What a Week. The Fed Messes Around and Begins to Find Out.

March 11, 2023

Busy busy week.

Breathless week in fact.

First up was Fed Chairman J. Powell, who testified before Congress and said the unsaid . . . rates? They may just go higher for longer, potentially increasing the Fed funds rate by an additional 50 basis points (0.50%).

What was previously debated about in closed offices and hushed voices, now exploded into view. They could just do it, couldn’t they?

The market certainly didn’t like that. It usually never does as gravity (i.e., interest rates) help to dictate prices, and when gravity gets strong? The balloons start to fall. On March 7, we can see that the S&P 500 promptly shed its fair share.

Then the job openings data came out.

Phew. It wasn’t soooo bad, I mean 10.8M job openings. That seems like alot, but it’s down by 400K from the last print. Maybe the labor pool shortage is getting better?

The market felt a bit better on Wednesday. We’ll wait for Friday for the February unemployment figures to decide. If they come in soft (i.e., higher unemployment), perhaps the Fed won’t be as anxious to raise rates as aggressively.

Before Friday though comes Thursday, and out of left field comes Silicon Valley Bank, a regional lender to tech and biotech companies, that found itself caught in a good ole fashion bank run.

SIVB stock cratered on Thursday as news hit that it had liquidated much of its assets held for sale to raise capital. Quickly thereafter, VC firms advised their start-ups to withdraw deposits from the bank as fear and uncertainty began spreading. So a bank run.

