Walking Through RH, Failing to See the Vision

February 28, 2025

I have to admit.

I’m fascinated by this company. Restoration Hardware . . . sorry since rebranded “RH”. A company Gary Friedman built from scratch, one that used to sell a smorgasbord of low value items, only to transform itself into a high-end purveyor of luxury furniture and in their own words . . . one created with a “unique identity, one built on a foundation of invention and innovation, truth and trust, taste and style, leadership and love.”

Now that’s a tour de force!

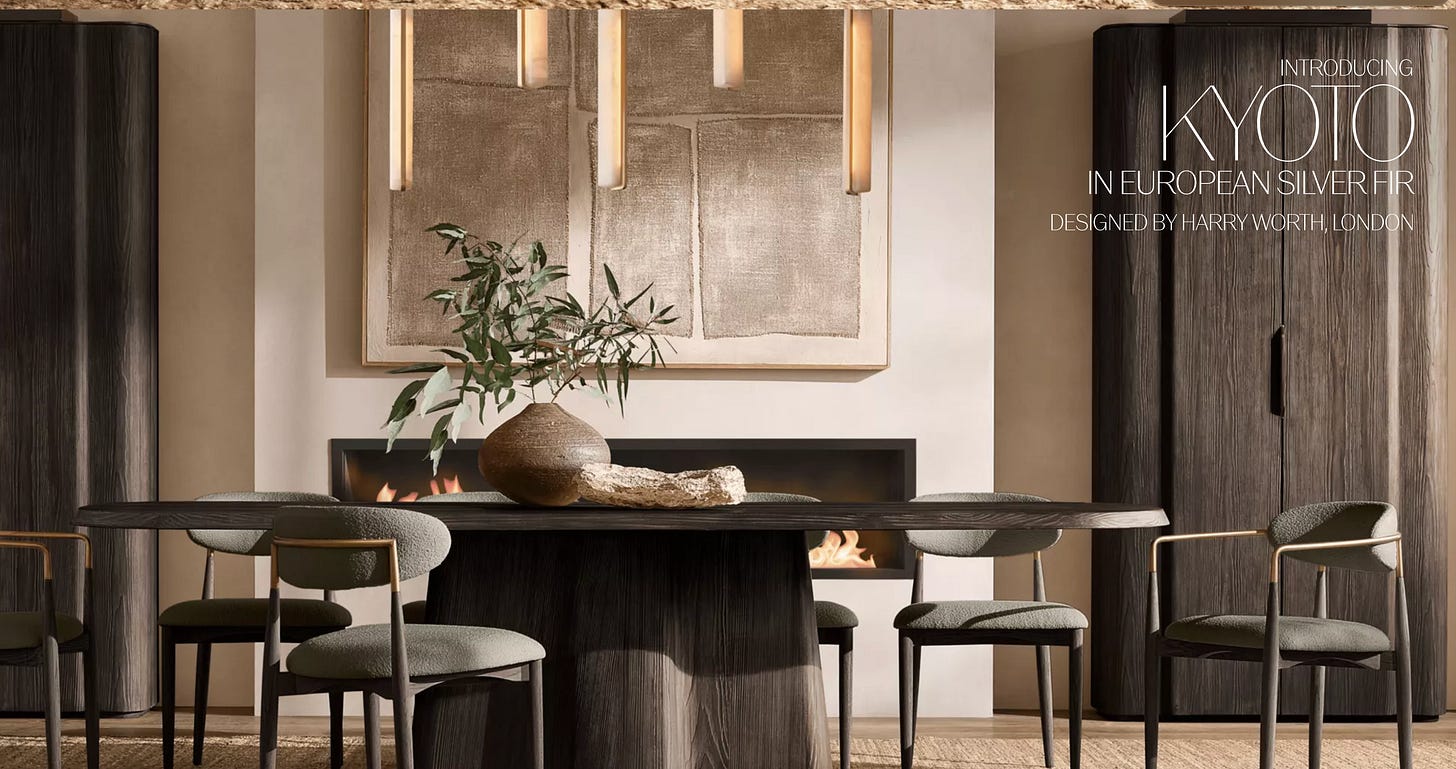

Don’t get us wrong, it’s not that the furniture isn’t nice, or that the interior designs are quirky and disjointed. Depending on your tastes, they’re at least pleasing to the eye in their neutrality.

The RH Galleries themselves are odes to the power of retail capitalism. Great halls of commercial selling, these are transformational spaces that redefine older buildings . . . like firehouses in Montecito.

