Here Comes the Rich Zombies

December 4, 2020

Having used an Irving Berlin song to introduce last week’s newsletter, we’re singing a different tune this week. Something decidedly more elementary, but one that keeps playing incessantly through our head.

“We’re going on a trip in our favorite rocket ship, Zooming through the sky . . . Little Einsteins.”

It’s a song that my little one sings like a mini-Pavarotti, but it’s also a tune being belted by the market. We seem to want to go higher, and guess what? We’re about to launch.

We’ve written about some of the reasons why in our prior newsletters:

Why Covid Will be Over by March

I Can Do Anything, Better Than You

Scientific breakthroughs have resulted in stunningly efficacious vaccines that are now being widely distributed. As we also anticipated, the vaccines will begin rolling-out just as the last waves of COVID cases recede in the West. European countries are on the mend (despite Germany’s extension of restrictions until early-January) as is the US (as the Midwest/Rustbelt recovers though the East/West Coasts are problematic). Nonetheless, economic recovery is beginning to climb, and should further accelerate as vaccinations begin in earnest. So what then? What’s the next six months and the next six months after that look like . . . and why is that song stuck in our head??

Because of that first line . . . “[w]e’re going on a trip in our favorite rocket ship.”

COVID Fatigue

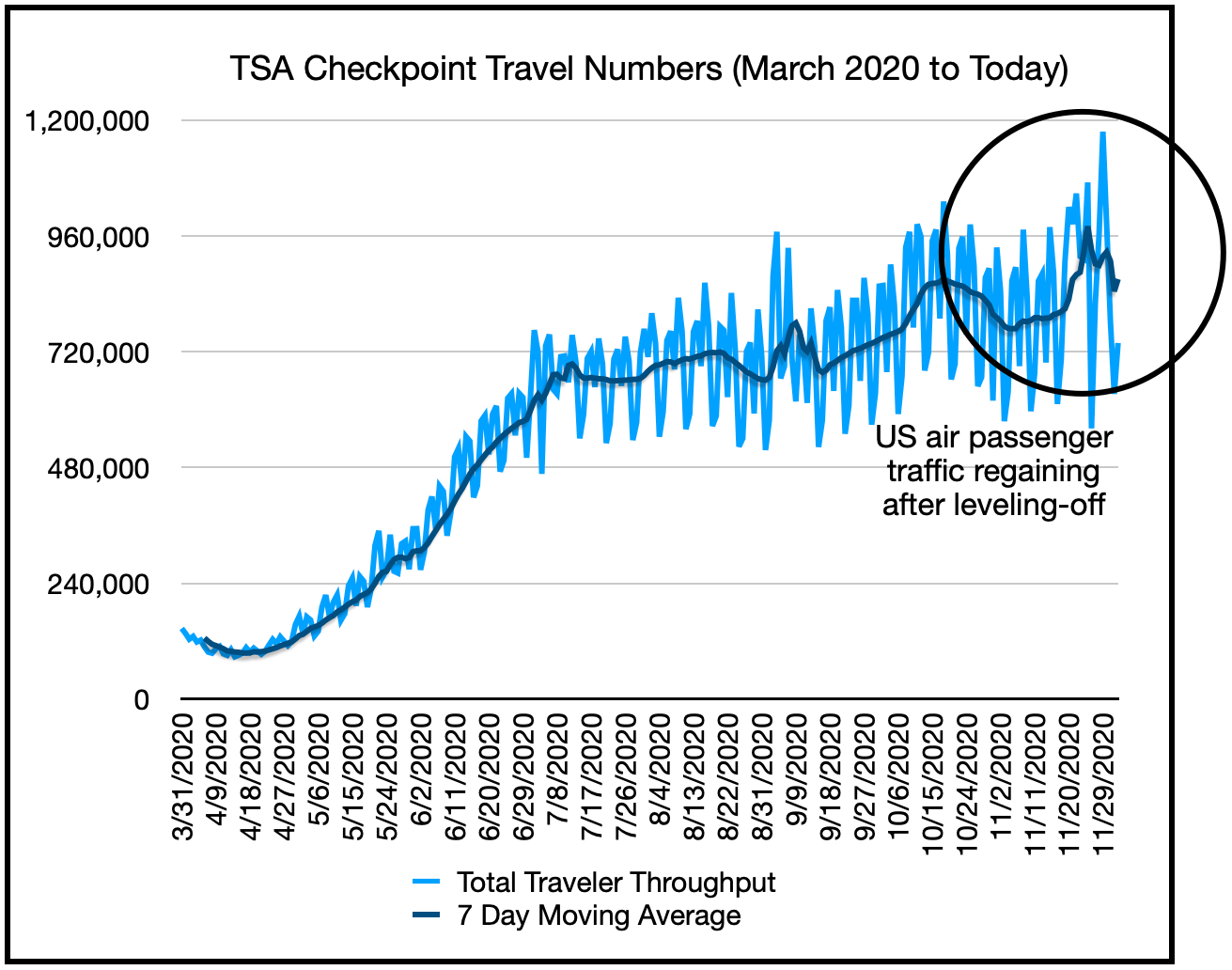

Because of you . . . because of pent-up demand. We see you. We see you traveling amidst one of the worst COVID outbreaks this country has faced since this entire pandemic began. We see the vehicle miles traveled and the TSA passenger counts in airports.

Have mask? Bring it. Middle seat? No worries, once I drop these armrests, my seat’s hermetically sealed. We’re now free to move about this country. We can’t fault you because we’re all tired. COVID fatigue is real, and we’re ready to continue with our lives. After an entire year of nothing-burgers, we want a triple-pattied, heart- disease spurring, extra sauce slathered, fried egg topping melted cheese concoction, and we want it now. More importantly? We gots the money.

