Waiting to See Who's Going to Make It

June 10, 2022

Waiting . . . waiting. This whole week we’ve been waiting. Waiting for Friday when the consumer price index (“CPI”) comes out and reinforces or disproves what we’re thinking. Inflation, it’s something we wrote about here.

here . . .

and here . . .

8.6%. Year-over-year price rise, boom, that’s what dropped this morning.

Again, we’ll say it. This is going higher. Again, dive into how this is calculated, and you’ll think, like we do, it’s going higher. Pundits galore think this will level off, and it will, but not for the time being, not when 87% of the things that make up this index are pushing upwards.

Shelter . . . ouch.

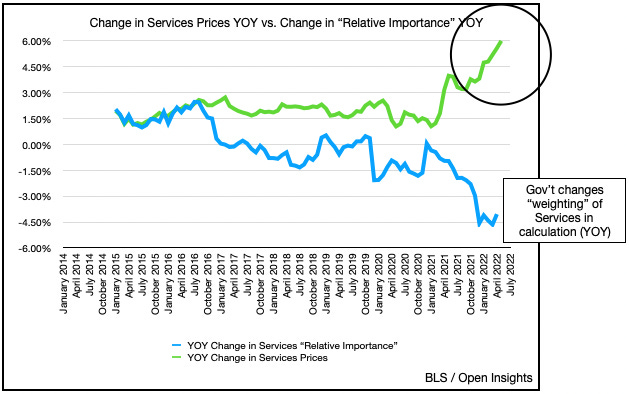

Services . . . yikes.

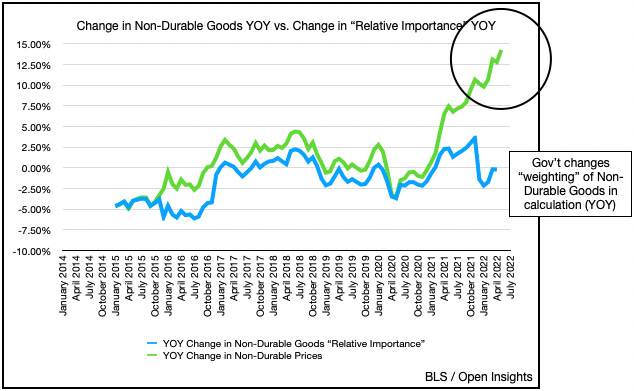

Non-durable Goods . . . whelp.

It’s all going up, not just in terms of pricing, but also the weighting (i.e., relative importance) each of these components have in the CPI. Said another way, higher prices in each of these categories will carry an even greater weight for the overall index (read: higher inflation rates).

Why is this important? Well again. Interest rates compensate you for two things, inflation and risk of loss. Where inflation goes, interest rates will follow (whether the bond market adjusts for it or the Fed, eventually prices/rates will adjust). In turn, interest rates are gravity, and the higher the rates, the higher the gravity on asset prices.

So is it any wonder why the stock market is experiencing an air pocket this today (and even yesterday afternoon when we think the CPI figures leaked)? More to come in the following weeks as today’s figure ripples through people’s spread sheets, altos and decision making process. Maybe inflation is higher and will persist longer than we thought. Maybe the Fed will be more aggressive at raising rates and quantitative tightening (“QT”), and even if they aren’t the bond market is already racing ahead of them. Maybe higher rates will pose a danger to risk assets. Maybe, just maybe risk assets shouldn’t be as highly valued when money is getting more expensive and liquidity is falling. Maybe I know this, so you know this, and now I know you know, and I should act differently.

Yeah maybe.

Everything’s a maybe . . . because THIS IS REALLY HARD. This is hard because many of us have never seen this before. There’s a whole generation of investors who’ve never experienced an environment with high inflation. Moreover, many aren’t even sure what to do in one. We certainly haven’t, but at least we knew beforehand that before we could say confidently inflation was/was not transitory, we at least have to try and figure out how it’s calc’d. Not just that, but at least project a bit and figure out how long it will last, and what’re the drivers for it. Instead many just pointed to a few things like durable goods, or used car prices, and declared, this too shall pass. Wait, what about the other 87% of things??! Yeah I don’t know.

Even if you figure out inflation, or at least have a directional view on inflation, you still have to run through the repercussions of a world beset by rising prices. How will rates react, how will assets prices react, how will investors, how will the global economy? Only then will some people ponder what they can do well in such an environment . . . what the heck are these things called commodities that rise as inflation rises??

Quite frankly, if we hadn’t been invested in the commodity space all these years, learn trying to learn it now would be brutal. Imagine thinking about, breaking apart, and examining in exquisite detail businesses like Netflix, Uber, Amazon, Adobe, etc. every day, every week, and every year for years on end. Those Malcom Gladwell 10,000 hours (likely more) means every nuance and “competitive advantage” of those business models became embedded in your investing soul. You walk around spouting endlessly the glories of customer captivity, proprietary IP, massive scale, network effects, moats and moats oh my, and why these orgy of moats grant thee infinite margins!

You didn’t think we actually know what you’re talking about did you? We troglodytes “only” know commodities, so we must be unwise to the things you’re talking about, right? You can’t possibly see what we see, nor comprehend how we value the things we value, especially with those beedy little oil blackened eyes that haven’t seen returns in years. Crawl back to the commodity holes where you dwell, you luddites. This too shall pass, and higher multiples are only . . . a day away.