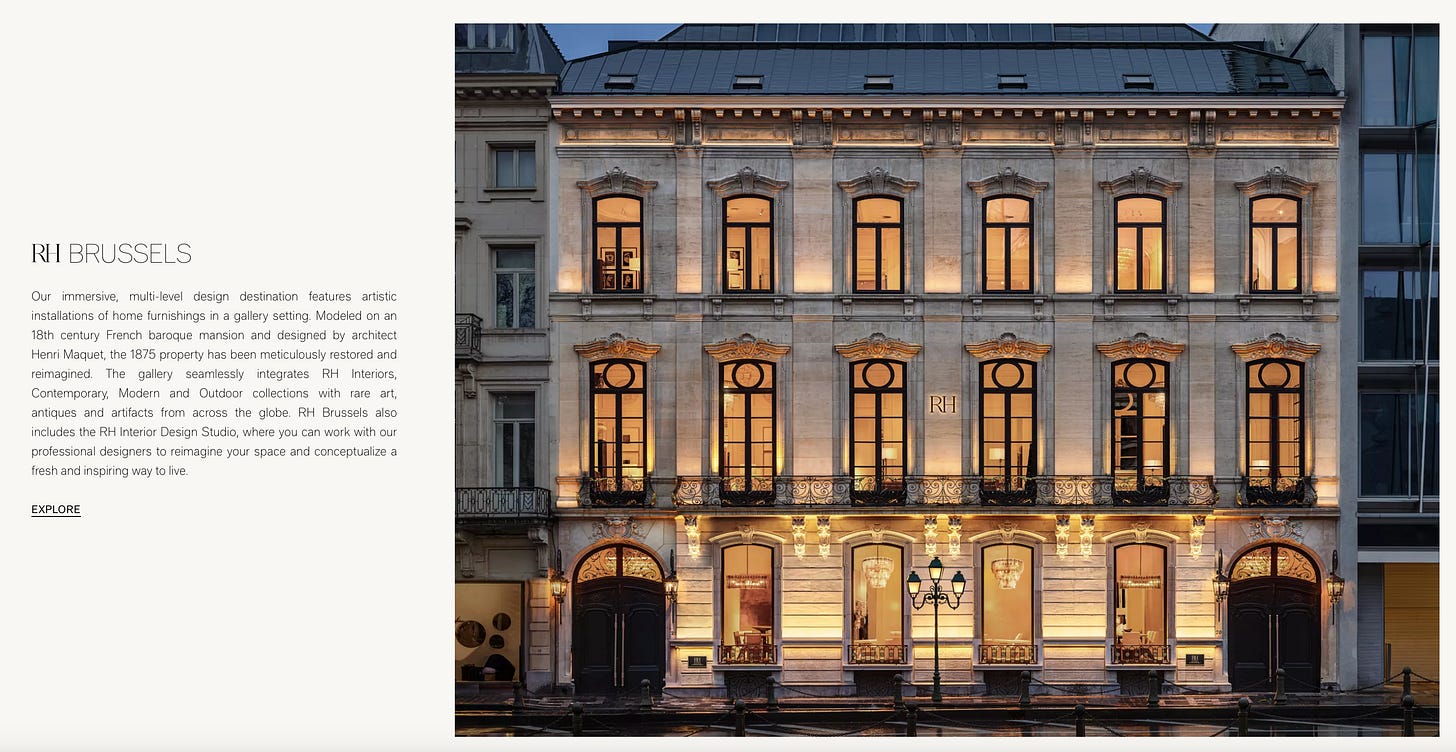

. . . or an 18th century Baroque mansion in Brussels

Like they say, if it ain’t Baroque, why fix it? Dad jokes aside, this latest creation is no joke.

That my friends is a 90,000 square foot interior design EXTRAVAGANZA trumpeting RH’s presence in Newport Beach. 4 stories of oversized furniture, topped by an indoor/outdoor restaurant with “sweeping views of the Pacific.”

As I walked through this behemoth, I marvel at the money spent, and the attention to detail. What I couldn’t help wondering though was . . . how does this thing make money???

Investors need not worry though because per Gary Friedman, it will.

“Our plan to open open immersive design galleries in every major market will unlock the value of our vast assortment, generating revenues of $5 to $6 billion in North American and $20 to $25 billion globally.”

That’s amazing. It’s amazing because this company currently generates $3B of revenues, so if we’re talking about $20-25B globally, watch out. If they do, they might really be visionaries. At the very least they think they currently are . . .

