When Inflation Passes its Baton from Goods to Services

November 18, 2021

You’re animals. Just wild wild animals with your voracious appetite, consuming everything in your path as evidenced by retail figures that just came out.

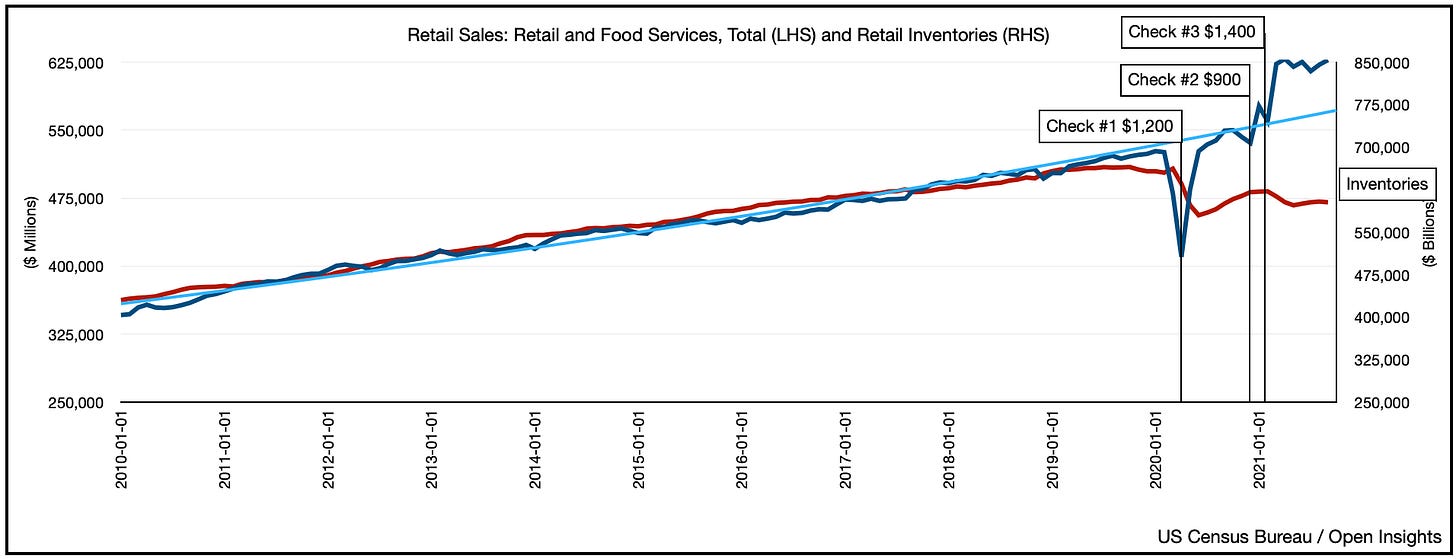

Look at that spike upwards, with no obvious fiscal stimulus in play, it was simply a combination of higher prices and more demand. We wouldn’t have been surprised if rising prices dampened demand, especially as the consumer price index (“CPI”) recently printed a +6.2% figure YoY.

Yet, that doesn’t seem to be the case. Perhaps it’s because real hourly wages are keeping pace (okay maybe not quite as it was -1.3% YoY after adjusting for inflation), but still . . . it’s close.

Close enough is good enough because again . . . stuff. We like stuff and we really like to buy stuff. Especially online. Just look at how closely the above wage chart mirrors our increased online consumption.

Just what are you buying? Pretty much everything and anything as every major category seems up.

The heightened demand though continues to collide with the inventory/supply chain shortages we’ve all heard about. It’s why inventories are still low relative to trend.

Coupled with increasing wages, we doubt the bout of inflation we’re seeing has peaked yet. Elevated demand and low supplies simply aren’t a good match for low inflation. In addition, energy and housing expenditures are poised to climb in the coming months, and though supply chain tightness should ease, that likely won’t be until after the holidays and well into H1 2022.

