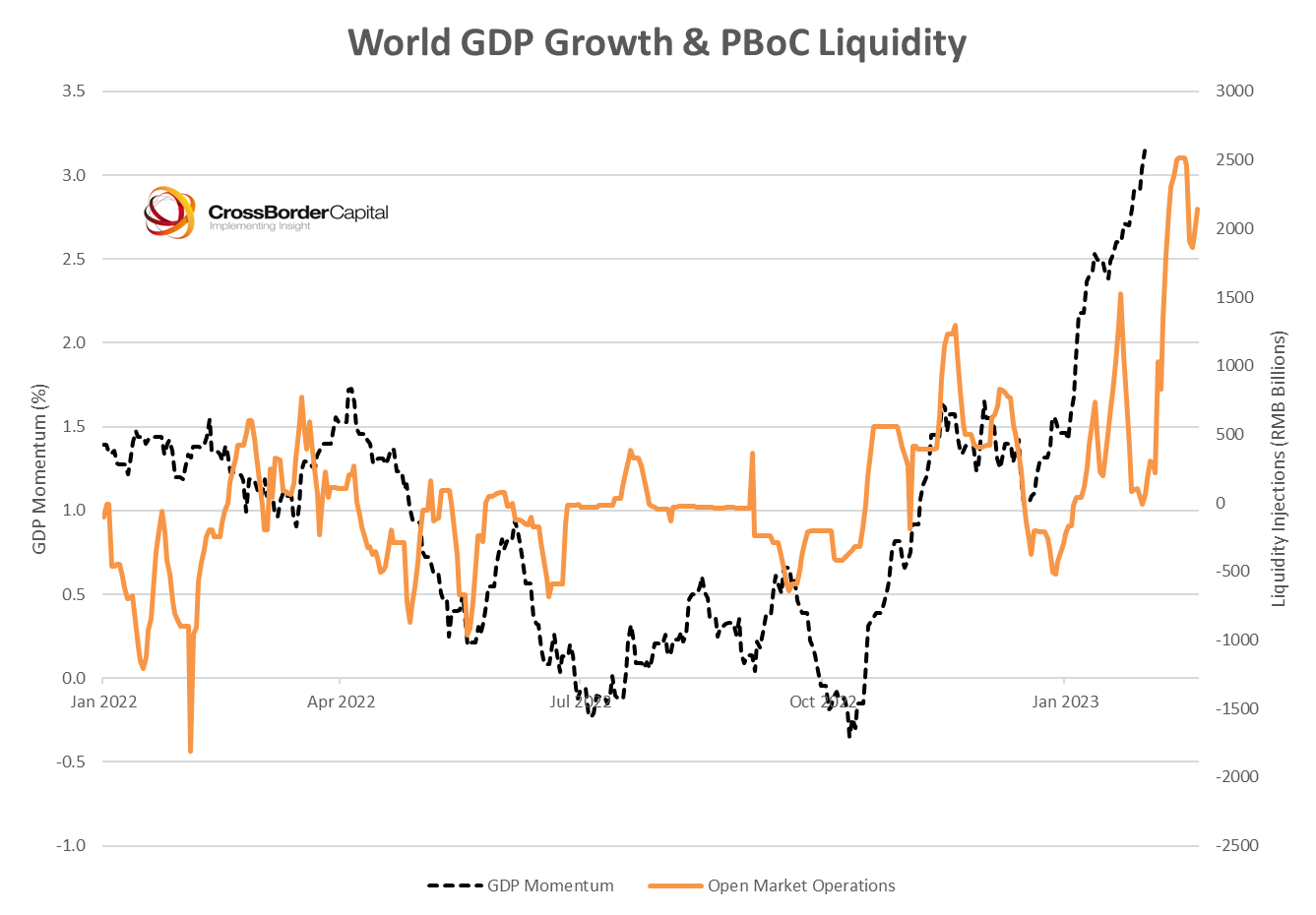

Early stages? Yes, certainly, but it starts there. Green shoots must first appear before the property market mends. Undoubtedly much of China’s recovery will hinge on the bevy of stimulus measures ready to juice the economy as everyone returns to work. So far, the government seems supportive along those lines. Just take a look at the list of policy measures the central government has been emphasizing. Can you guess the theme?

Growth, growth and more growth. If the fonts too small to be readable, then how about some lines. Here’s a chart from CrossBorder Capital.

Besides the Bank of Japan, the PBOC has by far been the largest provider of liquidity lately. What a spike.

Remember, the impact of monetary stimulus lags. It’s not unusual for heightened liquidity to take 6-12 months to create knock-on effects in the real economy. If China’s beginning to inject liquidity today, we’ll start to see the tailwinds of those policies by the beginning of summer. Couple that with historically high savings rates, economic development, investment and consumption could all simultaneously lift higher in the coming months.

Maybe even sooner. If the economy was truly moribund and physical demand stagnant, why did China suddenly decide to begin hoarding product?

That’s a mile marker if there ever was one. Nonetheless, will front-month crude prices ever reflect that reality? Not quite yet. Not yet because China has to first burn through elevated product stocks. Second, China is importing significant amounts of sanctioned Russian crude (err sorry, “Malaysian”) to refine into products, and it’ll likely access that source before materially tapping the market. Starving the world of product exports, however, means products should stay tight in Asia, lifting crack spreads. Ultimately, the thirst for products and crude by Asian markets should reverberate back to the West, and inventories there will draw. Demand is demand, and if Chinese consumers are really consuming, inevitably and eventually, the pull will be felt. This is after all a global commodity unconstrained by borders.

Still given the price action of late, this is a leap of faith. It’s why we call it a leap of faith, but this isn’t blind faith. We’re seeing people move and things move, and we’re seeing a relatively robust global economy. Energy investors may want to lighten their positions if they’re unable or unwilling to take that leap. The inventory and pricing data should eventually mirror the reality of what we’re seeing. As the old adage goes “the physical side will discipline the financial side.”

Eventually . . . but for now we wait . . . for our number to be called.

Now serving . . . G345 at window number 1 . . .

Bingo.

We recently released our YE letter, and it’s available for readers. As it contains performance figures for our fund that’s available only to accredited investors, readers will need to drop us a quick note to confirm that they’re accredited prior to accessing it. Feel free to use the button below and we’ll send you the letter via email. Thanks for reading.

If you’d like to subscribe to Open Insights, press the subscribe button below.