“LEADERS HAVE TO BE COMFORTABLE MAKING OTHERS UNCOMFORTABLE

Leadership is about pursuing a vision, leading people somewhere they've never been, doing things they’ve never done. As creatures of habit, change is uncomfortable for humans, but for the people and partners of Team RH, a culture of invention and innovation is at the core of who we are, and reflected in everything we do.”

You’d have to somewhat be to build these things. The Newport Beach store is already RH’s 37th Gallery location, and the stores typically span 50-70K square feet. RH New York comes in at 90K sq ft, and RH Raleigh, the Gallery at North Hills, 60K sq ft, just to name a few. In addition, there’s more coming.

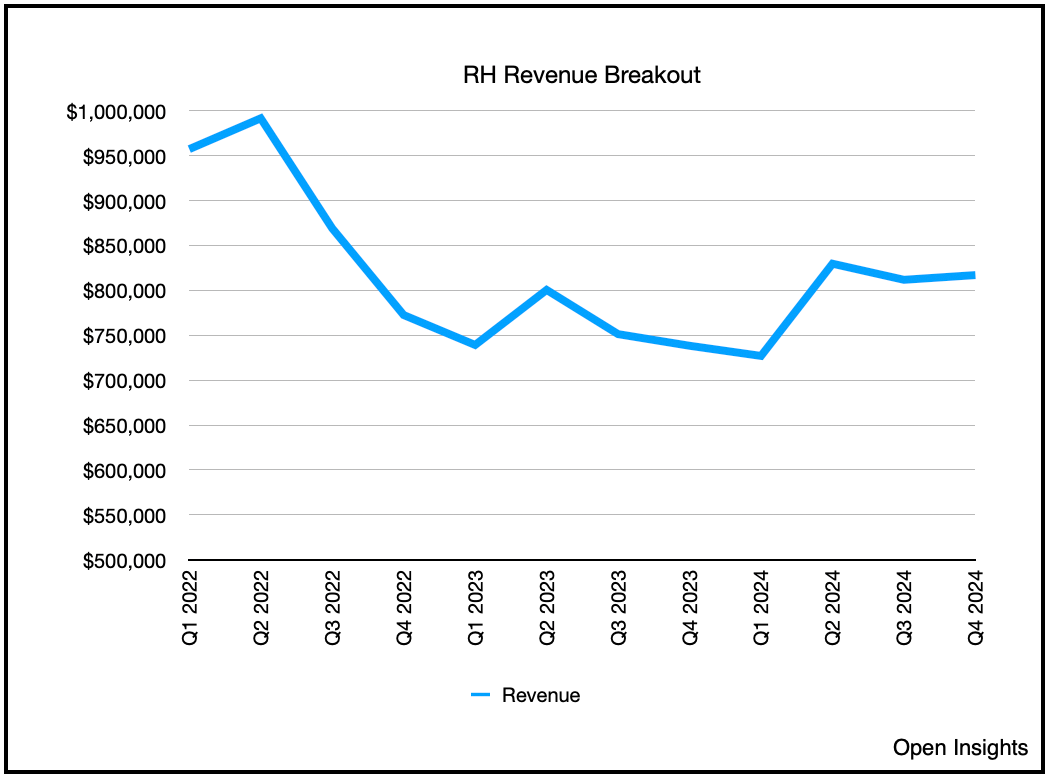

7 more in North America and 3 more in Europe. So obviously these things are driving significant revenue growth right?

Hmmm . . . meh.

