Will Inflation Derail the Economy? . . . or Us?

February 16, 2023

This is CPI.

6.4%. It’s coming down. Well some of it.

Specifically, durable goods. The stuff we buy. Most of the other stuff? Up a bit, but not as much as before, which is fine, good even, but maybe not good enough.

So there’s this big question out in market-land right now. Will inflation stay higher for longer?

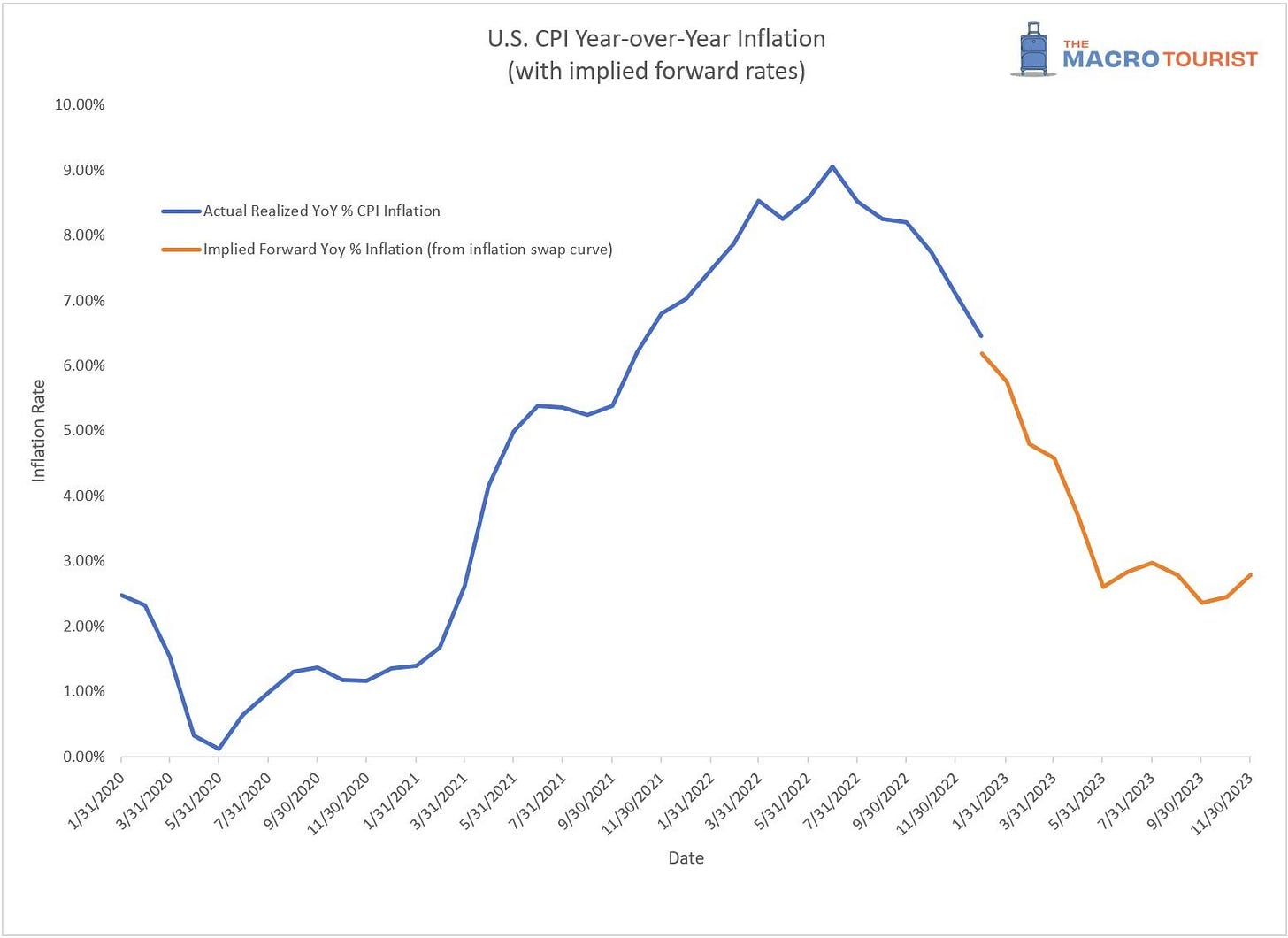

Why? Because look at this chart from MacroTourist. The market is currently projecting inflation to fall materially in the coming ear. If so, then surely interest rates will also revert. After all if inflation falls, then the Fed will relent . . . #canIgetanAMEN?

We’ll get to 3% by June, just a few months away . . . or so says the betting market.

3%. Think about that.

Quite a steep plunge from the 9% stratosphere we experienced only just a few months ago. What if it doesn’t? Well then, this will get a whole lot trickier. If inflation persists, the Fed will have to pivot, turning its back on a hopeful (if not ebullient) market, and keep ratcheting rates higher for longer until demand and inflation break. Unfortunately, that tightening may inadvertently break other things though. As rates stay higher and financial conditions tighten, expect the stronger gravity to beget lower asset prices (i.e., property, stocks, etc.) across the board.

If you ask us . . . we’re not sure. We’re not sure 3% is even achievable. Dive under the hood of the CPI and you can see a path for CPI to decline, but 3% in such a short period of time? That’s a tall task.

