Where We Think Inflation's Headed, or Not.

January 13, 2023

“I don’t know much, but I know I love you . . . and that may be, all that I need to know.”

Those lyrics are from the song Don’t Know Much, covered by Linda Ronstadt and Aaron Neville almost 33 year ago. The duo won a Grammy award in 1990 for the Best Pop Performance by a Duo with Vocals. So they did alright.

You can usually hear it late at night, on some easy listening channel where a soothing DJ dedicates one song after another to some amorous soul in the world. Scrounge around and I bet you can even find it on someone’s mixtape with the requisite pencil stuck in it. (Note to young readers . . . that’s how we used to wind cassette tapes). Aaah nostalgia.

Somehow, for some reason, the lyrics of that song sticks in my mind. It lives there rent free, and like the TripleDent Gum commercial in Inside Out, it occasionally pops into my head.

This one line in particular.

“So many questions . . . still left unanswered . . . so much I’ve never broken through.”

It’s a verse sung by Mr. Neville, and if you’ve ever heard his voice, an ethereal falsetto, it’s unmistakable. It plays in my head because that’s what I think when I look at the market these days. So many questions . . . still left unanswered.

It’s something we alluded to last week as the market reacts to the various conflicting signals bouncing around the economy.

Nearly everyone today predicts a recession.

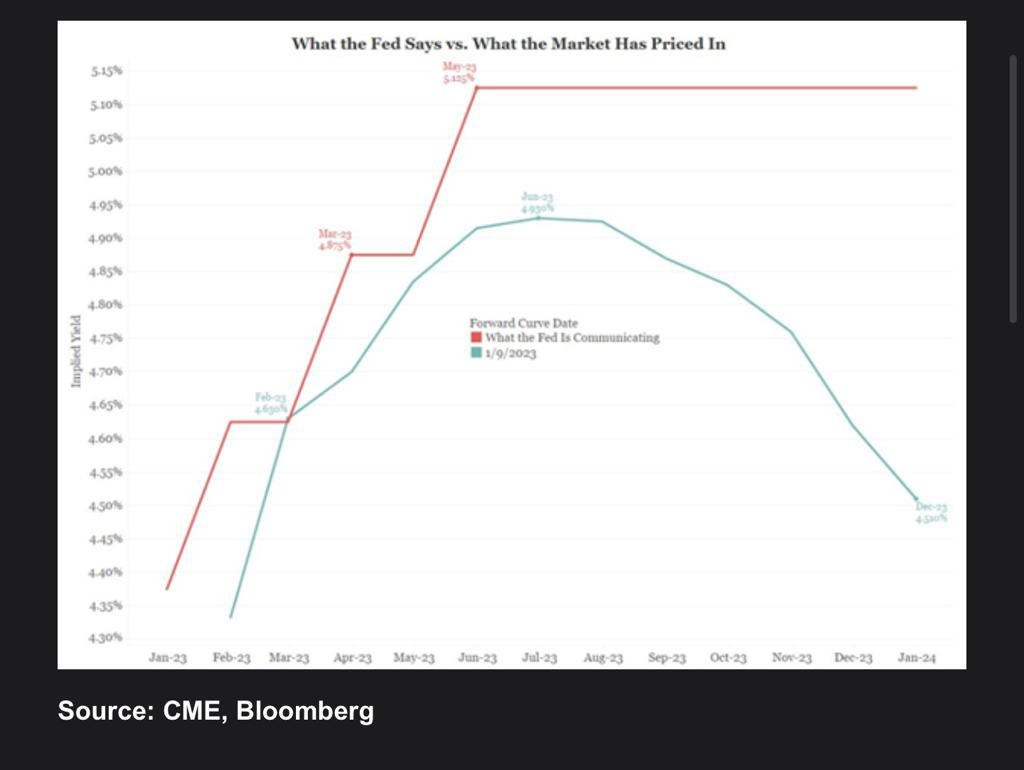

Nearly everyone predicts that during such a recession, the Fed will pivot from tightening financial conditions to easing them (i.e., lowering rates and easing quantitative tightening).

If inflation declines, then that’s certainly possible as it unties the Fed’s hands from its path of tempering demand. Fair enough. While inflation is declining now . . .

Will it continue?