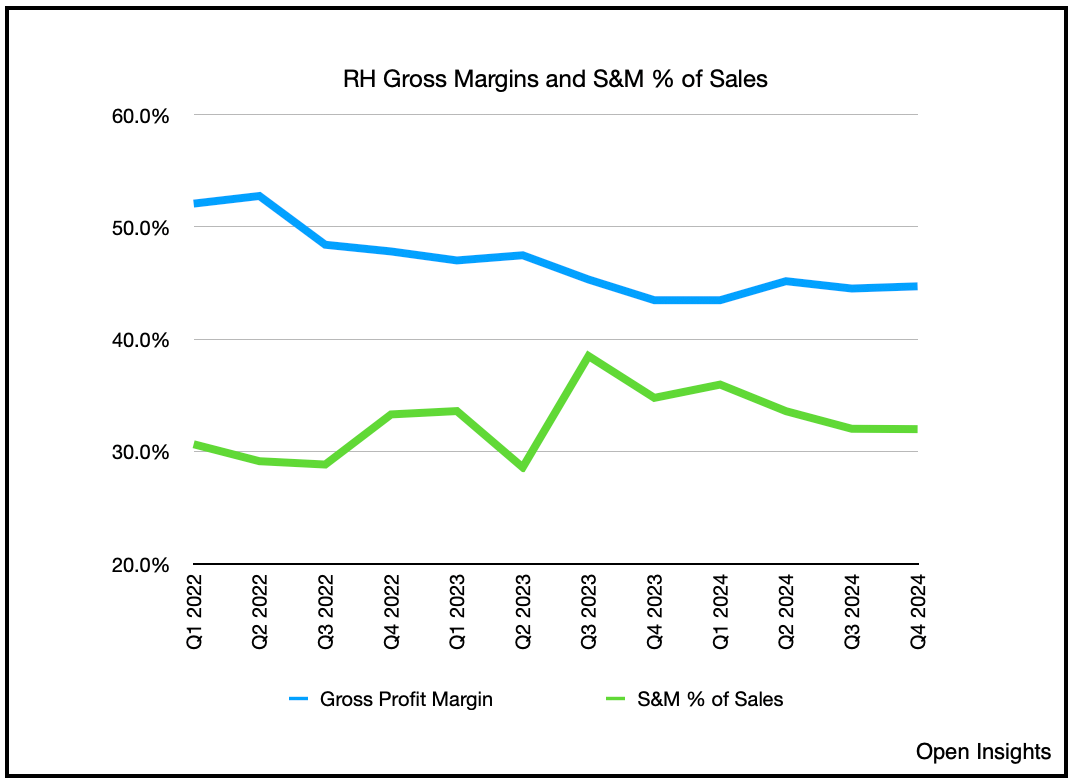

Well okay, never mind that. We know, the elevated experience and design consultations must mean they can sell their $10,000 tables and $2,000 chairs for even more, and juice those gross margins right?

Uh.

Okay, maybe not, yet somehow or the other, all of this translates to great free cash flow right? Maybe there’s a bunch of non-cash stuff larding up those COGS or Sales and Marketing.

Guess not. Well that’s troublesome. Look at how Net Cash from Operating Activities has deteriorated. Moreover, it’s not like revenues in 2023 and 2024 YTD weren’t flat to up. Declining cash flows coupled with higher capex spend as all the buildout has occurred has hammered FCF. So much so that it’s negative for the past two years. We don’t anticipate Q4 to be any better as seasonality doesn’t play into favor.

So if the Galleries aren’t driving business significantly higher, they’re more costly to build and maintain than “normal” stores, how valuable is this version of RH today? Some have argued that it’s not, and that RH is really a Friedman lifestyle company, one that simply exists to enrich the lifestyle of its creator. In truth, this is hard to argue against, as the opulence and corporate benefits are real, but the returns aren’t. Even if we were to dismiss the claims of self-dealing, the valuation remains difficult to justify.

After declining from its high above $400/share to $322/share today, this is still a $6.4B market cap company. 2x revenue doesn’t normally seem like a stretch for a growing company, but it’s hardly growing. Couple that with negative FCF, we think paying $6.4B for this company is . . . challenging.

The balance sheet is certainly levered with $2.5B of Term Loans. Prior to 2024, the company had nearly $1.5B of cash on hand, which would make it more palatable, but it’s since spent that down to aggressively repurchase shares, retiring slightly more than 20% of shares outstanding. Ironically, the CEO has also sold his shares into this “repurchase,” sure it’s well deserved given the value he’s created, but that does seem oddly coincidental. Today, we’re left with a company with little to no cash on hand, one generating negative free cash flow, and one living off of an asset based revolver (i.e., corporate credit card). $6.4B eh? $322/share. Hmmm.

Don’t get us wrong, we love the beautifully curated spaces. It’s hotel living/decoration at its finest.

Neutral, inoffensive, luxuriant and all carefully crafted and coordinated. Enough bling to capture the eye, enough baubles to bedazzle . . . but look closer and it’s missing something.

Just like the financials you’re left feeling a bit empty amidst the neutrality. What good is a makeover if it lacks substance, and what good is a transformational strategy if the reemergent entity isn’t materially more profitable (or simply profitable at that)? Those 37 galleries weren’t built this year, so the strategy isn’t exactly new, so if it worked . . . shouldn’t it have started working? If it doesn’t soon and/or if the economy deteriorates, a high-end retailer of luxury furniture may not fare well, in which case, we can easy see a scenario where the stock falls back to near $210, or it’s 52 week low.

Maybe we don’t get it. Maybe we’re too disassociated with this world. Visionaries vision, and mortals mutter we guess . . . we’re just finding it hard to envision, a real return.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

I was here for the RobinHood coverage.