What's Next for Putin? Hunger Games

March 4, 2022

We always worry. Well I should say I always worry. It’s part personality, part training. I used to be a lawyer before managing money . . . well still am. You know, contracts, corporate structuring, M&A, international tax planning. Move this, shelter that, break things apart, recombine them. It’s hard to shut that piece of the mind off. Why? Because we think about the 2%. We worry about the 2%.

What’s the 2%?

It’s when things go bad. No they’re not the “black swans” of the world. Those are the unexpected and wholly unanticipated tail risks. We’re talk about the “grey gooses” of the world, the “known unknowns” that Defense Secretary Donald Rumsfeld once famously spoke about.

Most people think about the 98% because odds are things are going to be just fine. 98% of the time, things work out. Business people think of the 99%. Business development people? Yeah they always give 110%.

The 2%? That’s our wheelhouse. It’s the 2% that concerns us. That’s when we get the panicked call. What can we do? What do we do? How do we do it? You better have thought of the 2% before you pick up that call, and even more importantly, you better have something in writing that lays out your options before that call is ever made.

So yeah. The 2%.

My friend? Nah . . . he thinks about the 98%. He thinks that I worry too much. He thinks it’s probably a waste of time and even if you could make string diagrams on the wall, you probably wouldn’t get any clarity. He’s probably right. Actually I know he’s right, but that 2%. Man, it sure nags. Like an ear worm or a burr in your shoe. That 2% just won’t let go and it’s unrelenting.

What’s my 2% of late?

Bread.

Corn bread. Wheat bread. Food. This.

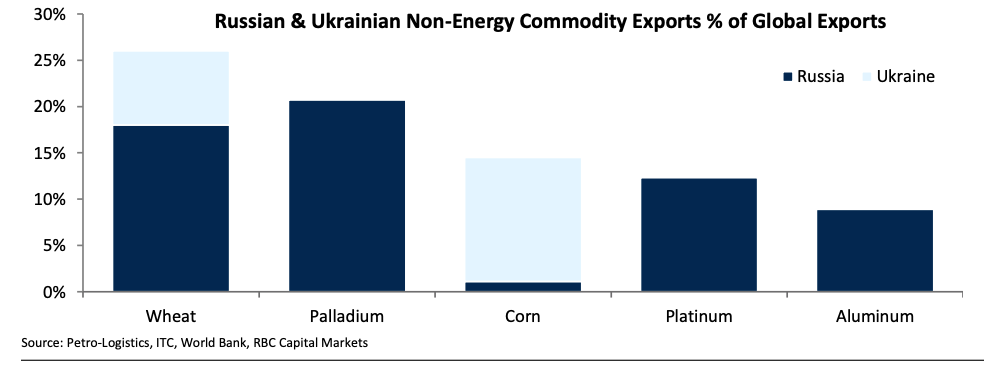

As the war rages on, our global food security is increasingly at risk. We believe it’s already at the point of no return. You simply can’t take away 20% of the world’s crop production and assume there will be enough to eat.

You can’t have that. You can’t take away 25% of global wheat crop & 15% of global corn crop without MASSIVE food security implications.

Planting season begins in 30-60 days and the Ukrainian infrastructure is currently being completely decimated. In addition, the Russian economy is in shambles. Almost certainly there’s no “farm to table” this year . . . there may not even be a farm this year.

If you think that’s bad, what about the other 75% of global wheat crop and 85% of corn? This.

That’s the cost of three fertilizers even before the invasion. The other big fertilizers, DAP (diammonium phosphate), MAP (mono ammonium phosphate) and Potash (potassium) have also notched higher prices as well.

According to DTN, “Russia is the second-largest producer of ammonia, urea and potash and the fifth-largest producer of processed phosphates. The country accounts for 23% of the global ammonia export market, 14% of urea, 21% for potash and 10% of the processed phosphates.”

Furthermore, Russia supplies the world with ~17% of all natural gas (“NG”) and NG is critical for processing nitrogen-based fertilizers such as potash and phosphate. As prices of fertilizers increase by 3x / 4x, farmers are using less. If farmers use less, crop yields begin to fall. Farmers can switch crops, foregoing wheat, which requires more fertilizer, to plant other grains, but that doesn’t solve the issue, it just shifts them.

This can’t end well. We’ll almost certainly see the remaining global supply of crops fall short at this stage, and that shouldn’t be a surprise for investors as we head into the fall (harvest season). It’s why wheat, corn, etc. prices have been limit up for the past four days as we write this.

Geopolitically, this should be concerning for us because as the New York Times put it, “Ukraine, long known as the ‘breadbasket of Europe,’ actually sends more than 40% of its wheat and corn exports to the Middle East or Africa, where there are worries that further food shortages and prices increases could stock social unrest.”

We can see from the chart above, some of the poorest countries in the world import a significant amount of wheat from Ukraine. Per capita GDP in Indonesia ($3,800/year), Egypt ($3,600/year) and Pakistan ($1,200/year) are at subsistence levels. Almost everything they make goes towards food. Think about $1,200 . . . a year. How do you sustain yourself, your family if food prices climb materially. Moreover, these are global commodities, if Indonesia, Egypt, Pakistan, etc. run low, they’ll reach for commodities elsewhere, forcing prices to go up everywhere until only the wealthier countries can afford them. China and India, with 2.3B people will inevitably feel the pain. The West, with its higher income levels will also feel it, but given higher incomes and better farmland productivity, the US should be better insulated. Not fully, but we won’t starve. The world ex-US? Not so much.

This is what Putin knows. He will make you feel the same economic and geopolitical pain he feels. If he goes . . . you go. Unfortunately, for the poorest, our current economic pains will translate to hunger pains.

Then? Hoarding.

Then?

Violence. Why? Because like one protagonist recently said in the latest Matrix movie “[n]othing can breed violence like scarcity.”

Countries and their central bankers/politicians will try to help. They’ll provide subsidies to the best they can. How do we know this? Well just look at gasoline/diesel. Some countries (e.g., Japan/South Korea) are already providing/raising subsidies on fuel. If food becomes an issue, they’ll almost certainly do the same, if not more. It’s the path of least resistance.

Food security = political security and as the Arab Spring riots demonstrated, it can destabilize governments very quickly. So we expect emerging markets to provide more subsidies, potentially weakening their currency. Inflation will likely wreak havoc on emerging markets as we head into harvest season.

The West? No different. We’ll also provide subsidies. Our central bankers will enable our politicians to provide food/fuel vouchers, stimulus payments, etc. If you can’t plant it, you will print it. On a relative basis though, we’d expect the US Dollar to strengthen in such an environment as emerging markets bear the brunt of the hunger pains.

Surely Putin will back off right? Surely he’s not so reckless or heartless as to continue orchestrating the hunger games . . . right?

Think again (article from ZeroHedge). The hunger games have only just started, and the brutality of it has just begun. We’re worried about the 2% now . . . for all of us.

“May the odds be ever in your favor.”

Please hit the “like” button below if you enjoyed reading the article, thank you.

Excellent