You're Rich . . . and It's Awesome.

June 10, 2021

My friend's got a boyfriend, man, she hates that . . . guy

She tells me every day

He wants more dinero just to stay at home

Well, my friend, you gotta sayI won't pay, I won't pay ya, no way

Na-na, why don't you get a job?

Say no way, say no way-ah, no way

Na-na, why don't you get a job?

- Why Don’t You Get a Job by Offspring

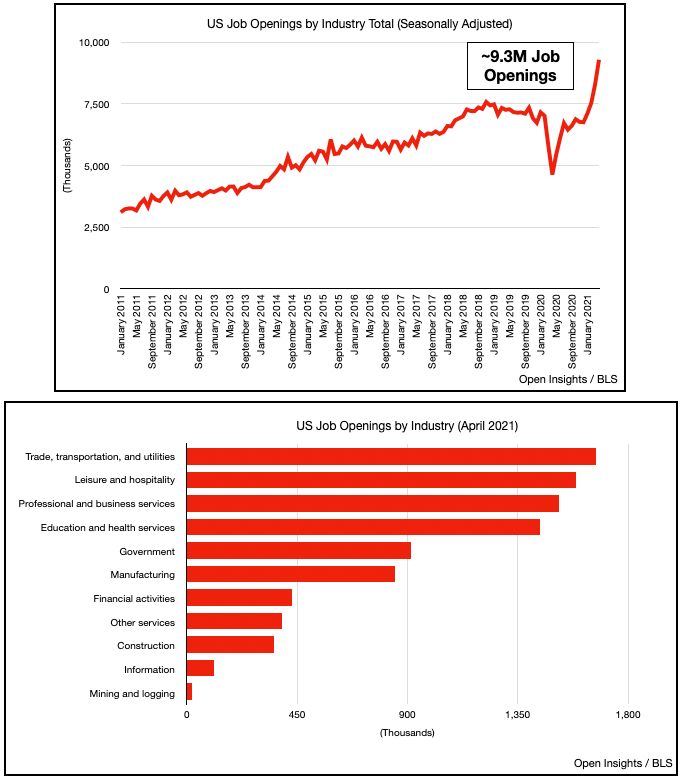

There’s this karaoke showdown going on in the US, where one side is singing the ballad by Offspring, “encouraging” people to go back to work. It’s something we discussed last week, and only exacerbated by this week’s JOLTS report that reinforces the discrepancy. Job openings climbed to a high of 9.3M jobs in April, which really illustrates the current dilemma for employers . . . have jobs, but no workers.

Pair that with the 9.4M people unemployed, and we can see why 25 states in the US have already started weaning their populace off the federal unemployment bottle. Unfortunately, those 25 states aren’t where most of the US’ population resides, so the majority of unemployed persons will likely stay that way until the situation resolves itself (i.e., unemployment benefits expire, child care availability increases, health restrictions lift, etc.).

Now job openings have always been an issue (and full employment impossible) because there will always be a mismatch between skillsets and demand. Even pre-COVID, with our low unemployment rates, we still had 7.2M job openings vs. 5.8M unemployed, so there were more jobs than people (qualified or otherwise) available to fill them. Still, an elevated figure of over 2M job openings coupled with the higher unemployment rate means there’s definitely some slack in the system. You’d think it’s time to get back to work, but that’s not what the other half of the karaoke bar is singing.

Instead it’s this . . .

“It's not about the money, money, money

We don't need your money, money, money

We just wanna make the world dance

Forget about the price tag

Ain't about the, uh, cha-ching cha-ching

Ain't about the, yeah, b-bling b-bling

Wanna make the world dance

Forget about the price tag”- Price Tag by Jessie J

So don’t @ me about working. Don’t IG me about JOLTs, and don’t talk to me about the unemployment rate. I didn’t survive a global pandemic to work in HR or make your double-shot whatchacallit-machiatto. It’s the summer, and there’s no more ‘rona. It’s YOLO-time baby, and right now, I’ve got the cash. It’s something we wrote about here; 5 months and two more stimulus checks later, it’s still true.

Despite the high unemployment, we’re actually seeing some pretty positive things for the US consumer. If you want a bit of good news in a market filled with fear, uncertainty and doubt, here it is . . . the US consumer is in great financial shape. Since personal consumption drives this country’s GPD, it matters, and it matters bigly.

Income / Debt

For those with jobs, personal income continues to rise according to the BEA, exceeding 2019 levels and registering month-over-month gains.

In addition to making more, we’re also saving more. While off the highs after we received our stimulus checks, our savings rate is still double the “norm” of 6-7%.

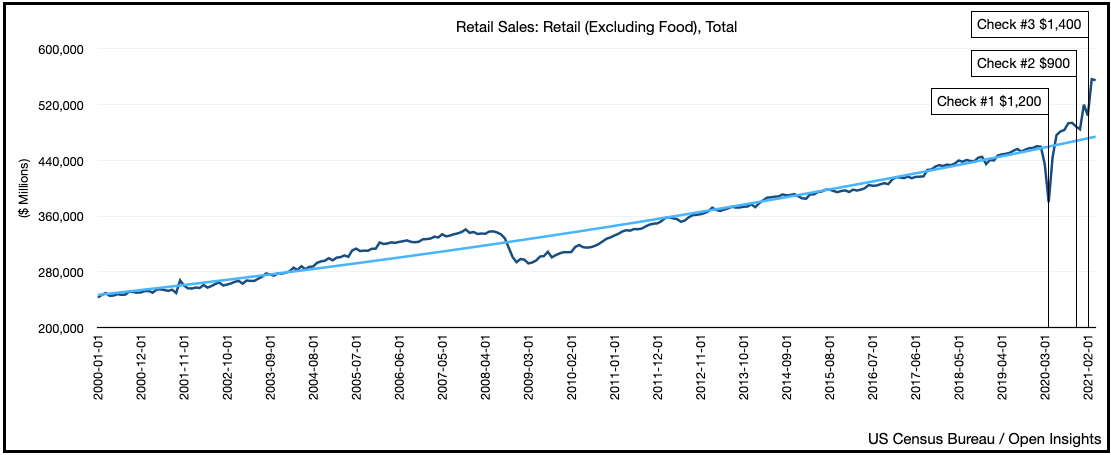

This despite our voracious appetite for “stuff,” which kept higher after the “stimmy checks” (note we’ve also learned to spend the money faster in this third iteration of the stimulus).

Our conspicuous consumption will die down as the economy reopens and we shift our focus to services, travel, entertainment, and food, but when we do, we’ll make that pivot with higher savings and manageable debt levels.

Although debt levels have continued to climb. The mix has shifted.

Since the great financial crisis, credit card debt and home equity lines (as a percentage of overall debt) are lower, but student loans are almost double. That reduction of credit card debt has been evident during the pandemic as we’ve managed to pay down our balances this past year.

Moreover, while the aggregate amount of debt continues to increase, what matters more is the ratio of debt to income . . .

. . . and that has turned lower as our disposable personal income has climbed. We’re making more and proportionately less indebted. Amazing.

Lastly, the cost to service our debt has fallen, thank largely to the reduction in interest rates since the GFC . . .

. . . in particular mortgage rates.

So . . . in conclusion . . . yeah sure. We get it. Your flush, well at least some of you are, and some of you don’t want to work. Maybe you don’t have to get a job just yet. Eventually, but not now. Collectively, we can afford it. Our government and our corporations? Not so much. But you? Yeah.

So enjoy your summer. You’ve “earned it” because you survived. So Who’s Awesome? . . . You.