What Not to Say at Polite Dinner Parties.

June 4, 2022

I’m at a teacher’s award ceremony. Yup, that’s my wife, collecting hers, adding another trophy to an already extensive collection. To say she’s an amazing teacher means I’m short-selling it. That’s no humble brag from a proud husband, it’s simply the truth. Her numerous accolades are a testament to her professionalism and the dedication she puts into her career.

After spending years judging management teams, boards, other investors, etc., you get a pretty good feel for what “A” players do in life, and without reservation, she’s an A player. Frankly all the teachers I’m meeting tonight are, their passion for what they do and how they do it fills the room. This one is for STEM (science, technology, engineering and math), last time it was for Teacher of the Year, but in all of them one thing is clear, their love for teaching is palpable. Every child deserves to be educated and every little one deserve a chance. What a truly noble idea, if only the world held it too.

“What do you do?”

That question freezes me. I don’t know why, but I suddenly become self-conscious, as if my chosen profession pales in importance (pssst . . . it does).

“I’m a hedge fund manager,” I respond sheepishly like a student who just saw their teacher at the grocery store, out in the wild.

“Oh you must be busy then.”

“Yeah, it unfortunately never shuts-off . . .,” I reply.

“The world is pretty crazy these days.” He says.

As if that’s my cue, I say “. . . well it’s more like if COVID was a tail risk, all of the repercussions we’re experiencing today are “tail risk” that follow . . .”

I can almost hear my wife’s eyes roll to the sky as the words tumble out of my mouth.

Blank stares, followed by this gem from another teacher . . . “I took a corporate finance class in college once, and we turned a stock portfolio of $2,000 into $250,000,” . . . just smile and nod.

Okay okay, this one’s on me. Who talks about “TAIL RISKS” at a teacher awards ceremony???

. . . this is why she doesn’t take me anywhere.

Yet that’s the dichotomy I find myself in.

I’m in a room filled with exceptionally talented educators striving to do their best of the next generation, working tirelessly to eke out incremental gains that are so difficult to come by when you’re already at the forefront of the field. They’re really the best of us, and education is truly a calling because only a few can do it and even fewer at their level.

Then there’s me. Before the awkward conversation about tail risks, I’ve been sitting at the table pondering the latest oil charts that I reviewed before we left. As they’re celebrating, I’m thinking about inventory balances and OPEC+’s intentions with its recent production raise. I’m also pondering whether the Saudis would consider releasing their spare capacity to prevent oil prices from “running away” as the shortages materially worsens. I’m wondering what happens when the world faces $150, $200 oil. Who will suffer, how will they suffer, and how do we avoid the worst of it?

You see the juxtaposition?

On one hand, I’m seeing on full display the selflessness and sacrifice of great educators so that our collective future may be better, but on the other hand I know full well that there are those out in the world who through sheer incompetence, ignorance, or ill-will, threaten to cause us harm. If not harm, then at least place their own interests above ours. Yet why shouldn’t they? It’s what we do in the US. Even before MAGA we had the Bush Doctrine, and even before that Monroe had his. So there was always something about protecting US interests. Nonetheless, we’re now forced to play a game that’s decidedly colder and more calculating. Perhaps that’s not right, perhaps it’s just become more apparent and broader in scope as food and energy shortages loom worldwide.

As I was holding court (albeit only briefly) at the ceremony, OPEC+ was holding theirs, and they came away with a 648K bpd increase to production for July and August.

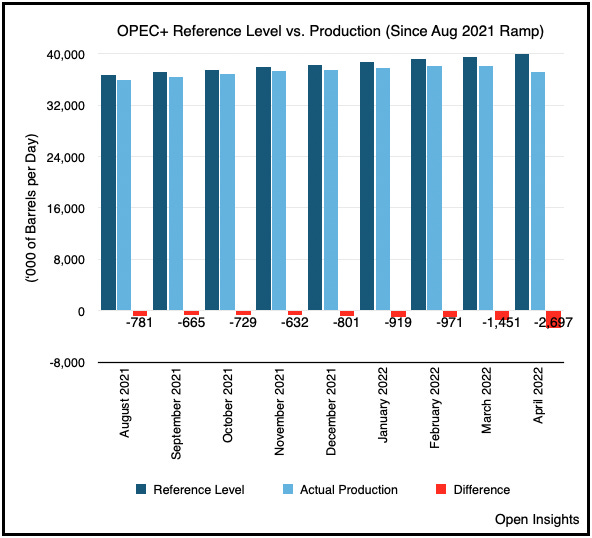

Energy crisis averted right? That may sound like plenty, but this has been OPEC+’s track record for actually adding production.

As we can see, the gap between actual production vs. their “reference level” is increasing. They can’t even keep up with their own quotas. So sure, let’s “pull forward” production increases planned for September into July and August, and spike the two summer months, but we’re left wondering if that will actually occur. At this stage, any announced production increase hasn’t been met with exactly more barrels on the market.