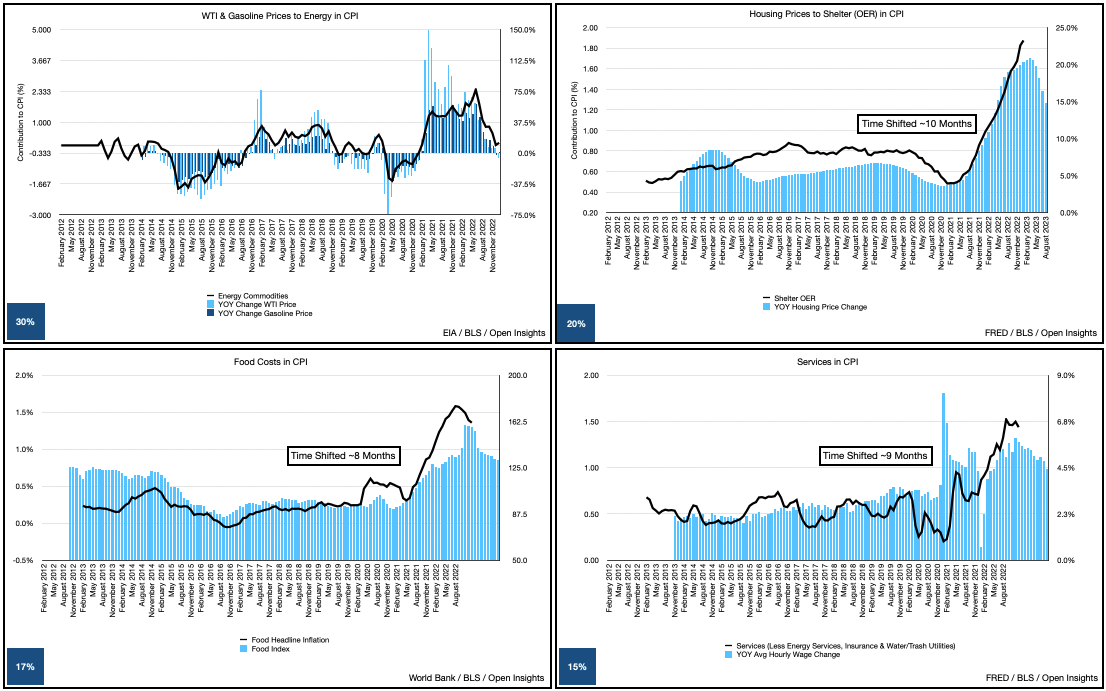

Here are some of the factors we look at and some real world factors that we track. We take those prices (e.g., energy, housing prices, food prices and wages) and “push them out” (i.e., time shift it by ~9 months) to see if they’re leading indicators.

Mind you, none of the above are that precise (except for energy, which we’ve found to be really accurate). Think of these gauges as more of the steam variety than digital.

Despite their imprecision, what we’re trying to determine is whether they’re “directionally correct.” For housing, food and services, we can see a pathway for inflationary pressures to decline, but even if CPI data eventually mirrors our “real-time indicators” we’re not certain that they portend a +3% decline (i.e., from today’s 6.4% CPI inflation to the 3% forecasted by markets). More likely we’re looking at an easing of about 1 to 1.5%, which would mean inflation levels during the summer season would still print 4.5-5%, well high of the 3% anticipated by the market, and a mile wide from the 2% sought by the Fed.

Note also, this doesn’t include energy. What if oil prices start to climb as we head into the higher demand seasons (H2 2023)? If so, it will materially offset many of the declining prices in the other categories given its sheer weight.

All of this brings our mind back to this simple notion.

Doesn’t this kind of make sense? If unemployment is so low . . .

and an enormous pile of excess savings still ripe for spending (i.e., ~$900B left) . . .

. . . won’t inflation be harder to tame in the interim? It’s not like we’ve yet to slow down as retail sales show no signs of peaking.

Heck, we’re likely to push that figure even higher in 2023. As you can see below, consumer sentiment is already rebounding.

What we’re most assured of is this, the more secure we feel about our livelihoods (i.e., plentiful jobs/low unemployment), the more freely we’ll spend as the animal spirits become emboldened.

So expect consumer sentiment to further improve as we roll into the summer months.

This is why this is all a bit confounding. For the next few months, the hard data (i.e., the government economic data) may lag. It will likely show easing inflation, but there’s a high likelihood that eventually it could stop, and actually start climbing higher. That’s a bad outcome for those holding risk assets. Furthermore, it doesn’t even have to climb higher. If it simply slows and levels out at 4%, that’s still a tad too high for the “2% Fed.”

Not that they have much of a choice. This is a consumer driven train that has momentum, and it will continue to barrel down the track over-powered on a mixture of COVID-savings and high employment. For investors though, focus on the tracks ahead.

While the concurrent economic data may show a green light, look down the road. If inflation doesn’t begin to cool down at a faster pace . . . we may just go off the rails.

Please hit the “like” button and subscribe below if you enjoyed reading the article, thank you.

Again, helpful commentary.

I am wondering if the implied forward inflation matters or is well considered by most market participants. If not, the 3% doesn’t mean much for risk asset markets which may already take higher inflation into valuation consideration.