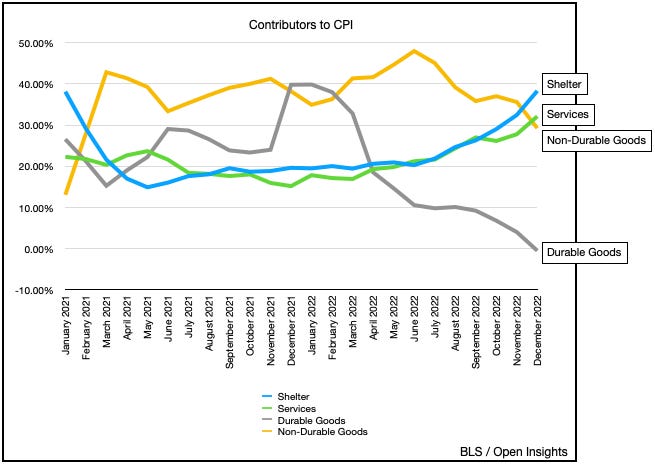

Well, why is it declining? Pretty much because the prices of nondurable goods (energy and food) and durable goods aren’t rising as fast anymore. In contrast, services (~33% weighting) and shelter (~38% weighting) continue to push upwards.

So let’s take a look at one of those falling categories, non-durable goods (food and fuel) for instance. One of the reasons for that drop was the decline in energy prices (specifically oil). In 2021, June to December, oil prices hovered around $71-$80/barrel (WTI). Since CPI is measured YOY, you can see that when oil prices vaulted to $115 in June 2022 and stayed around $100 all the way to August, the YOY change pushed inflation higher by 3%, 2.4% and 1.7%. Then as oil prices declined, that contribution similarly fell.

Today oil prices hover around $79/barrel and are beginning to climb again. Remember though, CPI is measured YOY. Since we had high prices mid-year 2022, higher prices mid-year 2023 shouldn’t spike inflation. Yet, if those prices stay high into year-end, then inflation in this category should push up again (as we experienced declining prices in H2 2022). Much of what happens will depend on how oil prices perform throughout the year, but we could be set for a potentially false period of “lower inflation” then followed by “higher inflation.”

Around the mid-year is also when we think energy will “join hands” with services to push higher. Services as a whole has about a 33% weighting in the CPI, and if wages continue to push upwards, so will services. Right now recreation is lower, but we wonder what happens to recreation once tourism starts to get moving again. Transportation and recreation may just run higher.

We think tourism and revenge travel from Asia Pac will start to impact the industry this summer, and if you think your favorite spots were crowded this summer, just remember that was without any Chinese tourists. We’re going to need more bodies to fill those travel kiosks.

So let’s tie it all together. What we’re really saying is that it’s great inflation is simmering down. That’s a good thing. We’re just not certain it’ll get back to our previous decade of 2%. Some categories are definitely declining (e.g., durable goods) largely because the global supply chain is healing, but some categories are also poised to spring higher (e.g., energy) as global demand rises. So while we may have a decline in inflation, it could very well be temporary. We can see a situation where inflation figures will slow, and settle around a base of 4-5% . . . and then begin to slowly creep up thereafter. Perhaps not to the 9.1% high we experienced last year, but certainly higher.

Just take a look at some of these other commodity prices. Even before China has fully recovered, they’re starting to move.

So declining inflation? Sure for the time being. Still what happens when the Fed cuts, as the market anticipates, when the “mild” recession comes? What happens if it does, inflation starts to creep higher? Are they forced to reverse it amidst a slower economy? Unlikely, so as they “stimulate,” do we experience another bout of higher inflation? Likely.

While we’re in a recession, Asia Pac should be recovering. What about Europe? Well if they don’t freeze this winter, then they get another year of reprieve to prepare for the next winter. Thus far, it looks like they’ll be fine; and given the worst case scenario everyone had anticipated, fine will actually be pretty good. As energy prices moderate, it should continue to drive the rebound in European PMI (via Tradingeconomics.com).

So while we’re slowing down, everyone else is speeding up, consuming more, wanting more, and doing more.

So you see? Puzzling all around. How the timing for all of this (and whether it actually will) plays out is uncertain. How the Fed will/will not pivot is uncertain. How the markets react to the ripple affects are equally uncertain. Now you see why the song is stuck in my head.

“So many questions . . . still left unanswered . . . so much I’ve never broken through.”

Now hand me that mixtape . . . I need that pencil.

We’ve got work to do.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Any thoughts about the pre- Ukraine war intention of the Fed to inflate away pandemic period monetary stimulus by keeping inflation relatively high at ~5%?

Another thing that is increasing is the cost of money. It may drain liquidity in the long term, but in the short term it is a very basic source of inflation.