In all likelihood much of the production, even if produced, won’t even see the export market. Higher cooling demand during the summer means many OPEC producers experience a spike in domestic oil consumption (as they burn oil to generate electricity). Here’s Saudi Arabia, where demand spikes seasonally (~300K bpd).

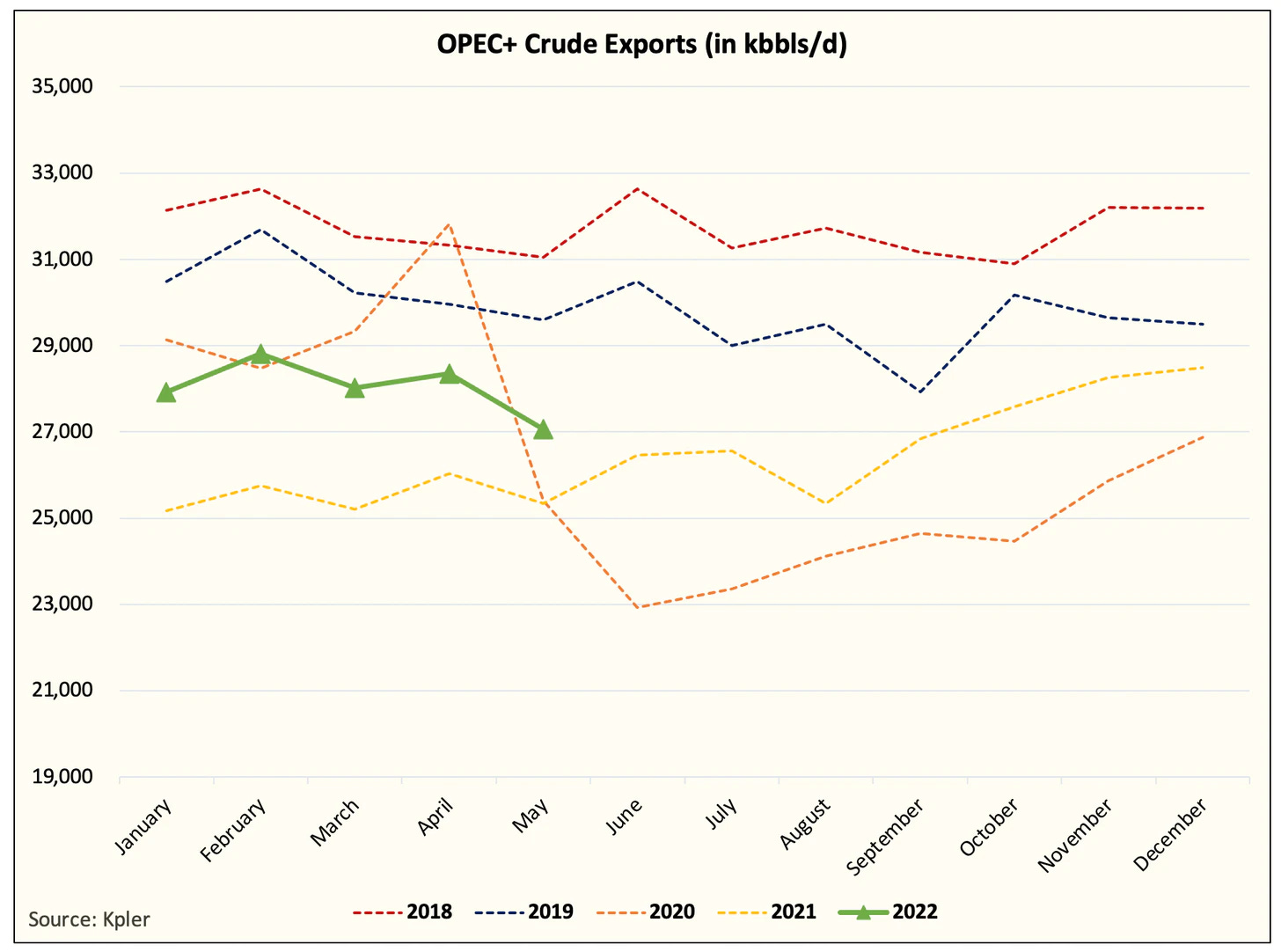

Still it’s an add right? I guess. Assuming they actually produce it, and then assuming that it actually gets exported. Call us skeptical. Heck, here’s exports if you want to see how things are progressing. Even as OPEC+ has declared that they’re “increasing production,” exports have actually been falling, which really means OPEC+ certainly doesn’t have our back, if it really ever did or can.