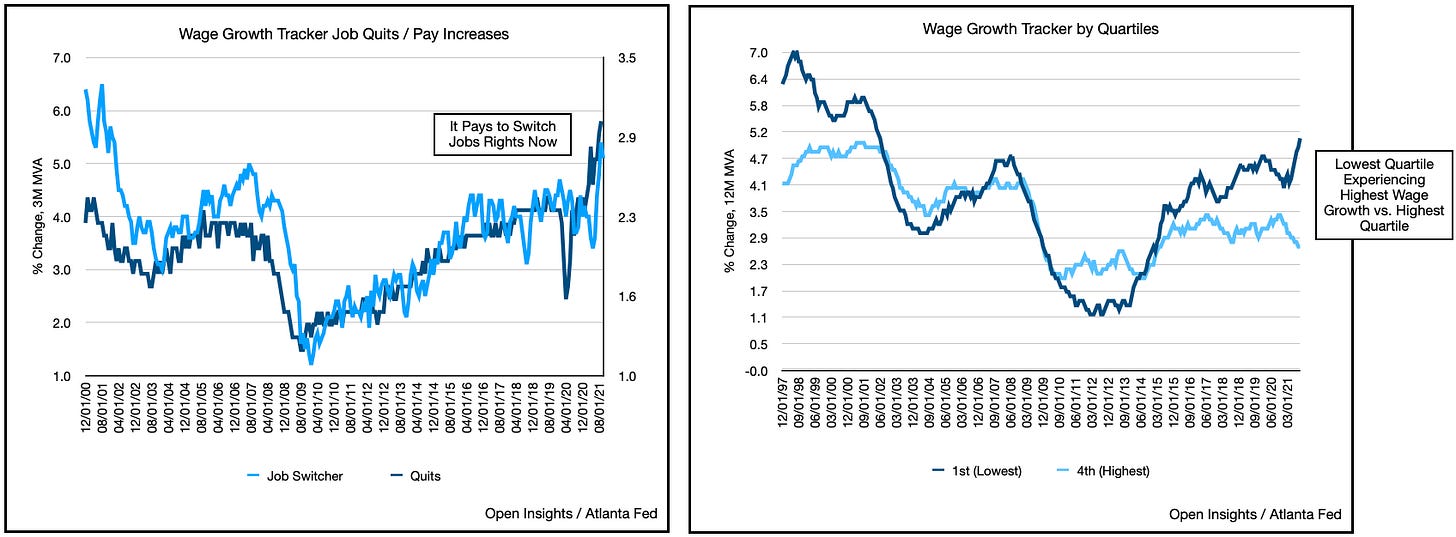

Moreover, wage pressures will persist as labor force participation will likely stay low. If you’re wondering where all the workers went, Goldman Sachs thinks that of the 5M “missing workers,” nearly 3.4M or 70% have retired.

It’s why it pays to switch jobs right now, particularly in the lowest paid work. It also explains why restaurants, hotels, etc. are having such a difficult time hiring.

If You Thought Goods Were Expensive . . . Watch Services

Speaking of labor, we had anticipated that as the economy reopened, we’d see a shift in our spending from goods to services and that seems to be occurring. If we look at personal expenditures data from the Bureau of Economic Analysis (“BEA”), the shift in spending is already beginning to show (note for retail sales, the BEA’s index is chained on a dollar basis vs. the Census Bureau’s retail sales).

At the time, service price inflation hadn’t spiked yet, but as labor shortages and wage increases persist, that’s likely to change. Besides, wage pressures aren’t even the highest concerns for small businesses today, which means they’re more than willing to pay more. What are they? The quality of candidates (NFIB).

So in the end, is the demand for goods elevated? Yes. Will it stay that way until we start to really move and shift our spend towards services? Yes.

As we begin to travel, visit relatives, and reconnect with friends, the dollars we currently spend to self-sooth our souls should decline, coupled with easing supply chain bottlenecks, inflation on durable goods will subside from today’s peaks, but inflation overall? We’re not so sure about that because the baton will pass from goods to services and services tend to be more labor intensive.

What concerns us, however, isn’t our heightened appetite, or necessarily the shifting inflation (if we can call it that), but this. Personal savings.

As the months have passed since the pandemic lockdowns lifted and the impact of fiscal stimulus packages fade, we’ve spent our savings. The elevated savings rates are now back to pre-COVID levels. Furthermore, we’re starting to see credit card balances trend higher, having dipped over the past year and a half.

While we’ve paid down our debt balances in 2020 because we had fewer things to spend on while at home, we’re starting to see the trend reverse as 2021 Q3 figures show near parity to 2020 Q3 figures.

So lower savings (or should we say pre-COVID savings levels) coupled with credit card balances starting to increase . . . all of this means the days of being flush with excess cash could be coming to an end for the consumer. A consumer who has an enlarged appetite for “stuff” is fine when they have excess cash, but an over-levered one who’s under-saved typically signals the beginning of a recession.

We’re still a long ways from that exact scenario, but looks like we’re starting to turn. With lower savings/higher credit card balances, the onus will fall on us making more money (i.e., working) to sustain the debt. Thank goodness there are plentiful jobs out there with increasing pay.

Let’s just hope we can fill them.