Yet . . . maybe. Just maybe it’s all changing. Maybe we can imagine a world where we’ll ask those same analysts or portfolio managers to pivot and consider the old economy stocks. To have them consider investing in the shares of commodity producers that have ZERO competitive advantages, no control over pricing, little control over their costs . . . and heaven forbid, high capital expenditures.

HAHAHAHAHAHAHAHAHA

. . . no stop laughing.

HAHAHAHAHAHAHAHAHA

. . . seriously.

HAHAHAHAHAHAHAHAHA

. . . omg, I’m crying. 😂

hehehe

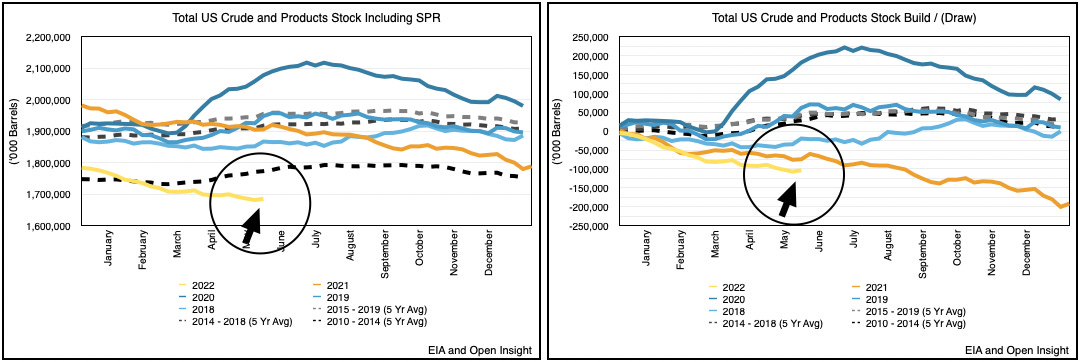

Maybe we’re wrong though . . . maybe we’re too “into” our thesis (in this case oil) and we’re the ones with major confirmation bias. Sure doesn’t seem like it, especially not when we’re seeing petroleum inventories continue their slide.

Not when the furthest barrels in the world are doing this . . .

or OECD inventories are pretty much doing this (i.e., drawing when they shouldn’t be) . . .

Not when we hear Energy Aspects turn bullish after years of caution, with Amrita Sen on CNBC saying . . .

“I don’t see any respite in the near term, it can easily go up another $20 maybe $30 dollars . . . at this stage it’s a number. The problem we have, and we’ve talked about it before, is the lack of spare capacity, lack of inventories, governments have thrown SPRs at this problem and that’s been absorbed, and even with that, inventories have continued to draw down, so unless prices go to the point that demand actually really curtails, there is no solution.”

Heck flashback to the day before and Jeff Currie from Goldman Sachs said . . .

“This is the first innings of a commodity super-cycle, it’s not just oil and gas, it’s metals, minings and agriculture, the sector has suffered a decade plus of underinvestment . . . the reality is the money in this space is really small . . . we haven’t seen a big influx of capital into this space.

The problem is we’ve now entered into this volatility trap, where the higher the volatility, the less incentive people have to put money to work in this space, which then exacerbates the problem and creates this vicious loop and reinforces the volatility . . . so the question becomes what’s to stop this? High, high returns. When I go out and I survey investors as to why they do not want to put money into this space, reason number 1, a history of poor returns . . . reason number 2, the volatility is too high. . . . reason number 3 is ESG . . . So I ask, what’s going to get capital back into this space? The answer is a 3 year track record in this space, and we’re about 18 months into that track record . . .

3 years to get a track record, 3 years of spending that creates cost inflation, then finally 3-4 years of investment that gives you supply. So in years 10-12, you de-bottleneck the system, and that's why they're 12 year super cycles.”

Flash forward again to Ms. Sen who ended her interview with this . . .

“This is a structural story, and this is important for everyone to understand. The reason we are here today and not really anything to do with Russia, we were at $95 oil prices crude price we’ll before the invasion, we would have gotten to $100 regardless, maybe six months later, this has to do with years of underinvestment . . . even with these price signals . . . there is so little incentive . . . to reinvest because of ESG concerns so the market is not functioning as it should, this is why this is a structural story and could easily be with us a decade.”

We’re only talking about one commodity, oil, but all of the above applies to mining, metals, agriculture, natural gas, etc.

So maybe we are wrong. Maybe this guy is right.

Yet, maybe he’s not. Can you really just “strip out” the prices of things you don’t like? Can we really strip out food, oil, natural gas, services, etc. so the narrative fits with his earlier view that inflation is transitory? Hmmm. We think it all matters because it all adds up. We’re not picking on him specifically, but this persistent view for denying what’s so obvious at the grocery stores and at the gas station.

Still, you do you, and we’ll do we. If we are right then as the kids say “NGMI.” Someone tweeted that and I had to look it up. Not Going to Make It.

You darn kids and your “pager codes.” NGMI.

This is REALLY HARD, but maybe we’ll all collectively figure this out and we’re all goin to make it. Maybe we’ll all learn to pivot and we all are GMI.

HAHAHAHAHAHAHAHAHA

. . . no stop laughing.

HAHAHAHAHAHAHAHAHA

. . . seriously.

HAHAHAHAHAHAHAHAHA

. . . omg, I’m crying. 😂

Please hit the “like” button below if you enjoyed reading the article, thank you.

. . . maybe.

who is paying people so much money? Aren't businesses broke? How do people afford rent? Is homelessness rising?