Show Me the Money

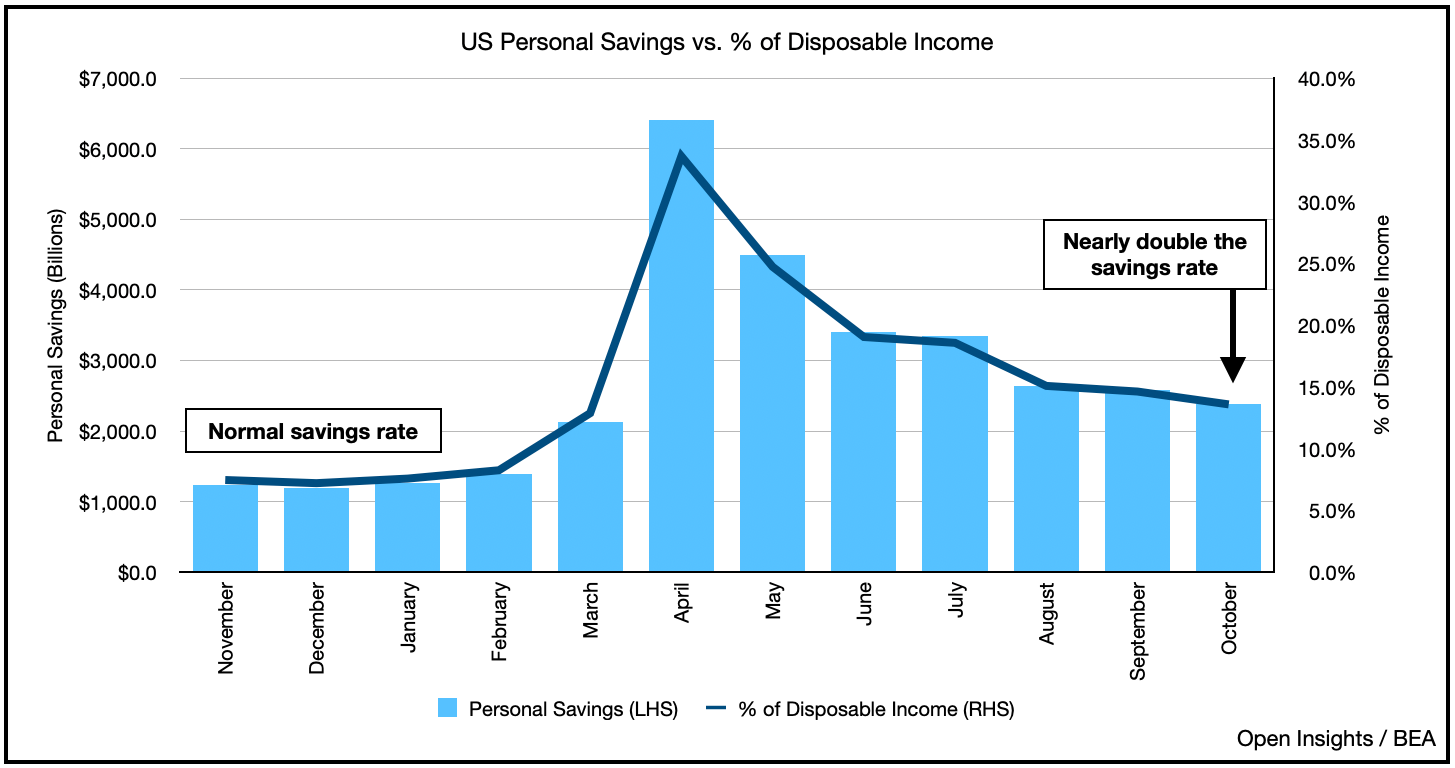

Consumer spending represents over 70% of our economy, and we know you’re flush with cash. You’ve done almost nothing this past year, and doing nothing means spending nothing. The activity diet means the only thing