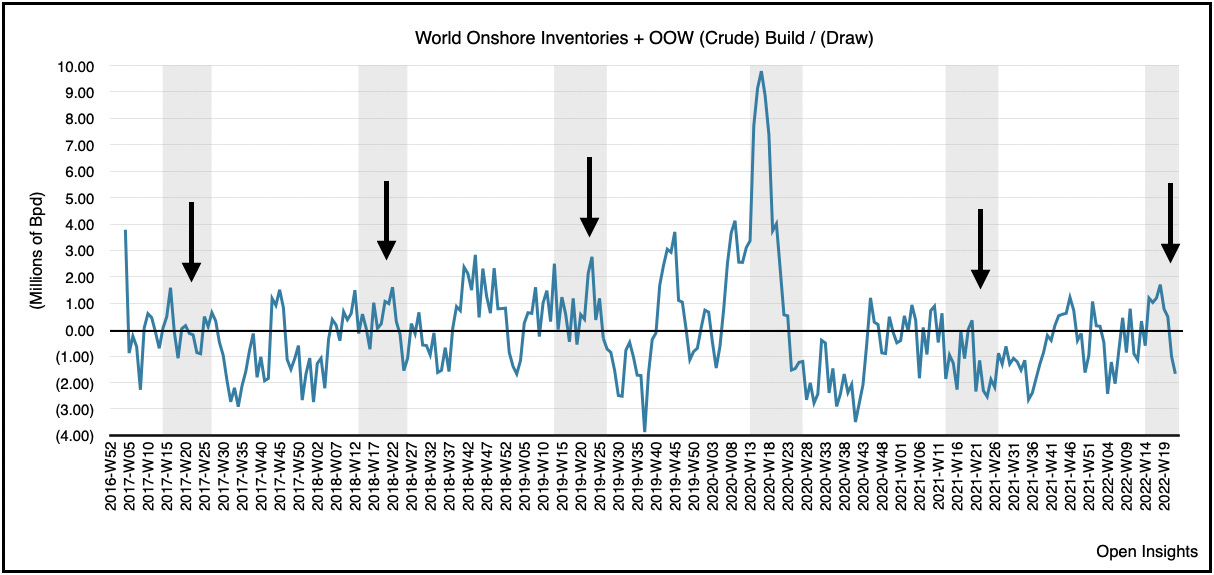

Take all of the factors above and it’s why we think we’re about to see this decline accelerate. This is global inventories.

They’ve been declining at a 4 week average pace of 1.67M bpd.

Yes, you read that right, for most of May, the declines have been nearly -1.7M bpd, which contrasts with the April build of nearly +1.28M bpd, or a swing of almost 3M bpd in large part due to China’s COVID lockdown.

It’s now ready to do so, so expect inventories to decline further and oil prices to step higher. Could the administration coax further barrels out of OPEC+? Maybe. Perhaps even likely, but we’re talking about a deficit of 1.7M bpd that we’re currently seeing, and that shortage is set to rise as we’re starting the summer season and China emerges from hibernation.

If we drill further down, we can also see that OECD inventories are currently drawing at the same rate today as they were in 2021, when we had global draws that were near all time highs.

Even that figure is only possible because of the massive release of Strategic Petroleum Reserves (“SPR”) by the US government, and if the commercial markets were left to their own devices, then we’d draw at a higher level than 2021. Again all of this is before China reopened and the summer season.

Drill down even lower and we can see that the inventories of the furthest barrel in the world (i.e., US barrel) are plummeting and they’re falling FASTER than the 2021 averages.

Again much of this is because of the US SPR releases.

So to reiterate, global inventories are resuming their collapse, OECD inventories are falling at the same rate as 2021, and inventories for the furthest barrels in the world (i.e., the US) are falling faster than 2021. So what happens to oil prices when the inventories of these furthest barrels run low? What happens when record SPR releases slow to preserve what’s left of a hollowed-out SPR? What happens when China restarts, what happens when seasonality spurs demand?

In totality? Commercial inventories will plummet, and oil prices? Well . . . you get the picture.

So do you now see why I’m uncomfortable at these parties? It’s not just social awkwardness, it’s that I see tail risks coming, and despite all the well wishes and hopes and dreams for kids and their future, our global picture is about to get a whole lot dicier.

There’s men out there who would do us harm and see us suffer economically and societally, and it just may be coming. The toll oil will take at $150, $175, $200? That’s your problem.

Almost certainly, we’re heading towards a period where we’ll pit the haves against the have nots, and that’s a zero sum game where some children will get left behind.

It’s a cold world, but that stuff doesn’t belong in this room. These rooms are sacred.

It’s why she doesn’t usually bring you . . . so just smile and sit quietly.

Tail risks . . . really??? Who talks like that . . .

Please hit the “like” button below if you enjoyed reading the article, thank you.

Love your recent articles.

So when we hit $150, $200 oil, the world goes into recession.

What happens to oil stocks when everything is going down?

Do they survive/thrive or do they fall too.

Beautifully written xxx