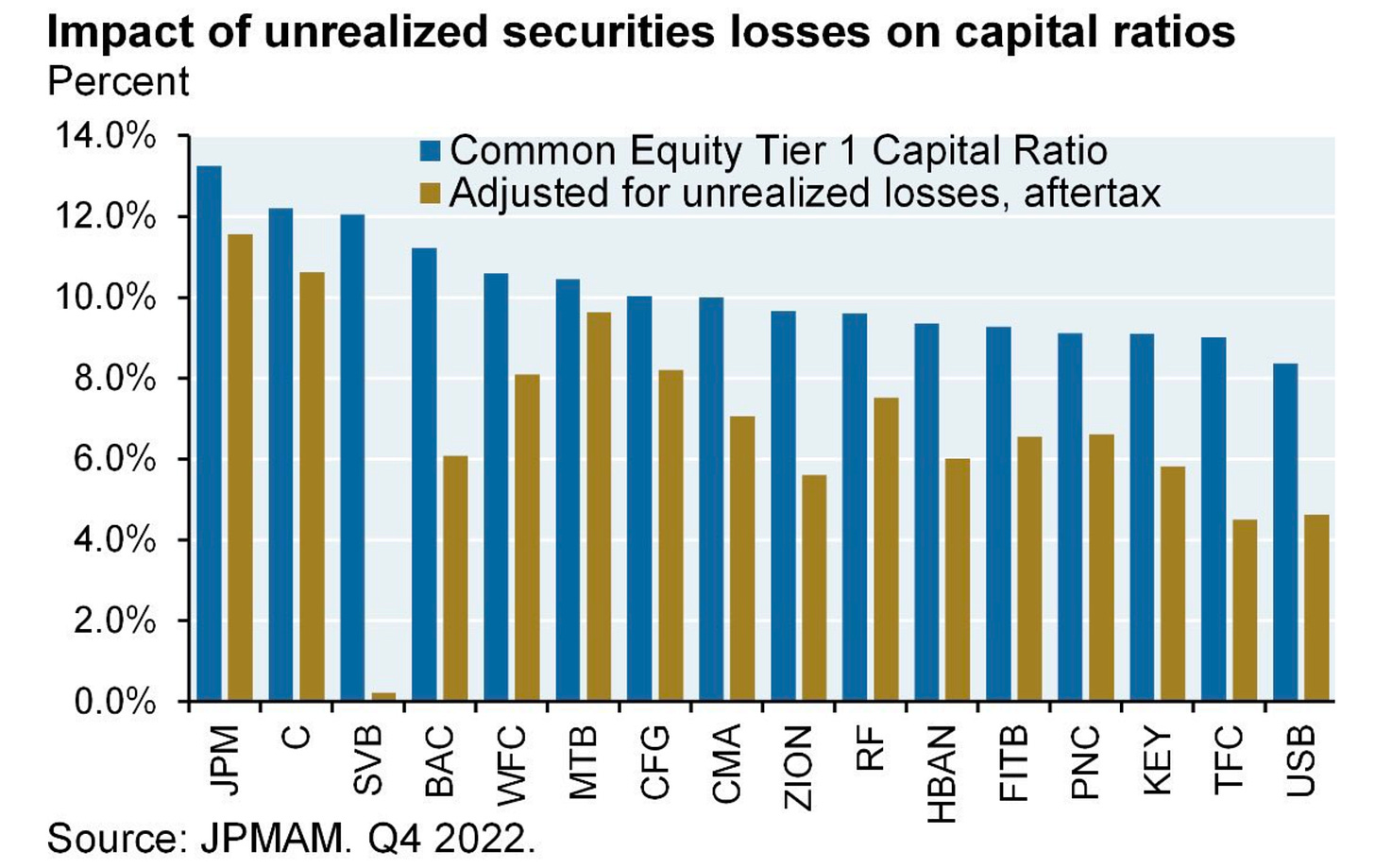

What sparked SIVB’s decision to raise capital? Well given the tech slowdown, many of its customers have been forced to drawdown deposits from the bank. Normally this isn’t an issue, however, the assets held by the bank itself were losing value as the Fed raised rates (i.e., bonds purchased by the bank were falling in value as interest rates rose). You’d typically want to hedge some of that interest rate exposure (so if you invest $1 of your customer’s money into safe instruments, you’d get back ~$1 even if rates moved against you before the instruments matured and your customers wanted their deposits back), but SIVB clearly didn’t.

So when you’re forced to liquidate them at an “inopportune time,” to meet capital ratios and customer withdrawals, losses shift from “unrealized” to “OMG.” Once you declare that you’re raising capital to shore up your balance sheet, forget about it. It’s a full “run on the bank” as a tsunami of withdrawals begin. What was customer float soon becomes much less buoyant. By Friday morning, SIVB was in FDIC’s receivership, equity holders are likely zeroed out, who knows what bond holders get, and everyone’s wondering whether this was a systemic event that truly begins to cascade the system.

Phew . . .

We don’t think so. We believe this is largely an idiosyncratic case as SIVB was juicing its profitability, but was caught in a cyclical downturn. If they were properly hedged, much of this shouldn’t have been an issue. It’s certainly not for many other regional banks and or larger institutions. Look, SIVB still has extremely valuable relationships and those are worth something. It previously banked most of silicon valley’s start-ups, and is deeply entrenched in the tech and biotech space. We know because many of our friends in that space bank with the firm.

So imagine if a large institutional player with a solid balance sheet wants an entree into that space. It could offer invaluable stability in the interim, and then later leverage that relationship for investment banking and asset management fees (i.e., IPO, M&A, bridge financing, executive/high net worth asset management, etc.). Imagine what that would be worth in the league tables for years to come.

So buy that ticket into this world for the low low price of “potential risks.” Heck, back of the envelope calcs are pinning the value of the deposits around 98%, which means they’re money good (assets are solid enough to cover most of the deposits). Moreover, the FDIC is now rumored to be insuring any buyer who takes over the company, 95% of the deposits. So basically we’re down to a theoretical loss/probable loss of 5%. That sounds pretty attractive wouldn’t you say Goldman, JP Morgan, Bank of America, Citibank, etc.? We’ll let the experts opine on this . . .

So throw everything at it, whether we create a bailout fund, have hedge funds and/or asset management firms bailout the depositors, or have a too big to fail Wall Street bank do so, there’s a strong incentive to make the depositors whole so this doesn’t become a systemic risk issue, so that these customers (i.e., real companies) continue to make payroll and pay vendors. So that other bank runs don’t begin happening.

We agree with that, so stay busy over the weekend folks, Monday’s around the corner.

Still . . . this whole episode in volatility that scares the BAJEESUS out of us and trigger everyone’s 2008 Great Financial Crisis PTSD, is a warning. It’s a warning like the UK pension issue was a warning. Interest rates (i.e., gravity) . . . matters.

Keep raising them aggressively and we’re going to find out what other knock-on effects they create, and not a slow and steady and “everyone has time to adjust” kind of way. Even if the accounting rules don’t require you to mark-to-market securities at today’s prices, it doesn’t mean you’re not sitting on assets that are worth less than they were when rates were at 1%. Assets that were used as collateral in the real world for other loans. We’re at ~5% for a Treasury bill, and that matters in the real world, regardless of what your books say.

We’re also not sure about the second order effects yet. We still need to see what the Fed says tomorrow (i.e., before the market’s open on Monday) and before VCs and start-ups really begin to panic if they can’t access their cash. We doubt that’ll happen because this is all about confidence, and anything less than telling depositors that they have a good chance of getting all their money back and soon, will spark a crisis of confidence.

The one thing we’re confident about? That 50 basis point interest rate hike hinted at by the Fed on Monday????

Yeah . . . you can probably forget that. 25 basis point it is, and then we’ll see because we’re definitely in no man’s land now. Keep messing around here . . . and find out.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Great article. I followed the story all over the weekend on fintwit.