that got fat was your wallet and so it has.

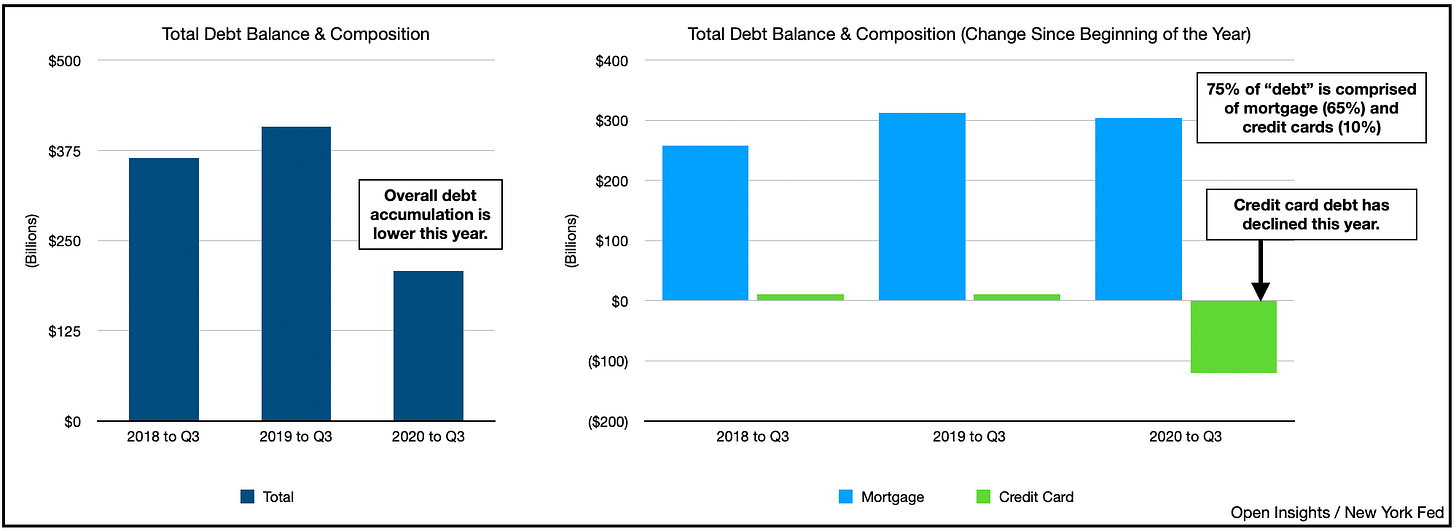

But, but, but, that can’t be true right? Sure our savings accounts are higher, but we’re probably socking away cash for emergencies and really running-up debt. Weeelll . . . maybe not so.

The growth in overall debt year-to-date has actually been lower than prior years as consumers were stuck at home. In fact, instead of building debt at a faster rate, they’ve paid down debt with the highest interest rates as credit card debt has fallen by over $120B since the end of 2019. Moreover, a significant portion of the debt they do have has become cheaper as interest rates for mortgages, which accounts for 2/3rds of total debt, have fallen dramatically. A 30 year fixed mortgage is near 2.25% today vs. 3.5% a year ago. So the extra interest savings again bolsters overall savings and debt reduction.

Now we know the counterarguments. All of the government transfer payments likely played a role in this right? The PPP, the loans, grants and stimulus checks. Yes, likely, but does it matter? Money is fungible. Government transfer payments displaced the household income that would have otherwise gone to meet household expenses. Moreover, once sufficiently covered and with nowhere to spend, the extra income either went to savings and/or debt. It’s counterintuitive isn’t it? Turn on the television, or pull-up your favorite news website and we’re inundated with news of the collapsing economy, rampant poverty, food lines and despair. Unemployment is still exceedingly high, and the jobs recovery is now stalling.

To some extent that’s true because layoffs have been massive, and permanent job losses are increasing, but the underlying story is more nuanced. The reality is that this pandemic has disproportionately affected the working poor. As we all know, low wage workers, blue collar workers, workers in the leisure, entertainment, restaurant and travel industry have been decimated; they’ve borne the brunt of the pandemic’s economic shock. Yet, if we invert that point, we can ask the other question. How have the “white collars” fared?

Pretty darn good. As you can see, those with higher education (and likely higher incomes) have kept their jobs and simply worked from home, a luxury unavailable to lower income/likely less educated workers. Sure some white collar workers have been affected, but not nearly to the extent as their blue collar brethren. Sheltered at home with little to do, they’ve paid down credit cards, saved money and refinanced their homes. In short, consumers, particularly wealthier “white collar” workers, will arguably exit the pandemic in a financially stronger position than when it first began.

Translation? The people who’ve spent little and done little in the past year are now antsy. They have more money, less debt, and the ravenous urge to finally DO SOMETHING = ROCKET FUEL.

Pasty White Zombies

You don’t buy it you say? That doesn’t mean stocks, and in turn the market, should go to the moon, right? Wrong because guess what happens when the hoards of pasty skinned home-bound zombies now descend in masse on the vacation locales, resorts, and hotels of their choice? Price inflation . . . so when the Summer becomes BANG ON, so will prices.

Capacity constraints will abound, call it asymmetrical demand meets finite capacity. The travel, restaurant, live entertainment, and other industries have cut capacity to the minimum in order to simply survive, and they won’t add capacity until we have additional clarity on the success/efficacy of the vaccines as they roll out.

As we vaccinate the high-risk population in January/February, COVID deaths and hospitalizations will dive. Nonetheless people likely won’t begin booking vacations until they receive their vaccinations, and for some that will be in April/May, which means bookings (i.e., demand spike) could come right before the summer season, leaving companies with little time to increase staffing. Even if they do, they’ll add capacity cautiously, unwilling to commit opex/capex in the event the pandemic recovery takes more time. This also means that these companies will likely be capacity constrained for the back-half of the year, and perhaps even into 2022.

It’s simple supply/demand, but with the added twist of a pandemic, which compels companies to be conservative and only add capacity when the hordes are assured, which means it’ll be too late. The onrush means prices will spike. Airline tickets, hotel fees, car rentals, etc. In turn, that means margins (i.e., profits) will leap.

Analysts who’ve been conservative on estimating what a recovery will look like will be forced to chase earnings upwards, revising and updating estimates as we move into 2021. These estimates will disproportionately affect the small-cap stocks, you know those representing “the real economy.”

Need another tailwind on the P&L? On the top-line, the US Dollar weakening will translate into higher non-US revenues. Ultimately, as expenses rise slower than revenue, the bottom-line, EBITDA, will receive a boost as pricing power, higher international earnings, and lower operating expenses do wonders.

Longer-term there could be some headwinds. Although interest rates are likely to remain low as the Fed allows the economy to run hot, will inflation eventually lead to higher interest rates? Perhaps, but unlikely in 2021. Taxes could also begin rising under Biden’s administration, but that will largely be determined by the special elections in Georgia on January 5, and whether Democrats can sweep and effectively control the Senate.

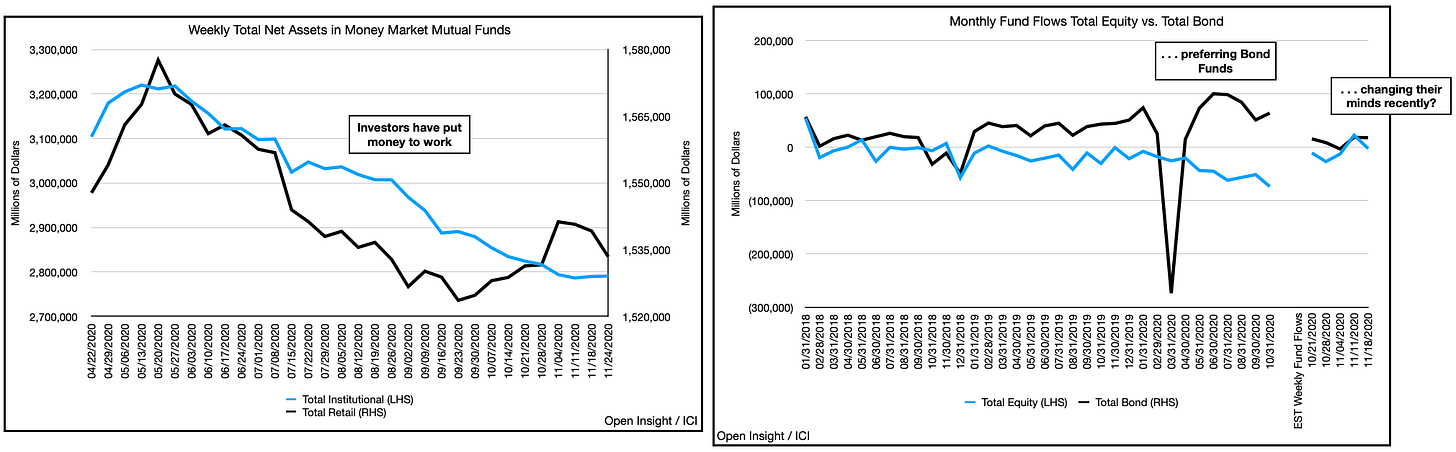

Lastly, FOMO (Fear Of Missing Out). As the rally builds, this will become real as institutional money managers begin facing career risk if they underperform significantly. Although they’ve put money to work since March, many have overweighted the bond side, which has performed well as interest rates have declined. Yet, will this continue as the economy recovers and inflation heats up?

Furthermore, what happens when stocks step higher as the economy spurs a leg-up in corporate earnings? As equity prices rise, these managers will be caught offsides. Now some would argue that technology stocks could crash from their lofty valuations. We think the push to index investing means they will still receive their share of inflows as investors increase their equity exposure. Moreover, given the size of tech, you can’t underweight tech to zero and overweight everything else. Yes, as we round-trip 2020, some YOY comps for the tech sector will make for harder comparisons, but that will only begin to show itself in H2 2021. For now, technology stocks should hold, or continue to drift upwards, while the Russell 501-2000 will vault higher as even a slight overallocation can do wonders for the downtrodden sectors. So for now, strap in and sing with us.

“Climb aboard, get ready to explore . . . There’s so much to find, Little Einsteins.”

Join the Distribution List

So that concludes this letter. We’ll endeavor to send these out weekly, so if you would like to be added to our distribution list click on the subscribe button above. This is our start and it’s our invitation to you to join us and share your thoughts. Welcome to Open Insights and let the conversation begin.